Author: stella@footprint.network

Data Source: NFT Research

December saw a notable surge in the crypto and NFT realms, with Bitcoin and Ethereum experiencing significant upward trends, signaling a rejuvenated market. The NFT sector, in particular, demonstrated its vitality with soaring trading volumes and an increase in unique user (wallet) counts, indicative of an evolving and maturing landscape.

This report is based on data sourced from Footprint Analytics' NFT research page, a comprehensive and user-friendly dashboard. It offers up-to-date statistics and metrics essential for grasping the pulse of the NFT industry, encompassing trades, projects, funding, and more.

Key Points

Crypto Macro Overview

-

December was a month of resilience for Bitcoin, commencing at $37,729 and climbing 11.8% to conclude at $42,171.

-

This optimism, coupled with the anticipated US Federal Reserve rate cuts, reinforced investor confidence, positively impacting the cryptocurrency sector.

NFT Market Overview

-

December stood out as a remarkable month, marked by a significant 32.3% surge in trading volume to $852.2 million.

-

The market cap of NFTs also displayed resilience, starting at $5.24 billion and growing 6.5% to close at $5.58 billion.

-

The Blue Chip Index saw a modest rise of 4.6%.

Chains & Marketplaces for NFTs

-

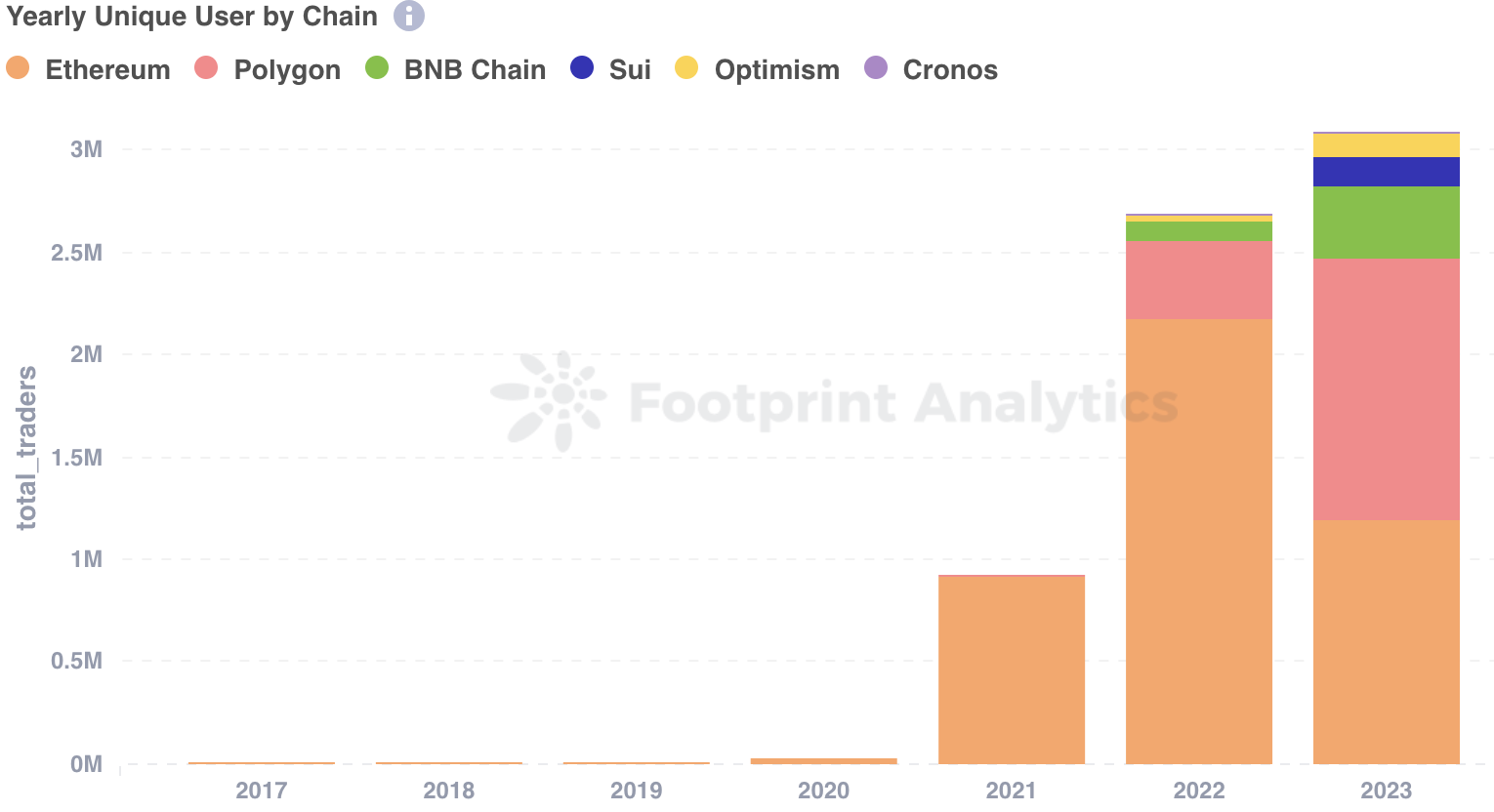

In December, diverse trends in blockchain network engagement were observed: Ethereum's user base grew by 10.9%, Polygon's increased by 19.2%, BNB Chain saw a 41.8% rise, and Sui's users doubled.

