Written by Lisa, LD Capital

BTC is often heralded as “digital gold,” and traders frequently refer to the NASDAQ index as a significant indicator of BTC price movements. Given that gold and the NASDAQ are respectively typical representatives of safe-haven and risk assets, this comparison may seem contradictory. This article will unveil whether BTC qualifies as a safe-haven asset by exploring the factors influencing the prices of BTC and gold.

I. Overview of Gold and BTC

1. Gold

Unit of Measurement for Gold

The “ounce” is the international standard for measuring gold, where 1 troy ounce equals 1.0971428 avoirdupois ounces or 31.1034768 grams.

Purity of Gold

The purity of metal, known as its fineness, is generally indicated in per mille (‰) or karats (“K”). Gold purity can be divided into 24 karats, with each karat (abbreviated as “k,” from the word “carat” or German “karat”) representing 4.166%. The gold content for various karats is as follows:

8k = 33.328% (333‰)

9k = 37.494% (375‰)

10k = 41.660% (417‰)

12k = 49.992% (500‰)

14k = 58.324% (583‰)

18k = 74.998% (750‰)

20k = 83.320% (833‰)

21k = 87.486% (875‰)

22k = 91.652% (916‰)

24k = 99.984% (999‰)

For instance, the standard delivery for London Gold is 400-ounce bars with no less than 99.50% gold content. Shanghai Gold includes delivery varieties like Au99.99, Au99.95, Au99.5, Au50g, and Au100g:

Au99.99 represents standard-weight 1 kilogram gold bars with a fineness of no less than 99.99%,

Au99.95 denotes standard-weight 3 kilograms gold bars with a fineness of no less than 99.95%,

Au99.5 is for standard-weight 12.5 kilograms gold bars with a fineness of no less than 99.50%,

Au50g stands for 0.05-kilogram gold bars with a fineness of no less than 99.99%,

Au100g is for 0.1-kilogram gold bars with a fineness of no less than 99.99%.

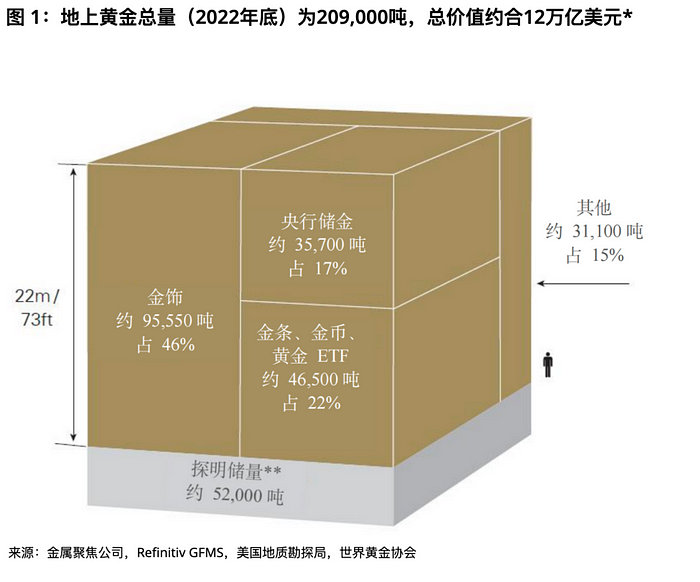

Total Market Value of Gold

According to the World Gold Council, it’s estimated that about 209,000 tons of gold have been mined, worth approximately 12 trillion US dollars, with about two-thirds of that amount being mined after 1950. If all the existing gold were piled together, the resultant cube of pure gold would have each side measuring 22 meters (or 73 feet).

Approximately 46% of this gold (around 95,547 tons, estimated value 6 trillion US dollars) exists in the form of jewelry.

Central banks worldwide hold 17% (around 35,715 tons, estimated value 2 trillion US dollars) as reserves.

Gold bars and coins represent about 21% of the total (approximately 43,044 tons, estimated value 3 trillion US dollars).

Gold-backed ETFs account for around 2% (about 3,473 tons, estimated value 200 billion US dollars).

The remaining 15% (approximately 31,096 tons, estimated value 2 trillion US dollars) is used for various industrial purposes or held by other financial institutions.

