Table of Contents

1. Introduction

2. SK Planet

2-1. Corporate Overview

2-2. OK Cashbag Revenue Model

3. Why Blockchain and What’s Expected

3-1. Success and Limits of OK Cashbag’s “Versatility”

3-2. SK Planet Attempts to Secure New Growth Momentum and Improve Profitability via Avalanche Blockchain

4. UPTN Project’s Current Status

4-1. SK Planet's UPTN Subnet temporarily outpaces Axie Infinity’s on-chain activity following the release of TEM NFTs

4-2. While there is an immediate cost burden, the framework is designed to yield both revenue and profitability in the long run

5. Closing Thoughts

1. Introduction

Let’s talk the MCU for a second. In “Iron Man 1”, Tony Stark is attacked by terrorists and nearly killed by the shrapnel lodged in his heart. While he is unconscious, Ho Yinsen, who was also held captive, plants an electromagnet in his heart to keep the shards away. Then with Yinsen’s help, Tony forges the Arc Reactor as a replacement for the electromagnet in his chest, extending his life by decades. And thus Iron Man was born. So, why are we talking about this famous superhero? We need to talk about UPTN project and whether it could be the arc reactor for SK Planet.

This report is organized into two parts. First, we’ll provide a brief corporate analysis for SK Planet, exploring the background, business direction, and expected effects of the UPTN project. In the second part, we analyze the current state of the business based on on-chain data and consider UPTN projects’ potential in the long-term.

Source: MCU’s “Iron Man”

2. SK Planet

2-1. Corporate Overview

SK Planet is a data business solution and O2O marketing platform under the SK Group, created in October 2011 when the platform business was spun off from SK Telecom. Currently, SK Planet is 98.65% owned by SK Square and 1.35% by treasury shares, but in September 2023, WEMADE will acquire a 12% stake in SK Planet as a means of strategic alliance.

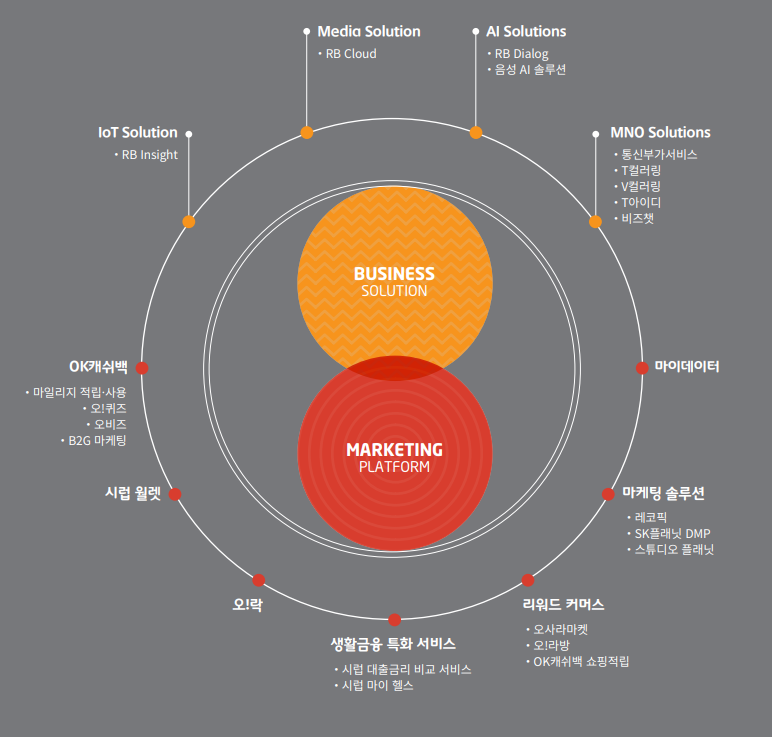

SK Planet is mainly composed of two divisions. The Business Solution division provides B2B business solutions in various fields such as IoT (RB Insight), Media (RB Cloud), AI (RB Dialog), and MNO. And the Marketing Platform division operates marketing services such as OK Cashbag and Syrup Wallet, which we will focus on in this report.

