Written by Duoduo & Lisa, LD Capital

Chainlink (LINK) is a leading oracle in the market and an indispensable middleware in the DeFi sector. This article provides a brief analysis of its financial status and recent developments.

1. Financial Status

Basic Information

LINK is ranked 19th in market capitalization, valued at $41 billion.Total supply: 1 billion LINK tokens.

Current circulating supply: 560 million LINK tokens, approximately 56% of the total supply.

24-hour spot trading volume: $220 million.

Price Trend

Reached an all-time high of $52 during the 2021 bull market. Fell to $7 in May 2022, and then oscillated. The lowest price was around $5 in 2023, while there were several attempts to reach $9.5 but failed. Current price: $7.38, down 86% from the all-time high.

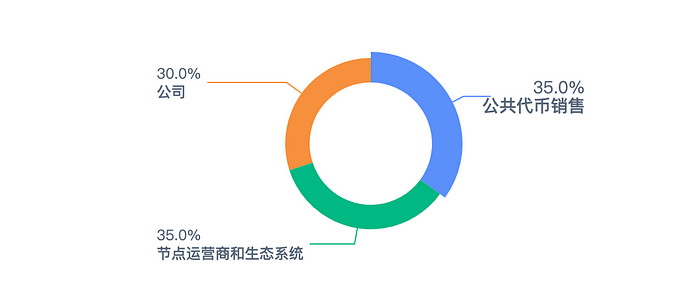

Token Distribution

Out of the total 1 billion tokens: 35% were sold through ICO. 30% were allocated to LINK’s parent company, SmartContract, for development. 35% are for node operator incentives.

The primary uses for LINK tokens are for paying fees to node operators for fetching data for smart contracts and as collateral required by contract creators. Notably, LINK does not grant governance rights over the project.

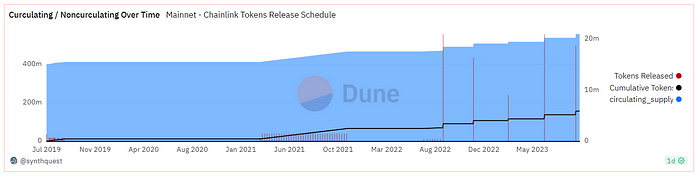

Currently, LINK’s circulating rate is about 56%. For the remaining non-circulated portion, there are no clear unlocking rules, with transfers out of the non-circulating supply wallet made intermittently.

The historical token release schedule of LINK shows: Intensive token releases occurred from July-August 2019, March-November 2021, and July-August 2022. Large-volume releases occurred in August 2022, November 2022, and March, June, and September 2023. Essentially, tokens are released every three months, ranging from 10 million to 20 million each time. Since last August, approximately 84 million tokens have been released. Valued at an average price of $7, this is worth around $590 million.

Nansen data on holdings shows, several non-circulating supply wallets collectively hold about 44% of the tokens. In the last 30 days, these wallets have seen an outflow of 17 million tokens.

LINK staking addresses hold 25.47 million tokens, 2.55% of the supply, with a recent increase of 315,000 tokens in the last 30 days, indicating the scale of token staking remains relatively small.

Binance wallet holds over 6% of LINK. Wallet 0XF97 had an inflow of 15.5 million LINK in the past 30 days, while Wallet 0X5A5 had an outflow of 8.5 million LINK.

Upbit’s labeled wallet holds 1.28% of LINK with an outflow of 760,000 tokens in the last 30 days.

A newly created wallet, 0X95a, from a day ago holds approximately 4.21 million LINK, 0.42% of the supply. This address is unlabeled and lacks clear ownership.

Market maker Jump Trading’s addresses collectively hold 4.66 million tokens, 0.46% of the supply, worth about $32 million. Over the past 30 days, 0X73A saw an inflow of tokens worth $1.55 million, while 0X2EF had an inflow valued close to $3 million, with a net outflow valued at $1.45 million.

Overall, LINK’s circulating tokens are well-distributed. Excluding project and exchange addresses, the two largest unlabeled addresses hold 0.42% and 0.4% of the tokens, respectively, with no transactional relation between them. Jump Trading’s publicly disclosed addresses hold 0.46% of the tokens, with a recent net outflow worth $1.45 million, a not-so-significant amount.

