[Xangle Digest]

※ This article contains content originally published by a third party on February 25, 2023. Please refer to the bottom of the article for the copyright notice regarding this content.

The emergence of Ordinals has sparked a rekindling of creativity and innovation among the Bitcoin community and led us to believe that now is the time for the most exciting trade idea we have had in a long time and one we’ve been working on for several months. Long $STX.

STX is the token Stacks, Bitcoin’s most advanced L2 (more on what exactly a Bitcoin L2 is later). It is a token we have been watching for some time as we have been looking for lateral ways to play the upcoming Halving in just over a year (currently expected March 4th, 2024). Why STX is important at this time requires some context. For most of its history Bitcoin had only to exist as it rode up the steep part of its adoption S curve. This meant that price appreciation was more than enough to offset the security reduction of each halving. BTC’s price more than doubled every four years and therefore Bitcoin’s absolute security budget continued to grow and was never compromised. However, now that BTC has matured as an asset, it has become apparent that relying on price appreciation to offset emission reductions every four years is unlikely to be sustainable in the long run. To illustrate this point, if BTC were to double every 4 years, it would be larger than global M2 in 5–6 more halving’s (20–24 years). Exponential gains are not sustainable for any asset as money supply doesn’t grow exponentially.

This leaves Bitcoin with two options for long-term security. Either the hard cap can be removed, and tail emissions implemented, or the Bitcoin community must figure out a way to generate a sustainable fee pool to compensate miners instead of purely relying on emissions. The tail emission option is not desirable for multiple reasons. Firstly, Bitcoin’s hard cap is a key Schelling point for its value and the removal of this core principle would hurt its appeal. Secondly, in the original whitepaper it states that the long-term path for security was intended to come from fee generation. Therefore, implementing tail emissions and abandoning Satoshi’s original vision would essentially be admitting defeat for Bitcoiners. Lastly, an SoV that has constant inflation is objectively a worse SoV than one that simultaneously has capped supply and remains secure. An SoV is meant to store value over time and consistent inflation directly works against that goal. For all those reasons it is clear to us that generating a sustainable fee pool is the far more attractive option for Bitcoin long term. It is still uncertain whether Bitcoin will be able to generate a large enough fee pool to fully avoid tail emissions, but we think it is clear the community will focus a lot of energy on trying to achieve this now that BTC is maturing as an asset.

As Bitcoin is the largest cryptocurrency, it is home to an enormous base of capital and to users that are already familiar with crypto principles, yet there is only a relatively small crypto economy built on Bitcoin today. Of course, there are challenges to developing a more comprehensive ecosystem. Despite these limitations developing a crypto economy on top of Bitcoin still represents a massive opportunity. The base L1 Bitcoin layer was not designed to optimize for composability and therefore it is bulky and inefficient to use for more complex applications. Building on an L2 and securing the value on an L1 is a more sensible design for most applications and this is exactly what Stacks does. There are three main L2’s on Bitcoin, Lightning, RSK and Stacks. They are different from L2’s on Ethereum, and we will discuss these differences shortly, but for simplicity we use the L2 term here. Each L2 is complementary, and has different goals, but of the three Stacks is furthest along in terms of developing an ecosystem for more traditional crypto applications (NFT’s, DeFi, Name Services, etc.). It has the most advanced NFT ecosystem, the .BTC naming service lives on STX and further DeFi applications will be enabled with their next upgrade this year. Furthermore, it is the only one of the three with a token.

Stacks, in its current form, is not a traditional L2 in the sense of an Ethereum L2. Having its own set of validators is necessary to add flexibility on top of the current state of Bitcoin L1 but does forfeit certain trust assumptions of L1. Namely, censorship resistance is inherited from the Stacks signers while reorg resistance is inherited from Bitcoin L1. Censorship resistance is not possible today due to technical limitations of the Bitcoin L1 (you’ll need to change Bitcoin L1 to do this). Stacks derives its censorship resistance from a group of decentralized signers who stake STX in the system and are separate from the miners. These decentralized signers create strong economic incentives for BTC movement back from L2 to L1. This is the best option that exists today and in our opinion is extremely powerful on its own. The current solution provides much value to the Bitcoin ecosystem. It provides an environment to explore developing a native Bitcoin crypto economy (a long-term necessity to generate a security budget), supplements Bitcoin’s security by paying BTC fees on the base layer and generally grows the Bitcoin ecosystem. We view this as the optimal solution to develop a broader Bitcoin economy today and a viable long-term solution. However, should Bitcoin L1 make the necessary changes required to support a more traditional L2, with even stronger security assumptions, Stacks has maintained that they would embrace this and become a more traditional L2 that fits the Ethereum L2 definition. Should this happen in the future it would further enlarge the TAM for Stacks, and they would still be able to benefit from the existing development and will have captured a dominant market share in the meantime.

