Author: Lisa, LD Capital

In recent times, international crude oil prices have strengthened continuously, with an increase of nearly 30% since early July. The price of Brent crude is approaching the $100 mark. Crude oil, regarded as the king of commodities and the mother of industries, holds three major attributes: commodities, finance, and politics. The factors influencing its price are intricate. This article will endeavor to analyze the crude oil market from the perspectives of its development history, supply-demand relations, and geopolitical concerns.

I. History of the Crude Oil Market

1. The Rockefeller Era

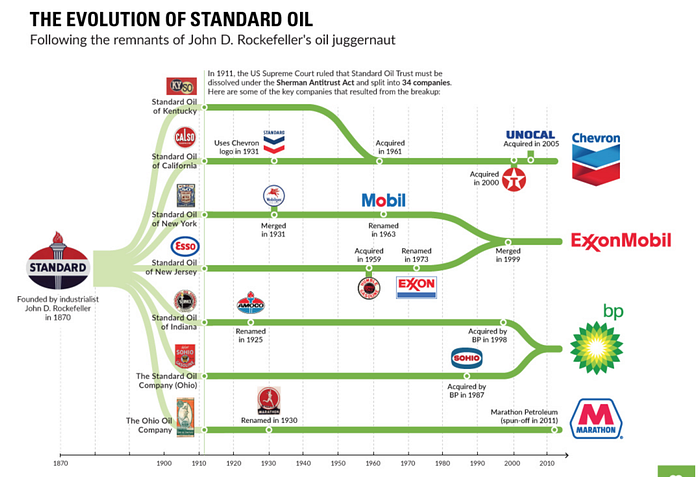

In 1870, John D. Rockefeller founded the Standard Oil Company, becoming the renowned “Oil Tycoon”, monopolizing over 90% of the U.S. refining capacity. Later, in 1911, the U.S. Supreme Court ordered the dissolution of the Standard Oil Company in what became the first antitrust case in global business history. Standard Oil was divided into 34 companies, the most significant of which were the following seven. In the years after the breakup of Standard Oil, major oil companies heavily extracted oil while engaging in price wars, resulting in relatively stable prices.

2. The Era of the Seven Sisters

Following World War I (1914–1918), Britain and France signed the Sykes-Picot Agreement on April 25, 1920, to divide Middle Eastern oil resources. They decided to jointly monopolize oil extraction in the region and limit U.S. entry into the Mesopotamian oil sector. Unquestionably, this incited U.S. discontent. With U.S. efforts, the Red Line Agreement was signed in 1928 by the UK, France, the Netherlands, and the U.S., replacing the Sykes-Picot Agreement. This new agreement granted the U.S., UK, France, and the Netherlands equal oil extraction rights within the gulf regions delineated in the agreement. Since then, the U.S. has made significant strides in the Middle Eastern oil sector.

To control prices, post-1928, major oil companies formed a cartel famously known as the “Seven Sisters”, which included Exxon, Mobil, Chevron, Texaco, Gulf, British Petroleum (BP), and Royal Dutch Shell. The first three emerged as successors of Standard Oil. The “Seven Sisters” monopolized the oil and gas resources of the Middle East. They owned almost all the oil extraction rights in the Gulf countries, controlling international oil prices, production, and trade. The countries housing these oil resources lacked both the production technology and trading channels, leaving them firmly under Western control.

Between 1939 and 1945, World War II erupted, and oil demand surged, making it the most critical strategic resource. Post-WWII, nations globally recognized the importance of oil extraction. Numerous countries and companies joined the competitive oil market, and by the 1950s, oil extraction witnessed exponential growth.

3. The OPEC Era

After being constrained by Western nations for over two decades, in 1960, in Baghdad, Iraq, oil-producing countries established the Organization of the Petroleum Exporting Countries (OPEC). Its mission was to coordinate and unify member countries’ oil policies, stabilize international oil market prices, and ensure steady income for oil-producing nations. From 1961 to 1975, OPEC’s membership expanded from the initial five (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela) to the current 13, which includes Algeria, Angola, the Republic of Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates, and Venezuela. During this period, Middle Eastern countries initiated the nationalization of oil field assets, reclaiming a significant degree of control over oil production.

With the end of the Bretton Woods system in 1971, the U.S. signed an agreement with Saudi Arabia in 1974. Since then, the U.S. dollar has been pegged to oil, forming a global oil-dollar settlement system.

4. Three Oil Crises

The world’s primary oil resources are predominantly located in politically sensitive regions. Hence, oil prices are significantly influenced by geopolitical events. Wars in these regions, leading to supply disruptions, can easily trigger surges in crude oil prices.

First Oil Crisis (1973–1975)

In October 1973, the Fourth Middle East War broke out. The US overtly air-shipped weapons to Israel and provided substantial military aid. In response, OPEC, aiming to penalize Israel and its supporters, wielded its “oil weapon” by announcing increased oil prices, reducing production, and imposing an oil embargo on Western developed capitalist nations. As a result, oil prices soared, marking the onset of the first oil crisis.

The price of crude oil quadrupled during this period, causing economic chaos in Western countries, eventually leading to an economic downturn.

Second Oil Crisis (1979–1980)

In late 1978, the “Islamic Revolution” erupted in Iran, eventually toppling the pro-US Pahlavi dynasty and causing intense social and economic turbulence. From the end of 1978 to early March 1979, Iran halted oil exports for 60 days, creating a daily oil market shortage of 5 million barrels, about 10% of the world’s total consumption. The subsequent Iran-Iraq war in 1980 further reduced oil production, inducing another global economic recession.

Third Oil Crisis (1990–1992)

In 1990, Iraq waged the Gulf War against Kuwait, severely damaging both countries’ oil facilities and drastically reducing oil production. International oil prices leaped from $14 per barrel to $42, triggering the third oil crisis. However, compared to the previous two crises, this one was of shorter duration and had a relatively minor impact.

5. The 21st Century

China joined the World Trade Organization in 2001. Represented by China, emerging economies entered a rapid growth phase in the 21st century, swelling the demand for commodities like crude oil. Coupled with the impact of the Iraq War, crude oil entered a super bull market in the early 21st century. From 2000 to 2008, oil prices surged nearly five-fold, breaking the $100 mark in 2008. Yet, in the same year, the global financial crisis hit, and oil prices plummeted to around $40.