Source: SK Planet

OK Cashbag is a mileage-based marketing solution that enables users to earn points for participating in events and paying for services and unlock various benefits. OK Cashbag has over 93,000 affiliate stores covering food and beverage, cosmetics, fashion, stationery, film, and culture, making it the largest of its kind in Korea. The total number of its users is 21 million, of which approximately 7 million are monthly users. Meanwhile, Syrup is a service that can manage and store debit cards, various membership cards, coupons, and public transit cards, with a total of 15 million users and 6 million MAUs.

2-2. OK Cashbag Revenue Model

The basic revenue model of OK Cashbag is based on the point fees collected from users and affiliate stores by operating a marketing platform that connects them.

Affiliate Stores: When users engage in consumption activities at OK Cashbag affiliated stores and accumulate OCB points, the store pays SK Planet a commission equivalent to 25% of the accumulated amount and points earned by consumers. The affiliated commission becomes revenue for SK Planet, which also holds the points accumulated by consumers. And SK Planet transfers the points to the respective stores when customers use these points at other affiliated store,. The interest earned during the holding period is recognized as revenue, and in case customers do not use the points, the unclaimed revenue also belongs to SK Planet. Previously, besides the per-transaction commission, stores had to pay membership and annual fees, but this policy has been abolished.

Users: Users pay a service fee to SK Planet each time they use OCB points accumulated at one affiliated store at another one (10% of the accumulated amount). While there used to be an annual fee, it has now been replaced by a service usage fee.

3. Why Blockchain and What’s Expected

3-1. Success and Limits of OK Cashbag’s “Versatility”

OK Cashbag, operated by SK Planet's Marketing Platform Division for the past 25 years, initially achieved industry-leading success based on the 'versatility' of points but has recently hit a business-growth wall. Specifically, OK Cashbag initially secured a customer base of 20 million through a strategy of integrating fragmented points into a universal point system through affiliations with over 90,000 stores. Over time, challenges emerged as 1) users and stores started leaving, leading to a reduction in universality, and 2) limitations in the existing point system became apparent in terms of scalability.

For instance, in 2020, Homeplus discontinued the affiliations with OK Cashbag in terms of point accumulation and conversation, maintaining only the point usage part. This was due to the increase in “cherry-picking” customers that convert points earned at Homeplus for use at other stores, undermining the expected marketing and revenue expansion effects. Also, as Homeplus’s own membership exceeded 6 million, the need for spending marketing costs to partner with OK Cashbag lessened.

Moreover, the decreasing number of OK Cashbag’s partnerships is also due to the inability to track data on points, for which affiliated stores cannot assess OK Cashbag’s marketing impact. Stores were paying fees and distributing points to customers but had no way to analyze where the said points were going and how they were being used. So what’s really the merit in partnering with OK Cashbag? Over time, OK Cashbag fell into a negative cycle of 'store departure → diminished point universality → diminished customer lock-in effect → deteriorating attractiveness and profitability of OK Cashbag's service.'

Furthermore, with 25 years of operation, loyal users are aging (OK Cashbag's customers are mainly in their 30s to 50s), and there is relatively less influx of younger users that find appeal in OK Cashbag service with changing needs and preferences. The existing rigid system fails to provide new experience that meet the needs of younger users, and the affiliations tend older, less popular brands rather than the latest brands and trendy shops that the younger generations flock to.

Essentially, SK Planet has been successful in controlling costs in various aspects, including R&D, depreciation, and service costs, centered on the 2018 divestiture of 11STREET, and has been able to improve profitability, but has been struggling to grow sales (see figure below).

Thus, SK Planet aims to establish a virtuous cycle of 1) improving service utility → attracting new users and increasing service activity → preventing store departures → enhancing point universality and 2) maximize revenue by expanding the value chain using blockchain technology, to achieve qualitative and quantitative growth simultaneously.