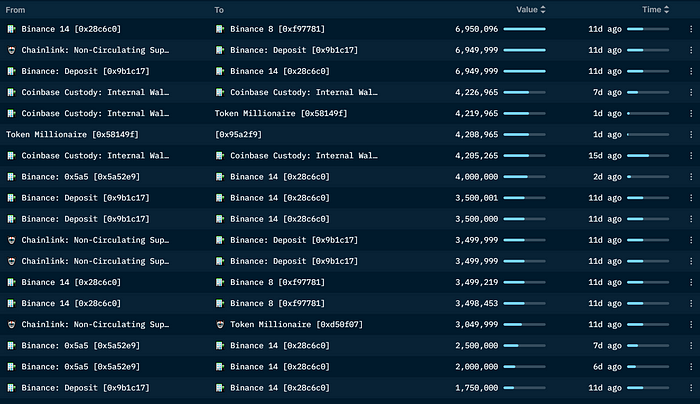

Recent Token Transfer Status

The table below shows significant token transfers over the past 30 days. Wallets marked as “Non-circulating supply” have cumulatively transferred approximately 17 million tokens into the Binance exchange. Based on an average price of $7 per token, roughly $120 million worth of tokens have flowed into the market in the last 30 days.

A significant holder withdrew 4.21 million tokens from Coinbase Custody, which equates to a market value of approximately $29.5 million at an average price of $7. These tokens were immediately transferred to the wallet address “0x95a”, which has not been specifically labeled.

It can be seen that the project’s main addresses hold a large number of tokens, and due to unclear release rules, there’s a possibility of a massive influx of tokens into the market in the short term. Moreover, after the recent price increase, major holders have withdrawn a substantial number of tokens from exchanges.

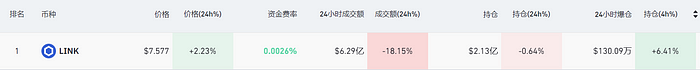

Contract Data

According to data from Coinglass, LINK’s contract position is worth $213 million, with a 24-hour trading volume of $629 million. The contract trading volume is approximately three times that of spot trading. Relative to LINK’s overall market value, the contract position ratio isn’t high, accounting for about 5%.

Looking at the contract data, after the decline on August 18th, the price oscillated between $5.8 and $6.5. On September 18th, the position volume increased significantly, with a single-day rise of over 50%, while the price broke through the bottom range.

Since then, the position has seen some pullbacks, with a slower growth rate, but overall it remains on an upward trend. The token price experienced three surges and three pullbacks, but the overall trend is bullish.

As the price rose from its lowest point, the ratio of long to short position holders decreased from 2.5 to 0.89. This means that there were more accounts shorting, indicating that accounts going long had a higher average value, implying a stronger bullish sentiment.

However, after the price rose to $7, the ratio of long to short positions among major holders also decreased, from 1.23 to 1.09. This suggests a reduced bullish sentiment among these major holders. (Note: In the ratio of long to short positions among major holders, “major” refers to the top 20% of accounts holding tokens on Binance.)

In summary, positions are in a continuous growth state. Even though there were pullbacks during the uptrend, these pullbacks did not fall below previous highs. The ratio of long to short position holders shifted from being predominantly long to predominantly short, but accounts with higher value exhibit a stronger bullish sentiment.

II. Fundamental Analysis and Recent Development Trends

Business Data

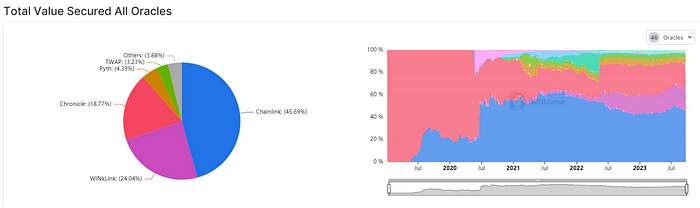

Currently, in the field of general-purpose oracles, Chainlink has displayed an overwhelming advantage and market position, establishing a significant market barrier.

Purely looking at the market scale of oracles, Chainlink, Chronicle Labs, and WINLink collectively account for over 90% of the entire oracle market. While Chronicle Labs and WINLink also have substantial market shares, their influence is hardly comparable to Chainlink. WINLink is a decentralized oracle project within the TRON ecosystem, limited to the TRON environment. Chronicle Oracles, funded by MakerDAO, specifically serves MakerDAO and is considered an internal oracle.

