Written by Riyad Carey, Research Analyst at Kaiko

South Korea is one of the most unique markets in crypto. Its government has been proactive – relative to countries with similarly sized economies – in regulating the industry, passing its most significant legislation in early 2020. This legislation requires virtual asset service providers (VASPs) to register with the Korea Financial Intelligence Unit (FIU). So far, 37 VASPs have registered, with Upbit the first to file in August 2021.

In March of this year, the FIU revealed that it had found abnormal transactions and insufficient internal controls following on-site investigations at registered exchanges, fining offenders a maximum of about $400k and demanding improvements within three months.

MARKET SHARE

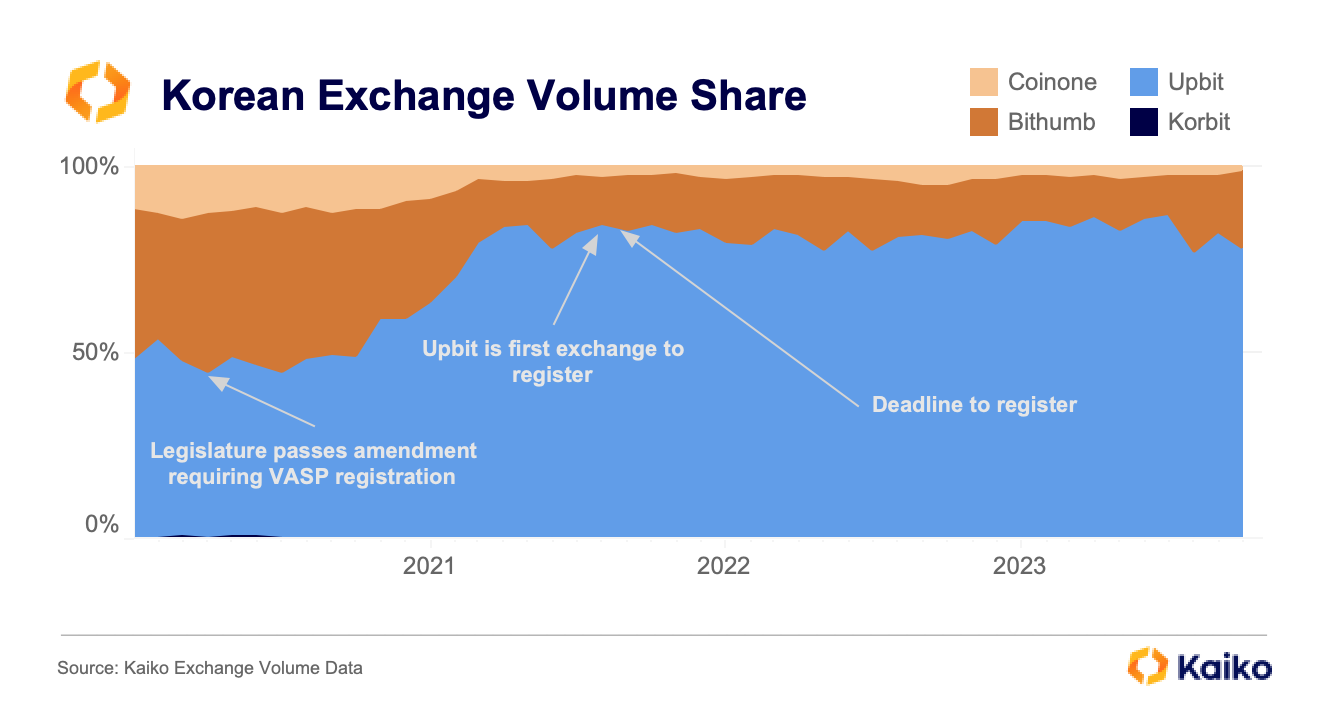

In the time between the passage of the legislation and its registration, Upbit gained considerable market share amongst the “Big Four” Korean exchanges.

Upbit jumped from less than 50% market share in the winter of 2020 to nearly 85% in May 2021, the month of a significant market downturn. For the next two years, its market share was unchallenged. Only in the past two months has Bithumb made a resurgence, growing its 10% share in July to over 20% this month. Meanwhile, Korbit, the oldest of the four, has been squeezed below 0.25% share; Coinone holds less than a 5% share.

