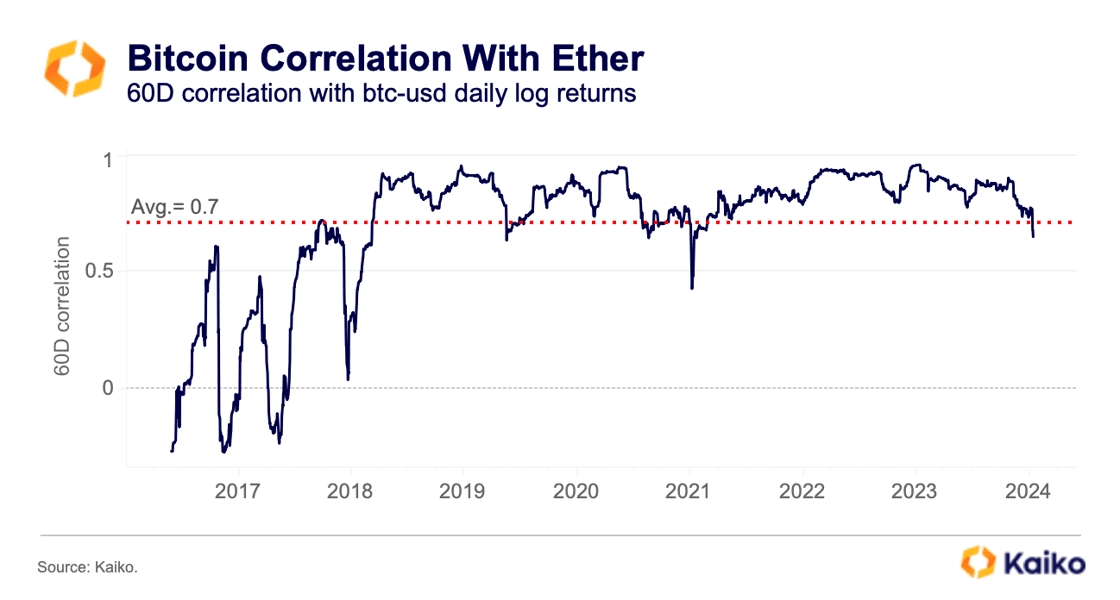

For the first time since 2021, the BTC:ETH correlation dropped below its all time average of 0.71. It is no coincidence that this occurred on the day that the bitcoin spot ETFs started trading. For months, the two crypto assets have been diverging in price activity as BTC benefited from ETF hype and speculation while ETH experienced a relatively sluggish rally.

Since the Merge, Ethereum has had a bevy of narratives: deflation and ultrasound money, Layer 2s, liquid staking derivatives, restaking, and now ETFs, with danksharding on the horizon. It has also faced more competition than at any point in recent years, with Solana’s low transaction fees and airdrops driving a resurgence in the network and bringing the SOL:ETH ratio to multi-year highs. Despite all of these competing narratives, it appears that the potential approval of spot ETFs is the strongest narrative right now.

This Deep Dive will explore the ETH’s market structure and assess whether a spot ETF could generate the same level of enthusiasm that BTC’s did, leading to a rally ahead of its decision date in May.

