Research Methodology

This report is based on an interview with Simon Kim, CEO of Hashed, and includes information about Hashed's Asia strategy from the interview, as well as independent research and analysis conducted by Tiger Research.

Introduction

The year 2023 was pivotal for capturing the opportunities and possibilities of the Asian Web3 market. Countries in the Western region have mainly been conservative and strengthening regulations on the crypto and blockchain industry. In contrast, Asia has pursued a more open stance by revamping regulations and embracing the Web3 market. The year also saw the emergence of several Asian-focused Web3 initiatives, most notably Hashed, which started in South Korea and has grown into a global-level VC.

Unique among other global crypto VCs, Hashed has Asia as its primary focus. Its portfolio is comprised of a larger Asian team. Unlike other crypto VCs whose portfolios are mostly focused on the North American market, Hashed has been actively investing in Asian founders and technologies. This research delves into Hashed’s position as a pioneer in the Asian Web3 market. Through an interview with Simon Kim, CEO of Hashed, we explore the uniqueness of the Asian Web3 market and the opportunities it presents.

Hashed, Asia's Web3 Market Leader

Since its inception in 2017, Hashed has shown a particular interest in the Asian market, actively investing in major Asian Web3 projects such as Vietnam's Kyber Network, Sipher, Sky Mavis, and Coin98. Considering that the majority of Asia-based crypto VCs funded by partners in Asia have largely stuck to portfolios centered around the North American region, it is clear how invested Hashed is in the Asian market.

In 2020, the company became a full-fledged venture capitalist by establishing Hashed Ventures and launching its first and second funds, totaling 360 billion KRW (approx. 275 million USD). What's notable is that Hashed is not just a capital provider, but also a company builder and project accelerator. For example, it has played a catalytic role in revitalizing the Web3 ecosystem in Asian countries through various ways such as establishing the Web3 venture builder “Unopnd”, running the think tank “Hashed Open Research”, operating the Web3 builder bootcamp program “Protocol Camp”, hosting the “Hashed Potato Club” community meetup, and holding global blockchain events such as KBW (Korea Blockchain Week).

More recently, the company has accelerated its ecosystem expansion in Asia. In 2023, Hashed physically expanded beyond South Korea, establishing offices in Singapore, India, and other key Asian hubs. This expansion is more than just an investment, it reflects Hashed’s commitment to engage more closely with key stakeholders in Asia and to participate more actively in the development of the Web3 ecosystem in each country.

What is especially impressive is seeing how much work Hashed has put into entering the Indian market. In 2022, the company established Hashed Emergent, which now employs more than 15 people in investment review and ecosystem support roles.

Today, Hashed Emergent has raised 512 billion KRW (approx. 39 million USD) in funds for investments in India and developing countries. In December 2023, Hashed Emergent organized the first-ever India Blockchain Week, bringing together the fragmented Indian blockchain-related events to showcase the potential of the Indian Web3 market to the world.

In Thailand, Hashed is also working with large financial companies to innovate Web3 technology. In September 2023, Hashed Emergent established the Shard Lab with Siam Commercial Bank (SCBX), Thailand's largest financial holding company, to innovate financial infrastructure. These activities demonstrate Hashed's active and diverse initiatives in the Asian market.

Why Hashed is focusing on Asia

Here are the reasons why Hashed is focusing on the potential of the Asian market, as disclosed by CEO Simon Kim.

First, Asia is an important market for Web3 popularization. This stems from the differences in the blockchain market between Asia and Western countries. While Western countries are primarily focused on infrastructure projects, Asia has more competitiveness in blockchain-based applications and content-based projects. Based on the proportion of the portfolio that Hashed has invested in, 71% of the blockchain market in the West, including North America and Europe, consists of infrastructure projects. 67% in Asia is applications and content-based projects.

This difference is crucial for the development of killer apps that can popularize the Web3 industry. Historically, the emergence of killer apps in the Internet and mobile markets has fueled explosive growth and development of related technologies, and we believe that Asia has the potential to continue this trend.

Next, he noted that the Asian market is characterized by being very responsive to new investment opportunities or experiences at the mass retail level. This became even more evident after the launch of P2E games such as Axie Infinity. In particular, Southeast Asia has been at the center of the P2E gaming craze, with many people in Vietnam, the Philippines, and Indonesia exploding into the Web3 ecosystem. It is also worth noting that in India, more than 100 million people have already been exposed to the cryptocurrency market and are actively engaged in investment activities.