Overview of Gold Trading

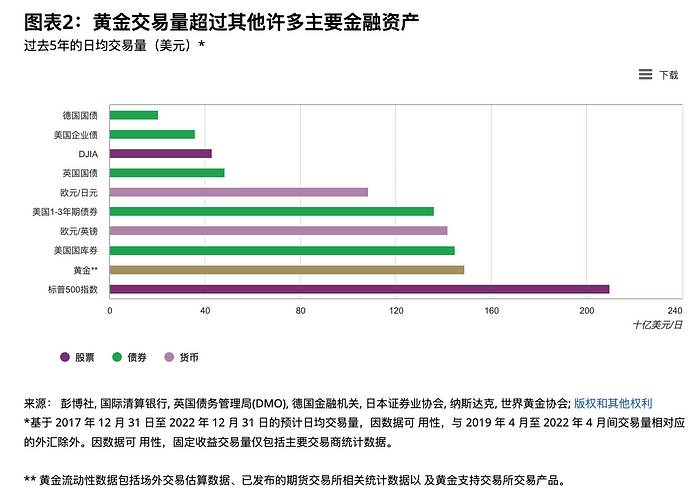

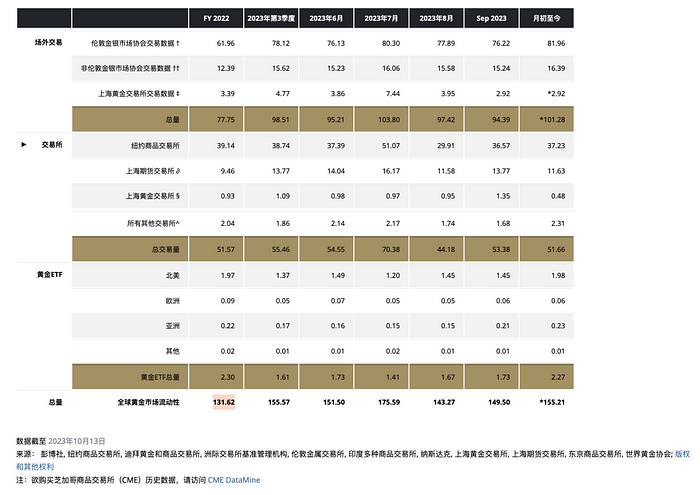

Gold stands as one of the assets with the best liquidity worldwide. In 2022, the daily average transaction amount of gold was approximately 131.6 billion USD. The principal markets for these transactions include the London Over-the-Counter (OTC) market, the United States futures market, and the Chinese market. London OTC Market: Established in 1919, the London OTC market, an essential hub for spot gold trading, operates under the London Bullion Market Association (LBMA). The LBMA sets the gold benchmark price twice daily (10:30 AM and 3:00 PM London time), serving as a reference for market participants. New York Commodity Exchange (COMEX): COMEX hosts the world’s largest gold futures market as of now. Shanghai Gold Exchange (SGE): Officially inaugurated on October 30, 2002, the SGE provides a spot trading platform for China’s gold market, complemented by the Shanghai Futures Exchange (SHFE) for futures trading.

Daily Average Volume of Gold Trading (in billions of USD)

2. BTC

BTC’s 24-hour trading volume stands around 24 billion USD, with a significant portion occurring in perpetual contracts. Notably, there has been a substantial increase in BTC’s average daily trading volume, with the 24-hour volume reaching approximately 15% of gold’s (compared to less than 10% prior to this trading cycle). Both spot and perpetual contract trading are most active on Binance. Currently, BTC’s total market capitalization is 677.7 billion USD, approximately 5.6% of gold’s total market value.

II. Price Influencing Factors for Gold and BTC

1. Supply and Demand Relationship

Gold

Supply of Gold

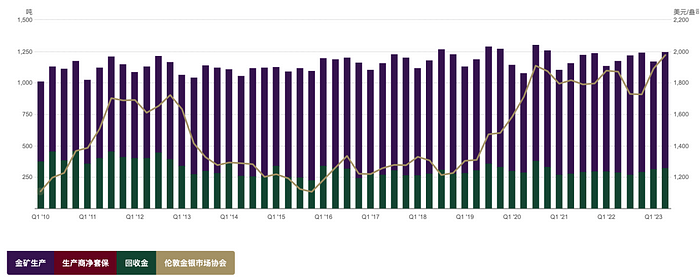

The global annual increase in gold supply has remained relatively stable, hovering around 4,800 tons from 2016 to 2022. Given gold’s durability, the metal used in consumer sectors still exists in some form and can re-enter the supply chain through recycling. Thus, the supply of gold emanates from both mining and gold recycling. In 2022, the total recycled gold amounted to 1140.6 tons, with mining production at 3626.6 tons. Approximately three-quarters of the supply comes from mining, and one-quarter derives from gold recycling. The graph below illustrates that the gold supply has been steady, without significant trend-based fluctuations over the years, thereby minimizing the impact of its relatively rigid supply on prices.

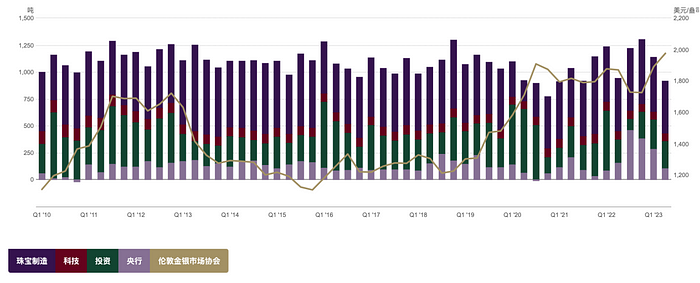

The Demand for Gold

In 2022, the global demand for gold totaled 4712.5 tons. In the first half of 2023, this figure reached 2460 tons, marking a 5% increase year-on-year. The demand for gold spans various sectors, including gold jewelry, medical technology, investment needs, and central bank reserves. In 2022, demand from jewelry manufacturing, technology, investment, and central banks was respectively 2195.4 tons, 308.7 tons, 1126.8 tons, and 1081.6 tons. Jewelry manufacturing took the largest share at 47%, while central bank demand constituted 23% of the total. Influenced by traditional cultures, China and India are the world’s largest consumers of gold jewelry, with both nations together accounting for 23% of the global demand for gold jewelry in 2022.