From 2009 to 2014, in the aftermath of the financial crisis, there was massive global liquidity injection. Coupled with the massive social unrest of the “Arab Spring” severely impacting Middle East oil exports, international crude oil prices once again began to climb.

A new force then emerged that shifted the global energy supply landscape — shale oil. The development of U.S. shale oil began in the 1990s. With the advancement of hydraulic fracturing and horizontal drilling technologies, large-scale commercial development started around 2007. Shale oil development cycles are much shorter than traditional oil wells, and by the 2010s, it saw rapid growth. The American shale revolution increased global oil supply, challenging OPEC’s dominance over the global oil market. Oil prices began to drop sharply from 2014.

In early 2016, international oil prices dipped to around $30 per barrel. To boost prices, in December, OPEC members and ten non-OPEC oil-producing countries, led by Russia, reached an output-limiting agreement in Vienna, Austria. On July 2, 2019, OPEC and non-OPEC oil-producing countries signed the “Cooperation Charter,” institutionalizing the “OPEC+” cooperation mechanism, which primarily influences oil prices by convening meetings to negotiate and agree on production levels. Production cuts resulted in a slight recovery in oil prices.

In 2020, the COVID-19 pandemic broke out, causing a sharp decline in global production and consumption. The oil market plunged once again, reaching lows of about $20. However, factors like OPEC+ production cuts, pandemic recovery, and demand revival gradually pushed oil prices back up.

On March 20, 2003, a coalition force led mainly by the British and American armies launched a military operation against Iraq. The United States justified its military strike on Iraq on the grounds that Iraq possessed weapons of mass destruction and was secretly supporting terrorists. By August 2010, when the US combat troops withdrew from Iraq, the campaign had lasted over seven years.

Starting in 2010, a wave of revolution swept through the Arab world. People from Arab nations took to the streets, demanding the overthrow of autocratic regimes and the establishment of democratic systems, leading to civil wars in several countries.

In September 2021, concerns about an energy crisis emerged, further driving up oil prices. In November, the Biden administration announced the release of 50 million barrels from the U.S. strategic oil reserves (with an actual legal sales amount of 18 million barrels, and 32 million barrels intended to help refineries address supply issues, requiring a return to the strategic reserves), combined with a resurgence of the pandemic in Europe, this move curbed the oil prices.

In 2022, overall oil prices showed a “V” trend. In the first half of the year, the conflict between Russia and Ukraine erupted, and economic sanctions such as the Western countries’ embargo on Russian oil drove oil prices to surge. Brent crude’s main contract rose to a high of $137 per barrel, breaking the historical highest price since the 2008 financial crisis. In the second half of the year, the U.S. Federal Reserve continued to raise interest rates. Expectations of economic recession increased, and bearish macroeconomic factors suppressed demand expectations. Commodities declined in tandem, leading to a fall in crude oil prices.

II. Overview of Crude Oil

1. Definition of Crude Oil

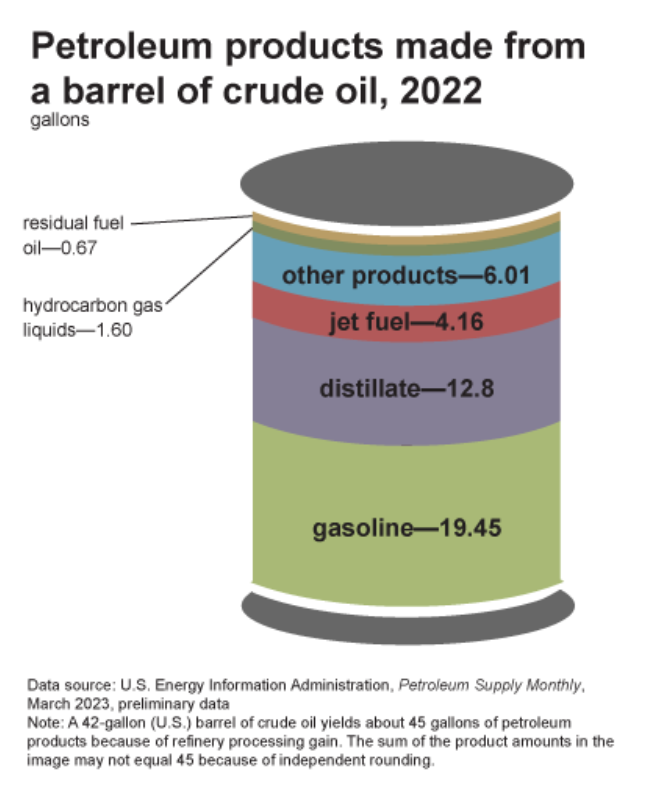

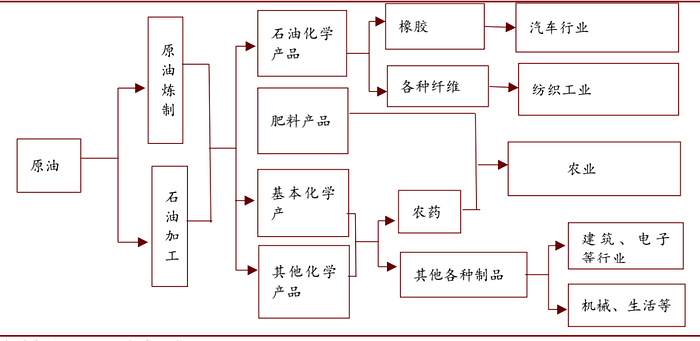

Petroleum that has not been processed is referred to as crude oil. It is a mixture of various liquid hydrocarbons such as alkanes, cycloalkanes, aromatics, and alkenes. Refined crude oil can yield fuel, lubricants, asphalt, petroleum wax, petroleum coke, solvents, and other chemical raw materials. Among these, fuel has the highest output, mainly including gasoline, diesel, and aviation kerosene, as well as kerosene for lamps, fuel oil, and others.