Major Asian game companies have also been quick to recognize this opportunity and have entered the P2E game market more aggressively than their Western counterparts. South Korea's WeMade, Nexon, Netmarble, Neowiz, and Com2Us, for example, are leading the P2E game market. This once again demonstrates the agility of the Asian market. In addition to this, Asia accounts for more than 60% of the world's cryptocurrency trading volume and has about five times as many cryptocurrency holders as North America. This shows how nimble the Asian market is in recognizing new opportunities.

Finally, Asia stands out as a market where major corporations are pioneering experimental Web3 initiatives. Leading global companies from South Korea, Japan, Thailand, and Singapore are participating in the Web3 ecosystem in various ways. In South Korea, conglomerates such as Samsung, SK, LG, and Lotte, along with global game companies such as Nexon, Netmarble, and Krafton have a strong presence in the Web3 market.

Along with the Web3 initiatives of Asian companies, their experimental and open attitude is also notable. Even if they do not run Web3 businesses themselves, Asian companies are open to incorporating blockchain technology where they deem necessary. They approach blockchain as a component applicable on a case-by-case basis. This approach has been dubbed "Web2.5," a concept between Web3 and Web2.

This flexibility of use is highlighted as a unique feature of the Asian market, and is facilitating access to the Web3 ecosystem for a wide range of companies. The recent launch of a Web3 wallet by Singapore's Grab is a good example of this trend. These factors are what Kim believes makes Asia a more promising market for Web3 adoption than the West.

Opportunities in the main Asian markets for Hashed

While Hashed is excited about the Web3 mass adoption that the Asian market will bring, it is also paying close attention to the unique features and opportunities of each region of Asia, especially in Japan, India, Thailand, and the Middle East. The following is an overview of some of the opportunities Hashed has seized in these countries.

Japan: A market with government policy-driven Web3 revitalization and strength in content

Japan is a market where government policies are expected to revitalize the Web3 market. Many large Japanese companies are actively participating in the Web3 market, which means new collaboration opportunities are on the rise. Hashed is also keeping an eye on these developments and potential investment opportunities.

Japan's strength in the content space is notable, especially considering the entry of major Japanese game companies into the Web3 market. Many top game companies, including SONY, Bandai Namco, and Square Enix, have established Web3 game development studios and are actively participating in the ecosystem with Japanese blockchain mainnets such as Oasys and Astar Network. In addition, SBI Holdings' recent announcement of a $663 million Web3 fund is also a factor to keep in mind.

India: Brain factory for global markets, birthplace of Web3 infrastructure projects.

India is a center of the global IT industry and an emerging Web3 market. According to Kim, the country has the advantage of being a powerhouse from a builder's perspective. India has the second largest number of developers after the United States, with nearly 13.2 million developers. This was evident at the recent India Blockchain Week hackathon organized by Hashed Emergent. While a typical hackathon has 100-200 participants, the event attracted over 2,500 people, more than 10 times the average number of participants, which is a testament to the size of India's developer pool.

He also remarked as impressive that, unlike other Asian countries, India has a strong capability in IT infrastructure and systems engineering. India has successfully launched global Web3 infrastructure projects such as Polygon, and this success has attracted many Indian developers to the Web3 market. Not only their development skills but also their data-driven, computational thinking and global leadership are noteworthy.

When talking to Indian founders, Kim was impressed at how they analyzed and communicated data in a much more three-dimensional and multifaceted way beyond the obvious indicators. According to Kim, the potential of the top 0.1% of India's population could even be higher than the top 0.1% of the United States. However, India still lacks an institutional foundation for the cryptocurrency market, with poor social infrastructure and high taxation rates. As such, the development of the internal market looks to take some time.

Nevertheless, India is a globally promising market and is expected to explode as an innovation powerhouse. In response, Hashed has been investing heavily in the Indian Web3 ecosystem by establishing Hashed Emergent. The company has also hired a number of Indian employees and now has over 30 India-focused portfolios.

Thailand: A market characterized by government and traditional finance-driven Web3 initiatives

Thailand is another one of the Web3 markets that Hashed has been focusing on recently. Thailand is particularly enthusiastic about crypto, with 22% of Thai citizens holding cryptocurrency, well above the global average of 12%. The country is also home to several government and traditional finance-focused Web3 initiatives, with the recent election of a pro-crypto figure as prime minister further emphasizing this point. In fact, the Thai government has announced plans to provide a basic income by distributing cryptocurrency to all citizens. Commercial banks such as Siam Commercial Bank and Kasikorn Bank are active participants in the Web3 ecosystem as well.

Under this context, Hashed is looking for new opportunities in the Thai Web3 market. In particular, Kim aims to develop Web3 ventures and create new Web3 opportunities with key ecosystem players by leveraging the strength and energy of the Thai market, rather than simple investment. Recently, Hashed joined a project with SCBX, a Thai financial holding company, to transform Thailand's financial infrastructure to Web3.