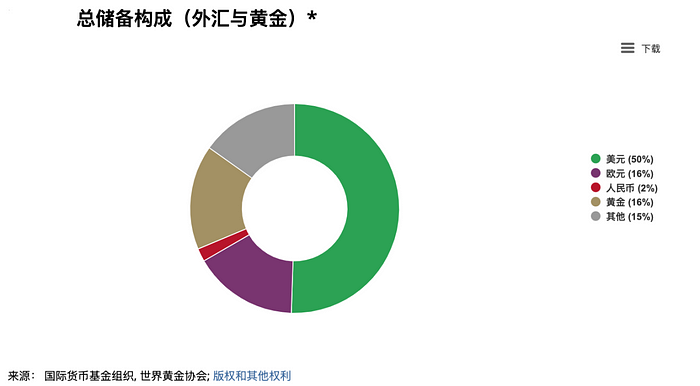

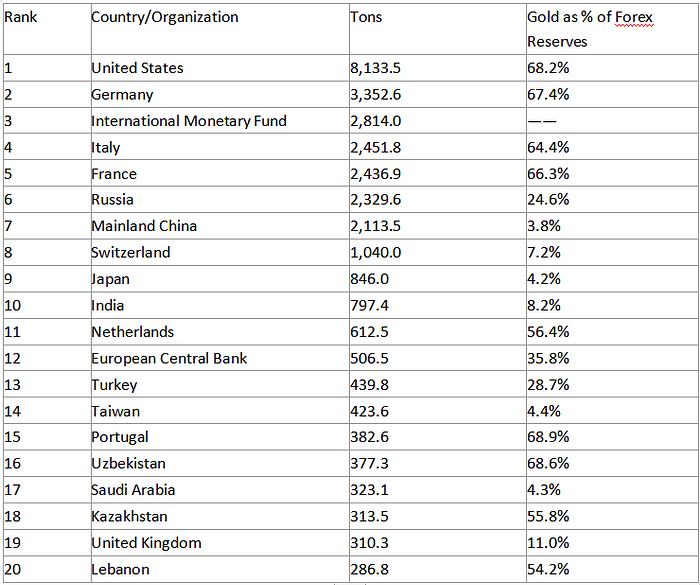

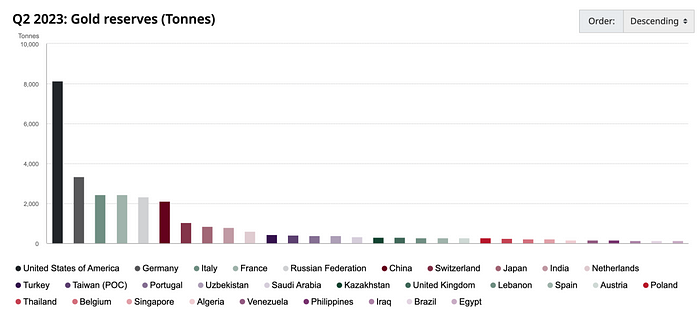

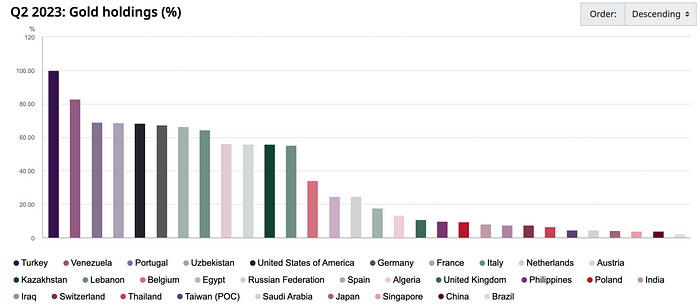

Gold constitutes a crucial part of global central bank reserves. However, the percentage of gold in central bank reserves varies significantly across different countries or regions. For example, the United States and Germany hold close to 70% of their reserves in gold, while Mainland China holds only 3.8%, and Japan, 4.2%. Following the outbreak of the Russia-Ukraine conflict, the United States and Europe froze the Russian central bank’s foreign exchange reserves in US dollars. This action shook confidence in the US dollar among non-dollar economies, spurring a rise in demand for diversified foreign exchange reserves and an increased focus on gold reserves. As efforts to de-dollarize advance, the trend of systemic increases in gold reserves by global central banks will become more pronounced in the long term.