According to official data, over 1700 projects currently operate within Chainlink’s ecosystem, including 704 DEFI projects, 525 NFT projects, 288 Gaming projects, etc., covering most of the renowned projects.

Product Architecture

Decentralized Oracle Networks (DONs)

A DON is a decentralized oracle network composed of numerous Chainlink nodes. By introducing multiple independent data provider nodes, it ensures data security, reliability, and tamper-resistance, reducing single-point failure risks and making data manipulation more challenging. Chainlink’s decentralized oracle feature makes it the preferred data provider for many DeFi projects and other blockchain applications, solidifying its leadership position in the oracle market.

Chainlink’s node operators mainly fall into the following categories:

DevOps Nodes: Organizations specializing in running blockchain infrastructures, such as PoS validator nodes, PoW mining pools, and full node RPC providers. These node operators have rich experience in managing critical Web3 infrastructure, handling cryptographic private keys, and offering services in exchange for cryptocurrency. Notable DevOps nodes include Fish, P2P Validator, and Staked among the top staking pool providers.

Enterprise Nodes: These nodes are spread worldwide, currently serving the backend infrastructure for the conventional Web2 economy. They include international telecommunications companies such as the subsidiary of Deutsche Telekom, T-Systems, and Swisscom, and global institutions like LexisNexis.

l Community Nodes: These nodes originate from the Chainlink community, including winners of the Chainlink Oracle Olympics, CryptoManufaktur, LinkRiver, and NorthWest Nodes.

Chainlink Data Feeds

Data Feed, one of Chainlink’s most extensively used features, aims to provide smart contracts with a secure, reliable, and decentralized off-chain data source. It’s widely utilized in DeFi for lending, derivatives, stablecoins, asset management, etc.

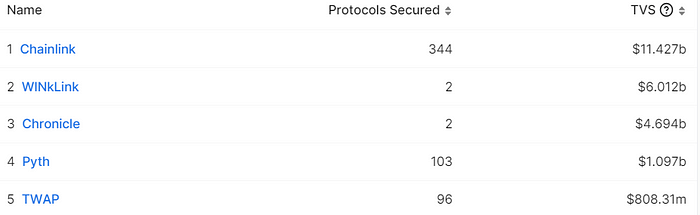

Data Feed employs a multi-tier data aggregation mechanism.

Initially, price data aggregators like CoinGecko and Coinmarketcap conduct the first aggregation, generating a trade volume-weighted average price to ensure the quality of trading data.

Chainlink’s node operators then fetch this price data for a second round of aggregation. The final layer of aggregation happens at the decentralized oracle network DON level, where all node operators upload their median data and node signatures to produce Off-Chain Reporting (OCR) published on-chain. The OCR aggregates all data and stores it in a contract, making subsequent tampering difficult. For OCR to be accepted on-chain, at least 2/3 of the nodes in DON must upload results and signatures. This mechanism greatly ensures the difficulty of tampering with the final Data Feed data.

VRF (Verifiable Random Function)

Chainlink VRF is a decentralized random number generation service, providing smart contracts with secure and verifiable randomness. In many applications, like games, NFT projects, and prediction markets, random number generation is crucial. For instance, Axie Infinity employs Chainlink VRF to ensure each of the 4088 original Axies is genuinely randomly generated based on predefined probabilities in the smart contract.

CCIP (Cross-Chain Interoperability Protocol)

CCIP is an interoperability protocol for building cross-chain applications and services. Developers can build their cross-chain solutions on top of CCIP, which also offers simplified token transfers, supported by Chainlink’s decentralized oracle network. While CCIP’s use cases resemble those of products like LayerZero, CCIP is more than just a bridge with a programmable layer. Hybrid smart contracts will allow interactions between on-chain and off-chain smart contracts and cross-chain execution, serving as a bridge between Web 2 and Web 3.

Developers, applications, and businesses can leverage CCIP to unlock various use cases, such as:

Cross-chain tokenized assets: Transfer tokens across blockchains from a single interface without building their bridge solution.

Cross-chain collateral: Launch cross-chain lending applications, allowing users to deposit collateral on one blockchain and borrow assets on another.

Cross-chain liquidity staking tokens: Establish bridges for liquidity staking tokens across multiple blockchains, enhancing their utilization in DeFi applications on other chains.