BTC VS. ETH: TRADING TRENDS

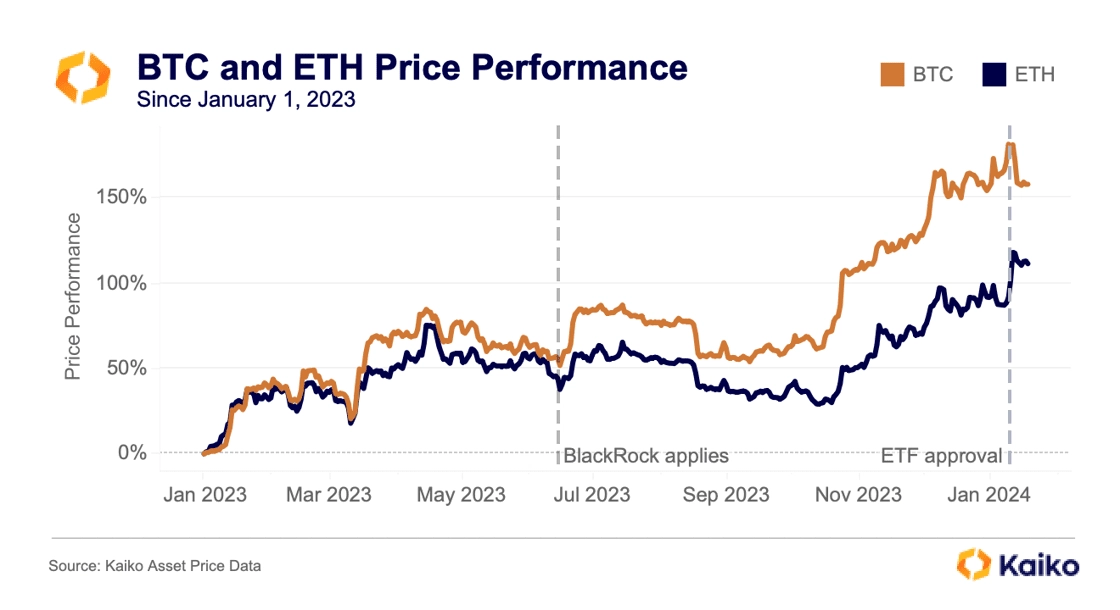

We can look at what happened with BTC in the run-up to its ETF approval to get a sense of ETH’s prospects. Over the past 365 days, BTC’s 100% returns far outpace ETH’s 60% returns. That changed on the day of the BTC approval: BTC fell and ETH rallied, building on hype that ETH could be next in line.

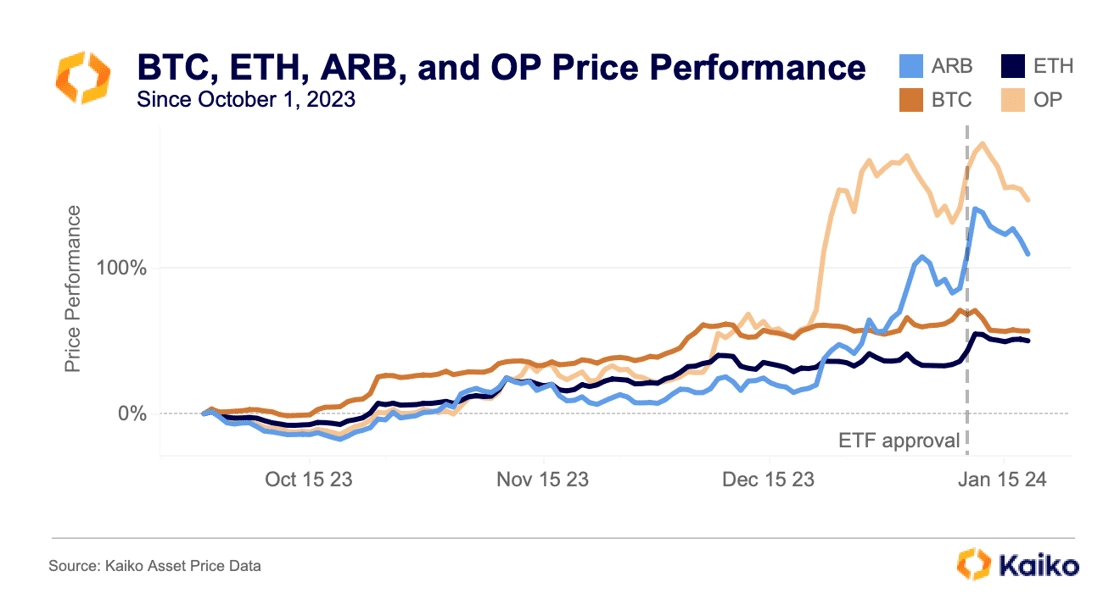

Prior to the BTC approvals, investors and traders targeted “ETH beta” – tokens related to ETH but with higher volatility, like Optimism (OP) and Arbitrum (ARB) – instead of ETH itself. However, post-approval, ETH beta has slumped while ETH has outperformed by falling the least.