VOLUME

Currently, it’s more of a Big Two than a Big Four. In terms of tokens available for trading, Korea’s Big Two looks a lot like the U.S.’s. Upbit actually offers the fewest tokens at just under 200, while Coinbase, Kraken, and Bithumb each offer nearly 250. However, Kraken offers by far the most instruments (for example, BTC-USD and BTC-USDT are two separate instruments) at over 650 because it has many EUR and GBP-denominated instruments; Coinbase offers just under 400. Korean exchanges almost exclusively offer instruments denominated in KRW.

Coinbase and Upbit have also facilitated very similar volumes this year, so we’ll use Coinbase as our point of comparison. Both exchanges check in at about $330bn in volume YTD while Bithumb recently breached the $50bn mark.

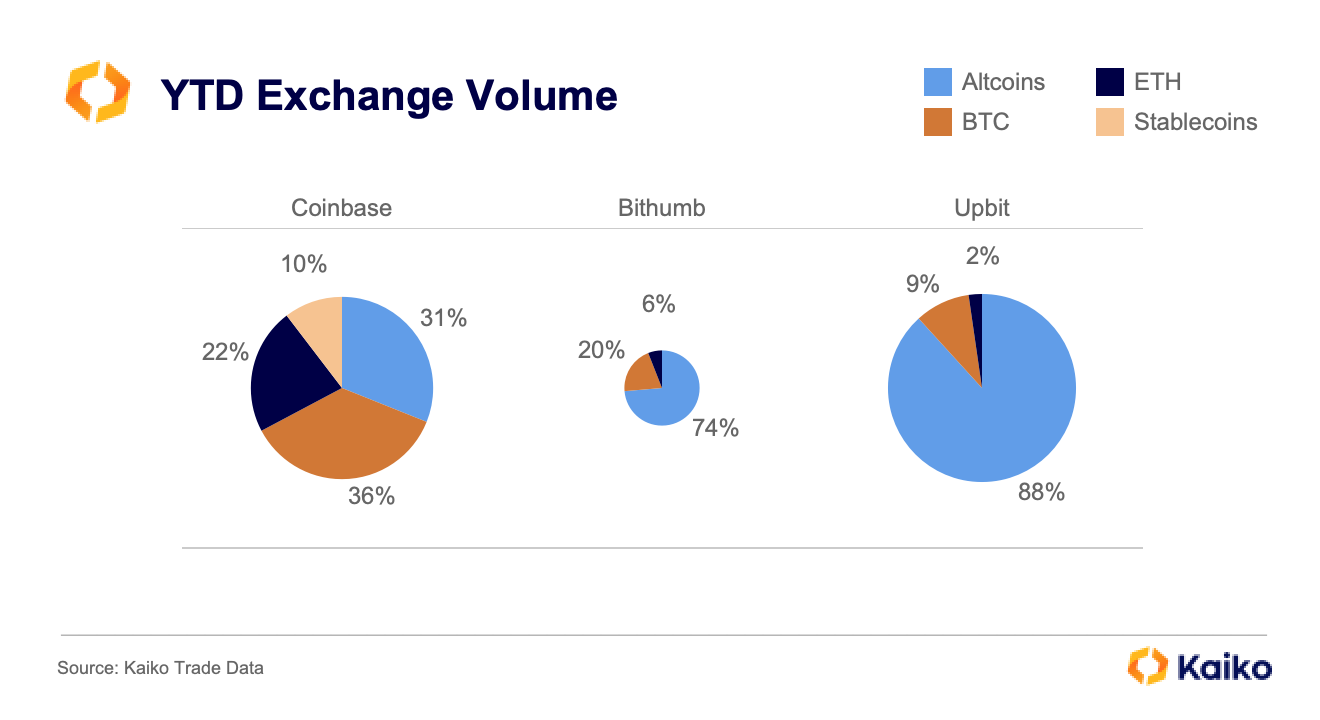

However, on Korean exchanges, the vast majority of volume comes from altcoins. On Upbit, just 2% of its volume has come from ETH and just 9% from BTC.

On Coinbase, BTC and ETH account for the majority of volumes, at 36% and 22%, respectively. Altcoins account for just 31% while stablecoins (USDT-USD, for example) represent 10%. There is virtually no stablecoin-stablecoin or stablecoin-fiat trading on Korean exchanges.