-

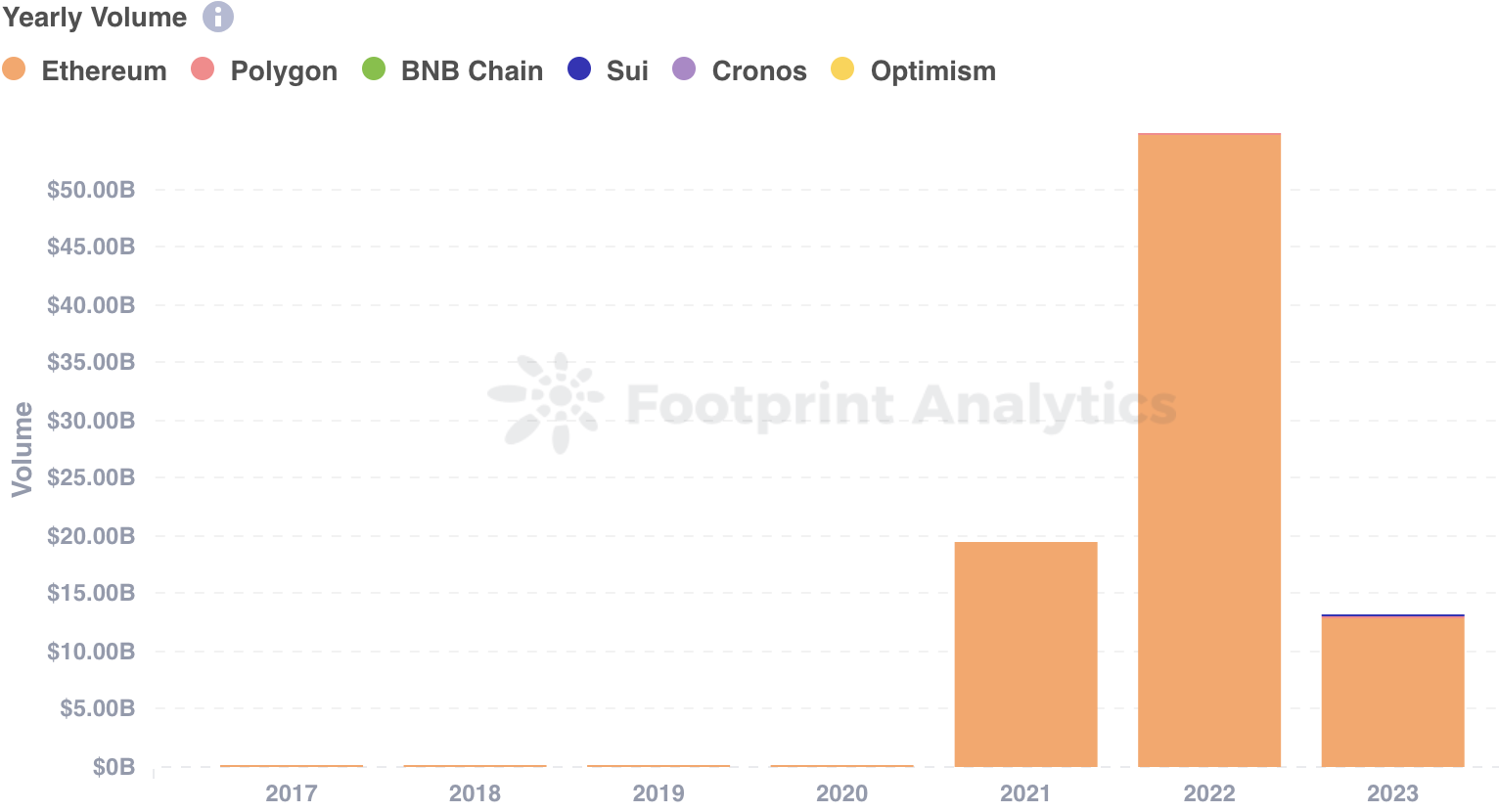

The 2023 NFT market volume totaled $13.12 billion, marking a decrease from the previous year's high. Ethereum's market dominance slightly receded to 97.8%, down from 2022’s 99.8%, indicating a gradual diversification in the market.

-

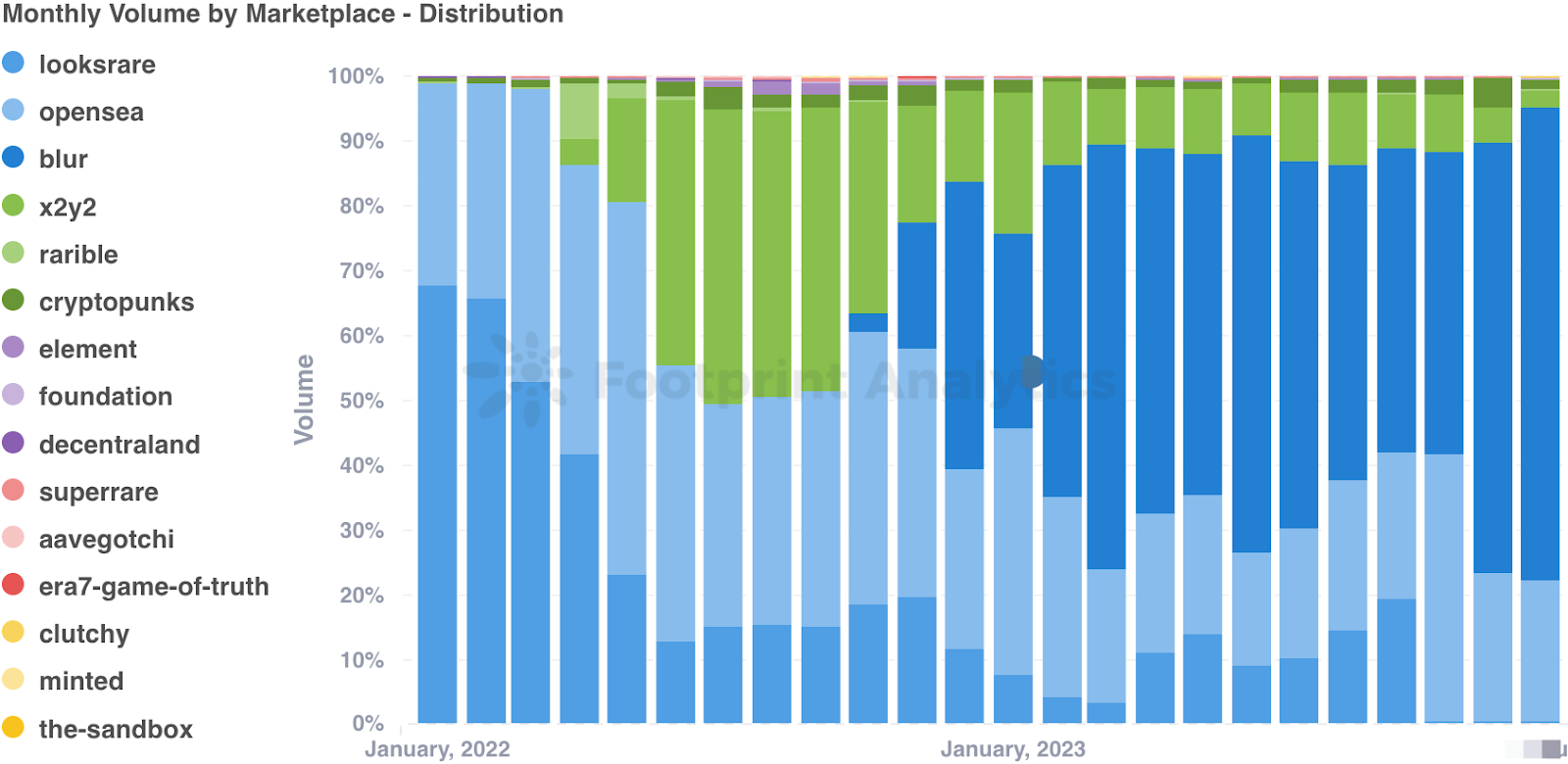

In 2023, the yearly volume performance of key NFT marketplaces showed notable shifts from the previous year. Blur achieved a remarkable yearly volume of $7.26 billion, a leap from $646.03 million in 2022.

NFT Investment & Funding

-

December was a bustling month in the NFT market, marked by five funding rounds that cumulatively raised $159.88 million.

-

LINE NEXT raises $140 million to expand the Web3 ecosystem.

What’s New?

-

Ubisoft introduces “Warlord NFTs” ahead of its highly anticipated release of “Champions Tactics: Grimoria Chronicles” set for 2024.

-

Forbes Web 3.0 launches NFT collective wallet.

-

Animoca Brands raises an additional US$11.88 million in the second tranche of funding for Mocaverse.

-

Magic Eden integrates the NFT marketplace into the blockchain strategy game Honeyland.