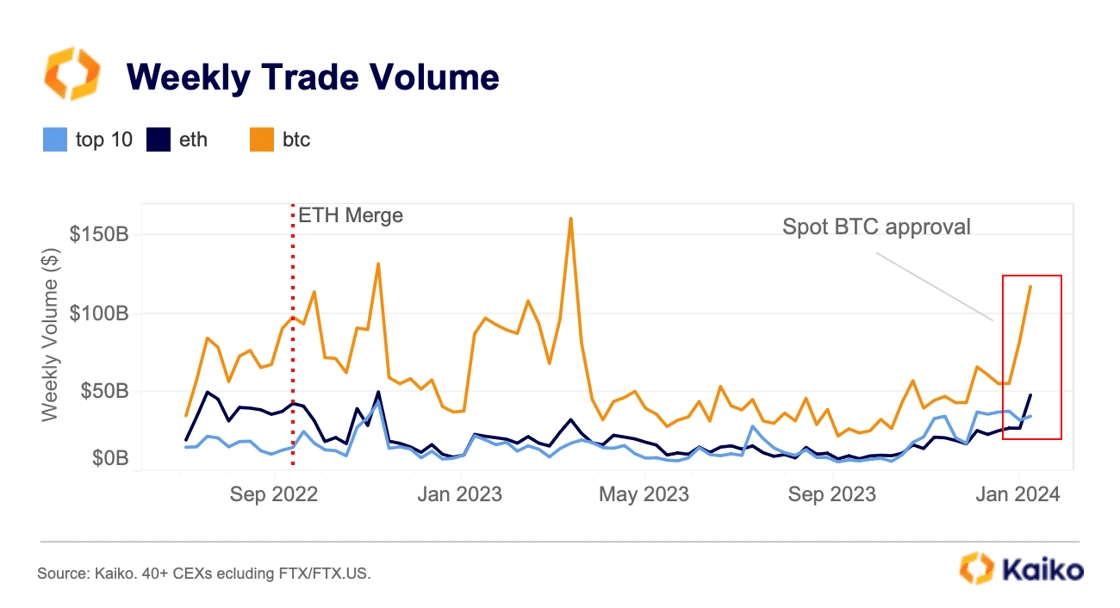

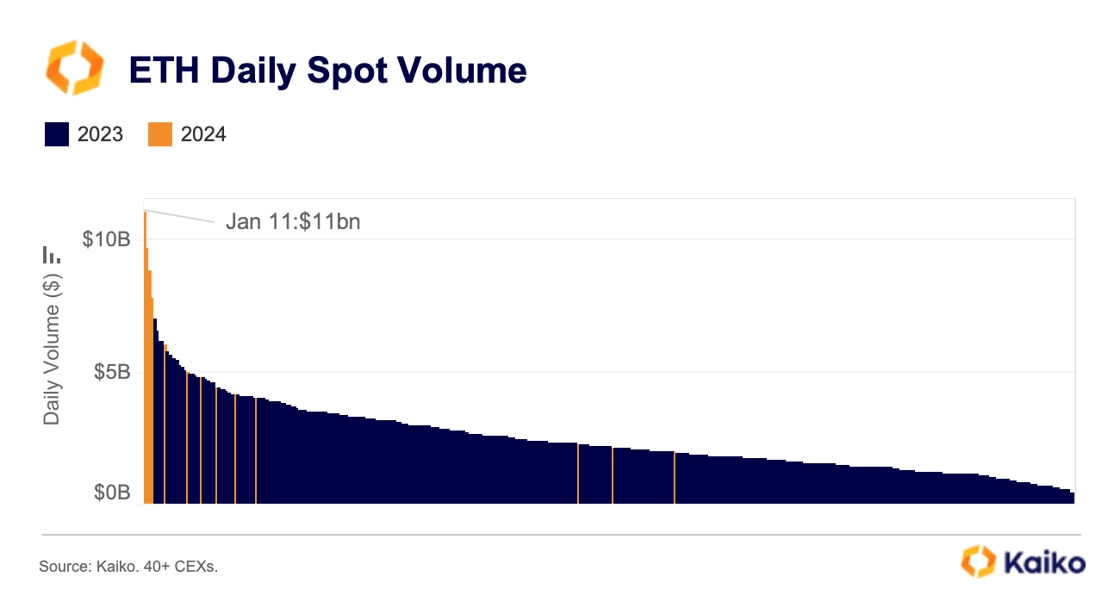

Last week, ETH spot volume on CEXs spiked to its highest level since the FTX collapse, with the biggest gap between ETH and altcoin volume – in favor of ETH – since March 2023.

Additionally, last week held the three highest ETH spot volume days since the start of 2023; January 10, 11, and 12 had significantly higher volumes than any day last year.

