Author: stella@footprint.network

In October, the Web3 gaming industry experienced a 15.8% increase in tokens' market cap, driven by the surge in Bitcoin. The industry has been steadily expanding, with a total of 2,651 games available. However, the growth in active games and users has not kept pace. Surprisingly, 73.1% of the games had less than 10 active users in October, highlighting the ongoing challenges that Web3 game developers face in acquiring and retaining users.

Data for this report was obtained from Footprint's GameFi research page. An easy-to-use dashboard containing the most vital stats and metrics to understand the Web3 Game industry, updated in real-time, you can find all the latest about prices, projects, funding rounds, and more by clicking here.

Key Points

Crypto Macro Overview

-

Starting the month at $26,967, Bitcoin demonstrated a substantial increase of 27.9% over the period, ultimately closing at $34,497.

Overall Web3 Game Market

-

The Web3 gaming industry has been experiencing steady growth, with a total of 2,651 games available in October.

-

While the number of games in the industry is expanding, the growth in active games and users has not kept pace.

-

A significant majority of games, specifically 1,937 games, or 73.1% of the total, had less than 10 active users in October.

Web3 Game Chains

-

Among the games on Polygon, 38 of them attracted more than 1,000 active users, which represents 8.1% of the total games on the chain. On BNB Chain, the percentage is 5.4%, and on Ethereum, it's 1.7%.

-

The industry eagerly anticipates a game changer that could challenge the dominance of the top three chains.

GameFi Projects Overview

-

During October, 17 projects saw a significant surge in token price, surpassing a 50% increase.

-

In October, the price of AXS increased by 18.3%, while SLP saw a substantial increase of 70.0%.

GameFi Investment and Funding

-

In October, the Web3 gaming sector saw a consistent increase in investment, with seven notable funding rounds totaling $50.9 million.

What’s New?

-

Animoca Brands Presents FORMULA E: HIGH VOLTAGE Web3 Electric Racing Game.

-

Sega Co-COO Shuji Utsumi Says Blockchain Gaming an 'Unknown World' Worth Exploring.

-

Immutable links with AWS in the latest Web3 gaming push.

-

France introduces Sorare Law to regulate crypto-gaming.

-

Shrapnel game studio Neon Machine raises $20 million led by Polychain.