From one barrel of crude oil, a U.S. refinery can approximately produce 19.45 gallons of gasoline, 12.8 gallons of distillate fuel oil (most of which is sold as diesel), and 4.16 gallons of jet fuel and others.

Based on their composition, crude oils can be classified into paraffinic base crude oil, naphthenic base crude oil, and intermediate base crude oil. Based on sulfur content, they can be categorized into ultra-low sulfur, low sulfur, sulfur-containing, and high sulfur crude oils. In terms of relative density, they can be divided into light, medium, and heavy crude oils. The API gravity is a measure devised by the American Petroleum Institute to indicate the density of oil and oil products. Internationally, the API gravity is one of the main standards to determine crude oil prices. Contrary to the general concept of density, a higher API number indicates a lower density.

2. Global Energy Consumption Pattern

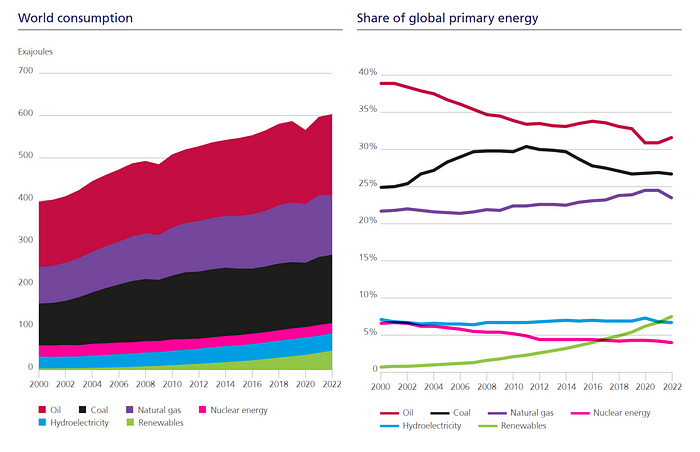

Global energy is mainly divided into fossil fuels (such as oil, natural gas, and coal) and renewable energy. According to the Statistical Review of World Energy, since 2000, the proportion of oil in the entire energy consumption structure has been declining, dropping from nearly 40% initially to over 30%. Renewable energy and natural gas are on the rise, in line with the global trend of energy structure adjustment.

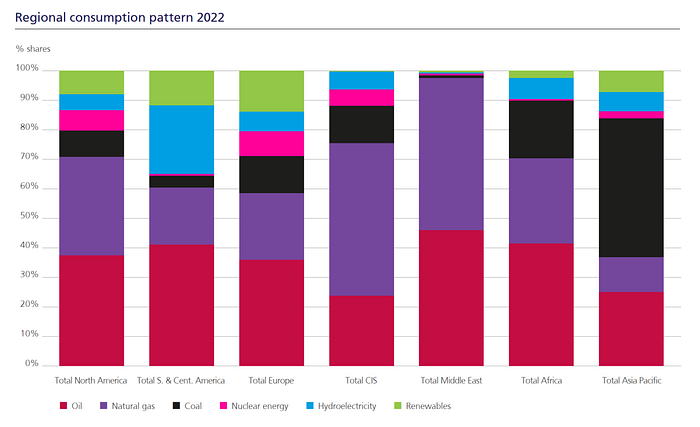

Regionally, the Middle East has the highest consumption of natural gas and oil, accounting for close to 100% of their energy consumption. In North America, natural gas and oil consumption make up about 70% of total energy consumption. In Europe, they account for approximately 60%. In the Asia-Pacific region, oil consumption represents about a quarter of the overall consumption, with the demand for coal being the highest at about 50% (indicated by the black portion), and natural gas consumption is relatively small.

3. Key International Crude Oil Pricing Indicators

The pricing of crude oil varies due to factors such as extraction costs and the quality of output. To facilitate trading, several benchmark prices have formed in the international crude oil market. Crude oil is typically measured in USD per barrel, where one barrel is equivalent to 42 gallons or approximately 159 liters.

Light low-sulfur crude oil traded on the New York Mercantile Exchange (NYMEX) is of high quality and is commonly referred to as “West Texas Intermediate (WTI)” or “Texas Light Sweet”. It serves as the benchmark price for crude oil in North America. Brent crude oil from the London International Petroleum Exchange, which is also a light crude, is of a slightly lower quality than WTI. Dubai crude oil, a light sour variety sourced from Dubai in the UAE, is not as widely utilized as the former two.

III. Oil Supply and Demand

1. Supply

(1) Proven Reserves

The global proven crude oil reserves have been increasing annually. By the end of 2022, they reached 1.74 trillion barrels, growing at an annual rate of 1%. Regionally, Middle Eastern countries account for the largest share with approximately 50%, totaling around 879.5 trillion barrels. Europe has the smallest share, roughly 1%, amounting to 135.6 billion barrels. OPEC holds over 70% of the world’s proven oil reserves, and its production and pricing strategies significantly influence global oil supply and prices. From a country perspective, Venezuela, Saudi Arabia, and Iran have the richest oil reserves with 303.3 billion barrels, 272.9 billion barrels, and 208.6 billion barrels, respectively.

Their respective shares in global crude oil reserves are 17.4%, 15.6%, and 11.9%.

(2) Reserve-to-Production Ratio (R/P Ratio)

The R/P ratio, calculated as reserves divided by production, indicates the number of years the proven reserves will last at the current production rate. Since both proven reserves and extraction rates change over time, the R/P ratio is not constant. In recent years, the global R/P ratio has stabilized around 50 years. In 2022, the global R/P ratio stood at 51 years. In regional terms, South and Central America have an R/P ratio of 110 years, North America 24 years, Europe 11 years, and OPEC has an R/P ratio of 100 years. By country, Iran has the highest R/P ratio at 160 years, followed by Kuwait, Iraq, and Canada with 160, 92, and 87 years respectively. The R/P ratios for China and the United States are 18 and 7 years, respectively.

The global oil storage-to-production ratio across different regions and specific nations.

