Written by Fred

I. Introduction

Since its inception, the OP Mainnet (formerly Optimism) has garnered significant attention and praise, emerging as the “phoenix” of Ethereum from its core developers. Its purpose is to address the scalability issue that has plagued the ecosystem. However, the subsequent development has encountered some hurdles. Initially, to quickly scale Ethereum, OP Mainnet deployed the EVM-compatible OVM 1.0. This required extensive custom development for protocols and applications deployed on Layer 2, resulting in a delay. Subsequently, an upgrade was made to achieve Ethereum equivalency, but the sacrifice of “optimistic proof” for the EVM equivalency tarnished the reputation of Optimistic rollup. On the other hand, Arbitrum One, another Optimistic rollup solution, launched its token nine months later than OP Mainnet but gained more popularity and users.

Nevertheless, the current OP Mainnet is embarking on a broader narrative and strategic layout. The Bedrock upgrade, completed on June 6, 2023, has laid the foundation for rapid development in the future. The next upgrade will focus on the implementation of the next-generation Fault Proof-Cannon, and the Cancun upgrade, centered around EIP-4844, was confirmed at the Ethereum developers’ conference in June and is expected to be completed in the second half of the year. The macro environment is also rapidly changing, with market panic caused by the SEC’s lawsuits against Binance and Coinbase, followed by top-tier traditional financial institutions on Wall Street investing in new U.S. cryptocurrency exchanges. In light of these developments, it is worth exploring whether OP can regain its optimism. This article will delve into this topic through research and analysis.

II. The Aura of OP Mainnet

1. Exceptional Core Team and Investors

In 2017, Vitalik Buterin and Joseph Poon co-authored the paper “ Plasma: Scalable Autonomous Smart Contracts” which was one of the earliest proposed solutions for Ethereum’s scalability challenges. The Plasma proposal resonated with three Ethereum core developers, leading to the formation of the Plasma Group, a nonprofit research organization dedicated to studying scalability issues. The project eventually evolved from the Plasma architecture and introduced the Optimistic Rollup solution. At the Devcon conference, they showcased a decentralized application (Demo) developed in collaboration with Uniswap. Shortly thereafter, top-tier venture capital firms, including Paradigm and IDEO, showed interest, and with a support of $3.5 million in funding, the Plasma Group transformed from a nonprofit research group into a for-profit startup, giving birth to Optimism (On June 24, 2023, the OP Mainnet officially named its blockchain network as OP Mainnet to distinguish it from other meanings of Optimism).

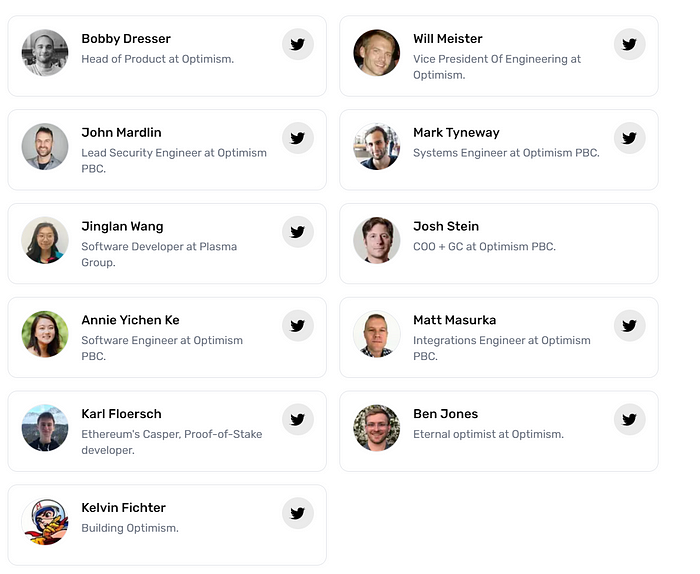

The team behind OP Mainnet consists of developers and researchers from the Ethereum core, and its investors include top-tier VCs such as Paradigm and A16z. With three funding rounds totaling $178.5 million, the company has reached a valuation of $1.65 billion. Coinbase has also joined OP Labs as a core developer and has released “base,” an L2 network based on the OP Stack architecture. The resources backing OP Mainnet are undoubtedly top-notch.