Crypto Macro Overview

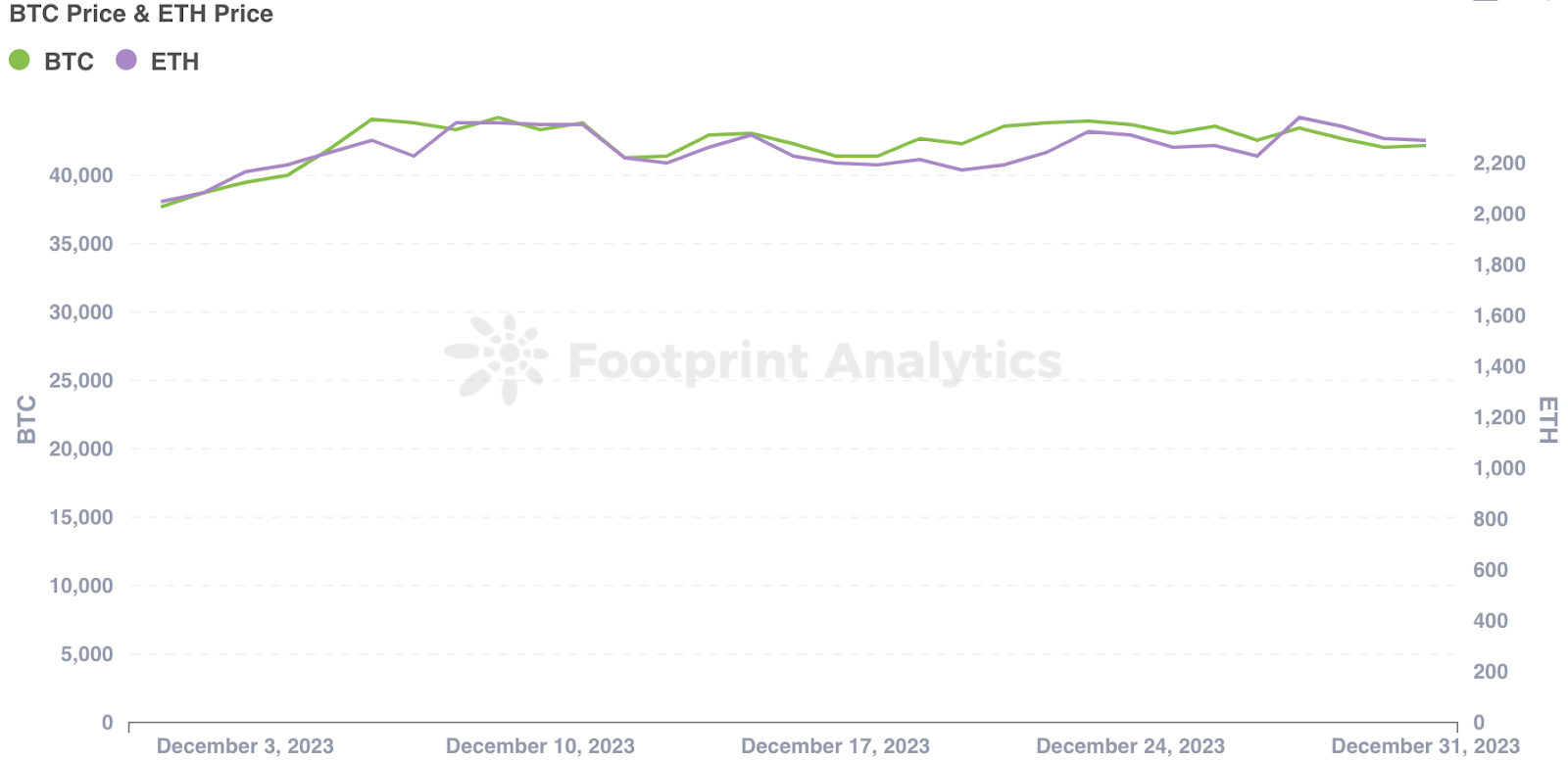

December was a month of resilience for Bitcoin, commencing at $37,729 and climbing 11.8% to conclude at $42,171. Ethereum mirrored this ascent, opening at $2,052 and escalating 11.7% to end at $2,293.

Source: BTC Price & ETH Price

Source: BTC Price & ETH Price

The month also witnessed a bullish sentiment in global stock markets, spanning the US, India, Japan, France, and Germany. This optimism and the anticipated US Federal Reserve rate cuts reinforced investor confidence, positively impacting the cryptocurrency sector. Furthermore, the expected approval of a spot Bitcoin ETF in the US and Hong Kong's readiness for spot crypto ETF applications contributed to this upbeat mood. These developments signify an increasing alignment between traditional financial markets and the crypto ecosystem.

NFT Market Overview

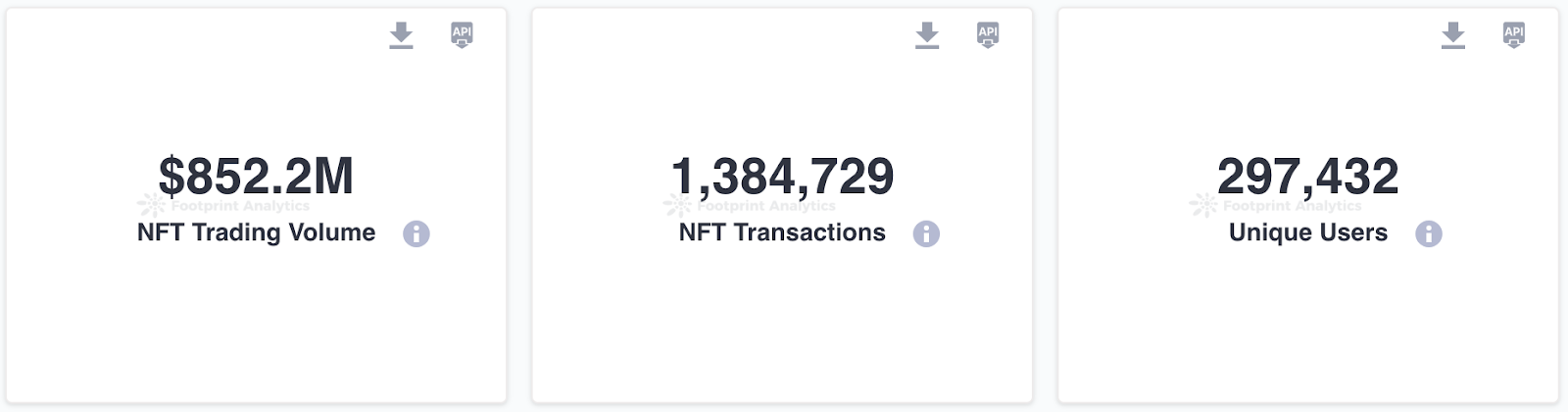

December stood out as a remarkable month, marked by a significant 32.3% surge in trading volume to $852.2 million. The number of transactions ascended by 29.4% to 1,384,729, while unique user wallets saw a 21.4% increase, reaching 297,432.

