The content of this article is provided by Sally Gu (researcher @OKX Ventures)

Primer

The impact of COVID, coupled with the Fed’s successive interest rate cuts after Powell took over Yellen, has made the market reach the largest bubble stage in financial assets since World War II, in the context of high inflation and low real interest rates over the past few years. Meanwhile, the Sino-US trade war, the Russia-Ukraine standoff, and the rise of populist forces in Europe have fundamentally begun to unravel the foundations of globalization over the past 40 years.

Gone are the financial wealth effects created by easy liquidity and high leverages since 2018. Under the trend of inflation at the bottom of social wages and deflation at the top, the excess income generated by valuation inflation due to the downward interest rate in the past seems to be irretrievably moving towards Mean Reversion.

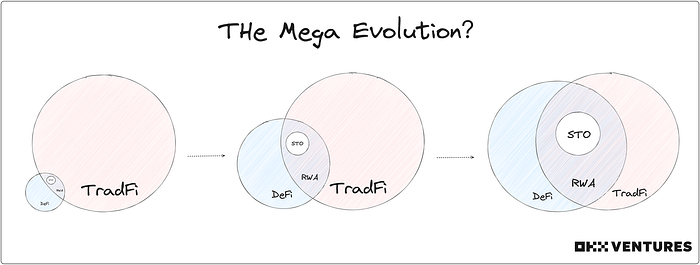

Therefore, after the interest rate hike cycle is prolonged, the long and short ends of the US debt maintain a deep inversion of over 50BP, and the pure virtual financial narratives such as Metaverse PFP NFT are declining due to the inability of endogenous value to support their traction. The DeFi or crypto economy’s re-embracing of TradFi and real assets, from virtual to real, may be homeopathy in this recession and deleveraging cycle.

To further explore the integration and evolution trend of DeFi and TradFi, we’ve made a simple analysis of the Real World Asset (RWA) direction that’s currently attracting more and more attention.

TL; DR

- Logic:

- TradFi-wise: Reduce trading cost, improve trading transparency and capital flow efficiency; improve financial primitive composability and provide more hedging tools; revitalize funds for potential speculators and institutions.

- DeFi-wise: Support and amplify the DeFi speculative loop; introduce massive liquidity and expand the scale of DeFi users; the stablecoin market has been demonstrated.

- Momentum: Macrocycle drives funds back to the USDⓈ standard; the interests of old money and traditional institutions in crypto are increasing; the crypto market needs fresh users.

- Handicap: Uncertain regulatory climates, limited traction, limited high-quality underlying assets.

- Evaluation dimensions: Product fundamentals, risk control capabilities, protocol mechanisms, partnerships.

- Classification:

- By asset form: Standardized, non-standardized.

- By asset class: Fiat, fixed income (bonds, credit), equity, alternative (real estate, collectibles, commodities).

- 46 projects mentioned: Centrifuge, ONDO, Maple, OpenEden, BondbloX, FortunaFi, CredeFi, Goldfinch, TrueFi, Defactor, Credix, Clearpool, Bru Finance, Resource Finance, Backed Finance, Sologenic, Swam, AcquireFi, Horizon Protocol, Hamilton Lane, ResalT, Parcl, LABS Group, Propy, Atlant, ELYSIA, Tangible, Blocksquare, Milo, Figure, LandShare Lingo, HOME Coin, Theopetra, EktaChain, Robinland, Homebase, 4K, Arkive, Mattereum, Codex Protocol, PAX Gold, Tether Gold, Cache Gold, Agrotoken The LandX

- Views:

- At present, most RWA products are difficult to find PMF: In the short term, it is more like narrative FOMO, not really groundbreaking innovation or strong growth momentum; pay close attention to the dynamics of the U.S., Hong Kong, and Singapore compliance policy, to control policy risks to the minimum.

- Alternative assets and non-standard RWA protocols are emerging: Non-standard assets can be written into ERC-721/1155 and ERC-20 may not become mainstream in the future; Invoice/Notes NFT, REITs NFT, and collectibles NFT all have wide imagination space.