Top 20 Countries/Organizations by Gold Reserves

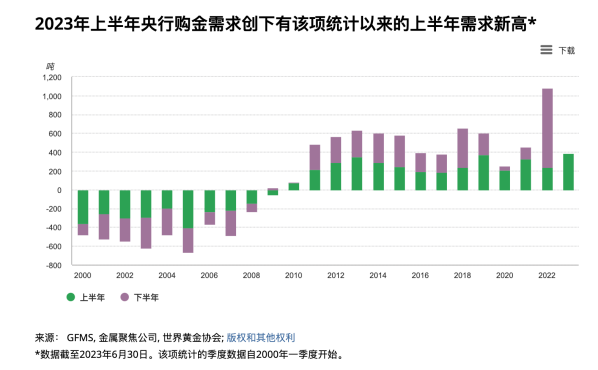

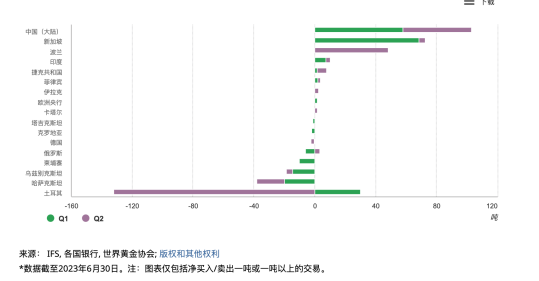

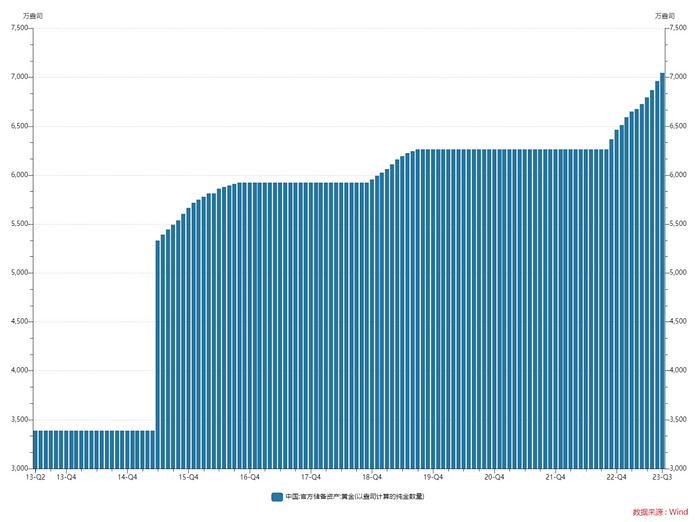

According to data from the World Gold Council, the demand for gold purchases by central banks saw a sharp increase in the second half of 2022, with a total of 840.6 tons, 1.8 times the total volume for the entire year of 2021. The demand for gold by central banks in the first half of this year has somewhat regressed compared to the second half of last year but still reached a high of 387 tons, setting a new record since this statistic was first recorded in 2000. Among these, Turkey, due to a period of political instability and robust domestic gold demand, temporarily banned the import of certain gold bars and sold gold to the domestic market. This does not indicate a long-term shift in Turkey’s gold strategy. Overall, Turkey’s gold sales in the second quarter did not undermine the overall positive trend in central bank gold demand. The largest buyer was mainland China, which purchased 57.85 tons and 45.1 tons in the first and second quarters, respectively. According to data from October 13, China’s gold reserves at the end of September were reported to be 70.46 million ounces, an increase of 840,000 ounces from the previous month, marking the 11th consecutive month of increase. Over the past 11 months, China’s central bank reserves have increased by a total of 7.82 million ounces. Historically, the gold purchasing of the Chinese central bank has been strategic in nature, with virtually no sell-offs.

BTC

The total supply of BTC is fixed at 21 million coins, with the current circulation being approximately 19.51 million coins, accounting for about 90% of the total supply.

The current inflation rate for BTC is roughly around 1.75%, with gold’s annual inflation rate at about 2%, making the two somewhat similar. Due to the Bitcoin halving mechanism, the future inflation rate of Bitcoin will be significantly lower than that of gold. The most recent halving (in 2020) reduced the number of Bitcoins issued in each block from 12.5 to 6.25. The next halving is expected to occur at the end of April 2024.

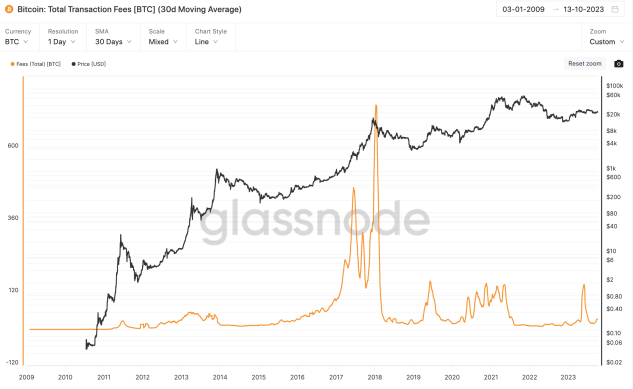

In terms of demand, it is divided into two parts: transaction fees and investment demand. For most of this year, BTC has consumed about 20–30 BTC in transaction fees daily, roughly estimating that transaction fee expenditures are about 10,000 on an annual basis, accounting for 0.5% of the total circulation. The rest represents investment or speculative demand.