Source: NFT Market Overview

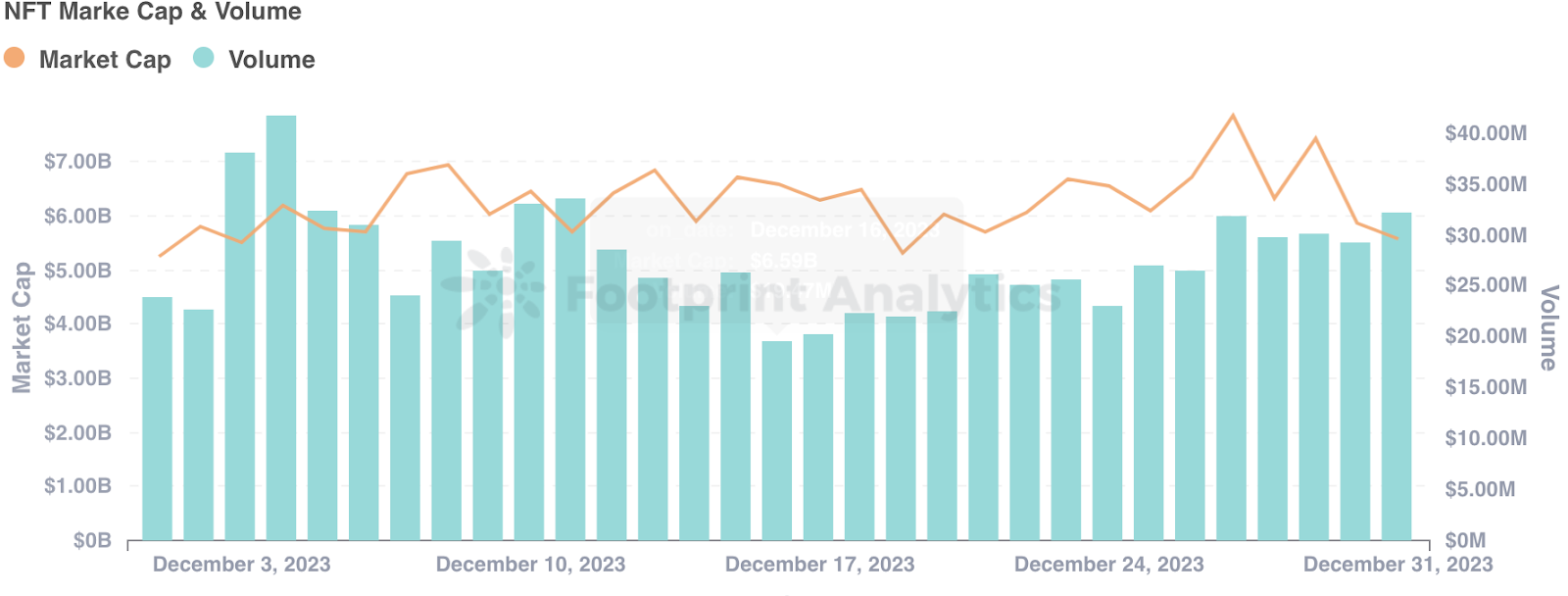

The market cap of NFTs also displayed resilience, starting at $5.24 billion and growing 6.5% to close at $5.58 billion.

Source: NFT Market Cap & Volume

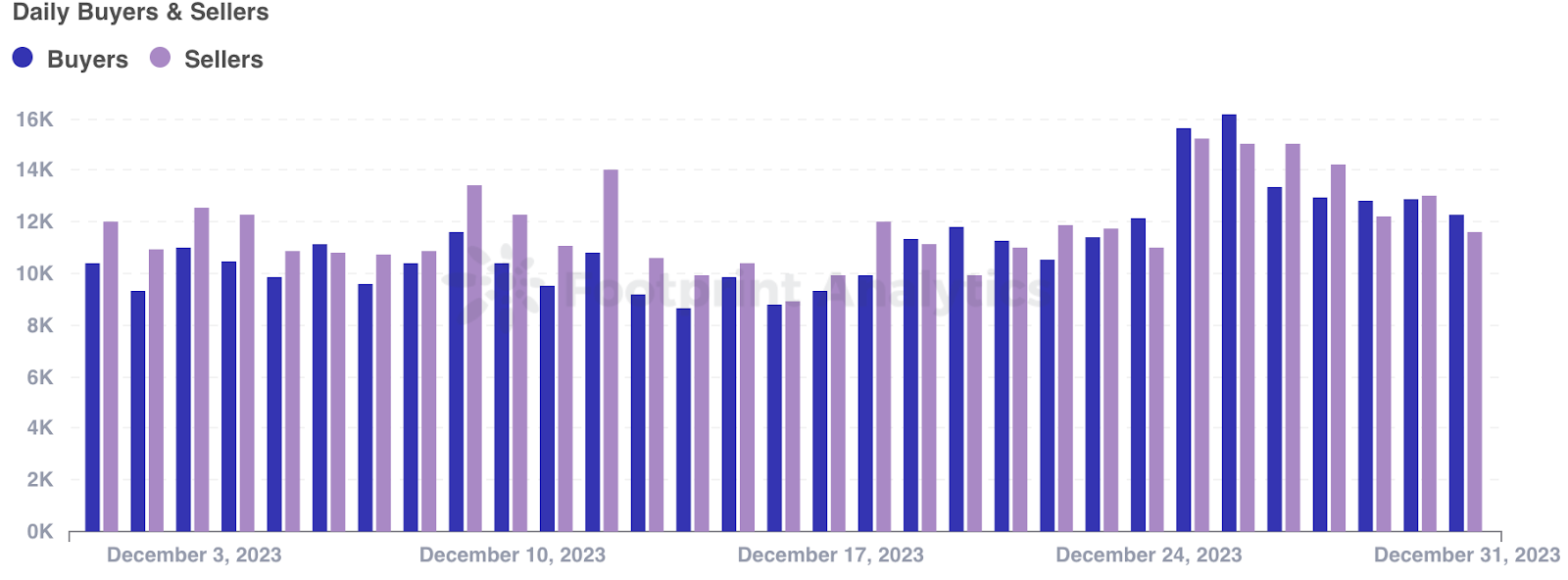

The buyer-to-seller ratio in the NFT market reached a notable 102.1%, a 1.45% increase from November, with 180,232 buyers (up 22.7%) and 176,607 sellers (a 21.0% increase).