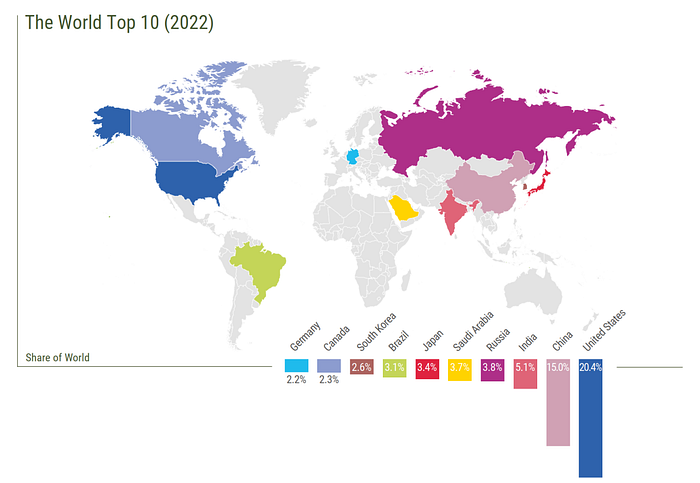

(3) Production

According to the World Energy Statistics Yearbook 2023, global oil production in 2022 was 93.85 million barrels/day, totaling 4.407 billion tons for the year. The top three producers were the United States with 17.77 million barrels/day (760 million tons annually), Saudi Arabia with 12.14 million barrels/day (573 million tons annually), and Russia with 11.20 million barrels/day (546 million tons annually). These three nations accounted for 42.68% of the world’s oil production in 2022. OPEC member countries contributed 36.4% to the global oil supply in 2022. Among European countries (excluding Russia), only Norway had significant production, producing 89 million tons in 2022, accounting for 2% of global production. China, with a daily production of 4.11 million barrels (204 million tons annually in 2022), was the world’s sixth-largest oil producer.

Note: The above data includes crude oil, shale oil, oil sands, condensates (gas condensates or those requiring further refining), and natural gas liquids (products separated from natural gas like ethane, liquefied petroleum gas, and naphtha).

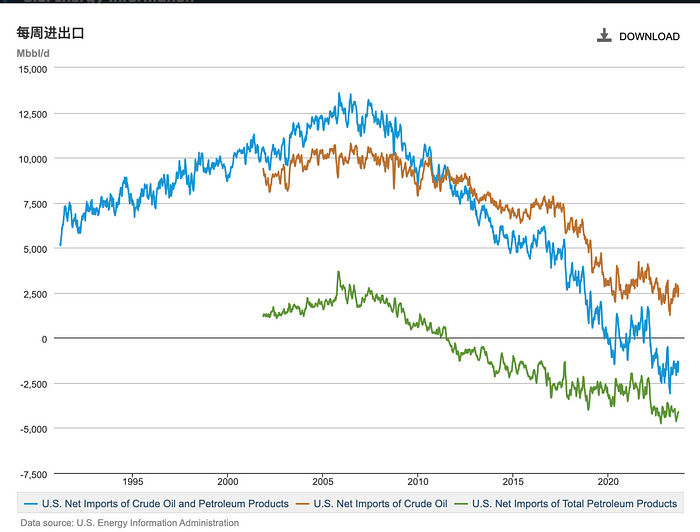

Through the shale revolution, the United States’ crude oil production surpassed that of Saudi Arabia and Russia since 2014, making it the world’s largest producer of crude oil. By 2018, the US transitioned from once being the world’s largest energy importer to becoming an energy exporter. According to EIA data, the US still remains a net importer of crude oil (represented in brown) and a net exporter of petroleum products (represented in green). Combining both (represented in blue), the US has maintained its status as a net exporter since 2022.

US historical crude oil production

EIA official definition: Petroleum products are derived from the processing of crude oil (including lease condensates), natural gas, and other hydrocarbons. Petroleum products include unfinished oils, liquefied petroleum gases, pentanes plus, aviation gasoline, motor gasoline, naphtha-type jet fuel, kerosene-type jet fuel, kerosene, distillate fuel oil, residual fuel oil, petrochemical feedstocks, special naphthas, lubricants, waxes, petroleum coke, asphalt, road oils, still gas, and other products.

(4) Refinery Capacity

Refineries produce products like diesel, gasoline, kerosene, lubricating oil, petroleum coke, asphalt, and ethylene through processes like distillation, catalysis, cracking, pyrolysis, and hydrofining. The Nelson Complexity Index (NCI) is a vital measure in the petrochemical industry to gauge the complexity of refining units. A higher NCI indicates stronger competitive capacity for the refinery. In 2022, the NCI for North America was at its highest at 11.7, with Africa at its lowest at 6.3, Europe at 9.4, and Asia at 8.2. Refineries in North America, especially those along the Gulf Coast of the United States, generally have a higher NCI, with a median value of about 10, making them the most complex refining centers in the world.

In terms of numbers, global capacity reaches 100 million barrels/day. US refineries boast the highest capacity at 18.06 million barrels/day, accounting for 18% of global capacity. Following the US is China, with a capacity of 17.26 million barrels/day. Despite being the world’s second-largest crude oil producer, Saudi Arabia’s refinery capacity is only 3.312 million barrels/day.

(5) Oil Production Costs in Different Countries:

The cost of crude oil production varies significantly across regions. Aside from production costs, there are transportation costs, taxes, and other expenses. As seen in the table below, when calculating per barrel, Iran and Iraq have the lowest oil production costs at less than $3/barrel. However, considering overall expenses, Saudi Arabia is the most cost-effective, with costs of only $3 per barrel.

Oil production costs by country (data from 2016)

Although Middle Eastern countries have relatively low total oil costs, their governments lack other financial income sources. Therefore, the fiscal breakeven oil price needs to be considered. This price is the crude oil price at which oil-dependent countries, which rely heavily on oil revenues, can achieve a balanced budget. If the international oil price exceeds the fiscal breakeven oil price, the government of that country may have a fiscal surplus. Conversely, if it falls below, the government may run a deficit.

IMF estimates of fiscal breakeven oil prices for Gulf countries.