2. Macroeconomic Environment

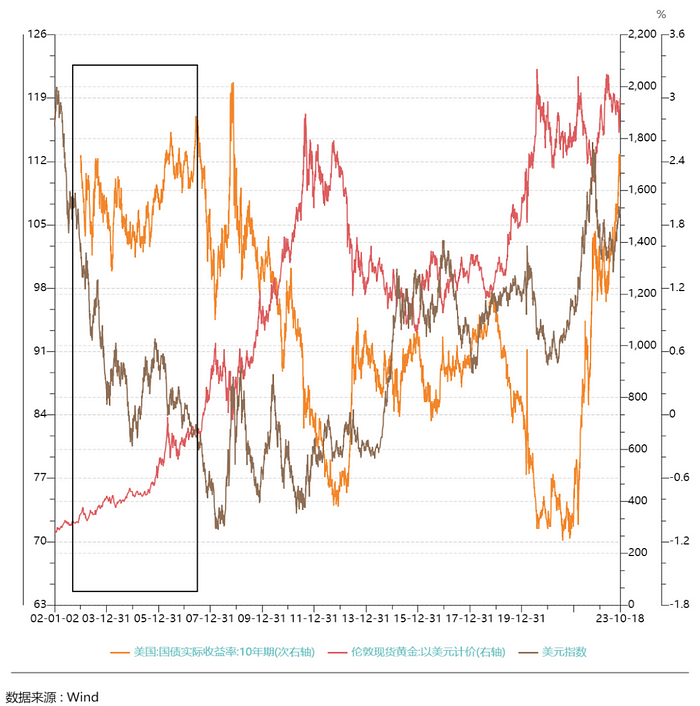

From the dissolution of the Bretton Woods system until around 2000, inflation expectations and safe-haven demand were the main determinants of gold prices. In 2004, the gold market began to introduce ETFs. With the launch of gold ETFs and the expansion of gold-related trading markets, the financial attributes of gold strengthened, and actual interest rates and the U.S. dollar index became important factors influencing gold prices.

The Dollar Index and Gold Prices

In theory, the price of gold generally moves inversely with the value of the U.S. dollar, as gold is priced in dollars. An increase in the dollar makes gold relatively more expensive, thus putting downward pressure on its price, assuming the price of gold itself does not change. From another perspective, in the long-term view, following the collapse of the Bretton Woods system and the U.S. dollar’s detachment from the gold standard, gold essentially serves as a hedge against fiat currencies (primarily the U.S. dollar). The stronger the creditworthiness of the U.S. dollar, the lower the strategic value of gold, and vice versa. Periods when gold and the U.S. dollar rise concurrently are often accompanied by crises such as oil shocks, subprime crises, debt crises, or other geopolitical or economic shocks, leading to heightened market caution and risk-aversion sentiment.

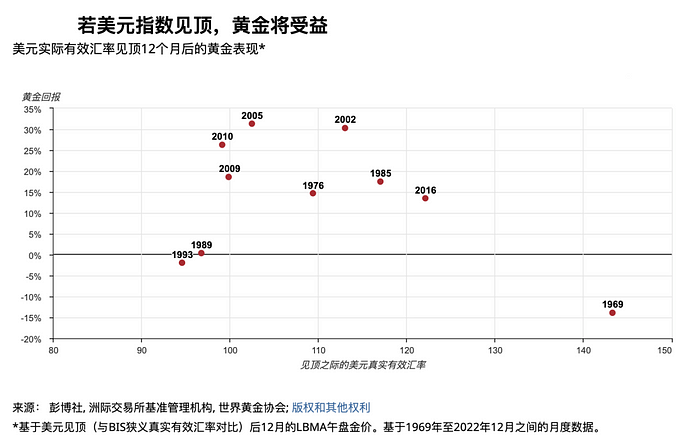

Historically, 80% of the time, 12 months after the U.S. Dollar Index peaks, gold yields positive returns (with an average return of +14% and a median of +16%).