Image: Core Team

Image: Financing Information

2. Pioneer Coin Issuance (OP) with a Strong Narrative Token Economy and Governance Vision

The OP Mainnet consists of two important organizations, namely OP Labs and Optimism Collective, with one responsible for technology and the other for governance. Among them, the concept of Optimism Collective is to create a prosperous and valuable ecosystem through the development of benign public products, and the economy of this ecosystem creates value and a flywheel through three steps.

Image: Ecosystem-driven Flywheel

There are three types of roles in the ecosystem: token holders, contributors and builders, and users and community members. As an L2 project, the goal of the token economy is to provide an efficient, stable, and cost-effective network ecosystem for ecosystem roles to use. The funding for the OP economy comes from the ownership of the OP Mainnet and the value of its block space, generating revenue from the demand for OP block space.

In driving the flywheel, the OP Mainnet first builds the network and provides applications. The revenue generated through the centralized sequencer, Sequencer, accumulates and is redistributed to The Optimism Foundation. Token holders can become citizens of the OP Collective after meeting certain conditions, and citizens have the right to vote, funding public products RetroPGF with foundation funds (Note: RetroPGF includes not only OP ecosystem but also many projects from the ETH ecosystem; OP’s positioning is symbiotic with ETH). Public products will airdrop some tokens, and users and builders will also use the OP token. The use of public products is based on the OP blockchain network and requires support from the Sequencer to complete one cycle.

Image: RetroPGF2 Funding Status

A good token economy is a “nuclear weapon” that accelerates project development. After announcing the token economy, OP launched on June 1, 2022, with an initial total supply of 4,294,967,296 OP tokens. The total token supply will inflate at a rate of 2% per year. Among them, 25% of tokens are allocated to the ecosystem fund, 20% to RetroPGF, 19% for user airdrops, 19% for core contributors, and 17% for investors. In the first year of the initial token issuance, 64% of the tokens will be allocated to the community (Note: investor and core contributor tokens will unlock after one year). OP initially airdropped 5% of the tokens to users (Note: 248,699 addresses), sparking some excitement. However, due to the lack of strong competitors from other chains in the ecosystem projects and the absence of airdrops and event milestones, the token’s popularity is not as high as ARB.

Image: OP Token Unlock Plan

Image: OP Token Unlock Plan

OP aims to introduce blockchain networks to the internet through an ecosystem focused on providing L2 networks and public products. With a strong narrative vision and evidenced by the public display of RetroPGF (Note: projects such as L2BEAT and EIP-4844 received funding in the second phase), OP is indeed fulfilling its promises. On June 22nd, RetroPGF announced the launch of the third phase, distributing 30 million OP tokens to ecosystem builders and projects.

Image: Optimism’s Ecosystem Vision

3. Efficient Cost Savings on OP Mainnet

Since its release, OP Mainnet has significantly reduced the usage fees of Ethereum, compressing them to below 90%. Compared to Arbitrum One, OP Mainnet has saved more transaction costs in its early stages. Future technological upgrades from both platforms may either shorten or further widen the cost gap.

Figure: Transaction Fees

Figure: Cost savings ratio compared to Ethereum L1

III. Existing issues with OP Mainnet

1. Centralized Sequencing Approach

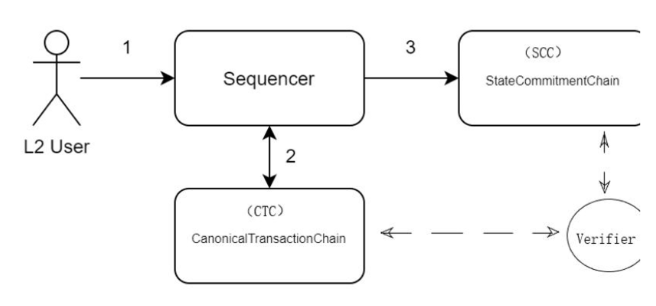

OP’s network architecture consists of four crucial modules: Sequencer, Verifier, CTC (Transaction Chain), and SCC (State Chain). The Sequencer and Verifier are Layer 2 nodes with hardware entities, forming the fundamental nodes of Layer 2 network. CTC and SCC are contracts deployed on Ethereum.