2. Demand

Oil has a relatively inelastic demand. The global growth in oil consumption correlates positively with economic growth. To a certain extent, one can predict the growth in crude oil demand by looking at the GDP growth rate of consumer countries. Different countries and regions have varying rates of crude oil consumption growth. Developing countries have a higher oil consumption level per economic activity. According to a study by Harvard University, for every $1000 increase in global GDP, approximately 0.4 barrels of oil are consumed (referred to as ‘oil intensity’). This figure was as high as 1 barrel per $1000 in the 1970s. The dependency of GDP on oil has been decreasing over time, but oil remains a crucial backbone for economic development.

Oil Intensity: The curious relationship between oil and GDP

According to the ‘World Energy Statistics Yearbook 2023’, global oil consumption in 2022 stood at 97.309 million barrels per day. The top three consumers were the United States with 19.14 million barrels/day, Mainland China with 14.295 million barrels/day, and India with 5.185 million barrels/day. These three countries accounted for 35.8% of the world’s oil consumption in 2022. Europe’s consumption was 14.06 million barrels/day, close to China’s level.

3. Inventory

The difference between supply and demand results in inventories. Inventory levels are crucial for discovering crude oil prices. Theoretically, both crude and refined oil inventories negatively correlate with crude oil prices. Oil inventories are divided into strategic reserves and commercial inventories. Strategic oil reserves are directly controlled by national governments, while commercial oil inventories are stored by oil field companies, import and export traders, refining companies, and consumers to ensure regular production.

OECD Strategic Reserves

OECD Commercial Stocks

Historical Data on U.S. Commercial Inventory and Strategic Reserves

The Organization for Economic Co-operation and Development (OECD) is an intergovernmental international economic organization composed of 38 market economy countries. Its aim is to jointly address challenges brought about by globalization in terms of economics, society, and governance, and to seize the opportunities offered by globalization. Founded in 1961, the OECD has 38 member countries and is headquartered in Paris, France. The 20 founding member countries in 1961 are: the United States, the United Kingdom, France, Germany, Italy, Canada, Ireland, the Netherlands, Belgium, Luxembourg, Austria, Switzerland, Norway, Iceland, Denmark, Sweden, Spain, Portugal, Greece, and Turkey. The 18 countries that joined later are (with the year of accession in brackets): Japan (1964), Finland (1969), Australia (1971), New Zealand (1973), Mexico (1994), the Czech Republic (1995), Hungary (1996), Poland (1996), South Korea (1996), Slovakia (2000), Chile (2010), Slovenia (2010), Estonia (2010), Israel (2010), Latvia (2016), Lithuania (2018), Colombia (2020), and Costa Rica (2021).

Since 2020, the total U.S. oil inventory (depicted in blue) has been steadily decreasing, primarily due to a reduction in strategic reserves. In the short term, the total U.S. inventory and commercial inventory rose to 850 million barrels and 480 million barrels at the beginning of this year, respectively. However, since March of this year, they have been consistently diminishing, with the total and commercial inventories dropping to 770 million and 420 million barrels, respectively, marking the lowest levels of the year.

The U.S. established the Strategic Petroleum Reserve (SPR) in the 1970s following the oil embargo by Arab nations. After 2015, the U.S. Congress passed several laws mandating the sale of the SPR, reducing its size, with the sales revenue recorded as the fiscal income for that year, used for Congress-specified fiscal expenditures. From 2021, the U.S. oil strategic inventory has been continuously declining, with the current stock standing at 350 million barrels, the lowest in nearly 40 years. To provide context, the average daily crude oil consumption in the U.S. in 2022 was 19.14 million barrels, meaning the 350 million barrel reserve equates to about 18 days of crude oil consumption.

On March 1, 2022, in response to the significant increase in international oil prices following the outbreak of war between Russia and Ukraine, the International Energy Agency announced that 31 member countries would collectively release 60 million barrels of oil reserves to the market. Of this, the U.S. released 30 million barrels, accounting for 50% of the total IEA member nation releases. On March 31, 2022, President Biden announced the daily release of 1 million barrels from the strategic reserves over the next six months. In 2022, the U.S. released a total of 218 million barrels, the largest ever release, leading to a significant reduction in the strategic reserves.

On February 13, 2023, the U.S. Strategic Petroleum Reserve tendered 26 million barrels of strategic crude oil, and contracts were awarded on March 9. Sources indicated that the Biden administration tried to stop the sale but ultimately failed.

On May 15, 2023, the U.S. Congress agreed to the Biden administration’s proposal to cancel the legal sale of 140 million barrels of strategic oil reserves for fiscal years 2024–2027. The ongoing release of the U.S. strategic oil stockpile could threaten the country’s energy security. Hence, the U.S. government is currently focused on replenishing reserves, with three bidding procurement activities undertaken this year. The first and second bids were launched in May and June, respectively, purchasing 3 million and 3.2 million barrels of crude oil at average prices of $73 and $71.98 per barrel, respectively. In July 2023, the U.S. Department of Energy’s Office of Petroleum Reserves announced a third bid to purchase approximately 6 million barrels of crude oil for the SPR, expected to be delivered between October and November. However, due to high oil prices, this procurement plan was retracted. The intake arrangements of the U.S. strategic reserves are a significant factor influencing crude oil prices.

4. Trade Flows

Mismatch between crude oil production and consumption forms the direction of oil trade. The chart below shows significant variations in production/consumption ratios worldwide, with the Middle East standing at 3.33 and the Asia-Pacific region at just 0.2.

Currently, the main crude oil exporting regions are the Middle East, the CIS, the U.S., Canada, and Africa, while the primary importing regions are Europe, the U.S., the Asia-Pacific region, and India. The U.S. both imports and exports crude oil due to differences in oil quality. Different densities of crude oil require different refining equipment and processes. Heavy oil requires additional refining techniques like cracking or coking, demanding higher investments, and hence its price is usually lower than light oil. The U.S. refineries generally have a higher Nelson Complexity Index, suited for processing heavy crude oil. To maximize profits, refineries require crude oil types that match their processing capabilities. Therefore, the U.S. tends to import heavier grades of crude oil while exporting light oil.

The Commonwealth of Independent States, abbreviated as “CIS”, is a regional organization formed by several former Soviet republics during the dissolution of the Soviet Union. It currently has 9 members, namely Azerbaijan, Armenia, Belarus, Kyrgyzstan, Moldova, Kazakhstan, Russia, Uzbekistan, and Tajikistan.