Crypto Macro Overview

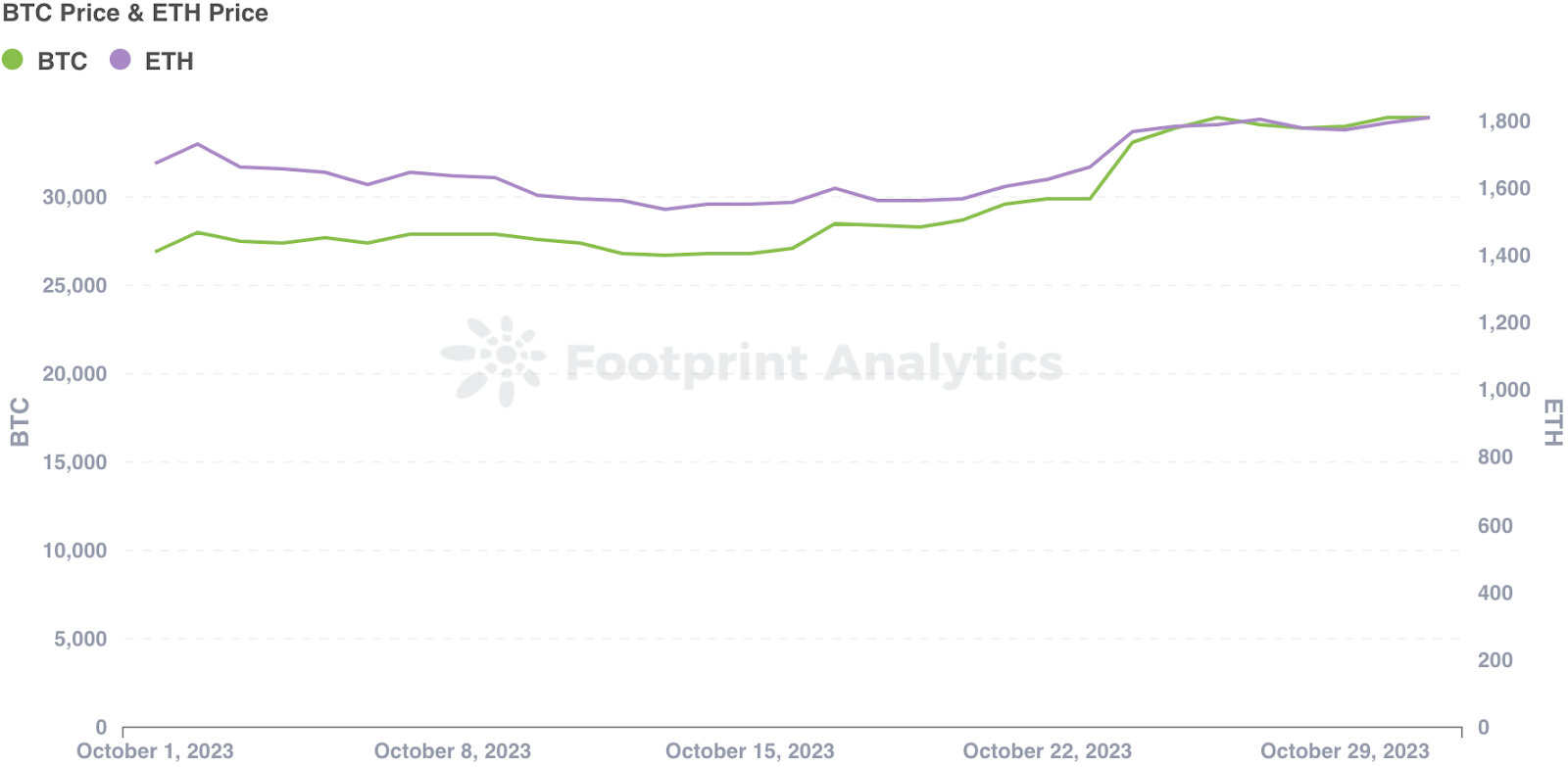

During October, Bitcoin experienced a notable surge in price, surpassing the performance of both traditional assets and other cryptocurrencies. Starting the month at $26,967, Bitcoin demonstrated a substantial increase of 27.9% over the period, ultimately closing at $34,497.

Ether started the month at $1,671 and experienced a relatively moderate increase of 8.3% during the period, ultimately closing at $1,810.

Source: BTC Price & ETH Price

Source: BTC Price & ETH Price

While technology stocks faced downward pressure, Bitcoin stood out by defying this trend. On October 16, the price of Bitcoin experienced a significant increase, reaching nearly $30,000. This sudden increase was triggered by a false report from cryptocurrency news site Cointelegraph, claiming in a tweet that the SEC had approved the first spot bitcoin ETF. However, the post