Author: stella@footprint.network

In October, Bitcoin witnessed a significant price surge. As a result, the NFT market showed signs of recovery, with a 15.2% increase in both monthly trading volume and unique users. While these October figures demonstrated improvement compared to September, they fell short of the levels observed in August and previous months. Therefore, it is premature to conclude that this signifies the start of a market recovery. The industry eagerly anticipates further positive developments that extend beyond the influence of Bitcoin.

Data for this report was obtained from Footprint Analytics’ NFT research page. An easy-to-use dashboard containing the most vital stats and metrics to understand the NFT industry, updated in real-time, you can find all the latest about trades, projects, fundings, and more by clicking here.

Key Points

Crypto Macro Overview

-

Starting the month at $26,967, Bitcoin demonstrated a substantial increase of 27.9% over the period, ultimately closing at $34,497.

NFT Market Overview

-

Supported by favorable trends in the broader crypto market, the NFT market experienced an increase this month.

-

The Blue Chip Index witnessed an upward trend in September, with an increase of 14.4%.

Chains & Marketplaces for NFTs

-

Ethereum continued to dominate the NFT market's trading volume with $421.7 million, accounting for a significant 98.7%.

-

LooksRare faced a drastic decline as its trading volume plummeted by 97.8%.

NFT Investment & Funding

-

In October, the NFT market maintained a slow momentum, with a single funding round totaling $5 million.

What’s New?

-

LooksRare updates token economy model, allocating future fees for token buybacks and rewards.

-

Fantasy horse racing startup Game of Silks raises $5 million.

-

Germany’s postal service will issue limited edition NFT stamps.

-

Institutional NFT fund Spencer Ventures plans to purchase 144 Pudgy Penguin NFTs from Three Arrows Capital (3AC) Collection.

-

Yuga Labs to focus on building Otherside following restructuring.

Crypto Macro Overview

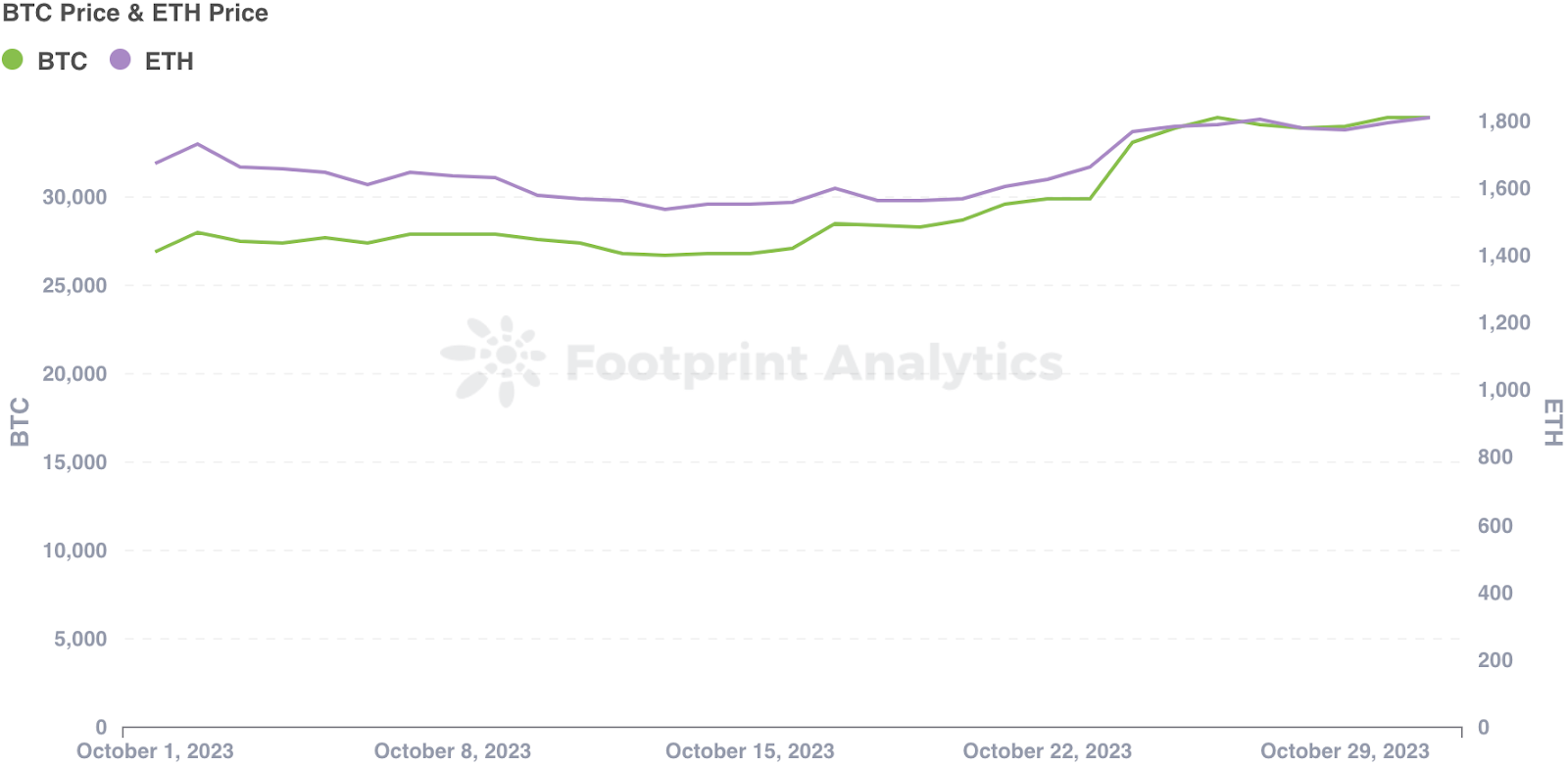

During October, Bitcoin experienced a notable surge in price, surpassing the performance of both traditional assets and other cryptocurrencies. Starting the month at $26,967, Bitcoin demonstrated a substantial increase of 27.9% over the period, ultimately closing at $34,497.