In 2022, the total international crude oil trade volume was 21.29 billion barrels. Currently, China is the world’s largest crude oil importer, accounting for 23.9% of global crude oil imports and is the second-largest oil consumer after the U.S. In 2022, China imported a total of 5.08 billion barrels, primarily from Russia and the Middle East. Saudi Arabia, with the highest crude oil export volume, exported 3.65 billion barrels, primarily to the Asia-Pacific region.

IV. Crude Oil and the US Dollar Index

Generally, a sustained rise in the US dollar has a bearish effect on commodities priced in dollars. International crude oil trade is usually priced in dollars. When the dollar appreciates, the amount of local currency needed by countries to buy crude oil increases relatively, leading to higher purchase costs and exerting downward pressure on oil prices. Conversely, when the dollar depreciates, the amount of local currency needed to buy oil decreases, reducing purchase costs and putting upward pressure on oil prices. An increase in oil demand might strengthen the dollar. As oil trade is dollar-denominated, when global economic growth leads to increased oil demand, the supply of dollars needed to buy oil will also increase, generating demand for the dollar and bolstering its strength. From an international trade perspective, the US is currently a net exporter of oil products. Rising oil prices can reduce the US trade deficit, and the offshore dollar becomes stronger.

However, historical data shows that the two haven’t maintained a long-term inverse relationship, and phases where the negative correlation was apparent weren’t solely driven by the mutual relationship between the dollar and oil. Crude oil prices are influenced by complex factors such as supply-demand dynamics, major power plays, geopolitics, and macroeconomics. The dollar exchange rate is just one aspect affecting oil prices.

Historical correlation between crude oil prices and the US Dollar Index.

Since July of this year, both the dollar and crude oil have risen, reflecting disturbances primarily from the supply side rather than the demand side.

V. Crude Oil and Inflation

Rising inflation expectations might push crude oil prices up. When inflation expectations rise, the anticipated purchasing power of currency drops. Investors might shift funds from currency to physical assets, such as crude oil, gold, and other commodities, leading to increased demand for oil and rising oil prices. Crude oil is a crucial production input; businesses and consumers might anticipate future cost increases, thereby purchasing and stockpiling raw materials like oil in advance to hedge against future price hikes. Rising oil prices intensify inflationary pressures. On one hand, since oil has a significant weight in the CPI, its price hike directly affects a basket of goods, resulting in increased costs for oil and related petrochemical products. On the other hand, through the industrial chain, increased costs in diesel, kerosene, and fuel oil would raise prices in metals, plastics, and so on, leading to an overall increase in everything from industrial production labor costs to consumer service prices.

The US CPI reflects changes in the price levels of goods and services related to residents’ lives, calculated by weighted average of various items. According to the weighting rules published by the US Department of Labor in 2023, housing prices have the highest share at around 34%; food and beverages, and transportation prices follow, both at about 13%; medical prices account for 8.1%, and energy prices 6.9%. Jerome Powell, Chairman of the Federal Reserve, stated in his semiannual testimony to the US Senate Banking Committee in March 2022 that a rough rule of thumb is that for every $10 increase in the price per barrel of oil, inflation rises by 0.2%, and economic growth takes a 0.1% hit.

Data indicates a strong correlation between spot oil prices and long-term inflation expectation market indicators.

In August, the U.S. Consumer Price Index (CPI) rebounded to an annual increase of 3.7% from 3.2% in July, exceeding the expected 3.6%. The core CPI year-over-year growth rate dropped from 4.7% to 4.3%. On a month-to-month basis, the rise expanded slightly from 0.2% in the previous month to 0.3%, surpassing the expected 0.2%. A surge in oil prices was the primary driver behind August’s CPI growth, accounting for more than half of the increase. As oil prices continue to approach $100 per barrel, the Federal Reserve may maintain higher interest rates for a longer duration to control inflation.

Rising crude oil prices can have both economic and political implications. U.S. gasoline retail prices quickly surged towards $4 due to the rising crude oil prices. Data from the American Automobile Association (AAA) indicates that the average price of regular gasoline at U.S. gas stations is $3.88 per gallon, with overall oil prices at a relatively high historical level. A past survey in the U.S. labeled a gasoline retail price of $4 as an “unacceptably high” price for consumers. Historically, for every $10 change per barrel in crude oil prices, gasoline prices fluctuate between 25–30 cents. If Brent oil prices reach $100, U.S. gasoline prices could very likely hit the $4 mark. With the U.S. elections coming next year, this could become a political issue.

VI. Crude Oil Market Overview This Year

1. Crude Oil Price Trends

(1) U.S. Bankruptcy Wave in March

On March 8, Silvergate Bank declared bankruptcy. On March 10, Silicon Valley Bank filed for bankruptcy. By March 13, Signature Bank shut down. Coupled with the crisis at Credit Suisse in Europe, international oil prices plummeted, driven by fears of a global macroeconomic downturn. Brent crude oil prices dropped by about $10 per barrel, a decline of over 10%.

(2) OPEC+ Announces Production Cuts in April

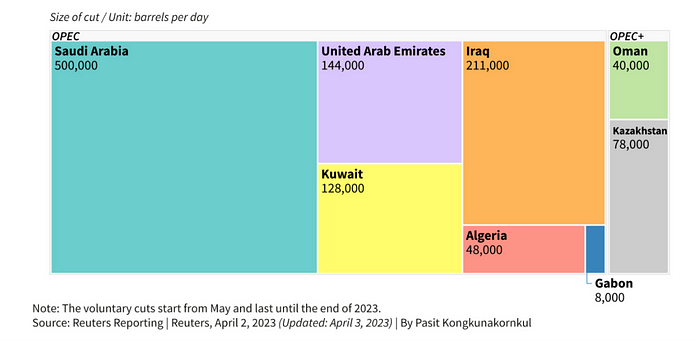

To stabilize oil prices, OPEC+ unexpectedly announced a production cut during their April 2023 meeting, reducing output by approximately 1.16 million barrels per day.