Figure: Four Important Modules in the Architecture

The Sequencer is a centralized mining pool node responsible for local block production in Layer 2 (similar to mining). It determines which transactions can be included in blocks. A healthy Sequencer should be decentralized, with Verifiers challenging and punishing it successfully. However, the current Sequencer node is operated by Optimism’s official team, which poses a serious centralization problem and contradicts the decentralized nature of blockchain networks. (Optimism plans to achieve decentralization of sequencing nodes in their 10th milestone of the roadmap.)

2. Failure of Optimistic Fraud Proofs, Default Trust in the Verification Process

In a typical Optimistic Rollup solution, the Sequencer in Layer 2 assumes transactions to be valid in an “optimistic” manner. After submitting the Rollup to Layer 1, there is a time window called the challenge period, during which anyone can challenge the transaction results of the Rollup by providing fraud proofs. If successfully proven fraudulent, the Rollup protocol re-executes the transactions and updates the Rollup’s state accordingly.

However, as a sacrifice for achieving EVM equivalence upgrades, the OP Mainnet fault-proof mechanism has been temporarily disabled. This means that users of the OP Mainnet network currently need to trust the Sequencer node in order to publish valid state roots on Ethereum. As a result, the Optimistic Rollup solution, which relies on fraud proofs, has been running for several months without anyone being able to verify potential fraud. (This issue is expected to be addressed in the next Cannon upgrade on the OP Mainnet network.)

1. Lack of Native Popular Projects in the Ecosystem, Significant Gap in Key Operational Data compared to Arbitrum One

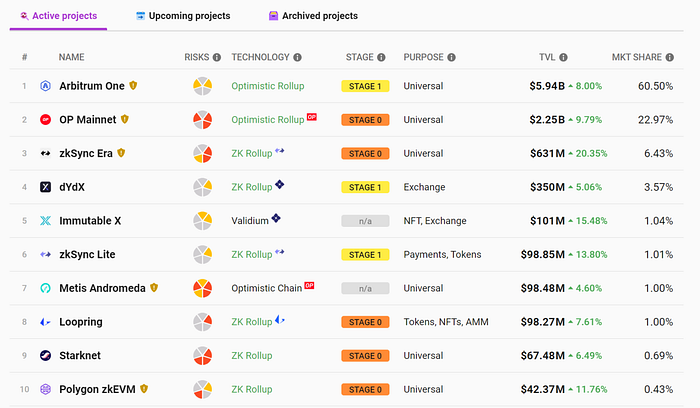

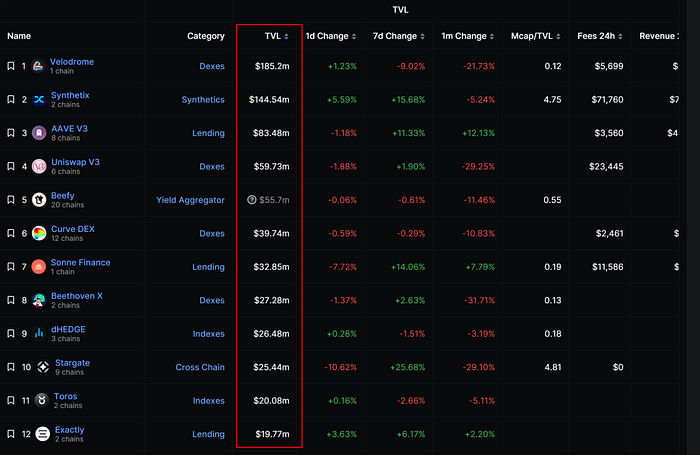

In the entire L2 ecosystem, Arbitrum One and OP Mainnet hold an absolute leading position, with a combined market share exceeding 83% of the total market. However, there is a significant gap between OP Mainnet and Arbitrum One, with OP Mainnet’s Total Value Locked (TVL) being only about 40% of Arbitrum One’s TVL.