- Treasury RWAs will remain mainstream, equity RWAs gain more attention: U.S. Treasury bonds have been recognized by the crypto community; the demand for yield enhancement products like equity RWA stands solidly, but it faces multiple impediments to compliance.

- The recognition of DeFi DAO matters, and cooperation with crypto-native communities is more difficult to achieve: The challenge for fixed income RWAs is to bridge the loan side; DeFi DAO members’ perception of off-chain assets is highly divergent, and excessively complex off-chain assets are difficult for community to understand.

- Points for discussion and further research: On-chain ponzi gameplays such as RWA Fi, RWA option trading, etc.; middlewares for on-chain verification, SaaS companies, compliant issuers, intermediaries that collate lending and borrowing; fragmentation and coexistence of RWA DeFi and native DeFi.

Concepts

- RWA — Real World Assets tokenization

- STO — Securities Token Offering, namely corporate bond financing

Differences: RWA asset classes are more diverse, spanning across primary and secondary, and the yield gradient can be built to be more extended

Market data

- Latest data shows that RWA has climbed to the top 10 in the DeFi category TVL ranking, with a 257% increase during the year

- Since January 2023, the market value and daily publishing volume of the overall national debt RWA Token have risen steadily. By July 2023, the total market value of the leading seven projects had reached nearly $300 million.

- The total value of U.S. Treasury RWA tokens has exceeded $600 million. In addition, the number of holders of RWA tokens has jumped from 28,000 to 40,000, an increase of nearly 43%. Among them, nearly 20,000 users have held them for more than 12 months.

- The private credit RWA agreement currently has about 1,553 loans, with a total active loan amount of $500 million and a total TVL of around $4 billion, which still shows large room for growth compared to the total loans of $1500 million at the peak in 2022.

- Statistics released by MakerDAO in June 2023 indicate that RWAs make up the vast majority of its stability fees. In May 2023, RWAs made up 79.7% of all stability fees. Also in May 2023, RWAs made up 79.7% of all stability fees created by the protocol, up 7% MoM from April 2023.

Logic

- TradFi-wise

- Reduce transaction costs and intermediate processes, improve the transparency of transaction and the efficiency of capital circulation

- Illiquid assets such as real estate and art can be tokenized to decentralize ownership and enable rapid secondary market turnover, trading, collateralization, and financing

- Heavy investments such as infrastructure, railways, and electrical works can directly issue tokens for quick cost recovery, and SMEs can achieve global crowd funding through tokens

- On-chain alternative assets and synthetics improve the composability of financial primitives and provide more available hedging weapons

- Derive a variety of portfolio paradigms, vertically elongate the asset class spectrum, diversify the portfolio risk exposures

- Within a single hybrid fund or structured product, on-chain assets can act as hedges against fluctuations in traditional assets and jurisdictional currencies

- Revitalize the restricted funds of potential foreign speculators and institutions

- Inclusive financing narrative. Larger TAM means higher margins for growth capture.

- The funds escaping from banks are actually flowing back into TradFi in another form.

- Further activates global liquidity for the benefit of some local institutional investors. The potential outcome is to rapidly exacerbate regional problems of wealth disparity and liquidity imbalance, leading to more brutal social divisions.

- DeFi-wise

- Support and amplify DeFi speculation loops

- DeFi creates a speculative market of tokens, whose value capture stems primarily from the protocol’s capacity to generate income from speculative activities

- RWA can shorten the token speculation loop, and the underlying assets are backed by liquidity, debt, collateral, etc. for swaps, namely bringing up an underlying layer backed by traditional assets under DeFi

- Introduce huge liquidity and expand the DeFi user base

- Simply put, the rules of TradFi are more acceptable and understandable to mainstream audiences, which helps lower the learning and entry barriers of DeFi to a certain extent

- The volume and intensity of institutional funds, the scope of the audience and its affordable risk exposure, sales channels, the market participants proportion, and the professionalization degree — TradFi outperforms DeFi in these respects

- BCG and ADDX Research believes that the tokenization market will reach $16 trillion by 2030 (including a $3 trillion real estate market, $4 trillion listed/unlisted assets, $1 trillion bond and fund market, $3 trillion alternative asset market, and $5 trillion ‘other’ tokenized markets).