Source: Daily Buyers & Sellers

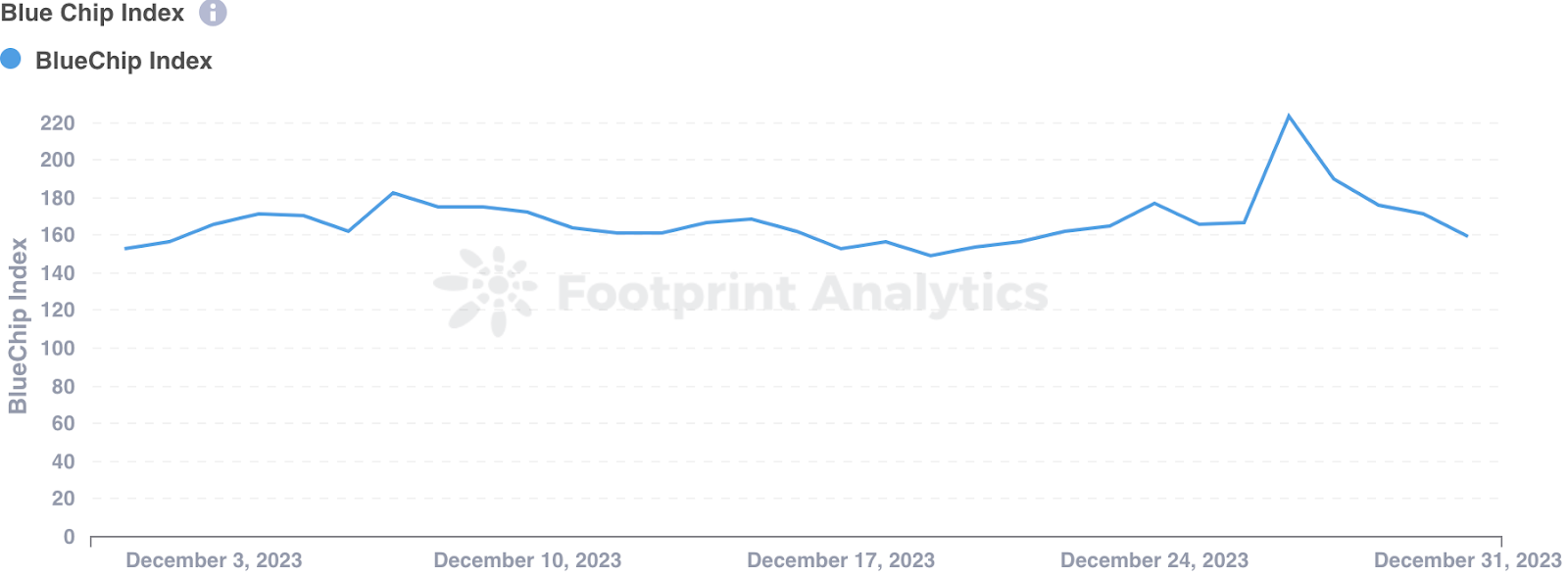

The Blue Chip Index, too, saw a modest rise of 4.6%.

Source: BlueChip Index

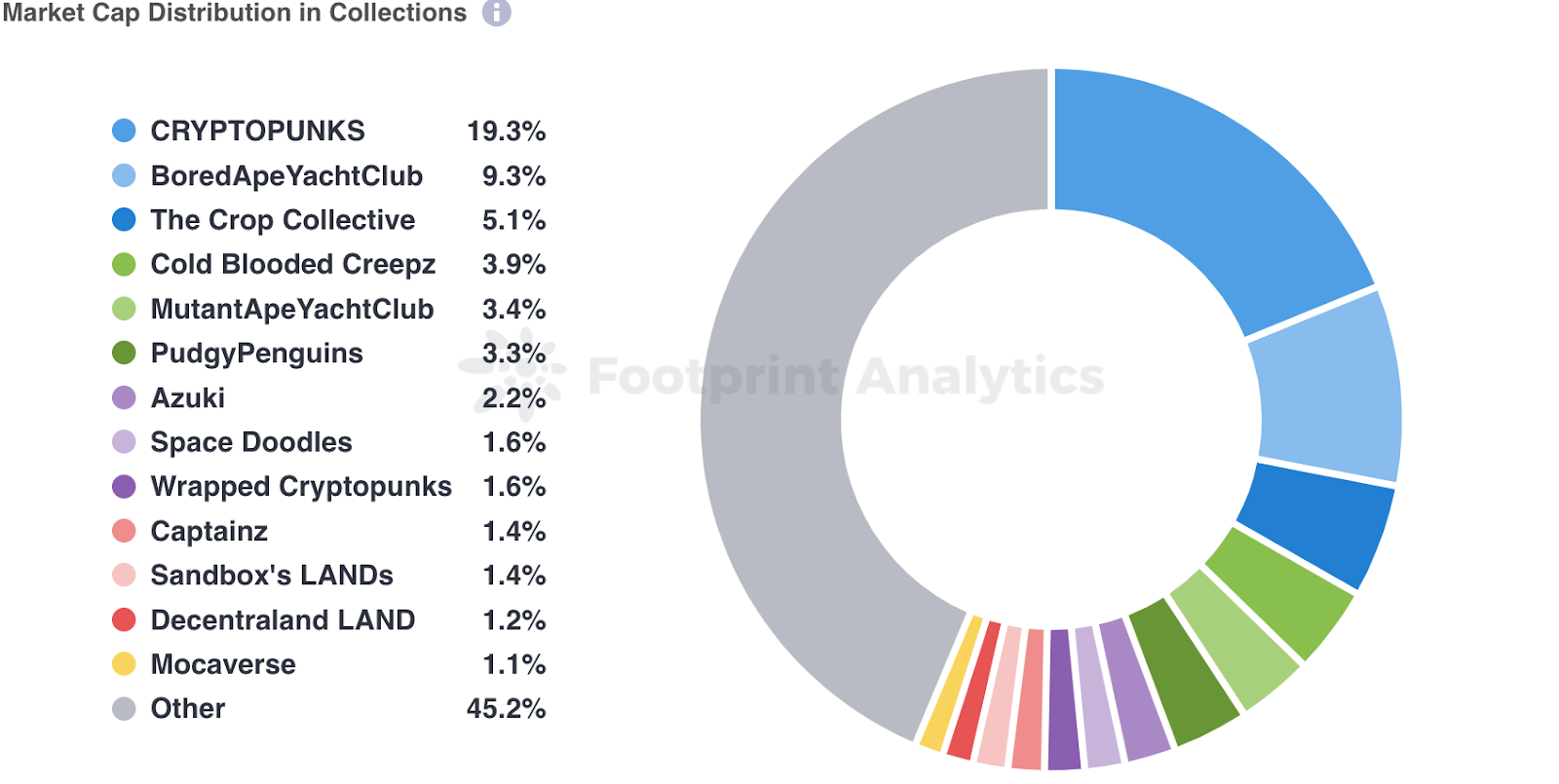

Key insights from Footprint Analytics indicated remarkable growth for Pudgy Penguins and Mocaverse in December. Pudgy Penguins’ floor price soared by 64.4%, rising from 6.46 ETH to 10.62 ETH, while Mocaverse's floor price escalated by 51.6%, from 2.23 ETH to 3.38 ETH. Additionally, Animoca Brands raised an additional US$11.88 million for Mocaverse in December, following a US$20 million investment in September 2023.