3-2. SK Planet Attempts to Secure New Growth Momentum and Improve Profitability via Avalanche Blockchain

From a broader perspective, the value of blockchain that SK Planet is focusing on is as follows:

- Improved Versatility: The emergence of NFTs, tokenized data, allows for the “on-chainization” of data, making data available to own and trade through a trustworthy network. If this concept is applied to the OK Cashbag service, users can not only earn and consume points, coupons, tickets, and memberships on the app, but freely trade these benefits according to their preferences and lifestyles. This creates a market where users can easily exchange points/benefits that are less appealing to them, fostering more active user participation in events. For SK Planet, this results in increased user utility and service activity, which leads to more affiliated stores, point universality, and advertising revenue. Also, it is made possible to generate revenue through transaction fees from the secondary market.

- Data Analysis for the Secondary Market: The advent of NFTs and FTs (fungible token) enables on-chain data tracking for the previously inaccessible secondary market, allowing for a more detailed analysis of consumer preferences and needs. This facilitates a sharper enhancement of services.

- Expansion of the Value Chain: Pursuing the NFT business requires supporting blockchain (transaction execution, settlement, consensus, DA), wallets (storage), marketplace (trading), communities (communication among holders), and publishing solutions (onboarding other NFT projects). In other words, sufficient capital and talent allows for extensive expansion of the value chain based on NFT technology, creating synergy among each component The UPTN project has already launched the services mentioned above or are in preparation (see figure below).

Other unexpected new use case opportunities are expected to emerge in continuing the blockchain business, just as the internet gave rise to unforeseen business models that exist today. So there is great anticipation on how blockchain will integrate with existing services to evolve from the current platform economy into the protocol economy.

We’ve discussed the broader direction that the UPTN project is taking. Now, let us delve into how SK Planet is envisioning the UPTN project and plans for business. We’ve categorized the UPTN project roadmap in two phases.

3-2-1. Phase 1: Preps for Activating Ecosystem and Expanding the Value Chain

Phase 1 focuses on preparing the infrastructure and launching various contents to facilitate the UPTN business and build the ecosystem by Q3 2024. It’s intriguing that unlike previous operations confined to applications, such as OK Cashbag and Syrup, SK Planet is attempting to expand the value chain by introducing blockchain technology. To be more specific, the services and expected effects that SK Planet will launch during Phase 1 are as follows:

UPTN Chain (Infrastructure)

This blockchain will be the basic infrastructure for the UPTN project, intended to support various services operated by SK Group, starting with OK Cashbag. The UPTN Chain is an Avalanche Subnet that offers advantages such as high scalability based on the Snowball consensus algorithm, it sown block space, and high flexibility in chain design. To read more about Avalanche’s technological characteristics: “Visualizing the Vision of Avalanche -1”.