Stacks was started in 2017 out of the Princeton Computer Science Department by founders Muneeb Ali and Ryan Shea and has been working toward bringing composability to BTC ever since. Muneeb has experience building protocols on Bitcoin L1 all the way back to 2013. Technically, this is a very difficult thing to do and culturally it has not always been a fit with the Bitcoin community. However, there are multiple catalysts and inflections occurring at that same time that are set to shift these dynamics in Stack’s favor. From a technical standpoint Stacks is set to undergo a transformational upgrade, titled Nakamoto, later this year that will facilitate the development of more traditional crypto application types like Opensea and Uniswap to exist on the Bitcoin network through Stacks. Nakamoto will give rise to subnets, which will support other codebases such as EVM and Solidity, solving another major sticking point for ecosystem development. Additionally, Nakamoto will enable synthetic Bitcoin (Bitcoin moved from L1 to L2) to more easily be utilized across the Stacks network, which should dramatically increase the network’s liquidity and give rise to more traditional DeFi applications. Lastly, one of the major inhibitors to Stacks adoption has been that block times are relatively slow as they occur on the Bitcoin L1 cadence. Nakamoto will see the implementation of a major technical breakthrough that will result in execution times decreasing from 10–30 minutes to just a few seconds. The breakthrough, developed by Stacks core developers along with Princeton computer scientists, is the ability to cryptographically prove the passage of time in-between Bitcoin blocks. The result will be a user experience akin to that of an Ethereum L2 but built on Bitcoin. This will unlock an enormous TAM and is arguably the most important part of the Nakomoto upgrade. Subnets will also be able to further decrease block times by exploring the tradeoff between decentralization and speed without compromising the Stacks base layer. We expect the upgrade to occur in Q4 2023. In aggregate the upgrades planned this year will have an enormous impact on the performance of Stacks and will give rise to the first truly composable and efficient L2 in Bitcoin history. It is hard to overstate the importance of the potential that will unlock. As discussed earlier, Stacks L2 is the most efficient and secure L2 you can build on Bitcoin today without changing Bitcoin L1 — making it a practical and commercial approach that can work today. If some small tweaks to Bitcoin L1 can be made, which is possible in the coming years, then Stacks L2 can be even more slightly integrated with Bitcoin L1 security in the future. More detail on the upgrade can be found in the updated Stacks whitepaper, which was released last month.