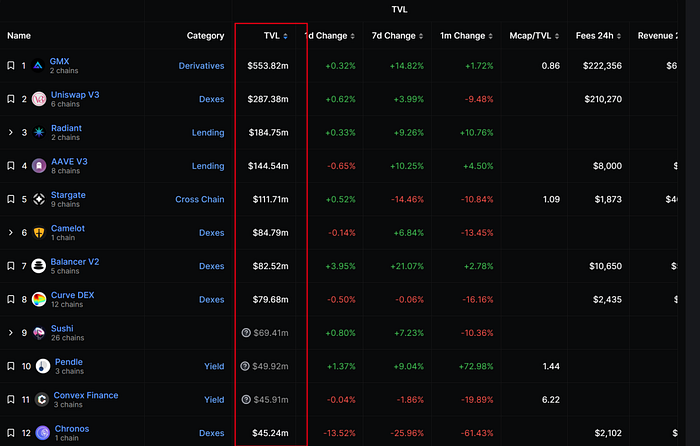

Figure: TVL situation in L2 ecosystems

Looking at the projects in the two L2 ecosystems, projects on Arbitrum One generally have higher TVL compared to those on OP Mainnet. Moreover, Arbitrum One hosts many highly popular native projects such as GMX, Radiant, Camelot, Arbdoge AI, and more. On the other hand, OP Mainnet falls slightly behind in terms of popular projects, with the top-ranked projects like Velodrome and Synthetix having a TVL that is only 50% or even lower compared to their counterparts on Arbitrum One.

(Note: L2BEAT and DefiLlama have different methodologies for calculating TVL. L2BEAT considers all assets locked in Ethereum contracts, including L2 native governance tokens like ARB and OP. On the other hand, DefiLlama focuses on assets actively participating in dApps on specific networks. Therefore, in terms of algorithm, the TVL calculated by L2BEAT is higher than that of DefiLlama.)

Figure: TVL Situation of DeFi Projects on Arbitrum One

Figure: TVL Situation of DeFi Projects on OP Mainnet

In comparison to other key data, most of the key data on OP Mainnet performs less favorably than Arbitrum One. This is because OP Mainnet lacks high-quality projects that can attract more users and activity. As a result, OP’s market value is lower than ARB, and the MC/TVL and FDV/TVL ratios indicate that ARB has a growth advantage over OP at the moment. However, OP Mainnet has a competitive advantage in terms of lower fees, thanks to the recently completed Bedrock upgrade. In the future, OP Mainnet still possesses technological potential and cost advantages, but efforts are needed to attract more high-quality projects and users.

Figure: Ecosystem Key Data Comparison (*Data as of June 27, 2023; if data was not available on that day, the most recent data from mid-June was used)

Figure: Token Data Comparison (*Data as of June 27, 2023; TVL calculated using L2BEAT standards)

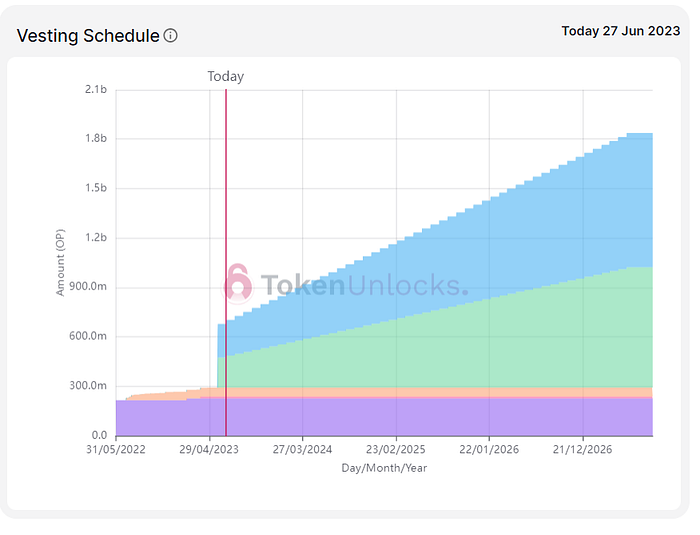

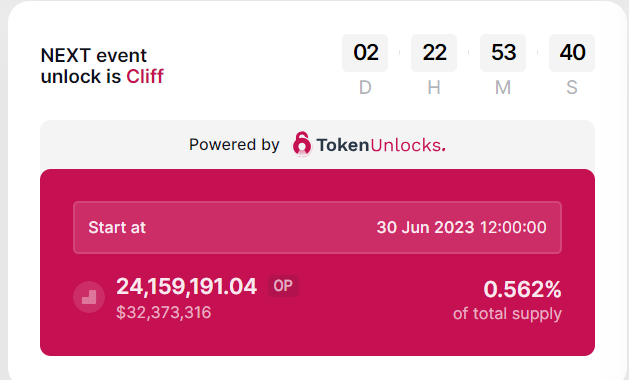

Regarding token unlocks, tokens held by investors and core contributors have started to unlock. Regular releases of 0.562% of the tokens will occur, with each release amounting to 24 million OP tokens. This represents a continuous token release pressure.