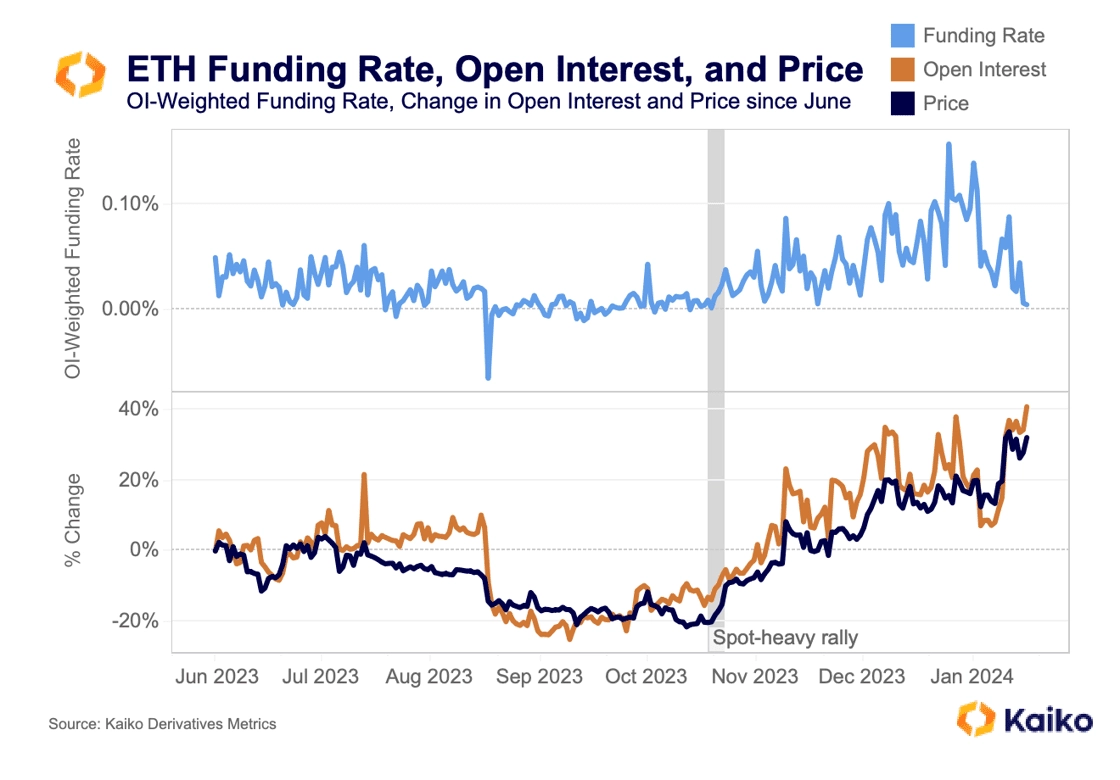

Derivatives data also indicates that recent ETH moves have largely been driven by spot, rather than by perpetual futures, suggesting that aggressive speculation on the ETF applications has not begun.

September and October marked a low point in futures markets, with aggregated open interest (in USD) falling more than 20% from its summer levels. At this time, there was little price movement and funding rates were neutral; this chart uses averages funding rates across all included exchanges, weighted by each exchange’s open interest.

Then, in late October, price began to bounce back, outpacing the growth in open interest, again suggesting that the move was largely driven by spot trading rather than new derivatives inflows. While open interest grew by up to 40% to end the year, it largely moved in tandem with price, meaning most of its surge can be attributed to price effects. Increasing funding rates show that traders skewed long during this time. Post-BTC approval, funding rates have reset to neutral, while open interest has surged ahead of price, indicative of increased shorting. Even still, we have not yet seen a major build up in open interest that is typical of a bull market.

WILL ETF ANTICIPATION BOOST ETH?

With all the hype around spot ETFs, it can be easy to forget that futures-based BTC and ETH ETFs have been trading for years, providing an imperfect proxy of how the latter’s potential spot ETFs might fare.