- — Saudi Arabia will voluntarily reduce production by 500,000 barrels/day from May until the end of 2023.

- 1. — Iraq will voluntarily cut its oil output by 211,000 barrels/day from May to the end of 2023.

- 2. — The UAE will voluntarily reduce its oil production by 144,000 barrels/day from May to the end of 2023.

- 3. — Kuwait will voluntarily cut 128,000 barrels/day of its oil production from May until the end of 2023.

- 4. — Kazakhstan will contribute a reduction of 78,000 barrels/day for OPEC+.

- 5. — Algeria will cut 48,000 barrels/day of its oil production voluntarily from May to the end of 2023.

- 6. — Oman’s Ministry of Energy and Minerals has announced it will voluntarily reduce its oil production by 40,000 barrels/day from May until the end of 2023.

- 7. — Russia will voluntarily reduce its oil output by 500,000 barrels/day until the end of 2023. Previously, in February, Russia announced a reduction of 500,000 barrels/day for March, which was later extended to June.

- After reaching a low point, oil prices rebounded in mid-April, with Brent crude returning to its pre-crisis price level.

(3 Impact of the May Debt Crisis

At the beginning of May, the banking crisis in the US and Europe, coupled with the heightened risk of US debt default, caused a significant drop in crude oil prices. Following this, crude oil prices oscillated within a range for a month and a half.

(4) Additional Reductions by Saudi Arabia in June

On June 5th, Saudi Arabia announced a voluntary reduction of 1 million barrels/day starting from July, increasing the voluntary cut from 500,000 barrels/day to 1.5 million barrels/day for a month, which exceeded market expectations.

On July 5th, Saudi Arabia declared an extension of its plan to reduce daily oil production by 1 million barrels for another month, indicating the potential for this reduction to last beyond August. Russia stated it would reduce its daily oil exports by 500,000 barrels in August.

On August 3rd, Saudi Arabia and Russia announced an extension of their supply cuts at least until September. Saudi Arabia will continue its voluntary reduction of 1 million barrels per day, maintaining a daily output of 9 million barrels. Russia revealed plans to decrease daily oil exports by 300,000 barrels in September. Furthermore, as the U.S. reached the peak of its summer travel season, and with a seasonal increase in demand, the global oil market inventory began to decrease, leading to a rise in oil prices in July and August.

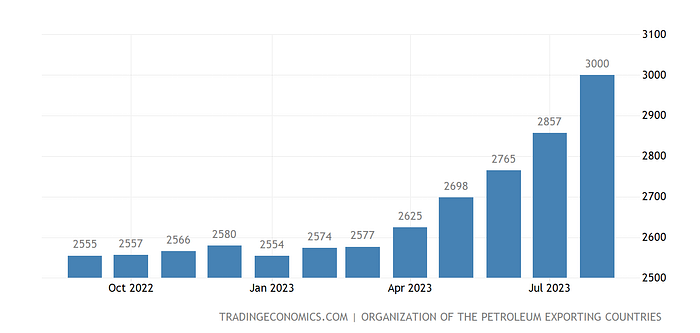

Chart: Crude oil production in Saudi Arabia over the past year (Unit: BBL/D/1K)

(5) Saudi Arabia and Russia Extend Reduction Plan to Year-End in September

On September 5th, Saudi Arabia extended its voluntary additional cut of 1 million barrels/day by three months to the fourth quarter of 2023. Simultaneously, Russia decided to prolong its September export reduction of 300,000 barrels/day to year-end, intensifying concerns about oil shortages and pushing oil prices further upwards.

2. Crude Oil Supply and Demand Situation

Iran Continues to Increase Crude Oil Production

Contrary to the reductions by Saudi Arabia and Russia, Iran’s crude oil production has steadily increased this year. As of August, the production stood at about 3 million barrels/day, an increase of nearly 500,000 barrels/day from the starting level of 2.5 million barrels/day this year. In early August, Iran announced plans to further boost its output to 3.5 million barrels/day in September. If achieved, this could offset the significant daily reduction by Saudi Arabia.

Chart: Iran’s crude oil supply has been steadily increasing this year.

Recently, there have been signs of easing in the long-standing U.S. sanctions against Iran. On August 10th, the U.S. and Iran reached a “prisoner swap agreement”. On September 18th, an Iranian Foreign Ministry spokesperson revealed that five Iranian citizens imprisoned in the U.S. and five U.S. prisoners in Iran would be released. Additionally, $6 billion of Iranian funds previously frozen in two South Korean banks were unfrozen and transferred to bank accounts in Qatar. The easing of U.S.-Iran relations might be linked to Iran’s recent consistent increase in oil production, suggesting the U.S. government might choose to foster closer ties with Iran to encourage its production.

Recent Increase in U.S. Crude Oil Production

As of the week ending September 15th, U.S. crude oil production stood at 12.9 million barrels/day, remaining stable from the previous week and increasing by 700,000 barrels/day since the end of July. U.S. crude oil imports amounted to 6.517 million barrels/day, a decrease of 1.07 million barrels from the prior week. U.S. crude oil exports reached 5.067 million barrels/day, an increase of 1.98 million barrels over the previous week. U.S. crude oil processing was at 16.304 million barrels/day, down by 500,000 barrels from the last week, with refinery utilization rates at 91.9%, a drop of 1.8 percentage points from the prior week.

Effective Implementation of OPEC+ Production Cuts

Throughout the third quarter, OPEC+ has effectively implemented supply adjustments in the trade market. In August 2023, the total crude oil production of OPEC+ member countries under the reduction agreement was 35.99 million barrels/day, lower than the production quota of 39.57 million barrels/day.

China’s Crude Oil Imports Reach Historic High in the First Half of the Year

Due to the expansion of Chinese refineries and the government’s measures to reopen the economy after relaxing COVID-19 mobility restrictions, China’s crude oil imports reached a historic high in the first half of 2023. In the first six months of 2023, China imported an average of 11.4 million barrels of crude oil per day, a 12% increase from the daily average of 10.2 million barrels in 2022. In the first half of 2023, most of China’s additional crude oil imports came from Russia, Iran, Brazil, and the United States.