- According to the conservative estimates of Citi, the combined scale of digital securities and blockchain trade finance can reach $5 to 6 trillion by 2030.

- The stablecoin market has been verified

- USDC and USDT are also RWA with fiat currency as the underlying asset.

- Stablecoin market cap peak reaches $180 billion in 2022

Momentum

- Macrocycle drives funds back to the USDⓈ standard

- Tightened regulation and improved compliance laws

- The return of traditional USD-standard funds has increased, and the continuous interest rate hike has lifted the interest rate of short-term government bonds to 4% (the latest two-year bond reported 4.64%, narrowing slightly but remaining high)

- Most of the free money was risk averse affected by the Silicon Valley Bank incident after March 2023, and still mainly accumulated in stable assets such as U.S. bonds

- Growing Interests from old money and traditional institutions

- The push of the Bitcoin ETF offering shows that alpha opportunity in the traditional market is also fading, with the mainstream being sustained by beta passive returns (not pursuing market outperformance, but only average market returns)

- TradFi’s own development is facing bottlenecks and seeking industry revolution. See its past paradigm shift, for example internet and finance, financial AI, the Aladdin Fintech case, and more

- Old money believes that crypto-native lacks a complete understanding of TradFi and can’t penetrate the depth of the market. The RWA sector is more suitable for traditional players to explore and layout.

- Crypto market needs fresh users

- Successive bankruptcy events (LUNA, FTX, etc.) seriously eroded market confidence

- On-chain liquidity dried up, with NFTs falling off a cliff

- Inverse primary and secondary market valuations for crypto infrastructure and tedious protocol Lego innovation

Handicap

- Uncertain regulation climate

- Taxation, asset definition, license establishment, recovery process and other aspects all depend on the local financial policy climate

- The regulation of digital assets in different jurisdictions around the world is fragmented, and a unified classification standard does not yet exist

- The attitude of the central bank, local banks, and security regulators basically determines the life of the protocol, and so, the probability of collapse remains high

- Limited traction

- Contrary to crypto-native beliefs, it’s hard to find product-market fit

- Early crypto-native users are extremely resistant to centralized supervision and the banking system, seeking the development of an independent on-chain DeFi ecosystem

- Most DeFi participants are averse to know your customer (KYC) / anti-money laundering (AML) (though zero-knowledge proof schemes can provide privacy protection), preferring completely permissionless interaction

- DeFi users with a high risk appetite won’t be satisfied with RWA APY. Even if we talk about equity RWA, the yield rate may not be as good as they earned from the uniswap pool (especially now version four has introduced hooks to further liberate interoperability and flexibility)

- The low risk preference DeFi user base is relatively small and they can directly stake blue-chip tokens or buy ETFs to make passive earnings

- Traditional institutions are not rushing in, still weighing

- On-chain liquidity is still small compared to TradFi, and the current market depth is not enough to create a huge wealth effect. It is only possible that the hot money of off-chain TradFi players feeds back on the chain, not the other way around.

- On the basis of this logic, it is unknown how much effort traditional institutions are willing to spend on an uncertain alpha arbitrage chance, and how much percentage to draw on the balance sheet to explore. At present, it’s impossible to draw more than 0.01% on the table in the short term, which is insignificant compared to other businesses.

- After communicating with the person in charge of the traditional secondary fund, most of them said they would not consider on-chain assets or synthetic assets in the short term. First, there are sufficient substitutes and hedging methods in the traditional stock market; second, subject to the background attributes and risk preferences of LP, they’re not likely to allocate too many crypto assets to interfere with its original investment system.

- Limited high-quality underlying assets

- U.S. bonds and other high-quality underlying asset classes are limited. Niche assets such as New Zealand stocks are not liquid enough and the settlement method is not T + 0. Other small-cap stocks and penny stocks are similar to altcoins and have limited connection with the macro economy. It’s difficult to formulate speculative strategies, and so it is unnecessary and unlikely to be tokenized.