Middle East: A market characterized by state-led Web3 initiatives backed by sovereign wealth funds.

Recently, the Middle East has been revolutionizing the Web3 market. These changes are centered on the United Arab Emirates and Saudi Arabia. According to Kim, these countries are actively pursuing industrial diversification strategies on a national level as they face the depletion of their oil resources. For them, transitioning to new industries and financial systems is not an option, but a necessity. Unlike other countries that are cautiously approaching the Web3 market, Kim says these countries are moving swiftly at the national level to promote the development of Web3 technologies.

The UAE is emerging as an important strategic location for Web3 companies, playing a similar role to Singapore in the Middle East. This has attracted many global Web3 companies to set up headquarters in the UAE. South Korea's Wemade and Neowiz have also established offices in Abu Dhabi. Dubai is home to more than 600 global Web3 companies, including Binance, at the Crypto Center at the Dubai Multi Commodities Centre (DMCC).

The United Arab Emirates, in particular, is actively developing innovative Web3 guidelines at the national level and is striving to become one of the most Web3-friendly countries in the world. This is due to the fact that the Web3 market is a high-risk area with regulatory uncertainty. In order to become a global hub, providing safe and leading guidelines quickly is imperative. In addition, the strong financial support from the UAE's sovereign wealth fund has led to increasing global investment and interest in the region. Abu Dhabi's accelerators and co-working spaces are also attracting developers globally, adding to the excitement.

Next, Kim considered Saudi Arabia as an important market because it has the largest retail market in the Middle East. Previously, the market has not received much attention due to its closed nature. This changed after Crown Prince bin Salman came to power, and changes and innovations have been underway. In 2019, tourist visas were issued for the first time in the kingdom's history, and more open policies are being implemented.

These factors are why Hashed is focusing on the Middle East market. Hashed says it will continue to focus on investments, Web3 developer training, and venture-building programs to expand Web3 opportunities in the region.

In 2024, it’s time for the preparations to pay off

CEO Simon Kim believes that the market will look a little different in 2024. In particular, he cautiously notes that the cycle centered on Bitcoin's halving will become blurry. This is because the supply-halving of Bitcoin will not have the same impact as in the past. With more than 90% of Bitcoin already mined, trillions in trading volume, and institutional investors entering the market in earnest, sudden multiplication in price does not seem likely. More importantly, he said, is the increase in real-life demand and mass adoption.

In particular, he noted that the influx of institutional investors has created massive liquidity, and demand is exploding as enterprises accelerate their entry into the Web3 market. Examples such as BlackRock's application for a Bitcoin ETF show that institutions are recognizing crypto as a major investment asset class. In the Web3 retail space, it is also notable that global enterprises are beginning to adopt Web3 wallets. As tech companies with hundreds of millions of users, such as Telegram, Paypal, and Grab, enter the Web3 market, a massive influx of users is expected.

The areas Kim is most excited about are 1) Web3 gaming, 2) stablecoin-based financial innovation, and 3) accelerating enterprise-focused Web3 adoption. Expectations are particularly high for Web3 gaming. The gaming market has always been one of the most innovative and challenging, and the most expected to bring about popularization of the Web3 market. Games have historically been the spearhead of new platforms. From the 386 computers in the 1980s to smartphones today, gaming is where people spend the most time and are willing to open their wallets.