was later deleted after BlackRock clarified to Bloomberg that their application was still under review. As a result, Bitcoin's price dropped to around $28,000 by the end of that day.

Following the incident, Bitcoin received support from growing anticipation for a spot ETF offering in the US market. The SEC chose not to contest the recent ruling in favor of Grayscale by the DC Circuit Court of Appeals. Grayscale's filing, along with other filings for spot bitcoin ETFs, now awaits review by the SEC. As a result, the price of Bitcoin experienced a notable upward trajectory starting from October 23 and remained near $35,000 until the end of the month.

Overall Web3 Game Market

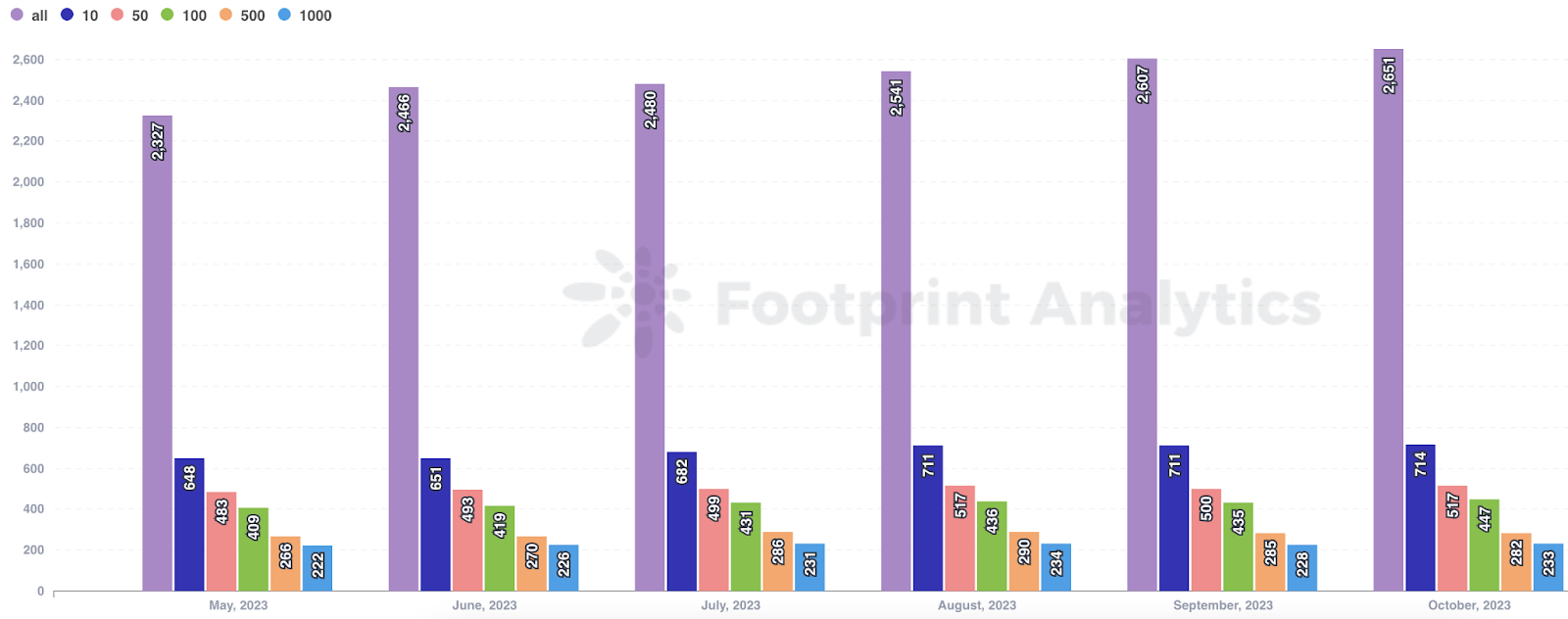

The Web3 gaming industry has been experiencing steady growth, with a total of 2,651 games available in October. This marks a 1.7% increase from September and a significant 13.9% increase from May.