Cross-chain NFTs: Enable users to mint NFTs on the source blockchain and receive them on the target blockchain.

Cross-chain account abstraction: Construct smart contract wallets with native CCIP functionality, improving users’ cross-chain function call experience. For instance, allowing users to approve transactions on any chain using a single wallet.

Cross-chain games: Create blockchain-agnostic gaming experiences, allowing players to store high-value items on more secure blockchains while playing on more scalable ones.

Cross-chain data storage and computation: Implement data storage solutions enabling users to store any data on the target chain and perform computations using transactions on the source chain.

Key Timeline for CCIP:

August 2021: Chainlink launched the Cross-Chain Interoperability Protocol (CCIP).

July 18, 2023: CCIP initiated its early access phase on the mainnets of Avalanche, Ethereum, Optimism, and Polygon. Both Synthetix and Aave have implemented CCIP.

July 20: CCIP became accessible to developers on five testnets: Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, Optimism Goerli, and Polygon Mumbai.

August 31: Swift conducted experiments in collaboration with several financial institutions, including ANZ Bank, BNP Paribas, Bank of New York Mellon, Citibank, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX), and The Depository Trust & Clearing Corporation. Chainlink served as the enterprise abstraction layer, securely linking the Swift network to the Ethereum Sepolia network. Meanwhile, Chainlink’s CCIP ensured full interoperability between the source and target blockchains.

September 15: The Depository Trust & Clearing Corporation (DTCC) explored CCIP’s features with Chainlink to aid in the tokenization of real-world assets. DTCC is a globally significant securities settlement system, processing transactions worth over $200 trillion annually.

September 21: CCIP went live on the Arbitrum mainnet.

September 28: CCIP was launched on the base chain mainnet.

Chainlink Stake v0.2:

Staking is a cornerstone of Chainlink Economics 2.0, aiming to bolster network security. By staking LINK, ecosystem participants, such as node operators and community members, can support the performance of oracle services and earn rewards.

December 2022: The initial test version of Chainlink Stake (v0.1) was released, supported by a staking pool of 25 million LINK, focusing on the ETH/USD data source on Ethereum.

Chainlink Stake v0.2 is slated for a Q4 2023 release, with the initial staking pool expanding to 45 million LINK. v0.2 will gradually open its access to a broader audience, starting with a preferential migration period for existing v0.1 stakers, followed by early access, and then general access.

v0.2 has been restructured to be entirely modular, scalable, and upgradeable. Building on the experiences from v0.1, v0.2 emphasizes the following goals:

l Greater flexibility for community and node operator stakers while retaining the non-custodial security of staking LINK.

l Enhanced security guarantees for oracle services supported by Chainlink Stake.

l A modular structure to iteratively support future improvements and additions to Chainlink Stake, including expansion to more services.

l A dynamic reward mechanism to seamlessly support new sources of rewards, like user fees.

III. Summary

Fundamentally, Chainlink is a leader in the oracle sector, currently dominating in terms of service quantity and quality. They boast robust product development capabilities, consistently launching and refining products.

Their recent focus lies in the business expansion of CCIP and the Q4 launch of Chainlink Stake v0.2. CCIP, a service product, is aimed at consolidating and acquiring new clients, receiving significant attention due to its innovation. Simultaneously, it’s a vital tool for asset tokenization. Chainlink Stake v0.2 is a profit-sharing model that strengthens the project’s security and stability.

Financially, the project holds 44% of unreleased tokens, with no explicit release schedule. In the past year, releases occurred once every three months, ranging between 10 and 20 million tokens per release. Given the significant supply and high uncertainty, the most recent release was in mid-September, suggesting the next release might be in December.

Apart from that, token holdings are fairly distributed, with the majority (~6%) on Binance. Jump Trading holds 0.46%. Recently, a significant holder acquired tokens, withdrawing 4.21 million tokens (valued at approximately $29.5 million) from Coinbase on September 27.

Contractually, there’s a steady growth in positions. Despite some pullbacks during upward trends, these haven’t gone below previous highs. Accounts with higher values are more bullish.

Overall, Chainlink has a solid foundation, classifying it as a blue-chip project with a high market cap. In terms of token distribution, while the project holds a significant portion, the rest are well-distributed. A notable new holder has recently entered the top 40 holders. The overall sentiment in the market is bullish.

Note: All data mentioned is up-to-date as of September 27, 2023.