Ether started the month at $1,671 and experienced a relatively moderate increase of 8.3% during the period, ultimately closing at $1,810.

Source: BTC Price & ETH Price

Source: BTC Price & ETH Price

While technology stocks faced downward pressure, Bitcoin stood out by defying this trend. On October 16, the price of Bitcoin experienced a significant increase, reaching nearly $30,000. This sudden increase was triggered by a false report from cryptocurrency news site Cointelegraph, claiming in a tweet that the SEC had approved the first spot bitcoin ETF. However, the post was later deleted after BlackRock clarified to Bloomberg that their application was still under review. As a result, Bitcoin's price dropped to around $28,000 by the end of that day.

Following the incident, Bitcoin received support from growing anticipation for a spot ETF offering in the US market. The SEC chose not to contest the recent ruling in favor of Grayscale by the DC Circuit Court of Appeals. Grayscale's filing, along with other filings for spot bitcoin ETFs, now awaits review by the SEC. As a result, the price of Bitcoin experienced a notable upward trajectory starting from October 23 and remained near $35,000 until the end of the month.

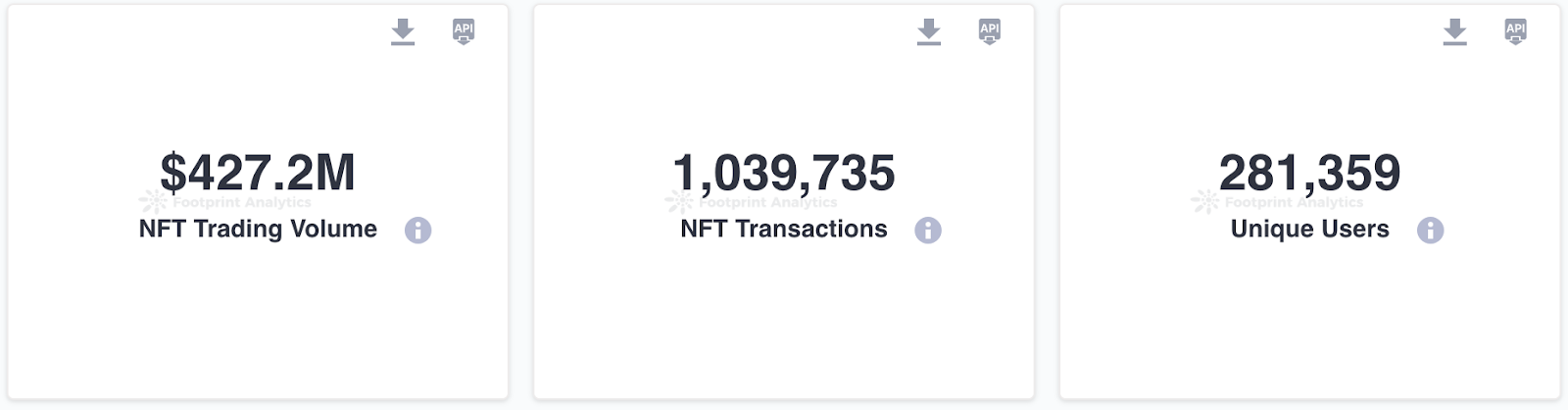

NFT Market Overview

Supported by favorable trends in the broader crypto market, the NFT market experienced an increase this month. The total trading volume for October amounted to $427.2 million, marking a 15.2% increase compared to the previous month. The number of transactions remained steady at 1,039,735. Moreover, October saw a rise in the number of unique users, reaching 281,359, representing a 15.2% growth.

Source: NFT Market Overview

Source: NFT Market Overview

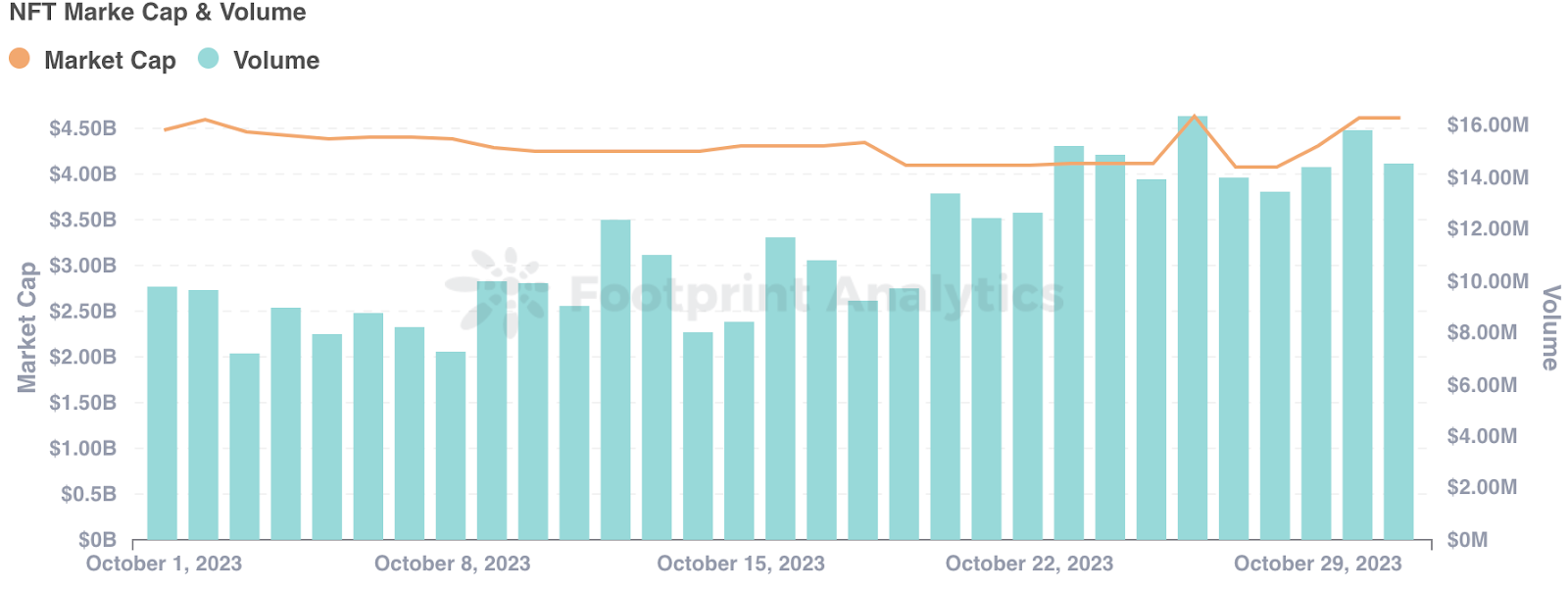

The NFT market maintained a steady daily market cap of approximately $4.5 billion throughout the month, while daily trading volume experienced an upward trend.