- Tokenization of similar underlying assets means that the barriers to competition in the protocol will not be fierce, and prone to homogenization

- The direction in the long run will inevitably move towards the Matthew Effect, just like liquid staking derivatives

Evaluation dimension

-

Product fundamentals

- The range of RWA products and rates of return provided are differentiated and competitive in the market, alongside the scope of service operations. This raises the questions: what assets are being made now? Where are such services provided? Are you qualified to provide this service for a long time?

- Total addressable market (TAM) stickiness, user retention, asset pool depth and liquidity, and fund discount rate

- Protocol revenue and net profit, token value and velocity

2. Risk control capability

- Team: Do they have experience in traditional investment banks, commercial banks, and securities companies? Do they maintain a good relationship with the local legal system? Do they have any illegal records or unsavory reputation in crypto communities?

- Compliance: Is the company subject to local securities laws and regulations (local policy environment and tolerance for crypto? Does the regulatory document clearly define asset attributes or disable such assets?), KYC/AML, default settlement, compliance costs, credit assessment.

3. Protocol mechanism

- The tokens mapped by real assets need to interact with multiple blockchain ecosystem backends, and building architectures on various chains requires good interoperability

- Whether the on-chain method is decentralized, what trust minimization mechanism is followed? Whether off-chain cash flow and related loans information are regularly disclosed, which oracle network data processing mechanism is adopted? And, how do they select nodes?

- Whether the security mechanism of the protocol can effectively prevent information leakage of interactive account addresses, oracle manipulation, hacker attacks, and more

4. Partnership

- Whether to establish cooperation with mainstream DeFi/crypto communities such as MakerDAO and Aave, or have stable on-chain loan backers

- Whether to choose an experienced and trustful third-party on-chain asset custodian (e.g.: off-chain collateral controlled by simplified payment verification at disposal)

- Whether it has long-term collaboration with TradFi agents such as banks, trusts, etc. with top reputation, volume and service scope

Underlying asset classification

Based on asset form

Standard (S)

- Semi-fungible/fungible, easily tradable, assets with financial and monetary value

- Usually circulated in open and floor market

- More likely to be regulated by the Security Exchange Commission

Non-standard (N)

- Assets that are illiquid, non-homogeneous, difficult to price, and difficult to trade

- Usually circulated in the private and over the counter market

- More likely to be regulated by the Commodity Futures Trading Commission

A brief overview of US regulators and regulatory objects is as follows:

Based on asset class

- The property of funds determines the behavior of traders, and trading behavior placed within broad asset classes determines that the options available are different

- Would-be users’ tolerance range for risk and uncertainty determines their allocation ratio to different asset classes

-

Fiat RWA

Common types: USD, EUR, JPY, GBP, RMB

Watchlist: Australian Dollar, Canadian Dollar, Korean Won, Swiss Franc, South African Rand, Mexican Peso, etc.

Key instruments: collateralized stablecoins

Projects: Circle, Tether, Frax, MakerDAO, etc.

- The original RWAs were stablecoin projects with fiat currency (mainly U.S. dollars) as the underlying asset, such as Circle’s USDC and Tether’s USDT.

- Transaction costs, channels, and optional categories are currently limited

- If more fiat currencies can be published as on-chain assets in the future, fiat-backed stablecoins from markets with weak correlation between stock and currency like Russia and Malaysia, and negative correlation between stock and currency like Canada, Australia, and South Korea, may become a good hedging means

2. Fixed income RWA

2.1 Bonds

Common types: government bonds (sovereign interest rate bonds: the United States, Europe, Japan, Australia, China), central bank bills, government bonds, corporate bonds, foreign debts, credit bonds, and convertible bonds.

Key instruments: ETFs, bond derivatives

Projects include: Centrifuge, ONDO, Maple, OpenEden, BondbloX, FortunaFi, CredeFi

- Treasury bonds/treasury bonds ETF currently have the largest proportion of RWA, because of its low risk, being usually regarded as safe-haven assets as a fixed income category of the main investment varieties

- Despite the unsatisfactory yield, the leading DeFi community is still willing to balance its risk exposure through treasury bonds and corporate bonds RWA. For example, 500 million DAI was invested in the first U.S. Treasury RWA purchase by MakerDAO at the beginning of the year

- There is still room for RWA in bills, corporate bonds, credit bonds, and more. Projects can seek differentiated market positions based on their own resources and background advantages.