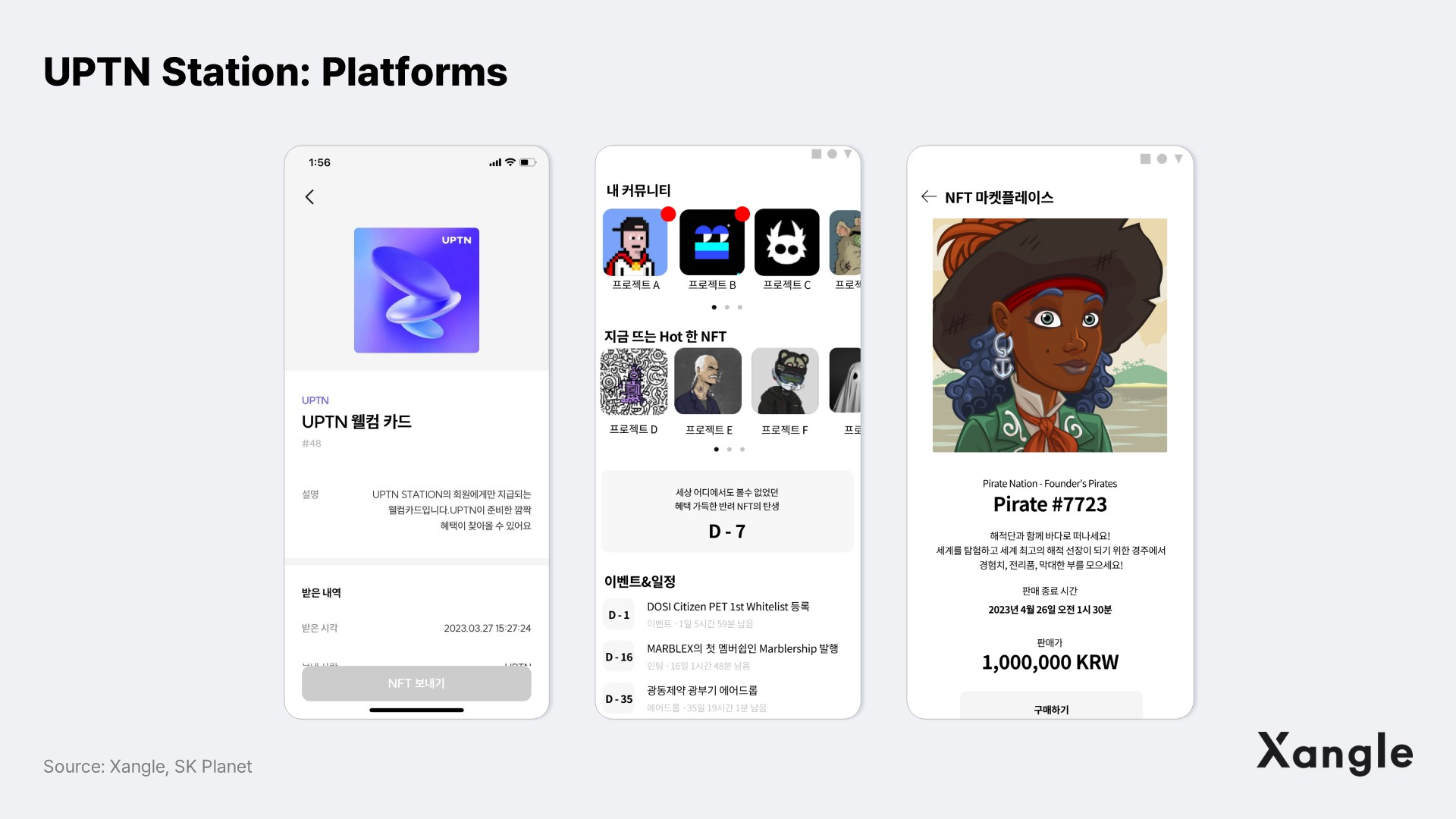

UPTN Station (Wallet)

Similar to UPTN Chain, UPTN Station is a user wallet that will serve as the basic infrastructure for the UPTN project. All NFTs and tokens that users acquire through OK Cashbag services will accumulate in the UPTN Station wallet, serving a digital inventory for them. While currently supporting only OK Cashbag, it’s possible that it will be compatible with other blockchain services that SK Group plans in the future. Nevertheless, at the present, SK Planet only issues UPTN Station wallets to OK Cashbag users that completed the KYC authentication.

Road to Rich NFT (Content)

Road to Rich is an NFT project in a membership-form that has been ambitiously prepared by SK Planet. It consists of two elements: 1) character NFT, 'Racky,' and 2) TEM NFT. Holders can customize their membership by combining TEM NFTs of various benefits with character NFTs to meet their own individual needs (see figure below).

This dynamic membership model aims to create a more personalized and tailored benefits for user lock-ins instead of unilaterally providing fixed benefits. This is because users experience the efficiency of the service they use when they can change the benefits as needed rather than using a fixed set of them. Thus, as more partners are secured and a more variety of benefits are provided, the stronger the lock-in effect will be.

Meanwhile, SK Planet can also significantly diversify sales and improve revenue. This is because Road to Rich generates transaction fees as users equip/detach TEM NFTs to Racky as well as create royalties through active secondary trading to obtain desired TEM NFTs. This design lessens the impact from the changes in the cryptocurrency market compared to regular membership NFTs, resulting in relatively low revenue volatility and better profitability defense.

Ticket NFT (Content)

In a strategic move to combat ticket counterfeiting, generate royalties from secondary transactions, and leverage transaction data analytics, SK Planet introduced ticket NFTs in September.

3-2-2. Phase2: Strategic Leap Forward for Revenue Maximization

Capitalizing on the groundwork laid during Phase 1, the imperative now is to significantly enhance the value chain by introducing marketplace and community services.