Figure: Token Unlock Schedule

Figure: Next Release Plan

4. New Narrative

Modular OP Stack Technology Stack

OP Stack is a general-purpose development stack used to build the L2 blockchain ecosystem. It follows a modular approach, creating a series of modules that work together to form a coherent and reliable blockchain. These modules provide the code that powers the next-generation architecture of OP Mainnet. Bedrock, completed in June of this year, is the first official version of OP Stack.

Each layer of OP Stack is built with well-defined APIs, allowing builders to easily modify existing modules or create entirely new ones to meet the needs of any application being developed. Such an architecture will seamlessly support the vision of the OP superchain in the future.

Figure: OP Stack Architecture

Breaking down the various layers, the bottommost layer is the data availability layer, which defines the publication location of the raw inputs based on the OP stack chain. The OP stack chain can utilize one or multiple data availability modules to obtain its input data. Ethereum Data Availability (DA) is currently the most widely used OP stack data availability module, serving as the foundation for all Layer 2 constructions at present. When using the Ethereum DA module, source data can be obtained from any information accessible on the Ethereum blockchain. This includes Ethereum call data, events, and EIP-4844 data blocks. The inclusion of EIP-4844 in the architecture diagram suggests that OP stack will have high adaptability to future releases of EIP-4844.

Above the data availability layer is the sequencing layer, which determines how user transactions on the OP stack chain are collected and published to the utilized data availability layer modules (as mentioned earlier, this is the role of the Sequencer). This layer holds great expectations for OP and will play a crucial role in future superchains. However, the current Sequencer for OP is still operated by the official team and requires optimization as a core module.

The derivation layer defines how the raw data in the data availability layer is processed to form processed inputs. Its primary responsibility is data packaging, such as using Rollup solutions to provide data to the sequencing layer before entering the data availability layer.

The execution layer defines the state structure within the OP stack system and defines the state transition functions that modify that state. When inputs are received from the derivation layer through the engine API, a state transition is triggered. This layer mainly handles the conversion of data between upper and lower layers, using the same state representation and transition as the Ethereum virtual machine.

The settlement layer primarily serves the role of verification and is a crucial component of the consensus mechanism. Once a transaction is published and completed on the corresponding data availability layer, it is finalized on the OP stack chain. It cannot be modified or removed unless the underlying data availability layer is compromised. The mention of OP’s next-generation fault-proof Cannon implies its adaptability to zero-knowledge proofs within the OP stack.

The governance layer consists of general tools and processes used for managing system configurations, upgrades, and design decisions, such as voting and token governance. This is a relatively abstract layer that encompasses the management behavior of the OP stack itself and the mechanisms and behaviors of third-party chains that may impact other layers of the OP stack.

Once this modular technology stack is officially launched, developers can easily abstract various components of the blockchain and modify them by inserting different modules. For example, if an Optimistic Rollup wants to transform itself into a ZK Rollup, it can simply replace its fraud-proof module with a validity proof module from the settlement layer. This modular architecture provides significant room for imagination in the development of projects within the OP Mainnet ecosystem on a technical level (assuming OP completes the crucial decentralized sequencer and its own Cannon mechanism).

2.Next-Generation Fault Proof — Cannon

As a “side effect” of the upgrade equivalent to Ethereum, OP lost its core optimistic proof. According to the roadmap, the next milestone after Bedrock is to release the next generation of fault-proof Cannon to replace the lost optimistic proof. Currently, Cannon is still in the construction and testing phase, and there is still a long way to go before deployment in a production environment.

According to official OP documentation, Cannon will be the world’s first EVM-equivalent fault-proof method. Instead of re-implementing the EVM on L2, it leverages the existing EVM and introduces a minimal modified subset of minigeth (go-ethereum) compiled into MIPS. This simple abstraction allows the fault-proof program to access any content in the L1 or L2 state, and on-chain costs are independent of the size of that state. Other L2 implementations, such as Arbitrum’s AVM, require implementing state management from scratch to achieve this.