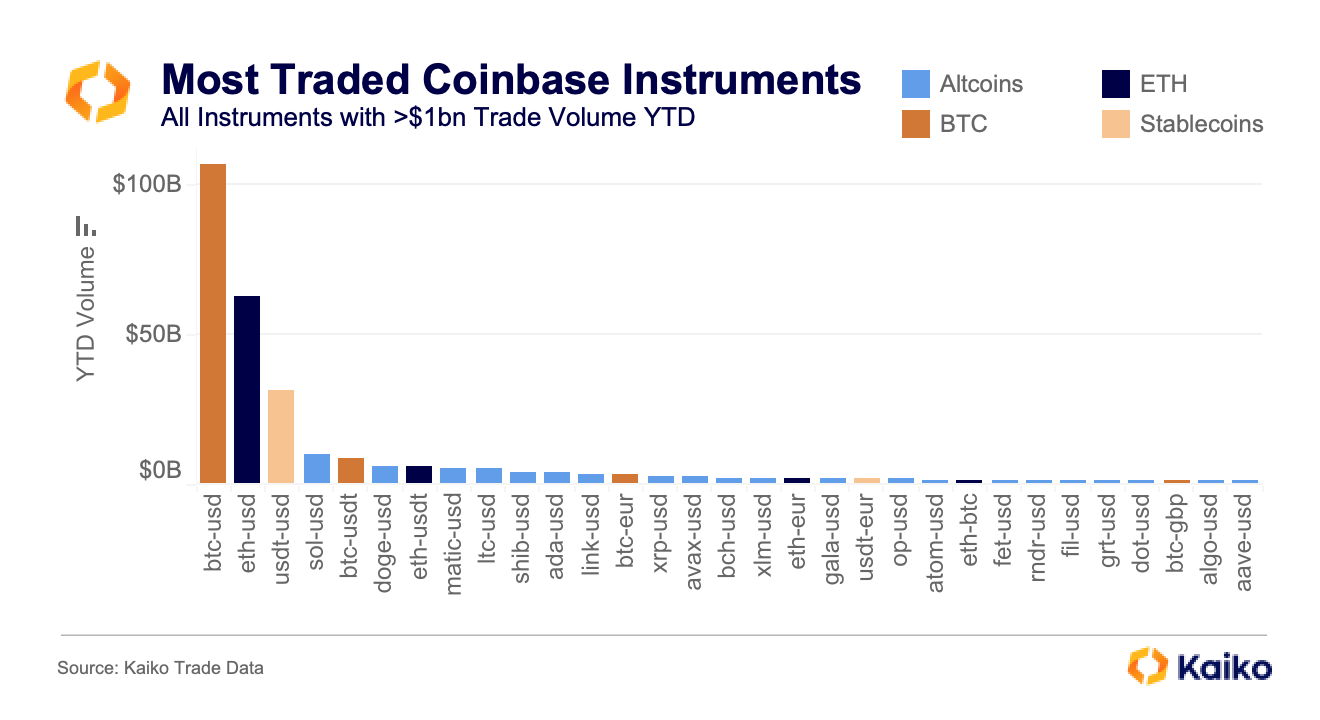

Below is every instrument on Coinbase with more than $1bn in volume YTD. BTC-USD dominates, followed by ETH-USD, followed by USDT-USD. There are two more BTC instruments and another ETH instrument in the top 15. In total, there are 31 instruments.