2.2 Credit

Common types: personal loans, corporate loans, structured financing instruments, personal housing mortgages, auto mortgages, and more.

Projects include: Centrifuge, Maple, Goldfinch, TrueFi, Defactor, Credix, Clearpool, Bru Finance, Resource Finance

- It can open up global credit and provide more opportunities for institutional investors and retail investors to obtain stable returns

- Corporate loans have largely eased the financial pressure of SMEs and made it more likely to obtain social and government support

3. Equity RWA

Common types: Equity stake, primary stock (private placement), secondary stock (open market), etc.

Watchlist: Some Emerging Markets for BRICS

Main markets: United States, Europe, Japan, China, Hong Kong, Macao

Key instruments: ETF, index derivatives, leading stocks in key industries

Projects include: Backed Finance, Sologenic, Swam, AcquireFi, Horizon Protocol, Hamilton Lane

- Individual stocks do not need to pay more attention to the macro cycle, but more to the operation of a single listed company

- The demand for trading this type of asset exists, but it is greatly limited by regulation issues. Projects like BackedFi, which can achieve 24-hour U.S. stock trading, are likely to become a paradise for arbitrageurs.

- Taking the ‘synthetic asset’ route combined with cryptocurrencies seems more attractive

4. Alternative RWA

4.1 Real estate

Common: Residential, commercial

Key instruments: REITs

Projects include: RealT, Parcl, LABS Group, Propy, Atlant, ELYSIA, Tangible, Blocksquare, Milo, Figure, LandShare, Lingo, HOME Coin, Theopetra, EktaChain, Robinland, Homebase

- Real estate tokenization NFT provides a convenient form of lending secured by real estate objects, and the fractionalization of real estate on the chain is also conducive to retail investors’ investment transactions

- On-chain REIT projects have been relatively mature, but the overall cost control (personnel traffic, property management and maintenance, real estate distribution, housing type) still depends on the ability of the single project

- There is a certain tradeoff between underlying asset diversification and operation globalization, and project cost and scalability

4.2 Collectibles

Common types: Art, jewelry, coins

Projects include: 4K, Arkive, matterea, Codex Protocol

- Asset types with large individual asset amounts but low standardization

- Can cut into more niche and non-standard luxury goods trading direction, creating new trading positions, such as on-chain traders for luxury watches, cars, handbags and others

- The vision of ‘make dealers as traders’ sounds promising

4.3 Commodities

Common types: Precious metals (gold, silver, platinum and palladium), base metals (copper, aluminum, cobalt, lithium, zinc), energy (crude oil BRENT, WTI)

Watchlist: Iron ore, coal, dairy products, agricultural products

Projects include: PAX Gold, Tether Gold, Cache Gold , Agrotoken, LandX

- Highly non-standard. And the method of traceability and confirmation, pricing and verification on the chain is usually very complicated.

- The long process of finding and encapsulating assets on the project side itself may result in greater cost consumption and make it difficult to achieve rapid growth and scaling

- TAM is relatively limited, and niche assets need to consider the depth dimension, which is only suitable for professional commodity investors

- Agricultural products tend to follow the pure commodity investment framework, and investors lacking traditional commodity investment experience may struggle to judge the production cycle of cash crops, warehousing and transportation processes, regional market environment, and the impact of climate and temperature changes

- Crude oil is basically regarded as an interest rate impact observation, being highly correlated with interest rates. Traditional investors can directly buy mainstream interest rate products, therefore too much on-chain demand can hardly be perceived.

- On-chain gold purchases can achieve instant settling and redemption with certain advantages. However, gold can be considered according to bond logic (interest rate and inflation expectations), and investors with large positions can still prioritize mainstream U.S. bonds RWA products.