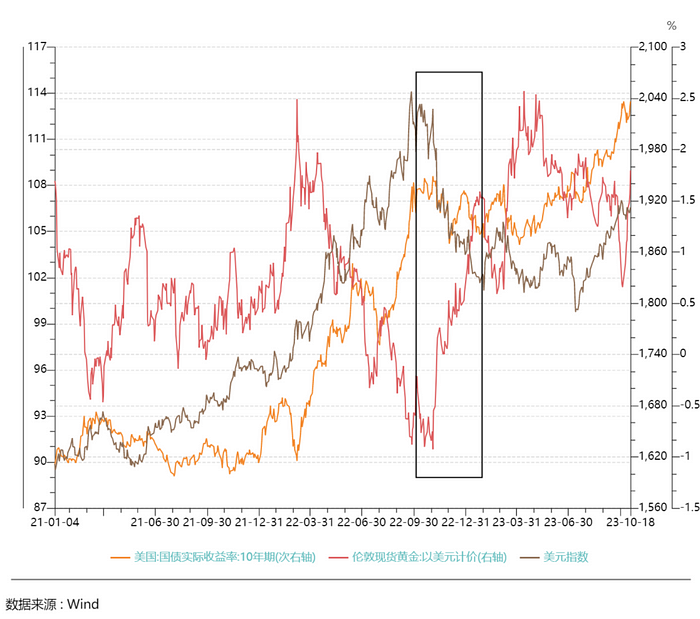

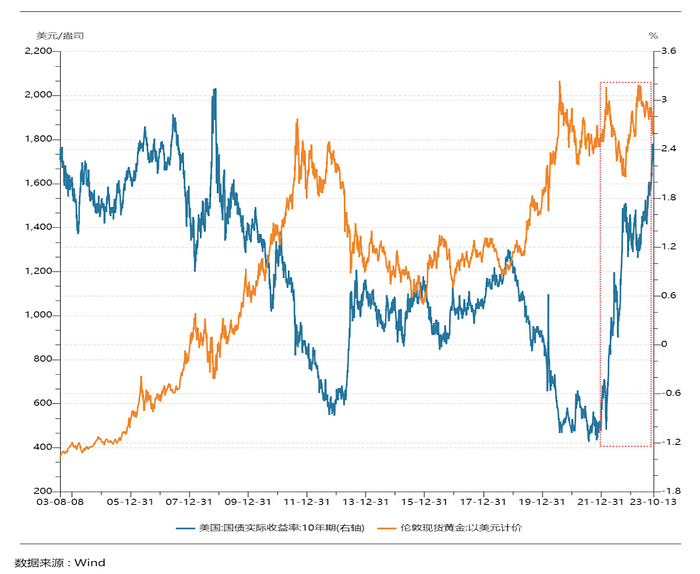

In the fourth quarter of 2022 through the beginning of 2023, the real yield of 10-year U.S. Treasury bonds remained volatile without significant fluctuations. However, the gold price rose from a low of approximately $1,600 to $2,000 per ounce, deviating from the restraint of U.S. long-term yields. From October 2022 to January 2023, due to expectations of economic recovery in China following the easing of the pandemic and the economic rebound in Europe, growth momentum outside the United States was stronger, resulting in a nearly 9% fall in the DXY (Dollar Index). During this period, gold primarily mirrored the rise in the DXY.

Real Yield of U.S. Treasuries

Gold is a non-interest-bearing asset, while the U.S. dollar is an interest-bearing asset. The U.S. dollar yield and inflation expectations are two forces driving changes in gold prices. The real interest rate in the United States (nominal interest rate minus inflation expectations) represents the opportunity cost of holding gold, and theoretically, there is a negative correlation between the two. Additionally, the U.S. real interest rate signifies the real rate of return achievable within the dollar system and serves as a gauge of the strength of the dollar’s creditworthiness.

Both the U.S. Dollar Index and the real yield of U.S. treasuries can be used to explain fluctuations in gold prices, with the correlation differing in various periods. Since the 21st century, except for the period before 2005, the price of gold has been significantly negatively correlated with the real yield of 10-year U.S. Treasury bonds for the vast majority of the time. The real yield of U.S. treasuries has dominated the price of gold for a relatively longer time compared to the U.S. Dollar Index. It can be considered that the real interest rate is the most crucial factor affecting the long-term price of gold.

Since 2022, the sensitivity of gold prices to real interest rates has declined. As U.S. Treasury real yields have risen rapidly, the extent of the decline in gold prices has been lower than historically, demonstrating improved resilience. Neither the real yield nor the U.S. dollar index fully account for the price fluctuations in gold during this period. This trend is likely primarily associated with the surge in central bank gold purchases that began in the latter half of 2022. The World Gold Council reported on October 9th that global central bank annual gold reserves are expected to maintain a robust growth trend. In August, gold reserves increased by 77 tons worldwide, a 38% increase from July, indicating potential structural changes in demand within the gold market.

3. Geopolitics

Adhering to the principle of ‘buying gold in times of turmoil,’ the outbreak of geopolitical conflicts can increase the demand for safe-haven assets, stimulating a rapid short-term rise in gold prices. For instance, following the Russo-Ukrainian and Israel-Palestine conflicts in 2022, gold prices rose to around $2000 per ounce, a development that cannot be fully explained by U.S. real yields and the dollar alone.

Asset price changes after the Russo-Ukrainian war

On February 24, 2022, Russian President Vladimir Putin announced that the Russian military would undertake an operation aimed at the ‘demilitarization and denazification of Ukraine.’ He stated that there were no plans for the Russian military to occupy Ukrainian territory and affirmed support for the right to self-determination of the Ukrainian people. Minutes after Putin’s speech, Russian forces launched cruise and ballistic missiles at military bases and airports in Kyiv, Kharkiv, and Dnipro, destroying the Ukrainian National Guard’s headquarters. Subsequently, Russian forces initiated attacks in the Luhansk region, Sumy, Kharkiv, Chernihiv, and Zhytomyr, controlled by Ukraine, and conducted large-scale amphibious landings in the southern Ukrainian cities of Mariupol and Odessa.

Between February 25 and March 8, gold prices increased by approximately 8% consecutively. BTC did not show significant fluctuations in the first three to four days after the conflict but surged by 15% on March 1, only to retract to its pre-surge position soon after. By March 8, when gold hit its peak, BTC was at $38,733, up 4% from before the outbreak of the conflict, while the NASDAQ index fell by roughly 1.5%.

From March 9 to the end of the month, as Western countries, including the United States and European nations, announced sanctions against Russia, the market anticipated the worst outcomes of the event, and gold prices fell from their historical highs. BTC and the NASDAQ index, after brief fluctuations, began to rise together from March 14, with gold prices stagnating during this period. By the end of March, BTC had increased by 20%, gold gains had narrowed to 2% (compared to February 24), and the NASDAQ was up by 6%.

In the same period, the Federal Reserve initiated the current cycle of interest rate hikes in March 2022. The impact of the Russo-Ukrainian war on asset prices began to wane, and the trading logic shifted towards the Federal Reserve’s rate hikes.