Source: Market Cap Distribution in December

Chains & Marketplaces for NFTs

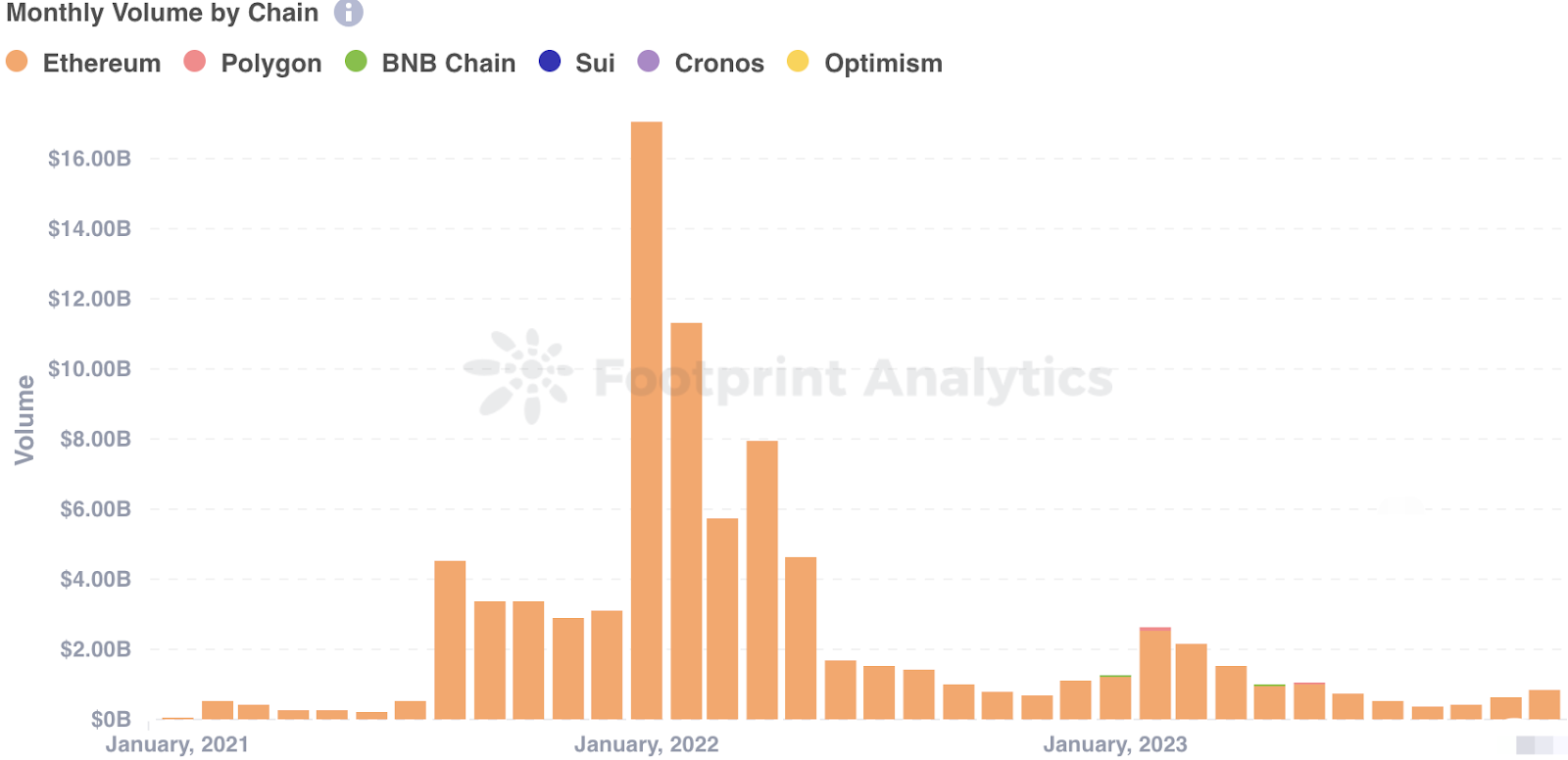

December spotlighted Ethereum as the leader in the NFT market with a substantial trading volume of $836.1 million, comprising 98.1% of the total market activities, a notable 31.8% increase from November.

Source: Monthly Volume by Chain

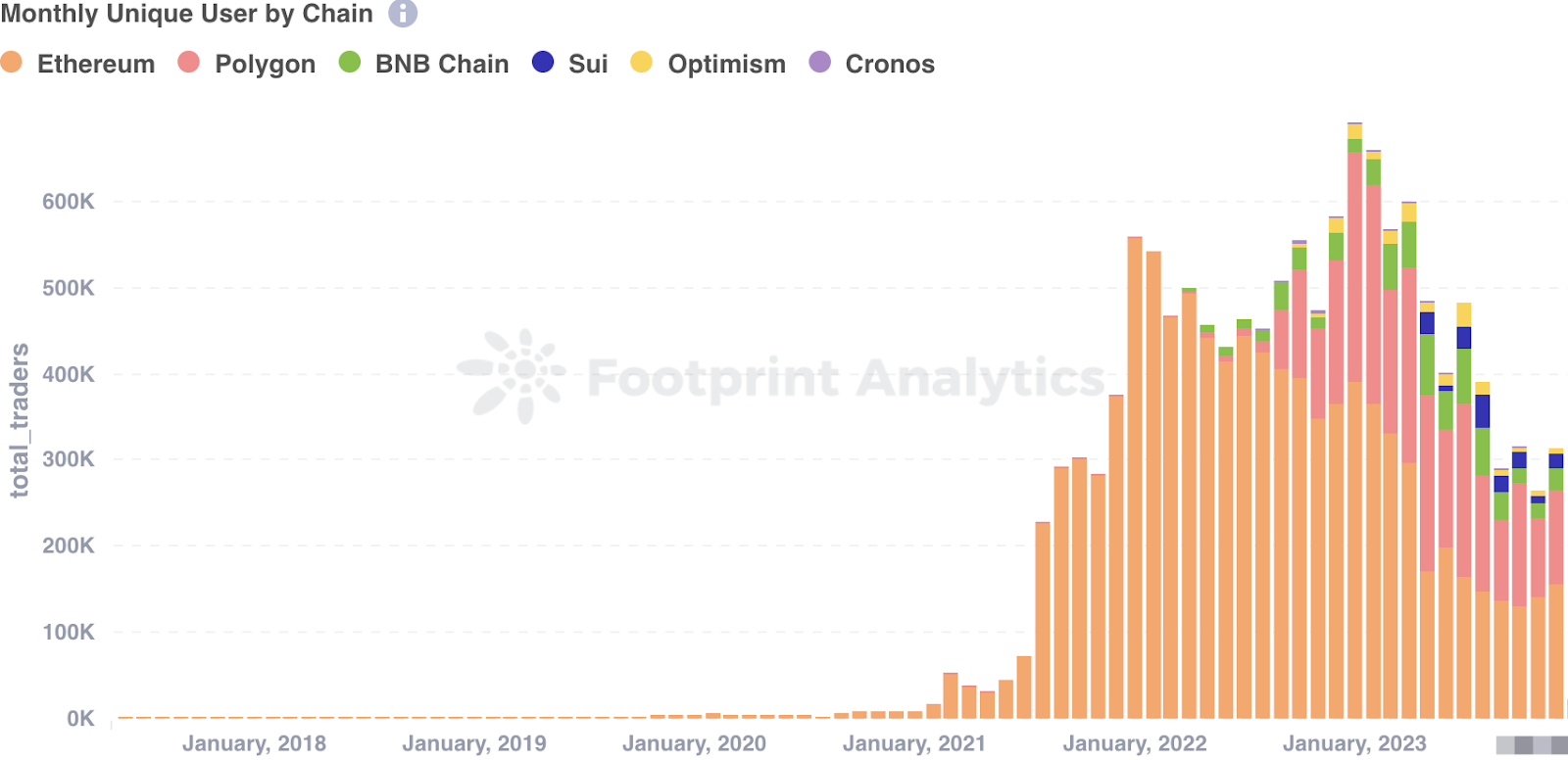

The month's data revealed diverse user engagement trends across blockchain networks. Ethereum continued its upward trend, growing its unique user count to 155.74K, a 10.9% increase from November. Polygon's user count rose by 19.2% to 109.65K, recovering from its previous decline. BNB Chain also bounced back, reaching 23.83K users, a 41.8% increase, though still shy of its July peak. Sui doubled its November figure, rising to 18.47K users.