POV

- Layout long-termly, take small steps, go with the flow

- For DeFi, RWA is likely to be a ‘necessary evil’ of its expansion to the next 10 billion users, but in the short term, it is more of a seller’s call and narrative FOMO, not really a breakthrough innovation or strong growth momentum. For small and medium investors or retail investors, asset allocation should still be tailored to your actual needs

- It is suggested that the organization can focus on the layout of the top one or two projects with an innovative design in the long run. In addition, pay close attention to the dynamics of the U.S., Hong Kong and Singapore compliance policies. Only with the collaboration and cooperation of the TradFi Institution can the policy risk of the overall direction be minimized.

- The unveiled trend is that alternative assets and non-standard RWA protocols are emerging

- Is standardizing the underlying assets a must-do? In fact, not necessarily. Non-standard assets can be directly pushed on-chain with the non-standard protocol ERC-721/1155, and structured products can even leverage the latest ERC-6551 directly. There is no need to use ERC-20. And, ERC-20 may not become mainstream in the long run.

- Centrifuge, Fortunafi, etc. have provided collateral loans for NFTs backed by future income bills and invoices; emerging REITs protocols and collectibles protocols based on NFT RWA narratives, such as 4K, have large imagination space. If the initial operation gains community trust, there are odds that it will lead the next wave.

- Treasury/U.S. Treasury RWA will remain mainstream, and Equity RWAs gain more attention

- The mature asset structure of the U.S. Treasury bond chain mechanism is robust and has been recognized by the crypto community. But most of their tokens have been listed, competing in the stock market.

- Thickening products such as equity RWA provide chain traders with the opportunity to speculate on traditional stocks. The demand exists, whereas they face multiple obstacles to compliance, because the influx of on-chain capital is too discrete and untraceable and is likely to disrupt the proper functioning of countries’ internal financial regimes.

- At present, most of the equity RWAs are still only for high net worth and ultra-high net worth institutional users, and have not played a role in lowering the threshold for retail speculation. Thus, there is still much room for development in this area.

- The recognition of crypto community matters, and cooperation with crypto-native communities is more difficult to achieve

- In light of fixed-income RWA, it’s not difficult for off-chain business partners to develop because they can bear less borrowing costs, while the challenge for fixed-income RWAs is to bridge the loan side

- Crypto treasuries such as DeFi DAO have a large amount of lendable funds, but DeFi DAO members’ perception of off-chain assets is highly divergent. Transparent programs need to be given by the project side in terms of specific auditing, underwriting, and off-chain asset tracing processes.

- There will be a certain friction between the off-chain TradFi’s lending compliance process and the DAO governance mechanism. Overly complex off-chain assets are difficult for the crypto DAO community to understand. If community members do not understand or do not want to understand, then the proposal will be shelved or rejected for a long time, and cooperation will not be achieved. Theoretically, it is difficult for pure TradFi background projects to win community trust.

- Points for discussion and further research:

- On-chain ponzi gameplay based on RWA assets is likely to be more suitable for crypto-natives to explore, such as RWA Fi, RWA option trading.

- Middleware, SaaS companies, and compliance issuers that verify assets on-chain, plus agents that match up and down the chain lenders such as IX Swap, Stima, Castle, Curio, are worthy of attention, and there may be monopoly players in the future

- It remains to be seen how the regulated RWA DeFi and the unregulated native DeFi will subsequently fragment and coexist, and what kind of competitive landscape will emerge with CeFi

Conclusion

The enthusiasm of European and American asset management institutions to get involved in the bond market of emerging countries through various means and private wealth management services has never faded. Under the mega trend of the gradual improvement of crypto infrastructure and the huge amount of asset management such as Blackrock viewing Bitcoin as digital gold, it is not difficult to perceive that the traditional fragmented financial markets are also actively seeking better capital utilization scenarios and liquidity efficiency enhancement solutions, and the tightening of regulation actually means that their serious gaze and governance measurements of crypto have begun. When the vision of the world economy shifting from Keynesian to Austrian gradually comes true, crypto will accelerate the extension of its tentacles in the traditional stock, bond and currency markets.

Amid the chant that “models will eventually run the world”, DeFi is whispering about swallowing all markets.

TradFi may embrace crypto faster than you expect.