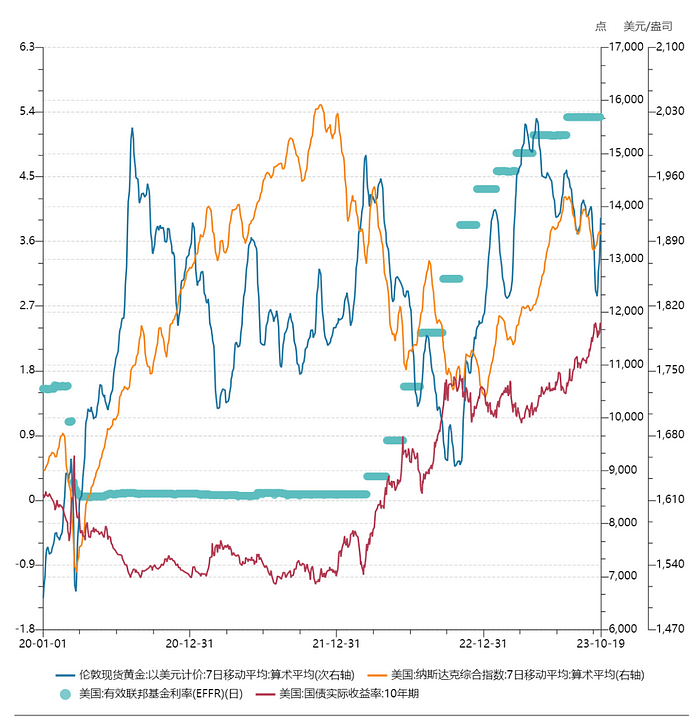

Beginning in April, with the interest rate hike, both Bitcoin (BTC) and the NASDAQ index entered a prolonged downward phase, paralleled by the price of gold, which, after a brief increase, began a long-term downward trend on April 19th. The NASDAQ index bottomed out around 10,000 points in October 2022, falling 28% since the start of the interest rate hikes. Gold reached its lowest at $1,615 in September and October, a cumulative decline of 16%. BTC bottomed out around $16,000 in November, plummeting 66% from the onset of the rate hikes.

Following these lows, gold was the first to initiate a new market cycle, continuously rising from early November, with a peak occurring on May 4th at $2,072, an increase of 28% from its lowest point. However, the market momentum for BTC and the NASDAQ index lagged two months behind gold. Beginning in 2023, BTC and the NASDAQ once again synchronized their uptrends. The peak for both BTC and the NASDAQ occurred in mid-July, with BTC reaching a high of around $31,500, nearly doubling from its lowest, and the NASDAQ reaching 14,446, a 44% rise from its trough.

This wave of increases was primarily associated with the peaking of U.S. bond yields in early November. Since the beginning of November, the decline in U.S. bond yields has led to a significant rebound in the price of risk assets. The main triggers were the CPI and core CPI data in October, both falling more than expected, coupled with a further deepening inversion of the 10Y-2Y U.S. bond yield curve, reflecting significant downward revisions in market expectations for economic growth and inflation. The decline in U.S. CPI and core CPI drove the 10-year U.S. bond yield to peak and fall, causing the Federal Reserve to slow down its interest rate hiking pace. Subsequently, driven by the AI boom in the NASDAQ, both gold and BTC had their unique narratives contributing to the further uptrend in various markets.

Overall, after the Russo-Ukrainian conflict, the synchronization of BTC prices with gold indicates that BTC has not demonstrated strong safe-haven attributes.

Changes in Asset Prices Since the Israel-Palestine Conflict

In the early morning of October 7, 2023, local time, the Palestinian Islamic Resistance Movement (Hamas) initiated an operation codenamed “Al-Aqsa Flood,” firing more than 5,000 rockets into Israel in a short period and thousands of militants from the Gaza Strip entering Israel to engage in conflict with the Israeli forces. Israel subsequently launched several airstrikes on the Gaza Strip, with Prime Minister Netanyahu declaring a “state of war,” vowing to deploy all military forces to destroy Hamas.

Gold experienced the most significant rise since the conflict, increasing approximately 8% from $1,832 on October 9 to nearly $2,000 on October 26, coincidentally consistent with the increase during the Russo-Ukrainian conflict. In contrast, BTC fell 4.4% from $28,000 to $26,770 between October 7 and 13, then rebounded following the confusion over the approval of the VanEck BTC ETF on the 16th, with a substantial intraday rise before a pullback, closing with half of the gains at $28,546. The upward momentum continued with the expectation of the ETF approval, culminating in a rise to $34,183 by the 25th. The NASDAQ experienced a slight increase from October 9 to 11, then began to fall from 13,672 points, dropping to 12,595.6 by October 20.

This period saw almost entirely divergent trends for BTC and the NASDAQ, each displaying independent market movements. Firstly, BTC’s price performance, contrary to that of gold nearly a week after the conflict began, suggests that BTC still does not embody the attributes of a safe-haven asset. The subsequent rebound was due to renewed and escalating confidence in the BTC spot ETF’s approval following the SEC’s decision not to appeal the Grayscale Bitcoin Trust case.

III. Is BTC a Hedge Asset?

BTC bears a high similarity to gold in terms of supply and demand, inflation, and other aspects, indicating that, theoretically, it should possess hedging properties from a model design and logical perspective. As Arthur Hayes elaborated in his article “For the War,” warfare leads to severe inflation, and a common method for ordinary citizens to protect their assets is by resorting to hard currency like gold. However, should a large-scale war erupt domestically, the government might ban private ownership of precious metals, restrict their trading, or even compel gold owners to sell their reserves to the state at low prices. Possession of strong currencies would also face strict capital controls. Only Bitcoin’s value and transfer network do not rely on government-authorized banking institutions, and it lacks physical existence, allowing individuals to carry it anywhere without restriction. In a genuine wartime scenario, BTC is actually a superior asset compared to gold and strong currencies.