However, despite the increasing number of games, the proportion of games with more than 1,000 monthly active users remains relatively small, accounting for less than 10% of the total. In October, this percentage was 8.8%, representing a slight increase of 5 games compared to September. Similarly, games with more than 500 monthly active users totaled 282, which is 10.6% of all the 2,651 games. This figure decreased by 3 games compared to September.

On the other hand, a significant majority of games, specifically 1,937 games, or 73.1% of the total, had less than 10 active users in October. This raises questions about the sustainability and growth of the Web3 gaming industry, with some considering it a "false prosperity."

Source: Monthly Active Games

Source: Monthly Active Games

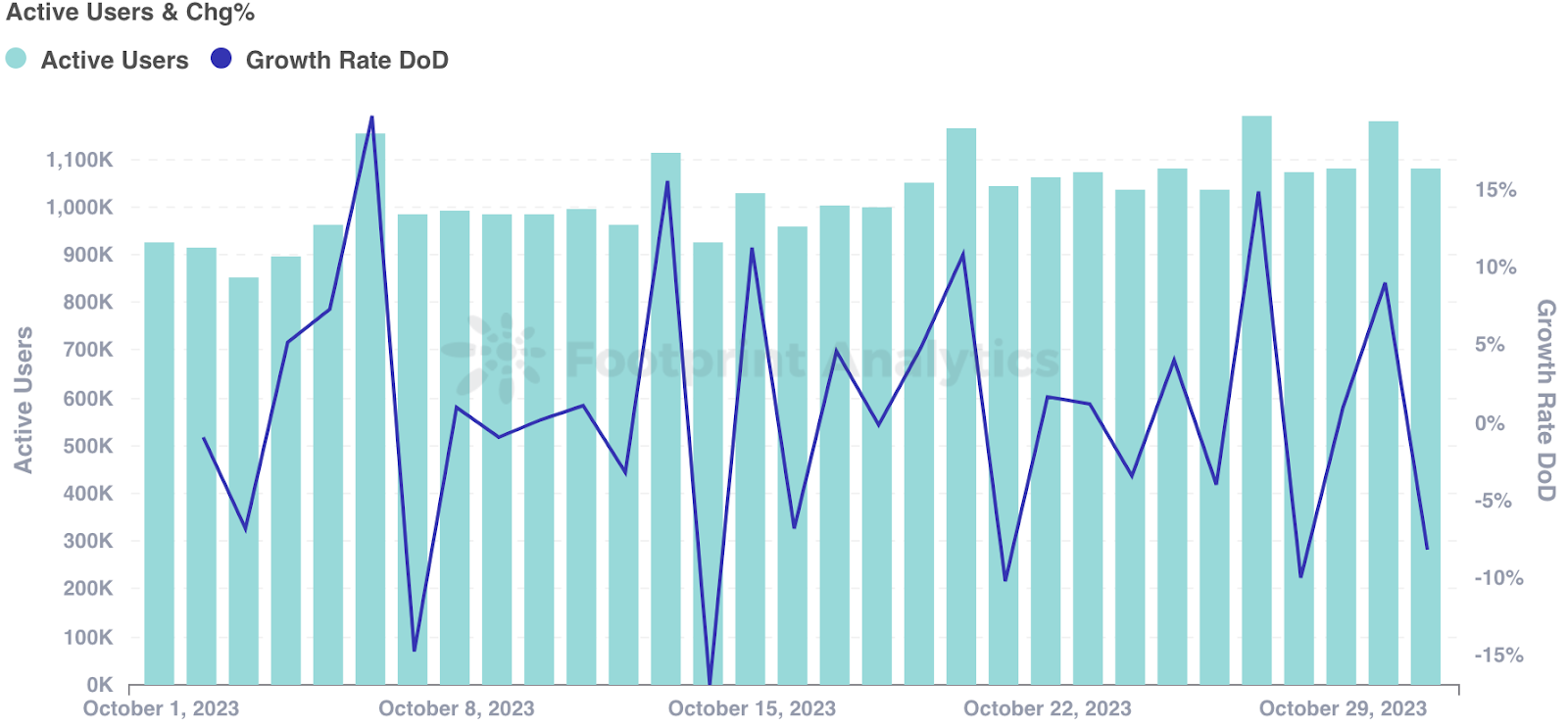

Throughout the month of October, the number of daily active users in Web3 games remained relatively stable at around 1 million, consistent with the figures observed in September.

However, it is important to note that while the number of games in the industry is expanding, the growth in active games and users has not kept pace. Acquiring and retaining users continue to be significant challenges for many Web3 game developers, despite the increasing variety of games available.

Source: Active Users & Growth Rate DoD

Source: Active Users & Growth Rate DoD

The Web3 gaming industry is relatively new but shows signs of rapid learning. In October, Shuji Utsumi, Sega Co-COO, expressed optimism about blockchain gaming and the potential of NFTs in the future of video games. This came after his previous statement to Bloomberg where he called play-to-earn games "boring." Sega has licensed its Sangokushi Taisen card game's IP to Double Jump.Tokyo, a blockchain firm developing a new trading card game (TCG) called Battle of Three Kingdoms. Utsumi acknowledged that blockchain gaming is still an unknown world for Sega, but they are collaborating on the development of the game, with Sega providing game assets for the project.