SK Planet's recent announcements highlight the initiation of 1) an NFT marketplace facilitating the trade of user-to-user TEM and other onboarded NFTs and 2) a dedicated community for holders incorporating features like live chat, bulletin boards, and NFT-gated services. Looking forward, there is significant consideration for a long-term DeFi venture centered around point tokens (for more insight, check out Xangle Original report, “Road to Rich: SK Planet's Rewards Program Meets NFTs”). Already fostering collaboration, SK Planet has forged partnerships with industry giants such as T1, Dreamus Company, and WEMIX. These alliances signify a strategic positioning for SK Planet beyond Phase 2, envisioning the UPTN project evolving from a mere marketing solution into a super app facilitating fandom-based community activities.

4. UPTN Project’s Current Status

4-1. SK Planet's UPTN Subnet temporarily outpaces Axie Infinity’s on-chain activity following the release of TEM NFTs

According to available data on UPTN Explorer, the UPTN station garnered over 100,000 subscribers in June, and the monthly growth rate (CMGR) has maintained an impressive 10%, culminating in a total of 200,000 subscribers as of November 6. Over the course of five months since the introduction of the Road to Rich service, SK Planet successfully converted approximately 0.9% of OK Cashbag’s extensive customer base of 21 million into UPTN customers. SK Planet reports a 7.2% higher subscription rate for UPTN station among users in their 20s and 30s, signifying a successful outreach to the Millenials and Generation Z.

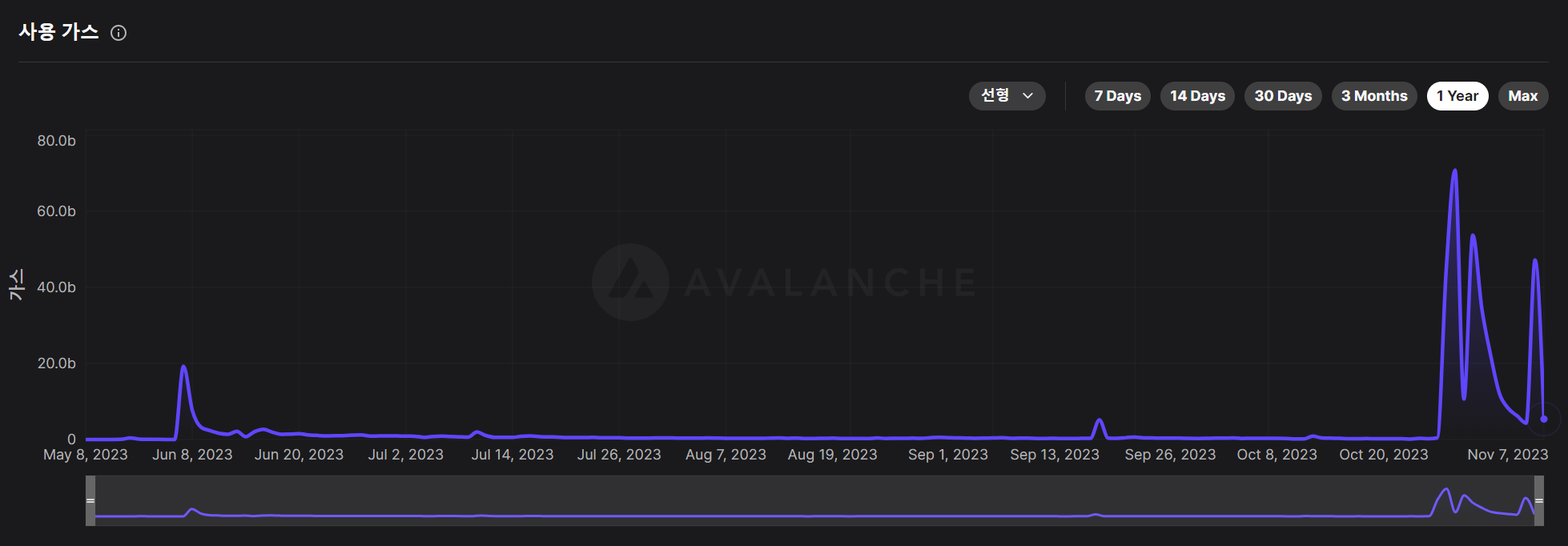

The surge in Daily Active Users (DAU) since the launch of TEM NFTs is equally remarkable. Initially, daily transactions on the UPTN chain were minimal, with fewer than 1,000 users per day, barring the first day of Road to Rich launch and the day of the strategic partnership announcement with WEMADE on September 18. The lack of on-chain activities, aside from creating a wallet and obtaining Racky, contributed to this trend.