In theory, Cannon can achieve the lowest ETH-Calldata gas cost, thanks to OP Mainnet’s completion of EVM equivalence. After Bedrock, it will further compress transaction fees on L2, making it an important component of the OP Stack architecture. The project’s progress regarding when the Cannon mechanism will be implemented should be closely monitored.

Figure: OP Roadmap

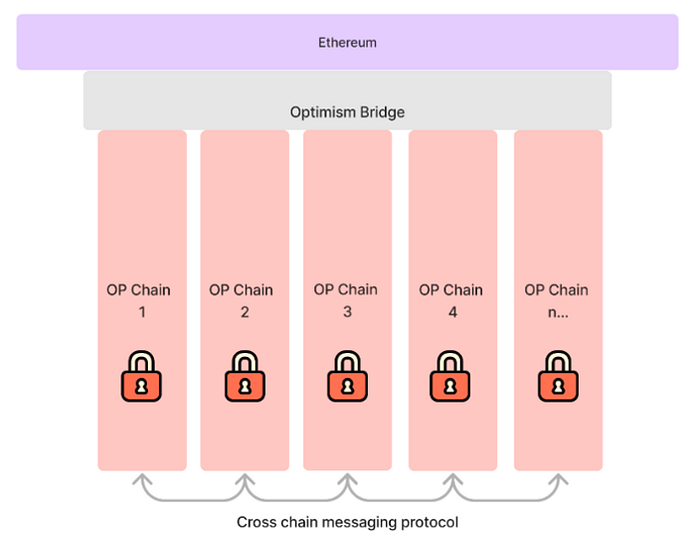

3. Becoming the Platform of Chains — Superchain

OP, based on the OP Stack architecture, articulates a grand narrative of creating a Superchain. Conceptually, the Superchain is a horizontally scalable chain network that shares security, communication layers, and open-source development stacks. It can highly accommodate the explosive growth of L2 and L3.

The Superchain relies on the modular OP Stack’s technical stack, allowing other chains to share and contribute to a reinforced, standardized, and modularized codebase, thereby becoming OP-chains without the need for custom adapters for each chain.

Figure: OP Superchain Architecture Concept

Multiple OP-chains share a sequencer, which generates block orders across several chains, ensuring atomic interaction between these chains. This is feasible because a single entity can generate blocks on each chain without depending on other validators to incorporate these atomic transactions. OP-chains that opt to join the shared Sequencer Set of the Optimism Collective become part of the system, erasing boundaries between chains.

If the Superchain initiative by OP proceeds, the OP token and its ecosystem will witness significant growth. Resources of the OP Collective will be available not just to Optimism, but also to many different OP-chains embedded into the Superchain, fostering a cooperative Superchain ecosystem based on the infrastructure provided by OP. The concept of the Superchain allows the resource advantages of the OP Mainnet to shine once more. Major American crypto exchange Coinbase has joined the development of OP Stack and launched the “OP-chain”base chain. On June 19, BNB also announced the launch of opBNB testnet built on OP Stack.

Figure: opBNB Testnet Launch

4. Conclusion

OP’s vision for the future is ambitious: becoming the Ethereum itself at the L2 level, enhancing scalability for the entire ecosystem by providing standardized, modular, customizable standards and code to support all chains and protocols in the Ethereum ecosystem. If all nodes can be completed swiftly, OP will truly become Ethereum’s phoenix. However, this relies on breakthroughs in the key technical aspects of OP Stack, as well as its ability to outperform competitors.

V. Looking back at the Bedrock Upgrade

1. What is Bedrock?

Bedrock is the name of the first official version of OP Stack, which was formally upgraded on June 6. Bedrock primarily includes the core software required to operate an L2 blockchain. It is designed for modularity and upgradability, reusing Ethereum’s existing code and closely mirroring Ethereum.

Bedrock brought about several improvements:

(1) Closer parity with EVM: Before the Bedrock upgrade, the difference between OP and Ethereum’s client code was around 3000 lines. This difference was reduced to fewer than 500 lines post-upgrade.

(2) Further reduction in costs: Bedrock implemented an optimized data compression strategy to minimize data costs to the fullest extent, eliminating all L1 execution gas and reducing L1 data fees to their theoretical minimum. This resulted in an additional 10% reduction in costs compared to the previous protocol versions.