Battle of Three Kingdoms

Battle of Three Kingdoms

Web3 Game Chains

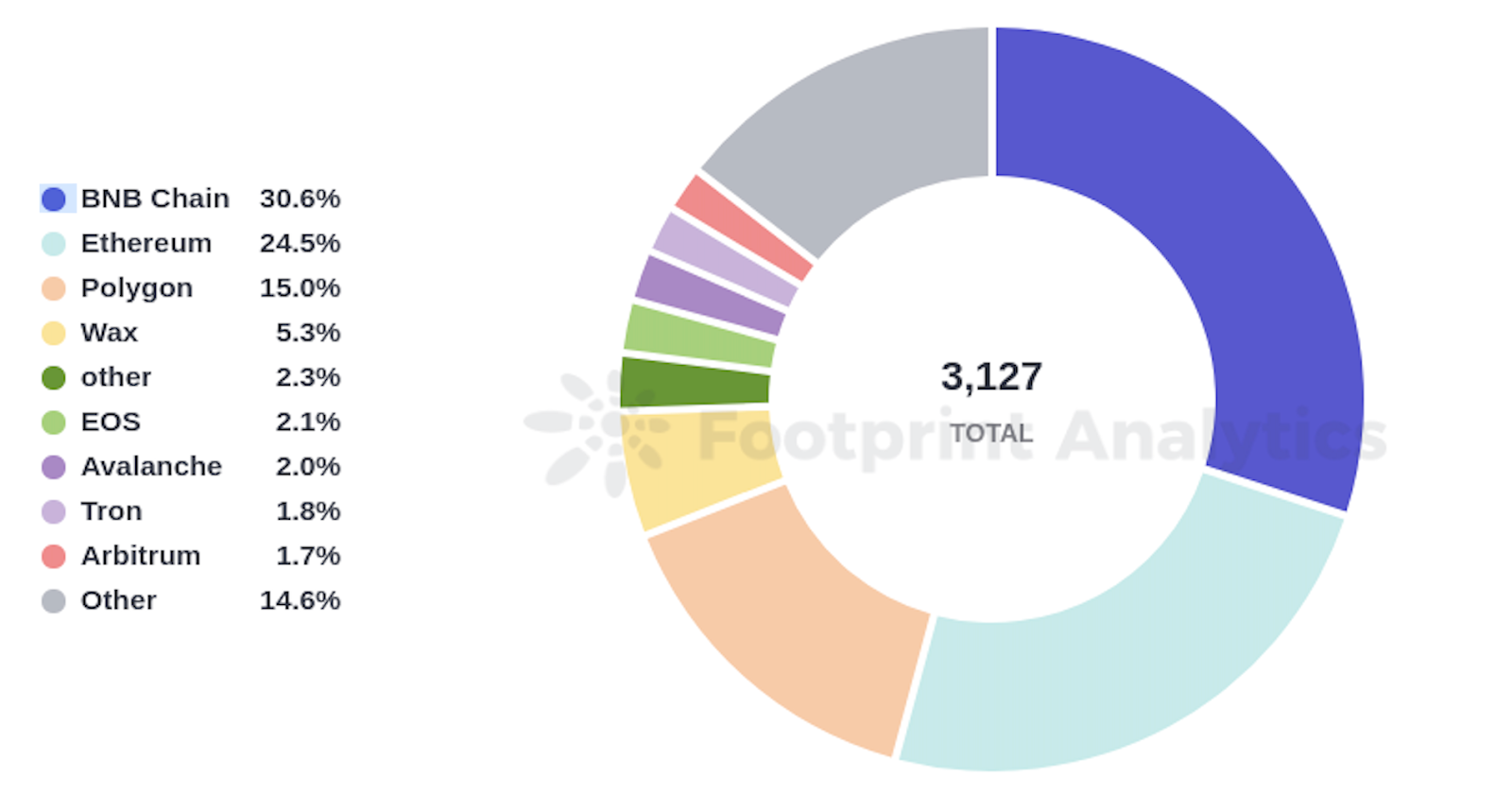

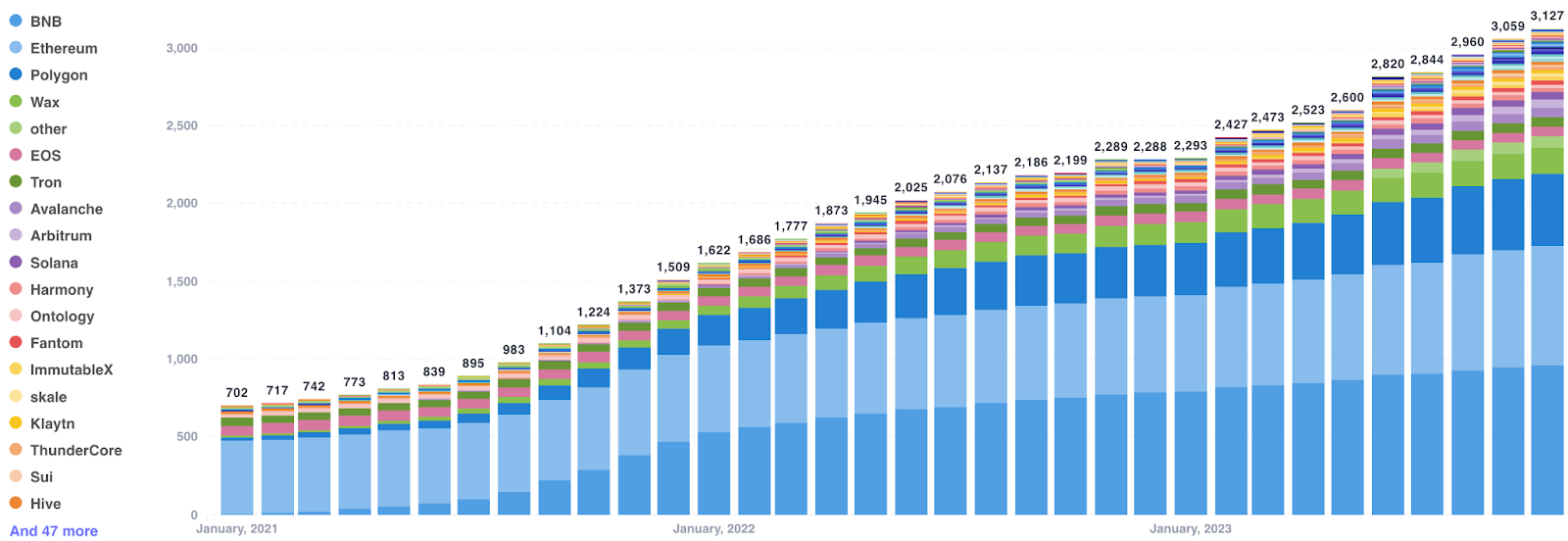

The distribution of games across different blockchains has shown stability, with BNB Chain leading at 30.6%, followed closely by Ethereum at 24.5%, and Polygon at 15.0%. However, there is a notable disparity between these top three chains and the second-tier blockchains like Wax, EOS, and Avalanche, which have distributions of 5.3%, 2.1%, and 2.0% respectively.

Source: Games Shared by Chain

Source: Games Shared by Chain

The industry eagerly anticipates a game changer that could challenge the dominance of the top three chains.

Source: Monthly Games by Chain

Source: Monthly Games by Chain

In October, there were a total of 233 games with over a thousand monthly active users. BNB Chain had the largest share, accounting for 22.3%, followed by Polygon at 16.3% and Ethereum at 5.6%. Among the games on Polygon, 38 of them attracted more than 1,000 active users, which represents 8.1% of the total games on the chain. On BNB Chain, the percentage is 5.4%, and on Ethereum, it's 1.7%.

Immutable has recently partnered with Amazon Web Services(AWS) to develop infrastructure solutions specifically for the crypto gaming industry. As part of this collaboration, Immutable has joined AWS's ISV Accelerate Program, which is designed for companies utilizing AWS services in their products. This partnership enables game developers who use the Ethereum-compatible ImmutableX blockchain to participate in AWS Activate, a program tailored for startups that provides technical support, grants up to $100,000 in AWS credits, and various additional resources. However, concerns have been raised about the centralization of gaming and the reliance on Amazon, a dominant market leader in the cloud services industry, holding approximately one-third of the market share.