However, with the introduction of TEM NFTs on October 27, users can integrate TEM with their wallets, resulting in a significant spike in active wallets. Presently, TEM NFTs come in three categories: Booster TEM (enhancing benefits from OK Cashbag), Benefit TEM (free tickets, event access, discount coupons, and others), and Cosmetic TEM (Racky Skins). In particular, Booster and Cosmetic TEMs are offered in limited quantities. Despite this, the recorded 50,000 DAUs on November 7 indicate significant potential for explosive growth, especially with the imminent launch of Benefit TEMs.

Source: UPTN Explorer

The introduction of TEM NFTs enabled users to engage in on-chain activities, such as adding and removing NFTs from their Racky. The impact was profound, with daily transactions surging to a remarkable 27.6 million, marking a significant milestone. Over the seven-day period spanning from October 27 to November 2, the platform witnessed nearly one million transactions, with users averaging 5.2 on-chain activities during this period. Furthermore, according to SK Planet, there was a 10.2% increase in the monthly average app visitation rate compared to the previous period. The utilization of mileage points for OK Cashbag also experienced a 7.4% increase, indicating a more active engagement in accumulating and using OK Cashbag points both online and offline, contributing to an enhanced user service experience.

Source: UPTN Explorer

In the highly competitive NFT market, it is rare for a single project to amass a staggering 27.5 million daily transactions, especially when compared to blue-chip projects such as Bored Ape Yacht Club (BAYC) and Azuki, which recorded significantly lower transaction volumes, with 246,000 and 160,000 transactions respectively. Even Axie Infinity, a prominent player in the space, averages around 160,000 transactions per day over the last 10 days on average.

Road to Rich emphasizes that the exceptional activity witnessed by TEM NFTs stems from their inherent "utility," surpassing the typical profile picture (PFP) paradigm. The surge in secondary trading activity directly correlates with increased royalty fees, providing a favorable scenario for the NFT issuer. As for PFP projects, there is a substantial rise in royalty income during bullish markets. However, during a downturn like the present one, it becomes highly unfavorable. On the other hand, Road to Rich, as earlier highlighted, is structured to be less affected by virtual asset market conditions compared to PFPs. This is due to 1) transaction fees incurred when users frequently equip/uninstall TEM NFT on Racky and 2) active secondary transactions to acquire the desired TEM NFT. As a result, it exhibits 1) relatively low revenue volatility and 2)an advantageous structure for defending profitability.

Transaction volume, similar to DAU, is anticipated to experience a substantial increase following the introduction of the 'benefit' TEM. Assuming a diverse range of TEMs is launched in the future, with an average of 275,000 daily transactions, and 20% of these transactions being secondary, the projected annual revenue from secondary transactions (royalty fees) can be approximated. Assuming an average TEM price ranging from $0.5 to $1 AVAX, and a 10% fee, the daily revenue is estimated to be between 2,750 to 5,500 $AVAX. On an annual scale, this translates to 1M to 2M $AVAX. Given the $AVAX value is approximately $13 as of November 7th, the anticipated annual revenue from secondary transactions is estimated to fall between $13M to $26M or roughly 170 billion to 340 billion KRW (in Korean won terms).

4-2. While there is an immediate cost burden, the framework is designed to yield both revenue and profitability in the long run

4-2-1. Short-term cost burden

Current key marketing cost elements, encompassing initial infrastructure setup costs, personnel expenses, and service operating expenses, include:

Initial marketing costs for attracting new users and activating the ecosystem

In an effort to acquire as many new customers as possible, SK Planet is currently offering substantial incentives to early users. For example, SK Planet is organizing various experiential free-point events for Road to Rich users. These events include daily rewards such as a 3 million KRW Hawaii travel voucher, complimentary fine-dining meal vouchers, a welcome gift valued at 0.35 $AVAX, and experiences like "burger making" for mission participants over a 40-day duration. It appears that, for the time being, there are plans to consistently conduct events similar to the ones mentioned above to promote ecosystem activity and enhance user retention.