(3) Shortened deposit time: Bedrock introduced support for L1 reorganization in node software, significantly reducing the waiting time for user deposits. Early versions of the protocol could take up to 10 minutes to confirm deposits. With the Bedrock version, deposits are theoretically confirmed within 3 minutes.

(4) Improved proof modularization: Bedrock abstracted the proof system from the OP Stack, so rollups could use fraud proofs or validity proofs (for example, zk-SNARKs) to verify the correct execution of inputs on the rollup. This abstraction lays the foundation for future applications of Cannon.

(5) (5) Two-step withdrawal: A withdrawal step is added that requires users to publish their withdrawal proofs in advance. Users must wait for a valid output root to be proposed, allowing their withdrawal proofs to be verified on-chain. After a 7-day waiting period, users can complete the withdrawal and claim their funds. By publishing proofs in advance, it provides sufficient time for on-chain monitoring tools to detect fraudulent withdrawal proofs and attempt to take corrective measures. Ordinary users can also perform this monitoring.

Figure: Optimized Withdrawal Visualization Process,

2. Token Changes Before and After the Launch of Bedrock

On the day of the Bedrock upgrade, OP experienced a brief rise after a large-scale token unlock, but it quickly fell sharply. On June 20, due to the emergence of new positive developments, it started to rise again.

Figure: Recent OP Price Trend

Looking back at the recent price trend: According to OP’s token economics, a plan was set to unlock 286 million tokens on May 30, 2023. The main sources of these tokens are core developers and investors, which put significant selling pressure on token holders. The token price started to decline for nearly seven days after May 29, with a total decline of nearly 25%. On June 6, OP Mainnet announced the completion of the Bedrock upgrade, and the token price rose by 10% on that day. Unfortunately, the SEC sued Coinbase on the evening of June 6 and then announced a document identifying 19 tokens as securities on June 8. Although OP was not included, concerns about U.S. regulation during these few days led many U.S. institutions and investors to choose to take risks and sell their tokens. The entire market fell sharply for four to five consecutive days. As a close partner of Coinbase, OP was naturally affected, with a decline of nearly 40%. After about a week of sideways trading, the market welcomed good news on June 20. Wall Street capital began to launch its own cryptocurrency exchanges in the United States. Led by BTC, the OP token price was pushed back to the level before the SEC lawsuit.

Figure; Large Amounts of OP Transferred to Coinbase After SEC Regulation

3. What changes has Bedrock brought to the ecosystem?

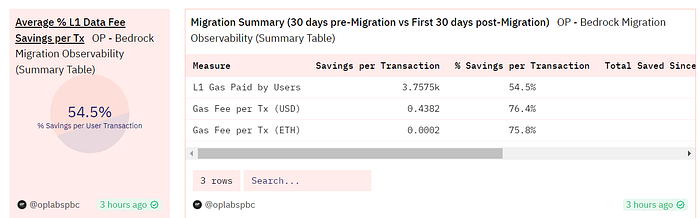

The most direct change after the Bedrock upgrade is a further reduction in fees. After the upgrade, the average L1 cost savings per transaction increased by 54.5% compared to before the upgrade. In specific areas, the savings in NFT minting, ERC20 token transfers, Ethereum transfers, and DEX trades increased by more than 60% compared to before the upgrade. The impact of the upgrade on fees can be seen more intuitively from the line chart.

Figure: Bedrock Upgrade Change Data 1

Figure: Bedrock Upgrade Change Data 2

VI. Looking Forward to the Cancun Upgrade

1. The Latest Progress of the Cancun Upgrade

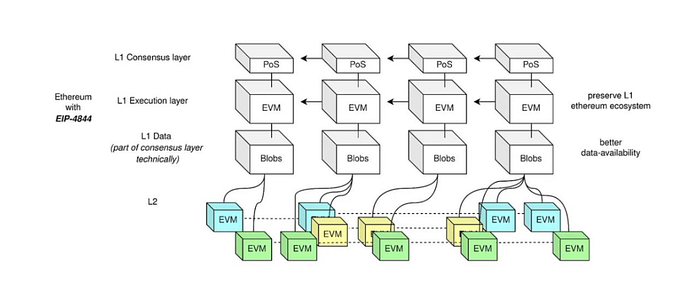

Every major Ethereum upgrade is one of the most noteworthy events in Web3. The Shanghai upgrade earlier this year kicked off an LSD Summer. At the latest Ethereum developer conference (*2023.6.15–111th ACDC Conference), the scope of the Cancun upgrade was finally confirmed. It includes EIP 4844 (*proto-danksharding), and EIP 4788, EIP 6988, EIP 7044, EIP 7045, and EIP 4788, among which the most noteworthy is EIP-4844, which focuses on scalability.