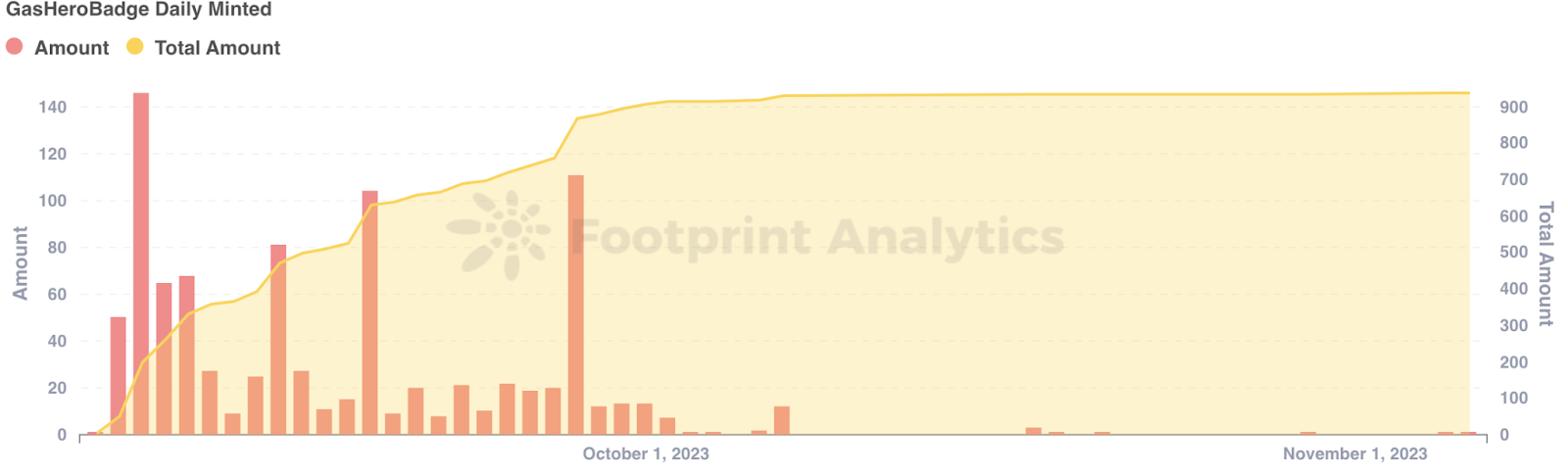

Gas Hero, developed by Find Satoshi Lab, is generating significant anticipation as one of the highly anticipated Web3 game launches in the 2023-2024 period. Following the breakthroughs StepN achieved, Gas Hero will be launching exclusively on Polygon. In contrast to StepN, which focuses on rewarding players for physical activity without characters or lore, Gas Hero is poised to be a fully-fledged MMO game set in a rich sci-fi world with an immersive backstory that extends into comic books. Recently, Find Satoshi Lab announced that Gas Hero will undergo community testing from November 24th to December 8th, further engaging the community in the game's development process. Gas Hero will use Stepn’s $GMT as its token at launch. Prior to its launch, the game organized multiple community events. As per the Gas Hero Dashboard on Footprint Analytics, a total of 936 Gas Hero Badges were minted by the conclusion of October.

Source: GasHeroBadge Daily Minted

Source: GasHeroBadge Daily Minted

GameFi Projects Overview

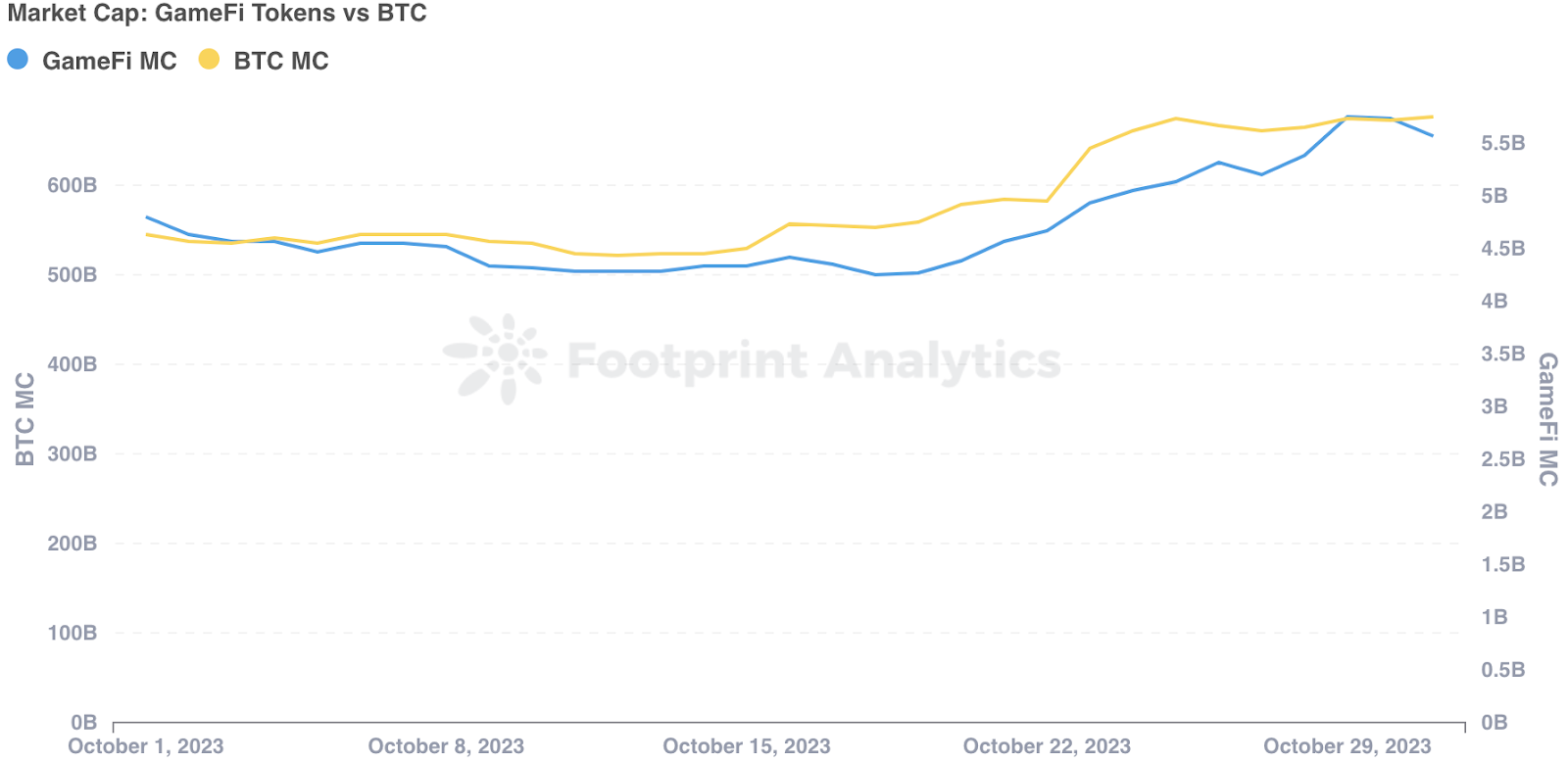

In October, GameFi tokens' market cap closely followed the trend of Bitcoin. The Web3 gaming industry benefited from the surge in Bitcoin and experienced a 15.8% increase in tokens' market cap during the month.