Source: NFT Market Cap & Volume

Source: NFT Market Cap & Volume

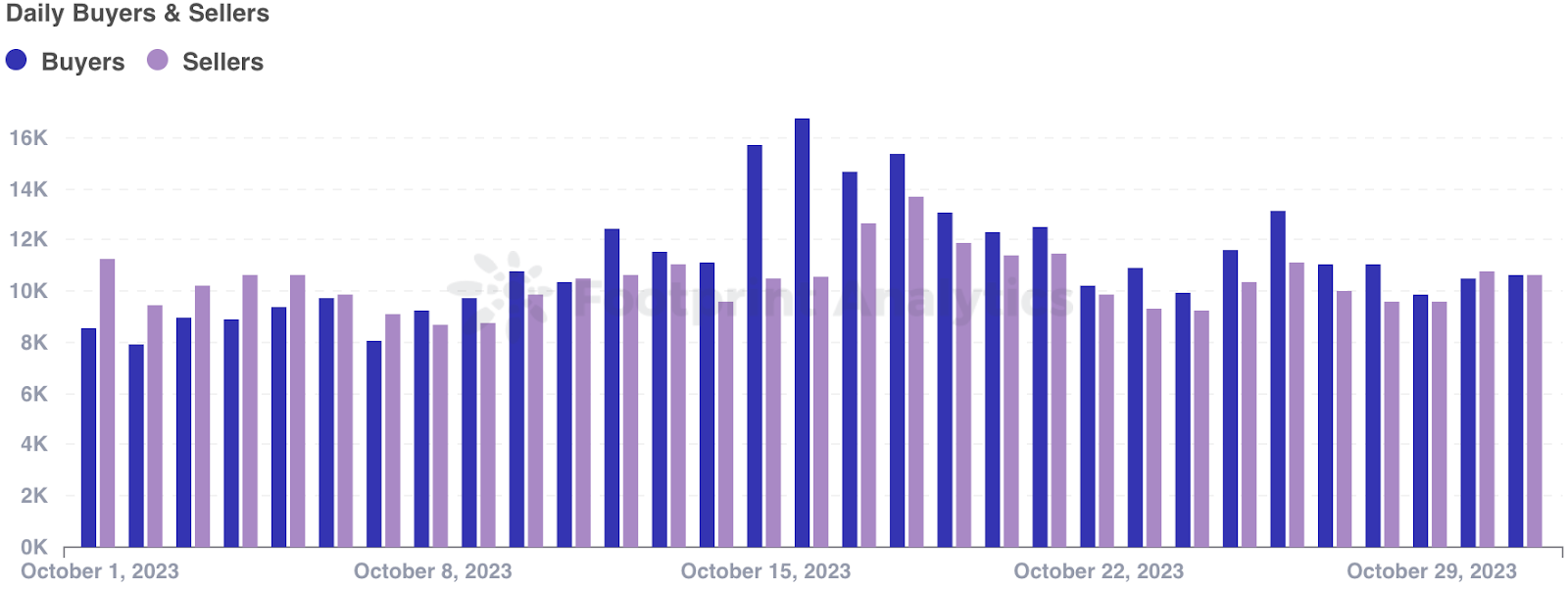

In October, the NFT market witnessed a buyer/seller ratio of 136.1%, marking a 33.2% increase from September. Throughout the month, there were 187,644 buyers and 137,845 sellers. Notably, the number of buyers rose by 26.9%, while sellers experienced a 4.0% decrease compared to the previous month. Although the data for October showed improvement compared to September, it fell short of the levels seen in August and previous months. As such, it is premature to conclude that this marks the beginning of a market recovery. Further positive developments beyond Bitcoin and Ethereum are eagerly awaited.