Source: Monthly Unique User by Chain

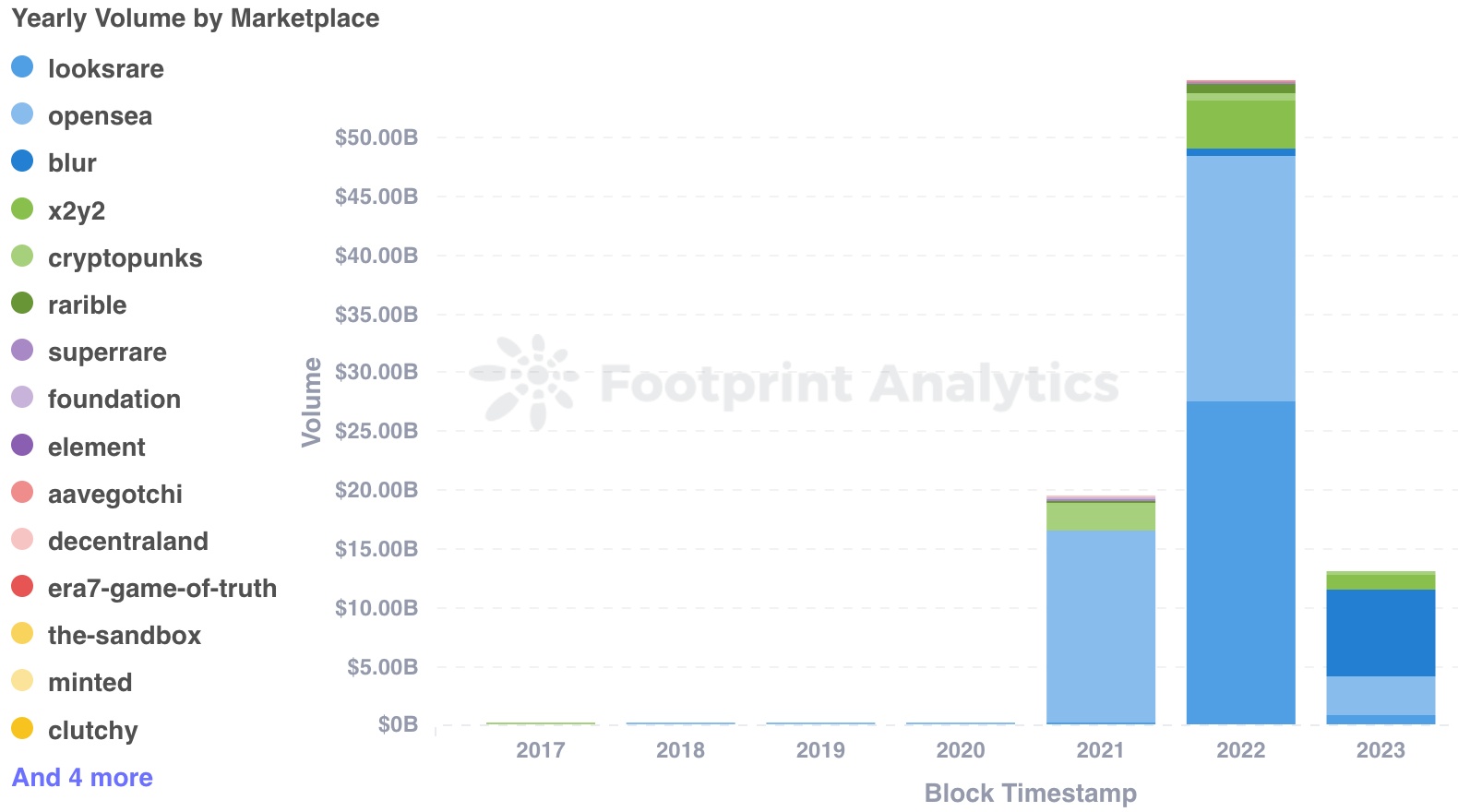

In a broader view, the 2023 NFT market volume totaled $13.12 billion, marking a decrease from the previous year's high. Ethereum's market dominance slightly receded to 97.8%, down from 2022’s 99.8%, indicating a gradual diversification in the market.

Source: Yearly Volume by Chain

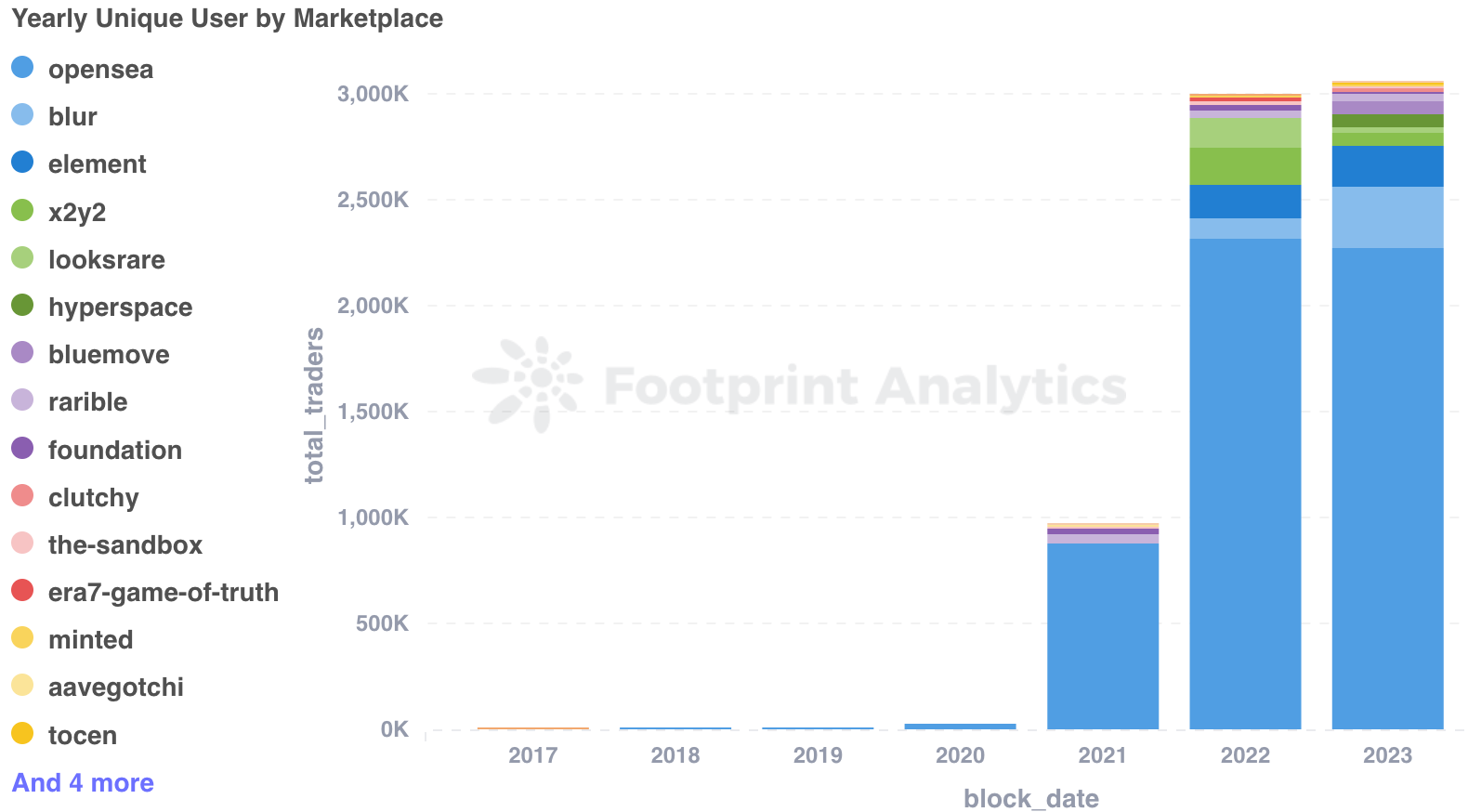

Polygon led the 2023 unique user count with a remarkable 231.0% increase, reaching 1.28 million users. Ethereum saw a 45.2% decrease to 1.19 million users, reflecting a shift in user preferences across chains. BNB Chain’s user base expanded to 0.35 million, a 280.7% jump from 2022.