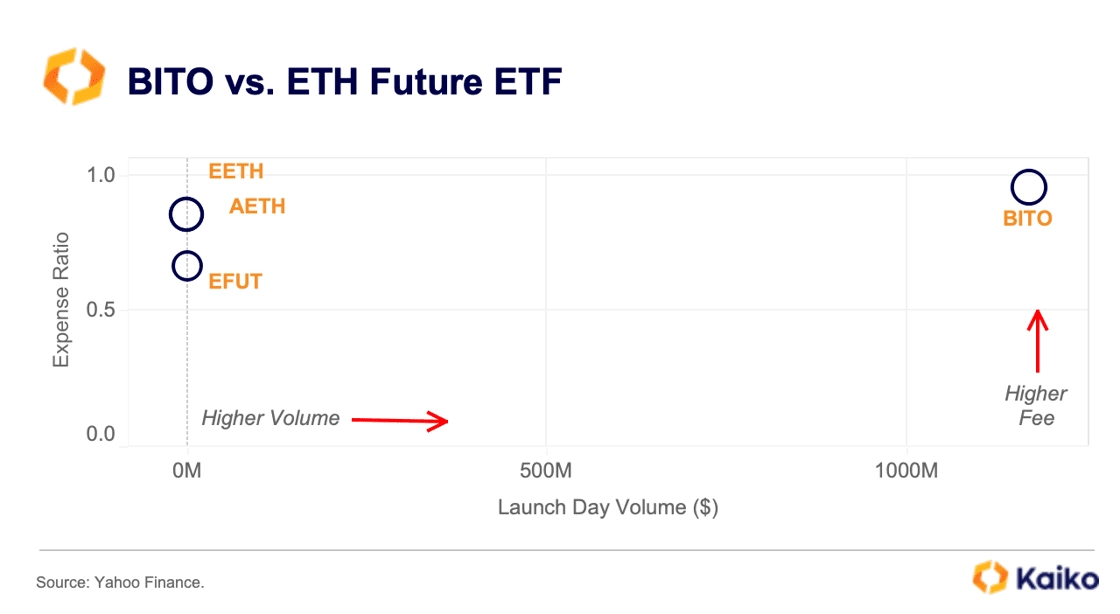

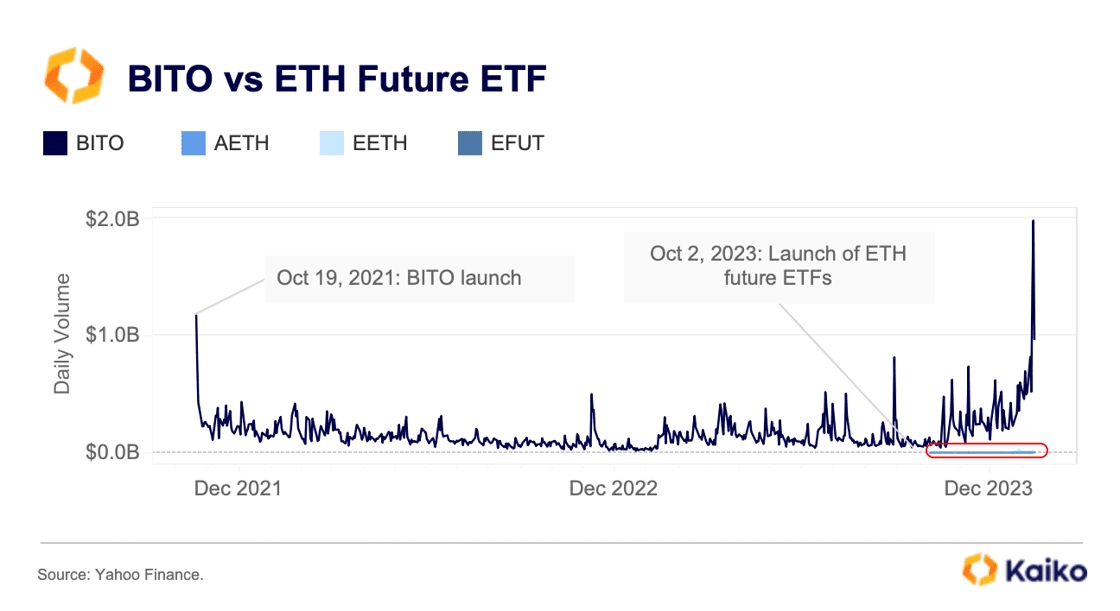

In 2021, BITO was the first BTC futures-based ETF listed in the U.S., registering one of the highest ever launch days by volume for an ETF. One year after BITO listed, a wave of ETH futures products began trading. Although the ETH futures ETFs launched in a different market environment, there is no denying that their volume was disappointing. EETH, AETH, and EFUT only had a few million in trade volume on opening day of trading, about 1,000x times less than BITO’s $1.2bn opening.

Trading activity for these products has not improved over time. ETH ETF activity remains low, while BTC futures ETF volume started soaring in the run-up to the approval of the spot ETFs.

This underwhelming volume can likely be attributed at least partially to the fact that any investors in ETH futures ETFs are forgoing potential staking yield of about 4% APY while incurring an expense ratio of more than 0.6%. Spot ETFs would avoid some of the inefficiencies associated with futures-backed ETFs, but would not provide staking yield. Then there is the matter of them even being approved, as ETH’s regulatory position in the U.S. has long been more unclear than BTC’s.

CONCLUSION

While there is some hype around ETH ETF applications, the data suggest that aggressive speculation hasn’t yet begun. ETH trade volume has spiked, but derivatives markets have lacked the telltale signs of traders positioning for a rally. ETH futures ETFs have also had a slow few months of trading.

ETH and BTC correlation has sunk to multi-year lows as each asset matures and develops its own narratives. While ETFs were one of the most catalyzing narratives in BTC’s history, it remains to be seen whether ETH will be able to replicate this. However, ETH has many narratives it can lean on; if ETFs don’t spur enthusiasm, perhaps new Layer 2s or the success of EigenLayer and restaking can.