Source: Daily Buyers & Sellers

Source: Daily Buyers & Sellers

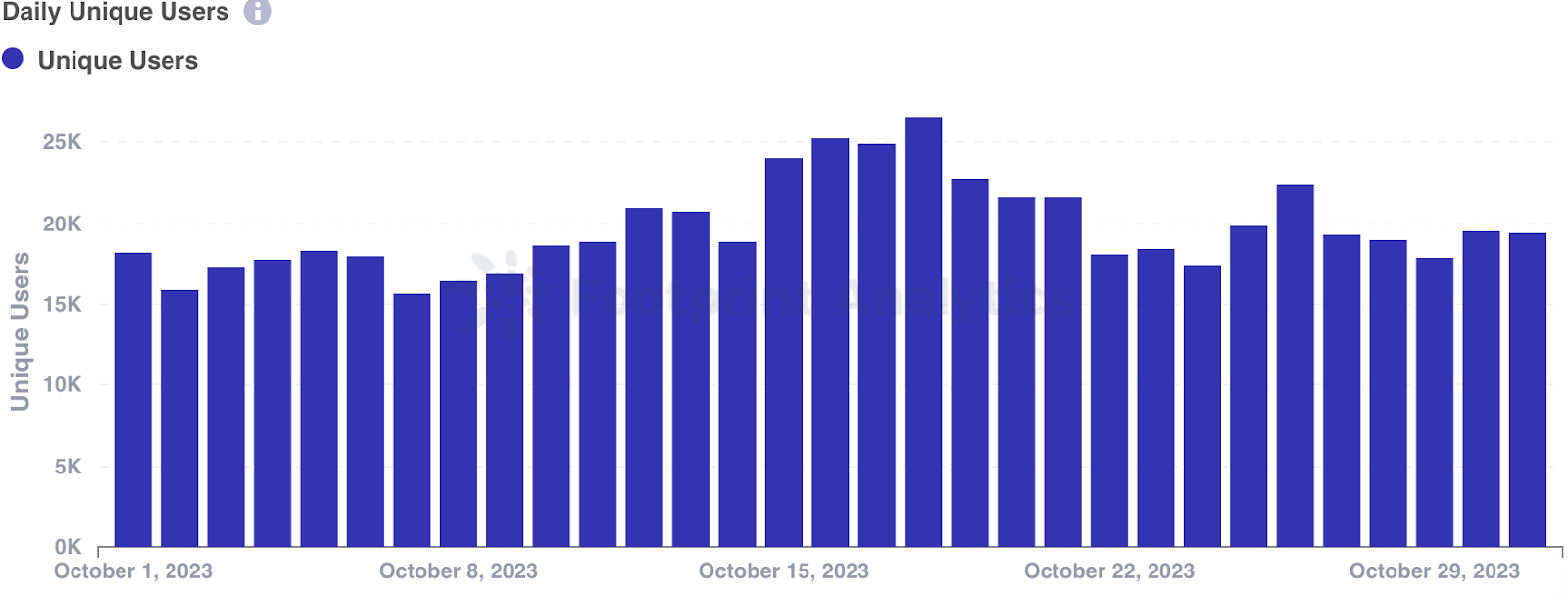

The trend of daily buyers/sellers and unique users remained consistent, with a modest increase observed between October 15 and 18. According to Footprint Analytics, two protocols, OpenSea Shared Storefront and AI-success on Polygon, experienced a rise in internal transfers.

Source: Daily Unique Users

Source: Daily Unique Users

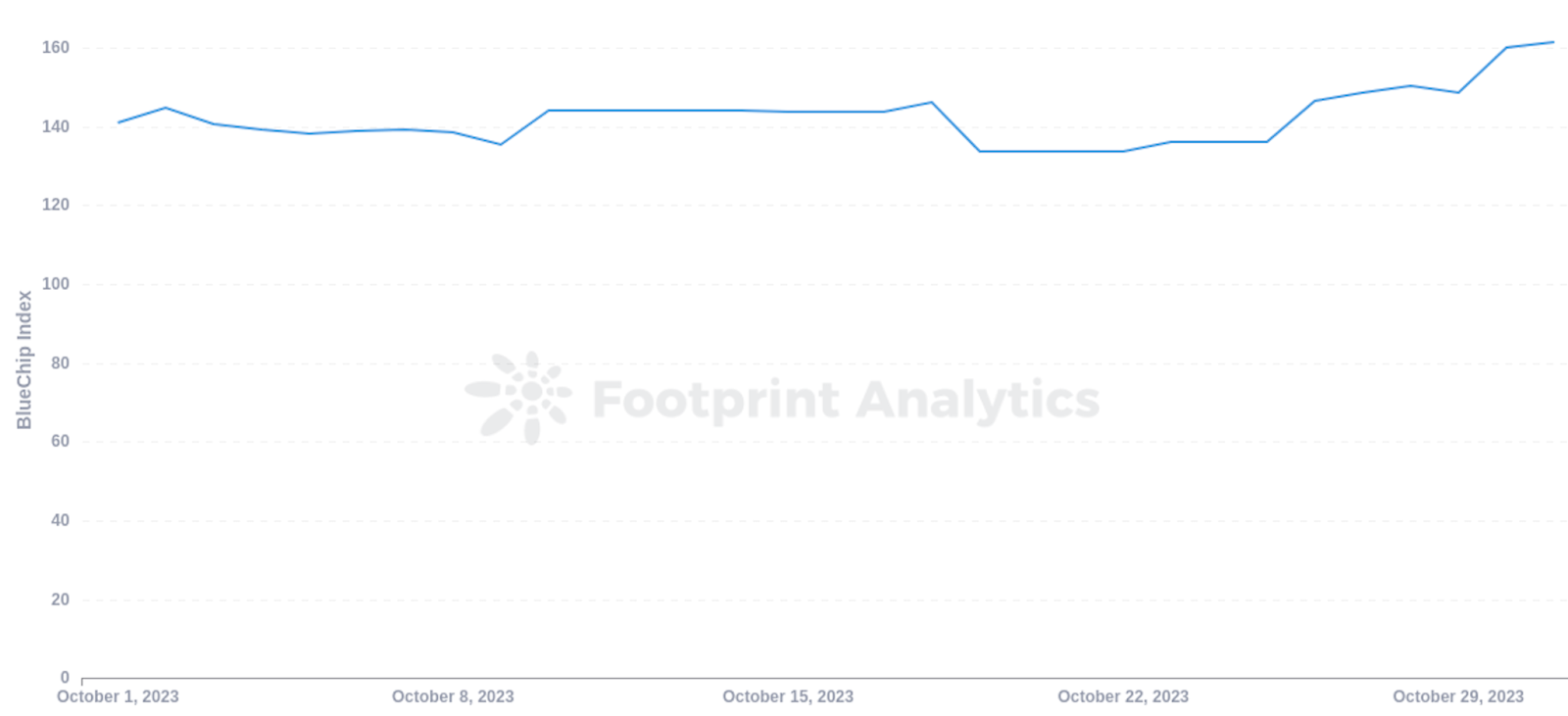

The Blue Chip Index witnessed an upward trend in September, with an increase of 14.4%.

Source: BlueChip Index

Source: BlueChip Index

Blue-chip collection Pudgy Penguins gained attention when it launched a toy collection in 2,000 Walmart stores last month. During the last week of September and the first week of October, both the floor price and trading volume of Pudgy Penguins experienced significant increases. On October 7th, Horlomite Research raised concerns on social media platform X (formerly Twitter), alleging that Pudgy Penguins CEO Luca Netz used funds from "100% from four rug projects" to acquire Pudgy Penguins, providing on-chain evidence. Luca Netz promptly responded to these allegations on X. Despite this incident, the collection's market performance in October does not appear to have been negatively affected.