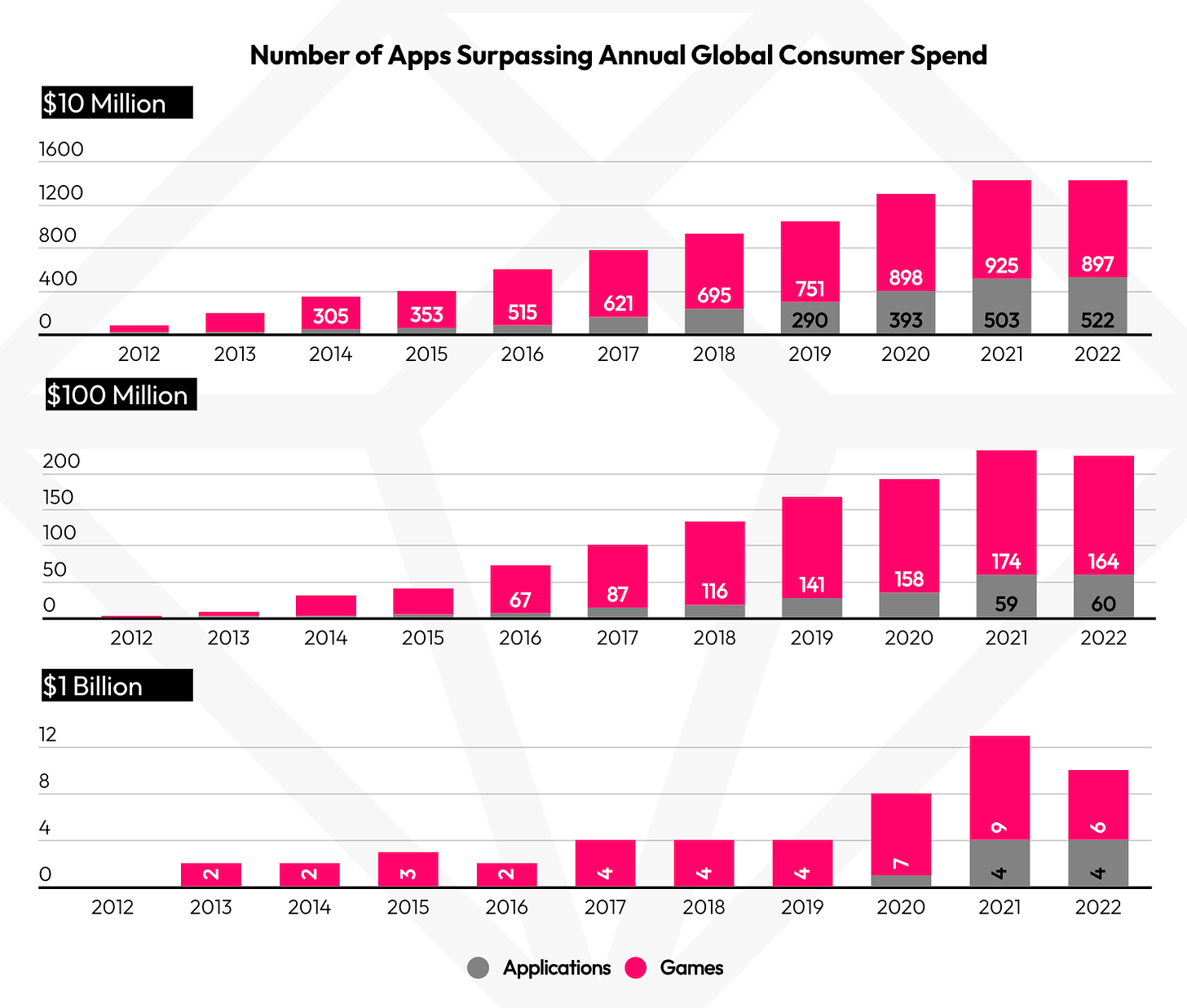

If one looks at the current revenue split between games and non-games on the Apple App Store and Google Play Store, games are the bigger earner. It is also important to note that now it is second nature for in-game assets to be linked to real-world assets. In the past, it was difficult to combine finance and gaming. Now, with Web3 technology, it is expected that large fields of content and finance will be integrated and create synergies. For example, the P2E game Axie Infinity is used as a way for people without financial accounts to earn financial income through games and accumulate basic assets while having fun.

Next, financial innovation centered on stablecoins is expected to accelerate. While there are currently no clear guidelines for issuing stablecoins, some Asian countries, such as Japan, Hong Kong, and Singapore, have already created enabling environments for stablecoin issuance. It is also noteworthy that the market capitalization of stablecoins such as USDT continues to reach new all-time highs. As digital wallets become more widely adopted, they are expected to revolutionize the consumer finance space.

Finally, enterprise-oriented Web3 adoption is also expected to increase. In particular, an increase in the use of Web3 components by non-Web3 companies. Web3 companies had a high barrier to entry due to their uniqueness, but now they are already being widely approached by general enterprises and startups. Some use cases are stablecoin-based payment components and NFT membership issuance by Shinsegae and Lotte Group, among others. This move is likely to further accelerate the landscape of utilizing components of blockchain technology as business tools.

Conclusion

In an interview with Hashed CEO Simon Kim, we discussed the importance of the Asian market and predictions for the Web3 market in 2024. While Kim is excited about the potential of the Asian market, he also emphasized the need to engage and collaborate with Western markets, rather than simply focusing on Asia alone. Western infrastructure projects will eventually need to onboard competitive applications and content to energize their ecosystems. Conversely, Asian projects need a solid infrastructure to onboard their applications, along with experienced open-source developers to support them. It is clear that Asia will bring about Web3 popularization in the coming years. Under these market conditions, it is worth looking forward to Hashed's efforts to connect the East and West as the Web3 market leader in Asia.