2. What is EIP-4844?

The biggest problem with Ethereum right now is scalability, and the core of the L2 track is to scale Ethereum. Currently, this is mainly done through the Rollup scheme, which tries to compress and bundle data before transmitting it to the L1 chain. But with the blockchain network becoming more and more prosperous, and the market price of ETH is quite high, the current L2 costs cannot meet future needs.

The reason why we need to dig into the cost structure of L2 is that L2 gas fee = L1 part + L2 part. Because the current Rollup scheme ultimately needs to write transactions into Ethereum’s Calldata, which is processed by Ethereum nodes and permanently stored on the chain, the L1 part cost has always been very expensive. To further reduce the overall cost of L2, it is not enough to rely on L2 projects alone, and optimization from Ethereum L1 is also needed.

The long-term solution to the scalability problem on Ethereum is data sharding, but it takes a considerable amount of time to implement and deploy. Rollups, in the short and medium term, and even in the long term, will be the only trustless scalability solution for Ethereum. There are mainly two solutions to the current situation, the first is to reduce the gas cost of current execution call data, and the second is to use a format that is not yet actually sharded but similar to sharded data. Past rollups have revolved around the first solution, while the introduction of EIP-4844 allows L2 projects to use the second solution.

EIP-4844 introduces a new transaction format called blob, which achieves a format that will be used in future shards without actually sharding these transactions, but the format is fully compatible with the format used in full shards (*avoiding a large upgrade of the Rollup scheme when full shards are introduced in the future). Blobs are like temporary expansion data packets for storing data, so they don’t have to be written into Calldata anymore. They encrypt the proof in a new way to prove that the verification node has verified the smallest subset of Rollup data, unlike now where all data submission is verified. The blob can store larger data than Calldata at a lower cost (*priced separately), it is deleted after a fixed time period (*1–3 months), which will greatly reduce the L1 part of the cost.

Figure: Schematic Diagram of EIP-4844 Introducing Blob

3. OP Cancun Upgrade and OP

The Cancun upgrade, centered around EIP-4844, will carry out capacity expansion through Ethereum L1 optimization, which will be beneficial to the entire L2 track by reducing fees.

OP completed the Bedrock upgrade in June, further reducing costs, and is currently the lowest-cost chain in the entire L2 track. Also, it can be seen from the official Optimism documents that OP has been deeply involved in the promotion of EIP-4844, which is also reflected in the modular architecture of OP Stack. As the project closest to ETH core developers, OP is expected to adapt efficiently and reduce costs even further after the Cancun upgrade.

Figure: Comparison of fees across different L2 chains

Compared to other L2 projects, ARB also has strong expectations. As the L2 track ecosystem with the highest TVL, ARB has many leading application projects, such as GMX, RDNT, JOE, etc. These projects have higher daily activity, trading volume, and greater price fluctuations. These applications that are directly linked to users may more intuitively feel the impact of the Cancun upgrade.

VII. Summary

At present, the OP Mainnet has problems such as centralized order sorting, failure of fraud proof, and the need for further improvement in the activity of the network ecosystem. However, the new narrative of the OP Mainnet is grand and is being implemented. It’s not hard to see from the plan that the OP Mainnet intends to complete the next-generation fault proof, Cannon, in 2023, to pave the way for the decentralization of the network in 2024. Through retroPGF funding and super chain aggregation to expand the influence of the entire OP ecosystem, the current retroPGF has reached the third stage, and Coinbase and BNB chain have each launched their chains based on the OP Stack.

The recently completed Bedrock allowed the OP Mainnet to practically advance the new narrative node and further improve the network to reduce costs, and the market has reacted accordingly. The Cancun upgrade in the second half of the year will be an important event that cannot be ignored in the entire L2 track. Let’s look forward to the performance of OP in the Cancun upgrade.