Apart from Pudgy Penguins, the Winds of Yawanawa collection also gained significant attention. Introduced in July 2023, Winds of Yawanawa is a collection of 1,000 unique Data Paintings that utilize weather data from the Yawanawa tribe's village in the Amazon rainforest, including wind speed, gusts, direction, and temperature. This collection aims to preserve the cultural richness of the Yawanawa by bringing their art to the digital realm. Recently, on October 11, it was announced that The Museum of Modern Art (MoMA) has acquired Winds of Yawanawa as a permanent collection, making it the first Generative AI and tokenized artwork to be welcomed by MoMA. Following this exciting news, the NFT collection experienced a significant increase of over 50% in both floor price and trading volume, as indicated by Footprint Analytics.

Winds of Yawanawa #102

Winds of Yawanawa #102

Chains & Marketplaces for NFTs

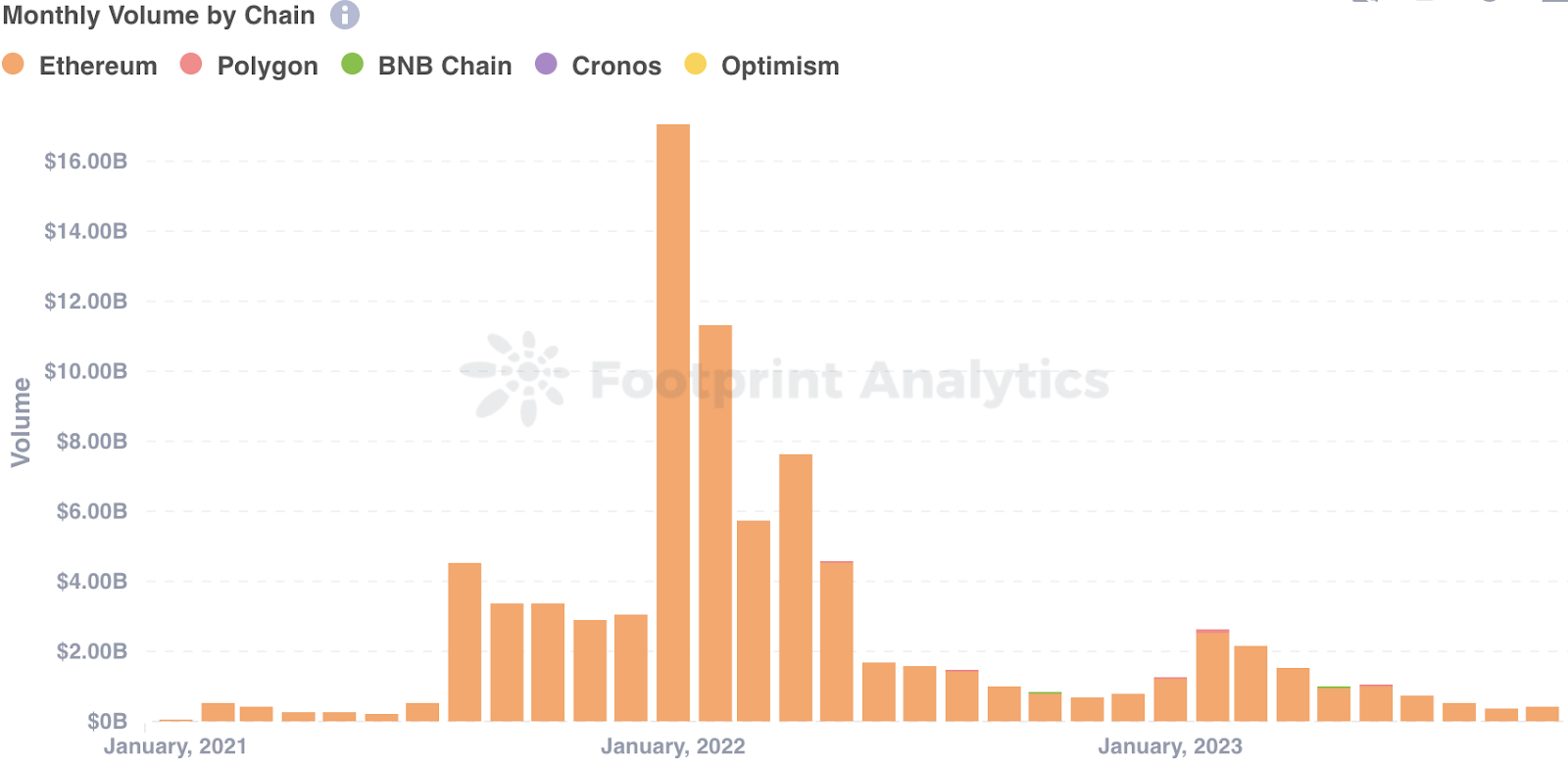

In October, Ethereum continued to dominate the NFT market's trading volume with $421.7 million, accounting for a significant 98.7%. The trading volume saw a 15.9% increase compared to September. But still, the trading volume in October was the second lowest in 2023.