Source: Yearly Unique User by Chain

December's marketplace dynamics showed significant shifts. Blur's trading volume grew by 45.4% to $620.82 million, while OpenSea’s volume rose 25.2% to $186.97 million. X2Y2, however, experienced a 32.0% decrease in volume.

Source: Monthly Volume by Marketplace - Distribution

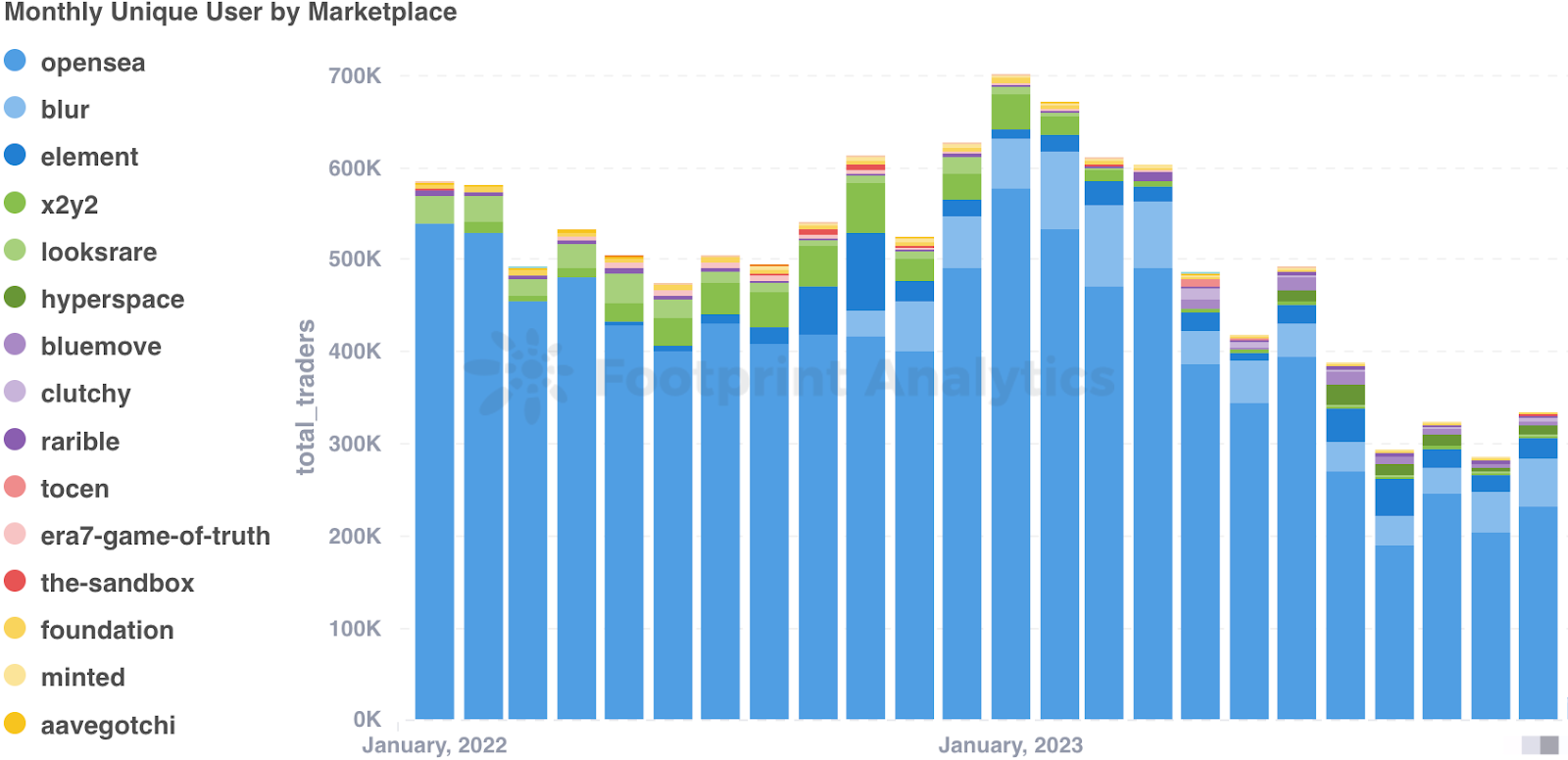

Furthermore, OpenSea's unique users increased by 14.02% to 232,702 in December, affirming its leadership. Blur and Element also reported growths in unique users by 18.99% and 18.58%, respectively.

Source: Monthly Unique Users by Marketplace

In 2023, the yearly volume performance of key NFT marketplaces showed notable shifts from the previous year. Blur achieved a remarkable yearly volume of $7.26 billion, a leap from $646.03 million in 2022. OpenSea, despite a volume drop to $3.31 billion from $20.91 billion, remained influential.

Source: Yearly Volume by Marketplace

OpenSea's unique user count saw a slight decline, while Blur's user base surged by 189.78% to 291,579, signaling its rapid ascent in the NFT market.

Source: Yearly Unique Users by Marketplace

NFT Investment & Funding

December was a bustling month in the NFT market, marked by five funding rounds that cumulatively raised $159.88 million.

Funding Rounds In December 2023

LINE NEXT, a subsidiary of LINE focused on NFT development, secured a major $140 million investment led by Crescendo Equity Partners. This stands as the year's largest funding in the Asian blockchain Web3 sector. This capital boost paves the way for LINE NEXT's anticipated launch of its global NFT platform, DOSI, in January 2024.

Source: DOSI Citizen

As we bid farewell to 2023, the resilience and dynamic evolution of the NFT market heralds a transformative year ahead in 2024. NFTs are rapidly moving beyond traditional collecting, increasingly serving as a medium to represent customer identities, melding digital with physical realities, and fostering user co-creation. This evolution marks a clear path toward broader mainstream adoption. The expanding diversity in user participation and the emergence of cutting-edge platforms are shaping a richly layered and multifaceted NFT ecosystem, poised for continued innovation and growth.

_______________

Data includes:

-

Blockchains: Ethereum, Polygon, BNB Chain, Cronos, Optimism, Sui

-

Marketplaces: OpenSea, LooksRare, Blur, X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era7, the Sandbox, Minted, Clutchy, BlueMove, Hyperspace, Tocen, and Keepsake.