SK Planet to cover gas fees to enhance user experience

In its commitment to providing a seamless user experience for Road to Rich, SK Planet is currently covering the associated gas fees related to on-chain activities. The UPTN token, serving as a medium for network fees within the UPTN chain, lacks an established market price (not in circulation), posing challenges in directly assessing gas fees. However, by leveraging calculations on DFK (Defi Kingdoms), one of the most active subnets, we can derive approximate figures. It is crucial to acknowledge that these are rough estimates, as actual figures may significantly

Analyzing data from DFK chain block #24542773 reveals a gas consumption of approximately 24,801,789, translating to about 0.49 JEWEL or $0.04 in gas fees (calculated based on the $JEWEL price as of November 8, approximately $0.1). Over the seven-day span from October 27 to November 2, the UPTN chain averaged around 35.45 billion gas consumption. By referencing the gas fees on the DFK chain, SK Planet's estimated daily coverage cost stands at $57 (approximately KRW 74,000 based on the exchange rate). With 10 block producers on the UPTN chain, SK operates one node, and Ava Cloud manages nine. Assuming an equal token staking for each node (as individual staking ratios aren't specified), SK Planet is likely disbursing about $51 to the Ava Cloud node. Consequently, sustaining the same network activity for a year would cost SK Planet approximately $18.8K (approximately KRW 24 million). If UPTN chain activity experiences a fivefold surge, the cost would escalate to approximately $93.9K (around KRW 120 million), and with a tenfold increase, the anticipated cost would be approximately $187.8K (around KRW 250 million).

Source: UPTN Explorer

4-2-2. A dynamic framework for long-term revenue and profitability

As previously discussed, SK Planet is actively delivering a range of benefits and directly covering users' transaction gas fees to kickstart the initial activation of the ecosystem. While upfront losses are inevitable, the overarching objective is to architect a framework that not only captures revenue but also ensures long-term profitability. The current revenue model of OK Cashbag centers around collecting fees from both member stores and users. Nevertheless, future expansion and diversification strategies are expectedto drive growth through the following avenues:

- Advertising Revenue: Aligning with the established revenue model.

- Network Fees (UPTN Chain/Infrastructure): SK Planet currently shoulders users' gas fees; however, validators are poised to receive network usage fees directly from users in the forthcoming phases.

- Wallet Fees (UPTN Station/Wallet): Imposing fees for transactions or swaps involving FT/NFT within UPTN Station.

- 1st and 2nd Content Transaction Fees (NFT Marketplace): Fees associated with the payment and transaction of content like TEM, tickets, coupons, goods, memberships, and others.

- IP Goods Sales (OSMU): Generating revenue from the sale of items, including Lucky and other IP goods.

- Publisher Revenue: Earning income through the distribution of external NFT projects.

- Financial Service Usage Fees: Charges associated with utilizing DeFi services, including loans, lending, farming, staking, and others.

5. Closing Thoughts

Technology doesn't shine just by existing; its brilliance is revealed when it catalyzes the creation of meaningful services embraced by a broad user base. Blockchain exemplifies this principle. While infrastructure development is pivotal, the creation of meaningful services utilizing it is equally crucial. From this standpoint, we anticipate a promising future for the blockchain market in South Korea, given the nation's robust retail sector and the genuine commitment of major enterprises to blockchain initiatives.

The era in which companies perceived blockchain solely as a marketing tool, mindlessly generating tokens, has largely passed. Major Korean enterprises are deeply reflecting on the objectives for adopting blockchain and contemplating how to seamlessly integrate this technology with existing business models to generate value. Their comprehension of blockchain, this novel and disruptive technology and ecosystem, is progressing rapidly. Building upon this understanding, they are meticulously and steadily preparing for business ventures. SK Planet stands as a prime example of such an entity, and we wholeheartedly commend their efforts.