Source: Monthly Volume by Chain

Source: Monthly Volume by Chain

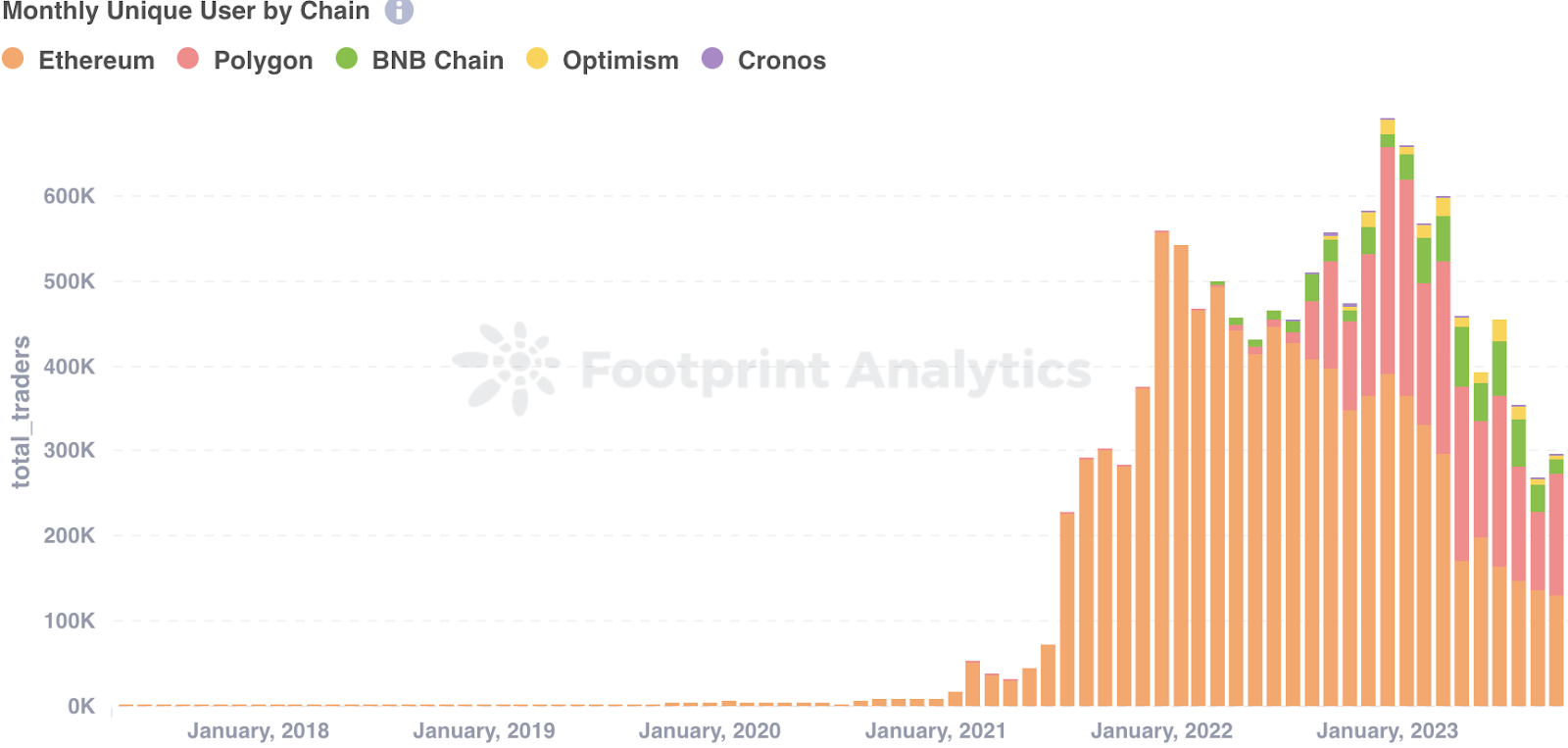

In October, Ethereum saw a decrease of 3.8% in unique users, attracting a total of 130.5K. On the BNB Chain, there were 17.5K unique users, experiencing a significant decrease of 44.8%. However, Polygon witnessed a notable increase in unique users, reaching a total of 142.2K, which represented a 51.8% rise, approaching the numbers seen in August. Despite the trading volume's 15.2% increase from September, there were no clear indications of user engagement recovering.