Source: Market Cap: GameFi Tokens vs BTC

Source: Market Cap: GameFi Tokens vs BTC

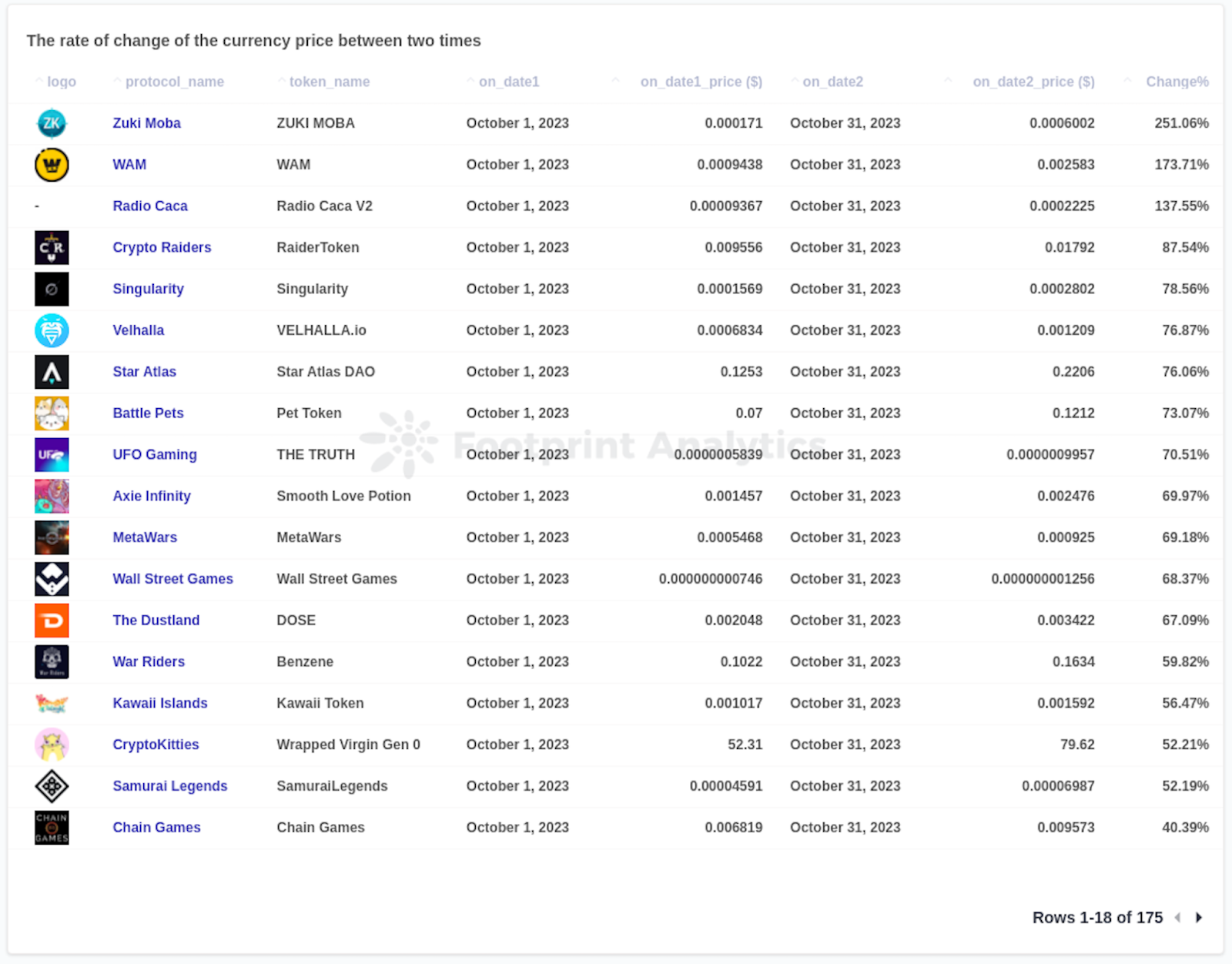

During October, 17 projects saw a significant surge in token price, surpassing a 50% increase. Despite the prevailing bear market in crypto, these sustained growth rates demonstrate the potential of these projects to attract and engage users and investors.

Source: Game Token Price Changes in September

Source: Game Token Price Changes in September

Flagship games continue to evolve. Axie Infinity experienced significant increases in both its utility token, Smooth Love Potions (SLP), and its governance token, Axie Infinity Shards (AXS). In October, the price of AXS increased by 18.3%, while SLP saw a substantial increase of 70.0%. These price surges are closely tied to the recent upward trend in the crypto market and the sustainable Axie ecosystem, which includes the Ronin Network and Axie Origins. Additionally, Axie organized the Axie Spooktoberfest event to celebrate Halloween, allowing players to participate in various events and earn rewards. This festival contributed to higher user engagement throughout October.

Axie Spooktoberfest

Axie Spooktoberfest

Ultimate Champions, a free-to-play fantasy football and basketball game, offers an innovative experience where players can utilize their sports knowledge to construct the most formidable team each week. In October, the game experienced a notable influx of new users on the Polygon and BNB Chain platforms. According to Footprint Analytics, Ultimate Champions successfully attracted 21,068 new users during the month, with 21,542 active users out of a total user base of 420,516 on Polygon. Planet Mojo and the Sandbox emerged as the runners-up in terms of new user acquisition.