Overall Supply and Demand Situation

In August 2023, the global crude oil supply was 100.79 million barrels per day, while the global demand was 101.37 million barrels per day, resulting in a supply-demand dynamic where supply was less than demand.

VII. Section VII. Outlook on Crude Oil Market by Three Major Agencies

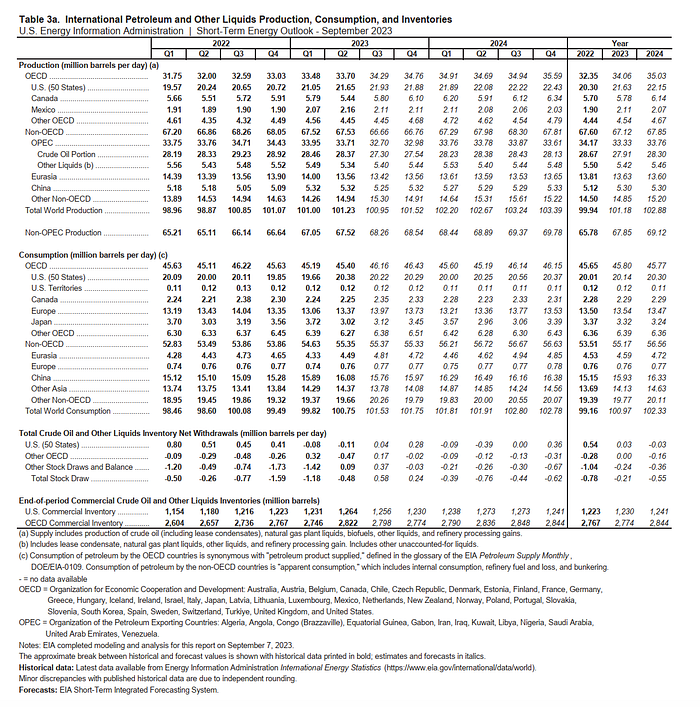

U.S. Energy Information Administration (EIA)

On the supply side, despite voluntary production cuts by OPEC+, non-OPEC oil production increases will support an increase of 1.24 million barrels per day in 2023, reaching a total of 101.18 million barrels per day. U.S. crude oil production for 2023 is projected to be 12.78 million barrels per day, an increase of 870,000 barrels daily from the previous year. Meanwhile, OPEC’s crude oil production is 27.91 million barrels per day, down 760,000 barrels per day from the previous year.

In terms of demand, the global oil consumption in 2023 is expected to grow by 1.81 million barrels per day from the previous year to a total of 100.98 million barrels per day. Of this increase, China’s demand will account for an additional 780,000 barrels per day, which is 43% of the overall growth.

Regarding inventories, global oil stockpiles are expected to decrease by 600,000 barrels per day in the third quarter of this year, and this figure is projected to drop to 200,000 barrels per day in the fourth quarter. Over the next few months, global oil inventories will exert upward pressure on oil prices. The spot price of Brent crude oil is projected to be $93 per barrel in the fourth quarter of 2023, up from $86 per barrel in August, with an average price of $88 per barrel in 2024.

Organization of the Petroleum Exporting Countries (OPEC)

OPEC’s monthly oil market report indicates that in terms of demand, global oil demand in 2023 will increase by 2.44 million barrels per day, with an average demand reaching 102 million barrels per day, a growth of 2.45% from 2022. The forecast remains consistent with last month’s projection. China is expected to see the highest growth, with its demand projected to increase by 6.51% in 2023.

On the supply side, even though Saudi Arabia voluntarily cut production, mainly due to increased production from Iran and Nigeria, in August, the 13 OPEC member countries produced an average of 27.45 million barrels of crude oil daily, an increase of 113,000 barrels per day from the previous quarter.

Forecast for 2023: The non-OPEC liquid petroleum output is expected to see a year-on-year increase of 1.58 million barrels per day in 2023. This growth is primarily attributed to countries like the United States, Brazil, Norway, and China, marking a year-on-year increase of 2.4%. On the whole, the predicted average demand for OPEC crude oil in 2023 stands at 29.23 million barrels per day. The OPEC crude oil production was 28.85 and 28.28 million barrels per day in the 1st and 2nd quarters of this year, respectively, indicating a potential supply shortfall. According to Bloomberg’s calculations, if OPEC maintains its production for the rest of the year, it is estimated that 30.70 million barrels will be needed daily in the fourth quarter to meet the demand. This could result in the largest inventory decline since 2007.

International Energy Agency (IEA)

The IEA’s September “Oil Market Report” forecasts that, driven by the recovery of consumption in China, aviation fuel, and petrochemical raw materials, global oil demand will increase by 2.20 million barrels per day in 2023, reaching a total of 101.80 million barrels per day. As of August this year, the OPEC+ production has decreased by 200,000 barrels per day. However, the overall loss has been mitigated due to a significant increase in Iranian output, while the non-OPEC+ supply has risen by 1.90 million barrels per day, setting a record at 50.50 million barrels per day. The global supply in 2023 will grow by 1.50 million barrels per day, with the main contributors being the U.S., Iran, and Brazil. In August, global oil inventories sharply declined by 76.30 million barrels, reaching a 13-month low. Non-OECD countries saw their oil stocks drop by 20.80 million barrels, with China experiencing the largest fall, while OECD countries saw a reduction of 3.20 million barrels.

VIII. Conclusion

Production dynamics and expectations among countries are major influencing factors for oil prices. Current crude oil prices are still supported by supply-side cuts, but the waxing and waning within OPEC means that the actual reduction results fluctuate quite a bit. Overall, the sentiment is more influenced by the tight supply situation. On the demand side, China’s crude oil demand remains robust, and the U.S. may need to restock in the foreseeable future. The oil supply-demand imbalance is expected to continue throughout the year, but the gap may narrow in the fourth quarter compared to the third quarter. Considering the impact on the U.S. CPI and the execution of government monetary policy, oil prices are expected to maintain a volatile but strong trend. However, Brent crude at $100 per barrel presents a significant resistance level, limiting the overall upward space. It is anticipated that the Brent crude oil price will hover around $90 per barrel in the fourth quarter of this year.

Original Link