Source: Monthly Unique Users by Chain

Source: Monthly Unique Users by Chain

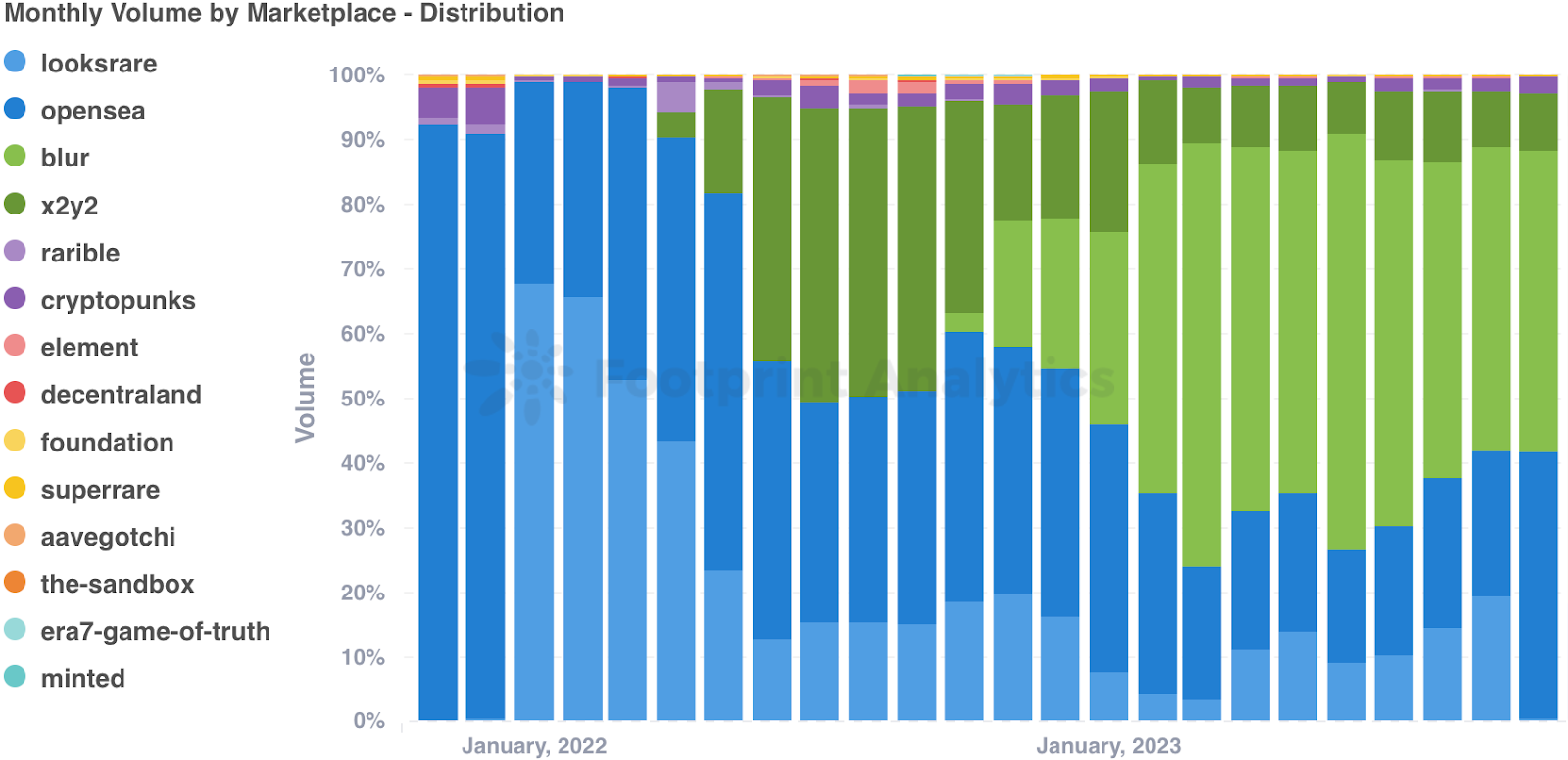

When it comes to NFT marketplaces, Blur continues to dominate with a significant market share, boasting a trading volume of $198.1 million and capturing 46.4% of the market. Opensea, on the other hand, experienced growth in October, with a trading volume of $176.7 million and an increased market share from 23.2% to 41.4%. However, LooksRare faced a drastic decline as its trading volume plummeted by 97.8% from $71.8 million in September to a mere fraction in October, resulting in a market share drop from 19.3% to 0.4%.

Source: Monthly Volume by Marketplace - Distribution

Source: Monthly Volume by Marketplace - Distribution

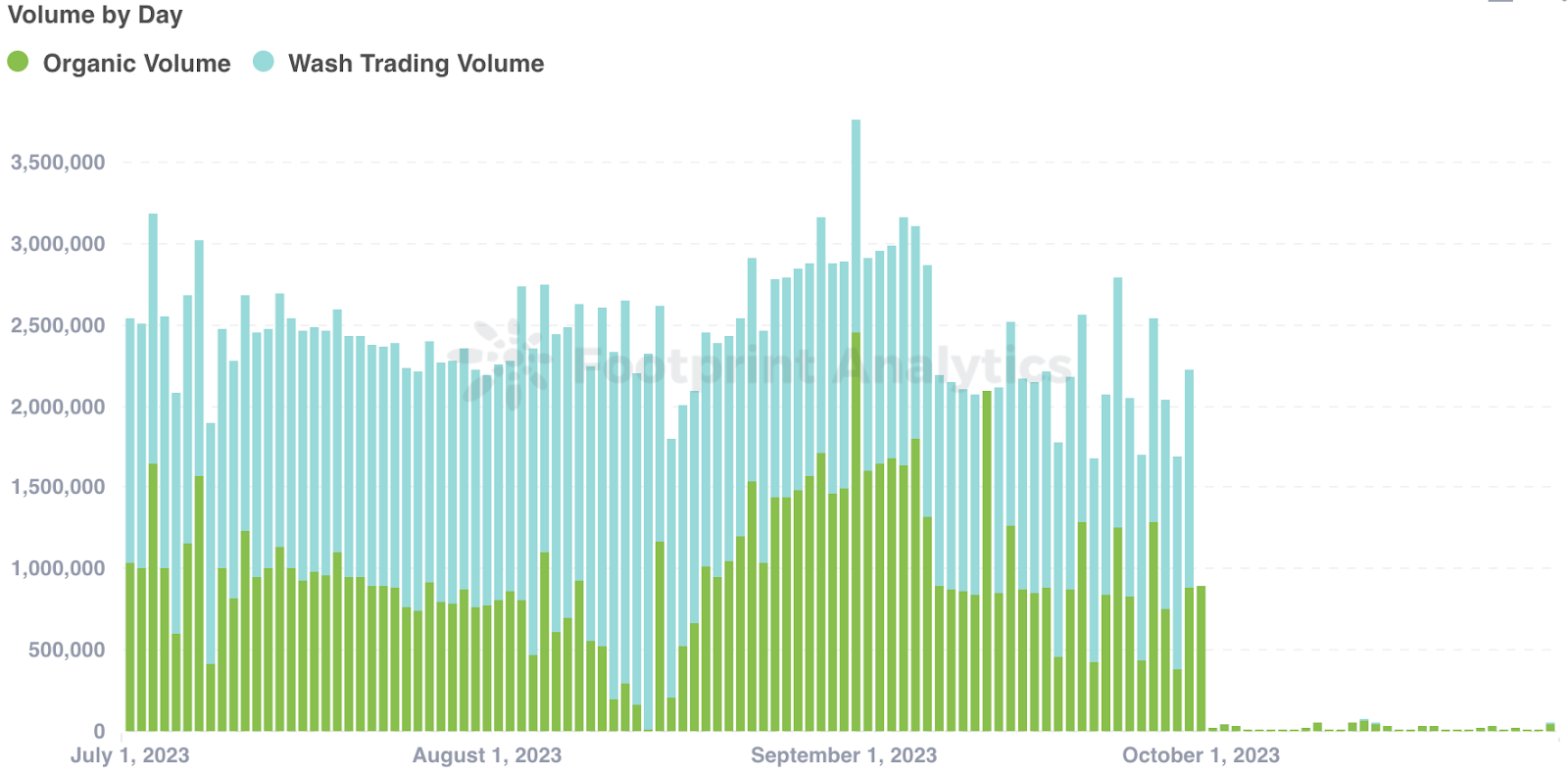

LooksRare implemented a significant update called "The big LOOKS tokenomics update" on September 29, 2023. The update introduced changes to fee distribution, with 50% of generated fees going towards buying back LOOKS tokens from the market, 40% being allocated to the Treasury, and 10% being earnable as LooksRare Protocol Rewards. As a result of this update, trading rewards were discontinued, and the LOOKS tokens previously allocated to trading rewards were redirected to the Treasury. These changes likely contributed to the crash in LooksRare's trading volume and market share in October, as user activities decreased significantly and wash trades became scarce.