Source: Hot Games on Polygon

Source: Hot Games on Polygon

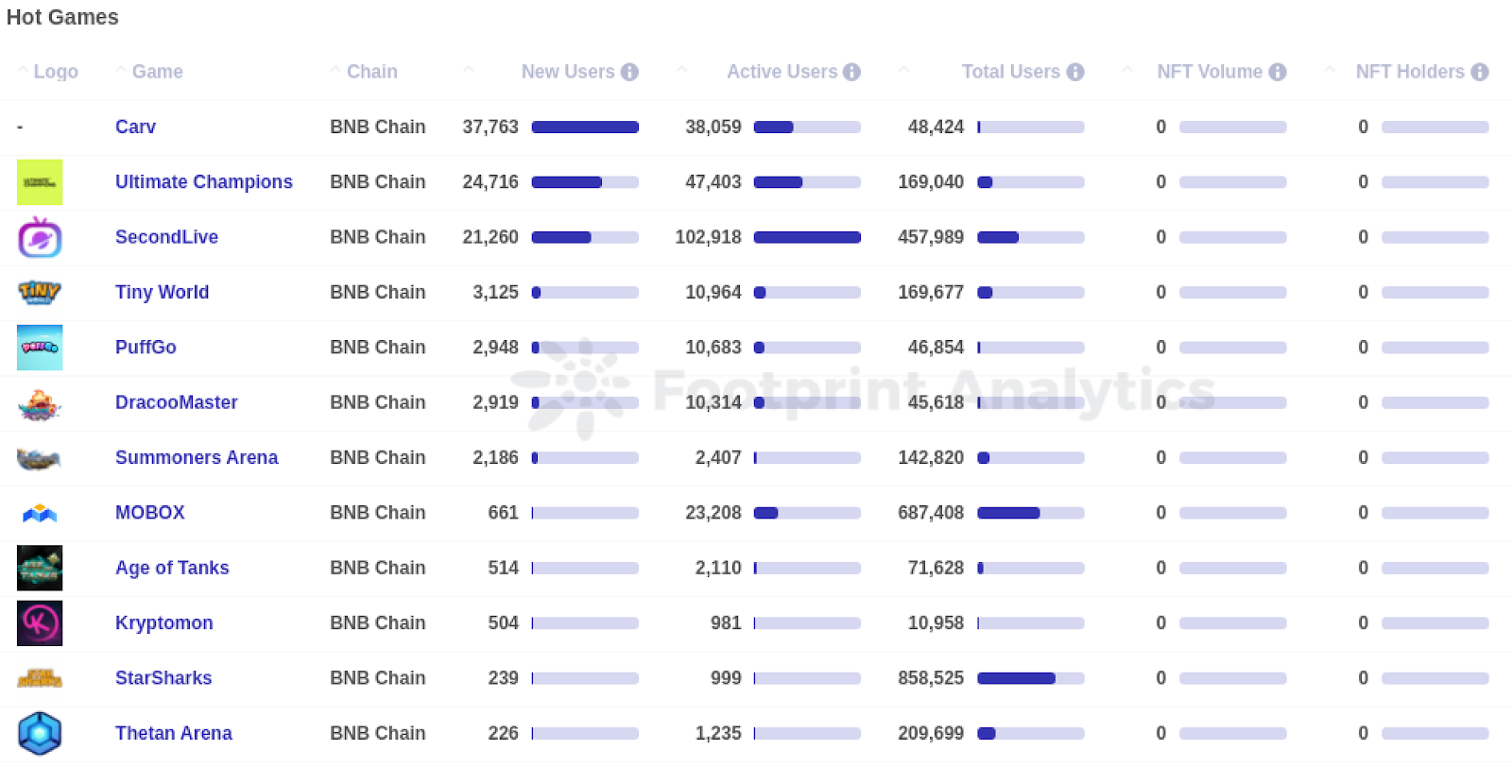

Simultaneously, Ultimate Champions gained 29,220 new users on BNB Chain, with 53,302 active users out of a total user count of 169,040. Carv and SecondLive also achieved impressive outcomes in terms of acquiring new users.

Source: Hot Games on BNB Chain

Source: Hot Games on BNB Chain

GameFi Investment and Funding

In October, the Web3 gaming sector saw a consistent increase in investment, with seven notable funding rounds totaling $50.9 million. These rounds have attracted significant investments in different companies and projects, including NexGami ($2 million), Forge ($11 million), Upland ($7 million), Darewise Entertainment ($3.5 million in token presale), Third Time Entertainment ($2 million), Neon Machine ($20 million), and Moonveil Entertainment ($5.4 million).

Seattle-based game studio Neon Machine has successfully raised $20 million in Series A funding for its upcoming first-person shooter game, Shrapnel. The funding round was led by Polychain Capital, with participation from Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures, and Tess Ventures. Shrapnel is set in a sci-fi extraction shooter universe and will offer a significant portion of its in-game content, such as weapon parts, weapons, and cosmetics, as non-fungible tokens (NFTs) on Avalanche subnet. In April, Shrapnel also introduced its own ERC-20 token called SHRAP.

Shrapnel

Shrapnel

Robby Yung, CEO of Animoca Brands and co-founder of The Sandbox, highlighted the importance of careful consideration in Web3 gaming investments at the European Blockchain Convention in Barcelona. Despite this, companies, including Animoca Brands itself, continue to raise funds. Animoca Brands recently announced a Strategic Partnership Memorandum of Understanding with NEOM Company to drive regional Web3 initiatives in line with the Saudi Vision 2030 plan. Moreover, the NEOM Investment Fund has signed a Convertible Notes Financing Term Sheet, proposing a $50 million investment in Animoca Brands.