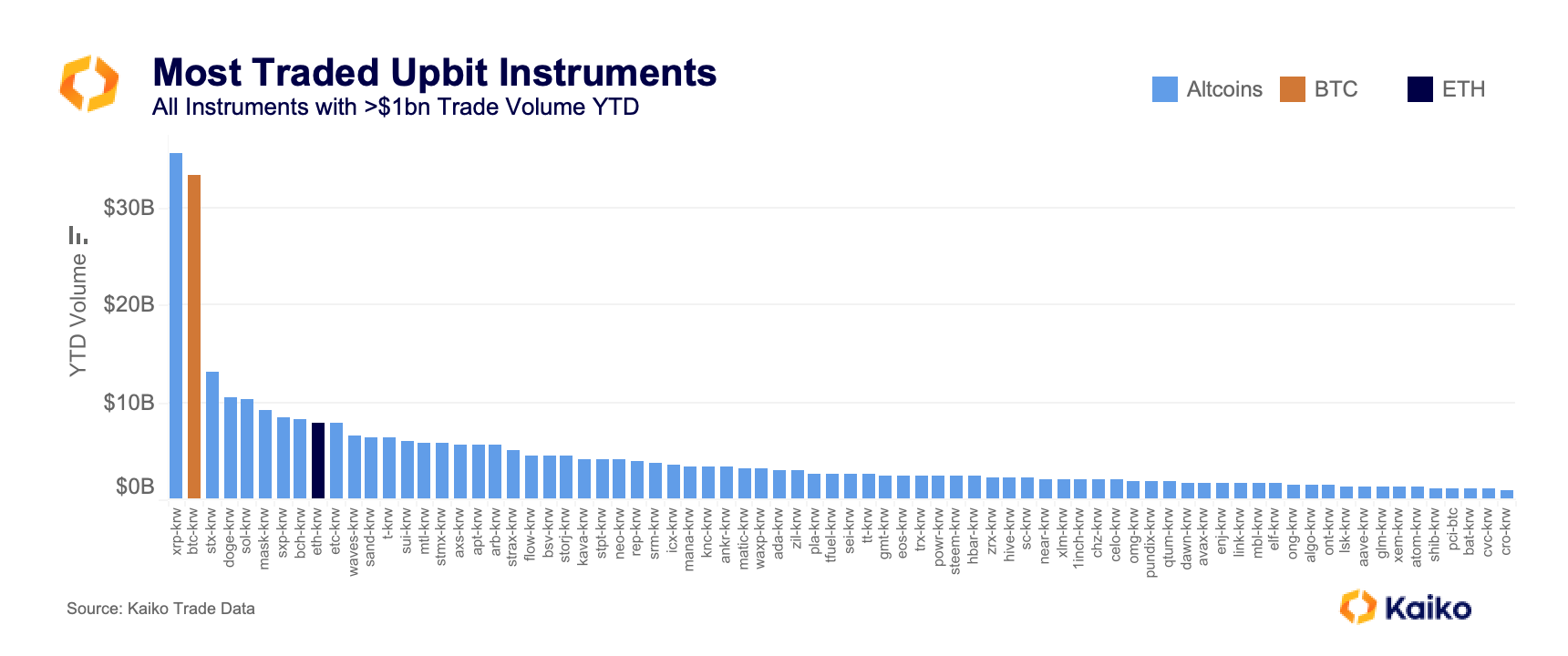

Upbit looks entirely different. XRP-KRW is the top instrument, followed closely by BTC-KRW. The token in third, STX, has registered $13bn in volume on Upbit this year. On Coinbase, it has registered under $1bn.

On Upbit, ETH-KRW is just the 9th most traded instrument, behind DOGE, SOL, MASK, SXP, and BCH’s KRW instruments. There are more than 75 instruments with more than $1bn in volume this year, all but two of which are altcoins.