Source: Wash Trading on LooksRare

Source: Wash Trading on LooksRare

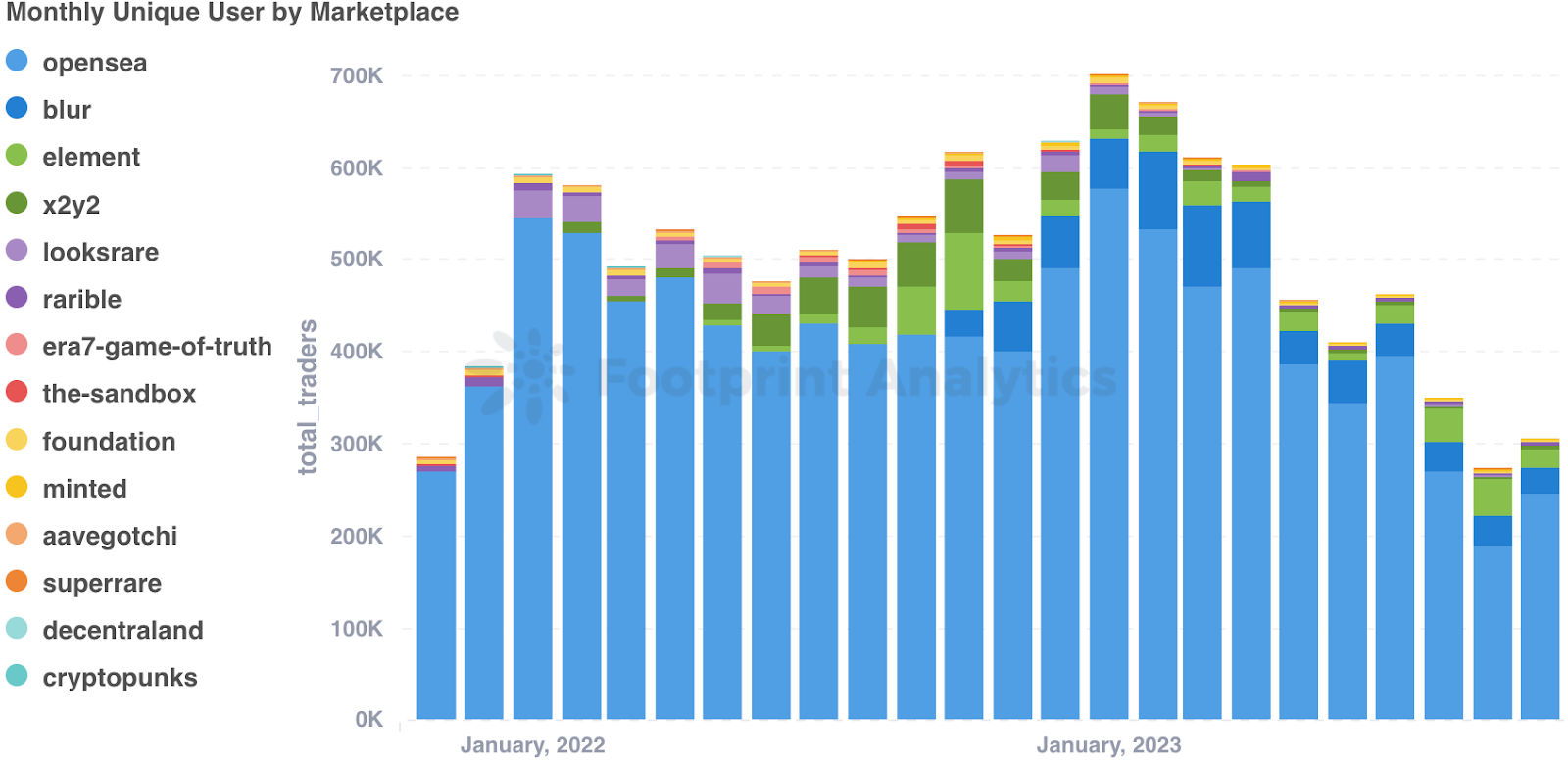

In October, NFT marketplaces displayed varying performance in terms of unique users. OpenSea maintained its dominant position, attracting a significant user base of 245.0K unique users, representing a 29% increase compared to September. However, this number remained lower than the user count in August. Element, on the other hand, experienced fluctuating numbers, with only 20.3K unique users, marking a significant decline of 50.8% from the previous month.

Source: Monthly Unique Users by Marketplace

Source: Monthly Unique Users by Marketplace

NFT Investment & Funding

In October, the NFT market maintained a slow momentum, with a single funding round totaling $5 million.

Game of Silks, a fantasy horse racing startup that connects NFTs to actual thoroughbreds, successfully raised $5 million this month. This recent funding round has brought their total funding to over $10 million. Game of Silks, which launched in June 2021, has established partnerships with prestigious organizations such as the New York Racing Association, Belmont Race Track, The Jockey Club, and FOX Sports' Americas Best Racing. They have created more than 7,000 "Silks Genesis Avatars" NFTs, allowing owners to earn rewards based on the real-world performance of the corresponding horse.

Game of Silks

Game of Silks

The integration of NFTs with the lucrative fantasy sports industry is not a novel concept. Sorare has emerged as one of the most prosperous platforms in this domain. They have recently revealed collaborations with prominent entities like the English Premier League, the NBA, and renowned tennis player Serena Williams.

___________________

Data includes:

-

Blockchains: Ethereum, Polygon, BNB Chain, Cronos, Optimism

-

Marketplaces: OpenSea, LooksRare, Blur, X2Y2, Cryptopunks, Rarible, SuperRare, Foundation, Decentraland, Aavegotchi, Element, Era7, the Sandbox, Minted