However, up to the present, BTC has not demonstrated clear characteristics of a hedge asset in terms of actual asset price performance.

To further understand the price fluctuations of various assets in a complete cycle, it is instructive to review asset price changes before the recent U.S. dollar tide and the Russia-Ukraine conflict. The outbreak of the COVID-19 pandemic in early 2020 led to rapidly falling inflation expectations, forcing the Federal Reserve to significantly cut interest rates to 0–0.25% and initiate unlimited QE at the end of March 2020. Asset prices rose collectively, with the price of gold rising the fastest, reaching a historic high of $2075 per ounce in London in August 2020, before starting to retract. From March 30, 2020, to November 21, 2021, the NASDAQ rose 144% from 6631 to 16212 points; during the same period, BTC surged from $6850 to $58716, an increase of 757%.

Since 2020, with the entry of traditional funds, BTC’s price has increasingly exhibited characteristics of a major asset class, aligning more with NASDAQ’s performance during this period. In contrast, gold’s differing price performance is believed to reflect its function as a hedge asset during the unique pandemic period. The spread of pandemic panic and concerns over severe economic deterioration, besides actual interest rates, were driving forces behind the rising gold prices. On the other hand, the COVID-19 pandemic also caused multiple obstacles in gold transportation, contributing to a faster increase in gold prices.

We can observe that, whether from the long cycle of the rise and fall of the U.S. dollar tide or from short-term geopolitical conflicts, BTC has not demonstrated obvious hedging properties. Instead, it has shown a higher correlation with the NASDAQ index. It’s important to note that gold, known as a hedge asset, has exhibited very strong financial characteristics in the large cycle, also maintaining a same-direction price trend with the NASDAQ influenced by interest rates over a longer interval.

IV. Future Trend Outlook

In October, several Federal Reserve officials expressed dovish sentiments. For instance, the previously hawkish Dallas Fed President Logan suggested that the rise in U.S. Treasury yields might reduce the necessity for rate hikes. Meanwhile, Fed Vice Chair Jefferson stated that tightening financial conditions caused by recent bond yield increases would be considered when determining future monetary policy. On Thursday, October 19, Federal Reserve Chair Powell hinted in his speech at the New York Economic Club that as long as recent efforts to combat inflation continue making progress, the long-term rise in U.S. bond yields could justify a pause in rate hikes at the next meeting. However, he emphasized that the Fed remains committed to sustainably reducing inflation to 2%, not ruling out the possibility of future rate increases. Following Powell’s speech, the implied probability of a November hold on interest rates, as reflected by CME rate futures, surged to 99.9%. Nevertheless, the 10-year U.S. bond yield rebounded last week, momentarily surpassing 5.0%. The short-term anticipation of a rate hike is no longer the focal point of U.S. bond yield traders. The rate increase on the day of the speech may be partly due to interpreting Powell’s cautious remarks as hawkish, coupled with concerns over potential U.S. fiscal expansion and increased bond issuance.

Overall, speculation based on current economic data suggests that a 5% yield on ten-year U.S. bonds is possibly the Fed’s perceived ceiling. Short-term U.S. bond yields are expected to continue performing at a high level. Long-term projections, based on dot plots and market forecasts, indicate a high likelihood that the Fed will begin cutting rates next year. This shift in the Fed’s monetary policy stance is set to become a fundamental game-changer for global asset allocation in 2024. Generally, the window for allocating into gold and Bitcoin is nearing, with timing being a more pressing issue.

1. Gold

The real yield of U.S. Treasuries remains the primary driver of gold prices. Following the cyclical turn next year, the negative correlation between gold and the 10-year U.S. Treasury real yield will likely revive, with the real yield once again becoming the main and persistent price-driving factor. Additionally, the trend towards multipolarity in the international monetary system, driven by “deglobalization” and the rise of non-U.S. currencies, will structurally undermine U.S. creditworthiness, supporting continued gold purchasing by central banks. Thus, gold is expected to enter an upward cycle influenced by both cyclical reversals and structural reforms, potentially breaking past historical highs.

In the short term, gold prices will remain volatile, with geopolitics continuing as a key influencer. The trend will depend on whether the Israel-Palestine conflict expands to other Middle Eastern regions. If the conflict remains confined to Israel and Palestine, it is highly likely that gold’s upward momentum will wane, making a breakthrough of the $2,000/ounce psychological barrier challenging. Conversely, if the conflict spreads to neighboring oil-producing nations like Iran and Saudi Arabia, potentially even triggering oil embargoes or a sharp drop in production, it could significantly impact the oil supply chain, prompting further increases in both oil and gold prices. Rising energy prices, transmitted to other commodities, could spur CPI growth, adding more variables to the macro environment. Currently, the former scenario seems more probable.

2. Bitcoin (BTC)

Similarly, with the Fed likely initiating the next cycle in 2024, overall market liquidity will improve, and global investors’ risk appetite will increase. Combined with its unique market logic and influenced by ETFs and halving events, Bitcoin is poised for another bull market, potentially breaking past its previous high. The short-term driver remains the SEC’s approval of a BTC ETF based on physical holdings, with BTC prices recently surging to over $34,000. We will delve deeper into the specific impact of the spot ETF on BTC prices and provide post-approval price predictions in our upcoming research reports. Please stay tuned.

- This article reflects the author’s personal views only and does not constitute investment advice for any individual.