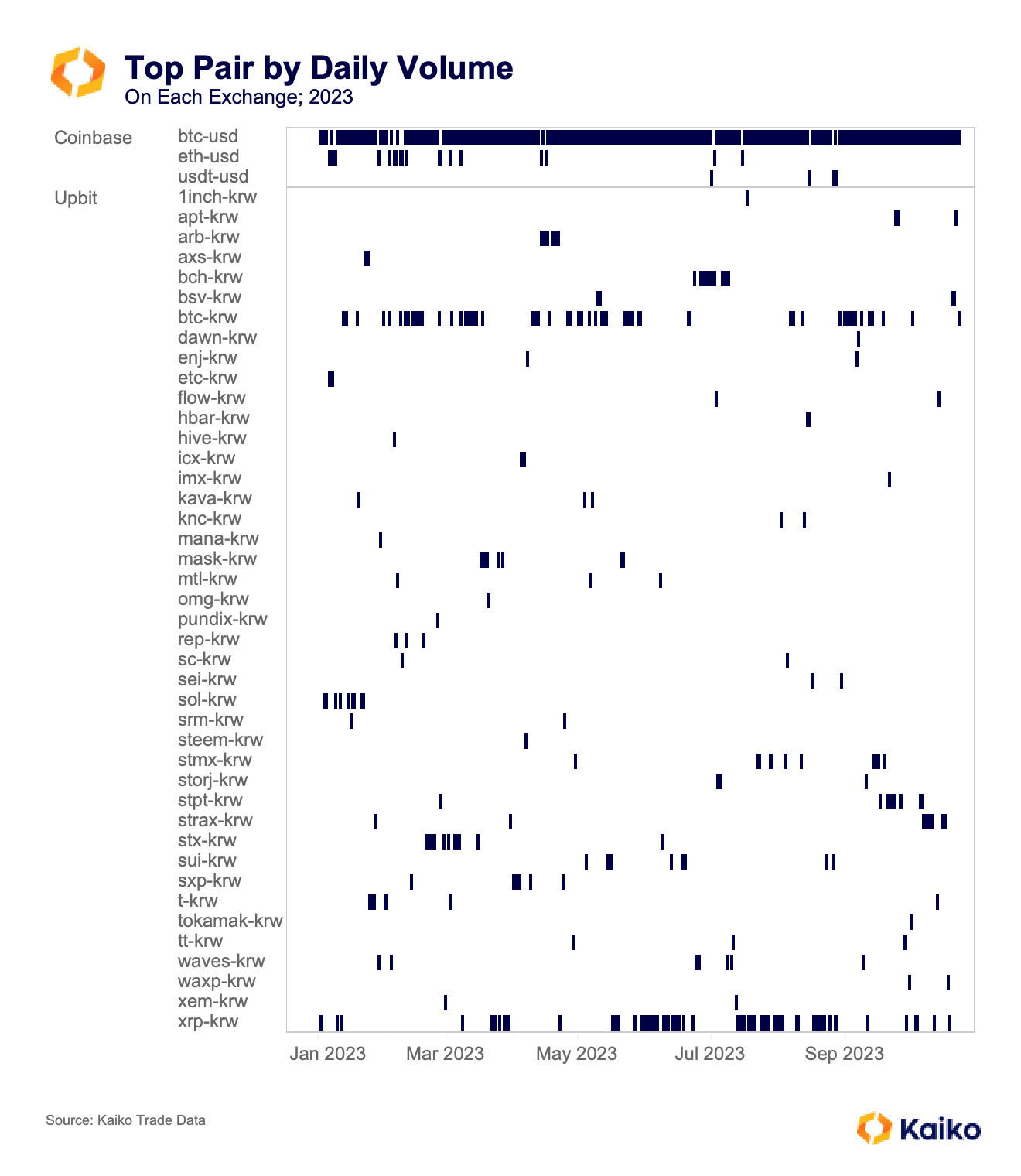

To put a finer point on the distribution of volumes, the chart below shows which instrument had the most volume each day this year. On Coinbase, BTC-USD was top for all but 22 days, with ETH-USD capturing some days early this year and USDT-USD capturing a few during the summer doldrums.

Upbit, on the other hand, has had more than 40 different instruments grab the top spot on at least one day. XRP-KRW has the most days on top at 70, followed by BTC-KRW at 64. After that, it’s chaotic. Tokens like T (yes, just T), HIVE, PUNDIX, and STEEM have all spent at least a day at the top.

In the past week, even as BTC rose above $35k, STRAX has taken the majority of days as top token; BSV has also grabbed a couple days.

CONCLUSION

Korean exchanges don’t follow any of the rules that hold true elsewhere. Namely, that BTC will be the top token and BTC and ETH combined will account for at least a plurality, if not a majority, of volume. There are some other exceptions, for example the Mexican exchange Bitso, where the majority of volume comes from USDT-MXN and XRP-MXN.

But, in volume terms, Bitso is about ten times smaller than Upbit. Upbit facilitates similar volume to the two big U.S. exchanges, Coinbase and Kraken, while even the smaller Korean exchanges register significant volumes. Despite that, they receive relatively little attention amongst English-speaking researchers and news outlets. We would like to be holistic in our research, ensuring that we capture as many relevant areas of the market as possible, and will thus emphasize Korean exchanges more going forward.