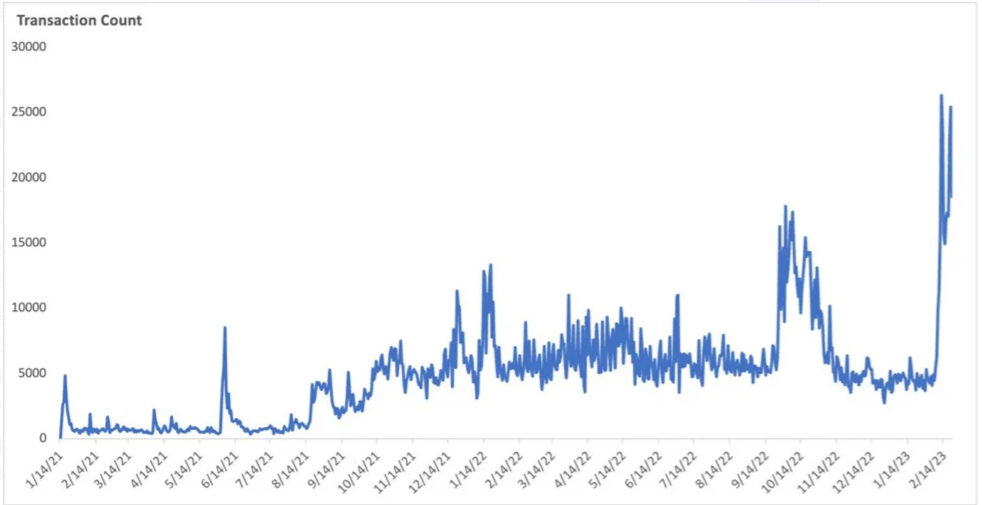

From a cultural standpoint, there is another shift underway. For the last year or so many prominent members of the Bitcoin community have denounced Bitcoin maximalism and welcomed a more flexible mindset. As the reality of the challenge Bitcoin faces regarding its long-term security becomes more apparent, the community has begun to recognize they must become more flexible for Bitcoin to achieve long-term success and sustainability. This has resulted in a more open-minded attitude across the community as creativity and innovation are embraced more than it was in the past. The culmination of this shift occurred recently with the launch of Ordinals on Bitcoin. Ordinals are a new primitive that allows data to be inscribed on individual satoshis (sats) on the Bitcoin blockchain, effectively creating the ability to turn each individual sat into their own unique NFT equivalent. This new utility has fueled an explosion of activity as new use cases are built out, sparking an inflection in Bitcoin on chain usage. Bitcoin network fees have tripled in the last month. More detail on this inflection can be found here a. Additionally, this activity combined with the rapid adoption of Bitcoin Naming Service (BNS), which is built on Stacks L2, has generated a major spike in Stacks activity.

Stacks Transaction Count

This dynamic has given rise to two further consequences. Firstly, there has been a flurry of development and inspiration that has further galvanized the community, refocusing their attention on the development of a more comprehensive ecosystem built on top of the Bitcoin base layer (link). Second, it has revealed the difficulties of building directly on the Bitcoin base layer, further emphasizing the need for an effective L2 ecosystem. Both of these factors benefit Stacks and should funnel capital and effort towards furthering the most prominent Bitcoin L2. There are now over 30 teams building on Stacks (many of whom we are in contact with); the ecosystem is primed for adoption with the Nakamoto release coming later this year, and the cultural shift already underway in the community. Stacks looks set to finally capitalize on the massive opportunity of developing a broader Bitcoin ecosystem.

This is the fundamental case, but what about the investment case for $STX? First some additional context on the STX token. Unlike many tokens, the STX token has real value accrual. Stacks runs on a Proof-of-Transfer system that works somewhat similarly to Proof-of-Work. Miners validate Stacks transactions, but rather than receiving emissions with no cost, they must bid for Stacks blocks in order to receive the STX rewards for each block. The currency they use to bid is BTC and this BTC goes to STX stakers who commit their STX to the network. This creates a system where miners do the work of validating transactions, but do not keep all the rewards, some instead get distributed to STX holders through the BTC bids from the miners. This creates a real BTC yield for STX stakers (currently 7% yield link) that importantly is correlated with activity on the network. As activity grows and the blocks are worth more, the BTC bids from the miners will also increase and with it the real yield that accrues to STX stakers. This sets an attractive foundation, but what’s most attractive about the STX investment case is the asymmetry of the risk reward.

ETH is worth ~$200B and the combined FDV of all L2’s in the Ethereum ecosystem (both private and public) we estimate is approximately $60B. Bitcoin is worth ~$480B and the combined value of the L2 ecosystem is solely STX, which is currently trading at a ~$1B FDV. The ETH to ETH L2 ratio is ~3.33 while the BTC to BTC L2 ratio is ~480. It makes sense that the Ethereum ratio would be lower. Ethereum is better suited to being a composable base layer and therefore the aggregate value that sits on top of that would rationally be worth more as a proportion than something like Bitcoin, which is not purpose-built to be a composability, layer and has much less built on it currently. However, the fact that the BTC ratio is ~144x higher shows the scale of the opportunity if the Bitcoin community emphasizes this effort and technical improvements make it more feasible. Both of these requirements seem to be occurring simultaneously right now. It does not seem unreasonable for this ratio to move from 144x to 14.4x as the Bitcoin effort progresses and is better understood. This alone would represent a 10x for STX. On an individual basis this also makes sense as it is appropriate for the most prominent Bitcoin L2 to have an FDV of ~$10B when it is has no competition for token value, is of increasing importance and several Ethereum L2’s trade above that valuation.

The second dynamic that boosts the STX investment case is the upcoming Bitcoin halving. The halving itself will decrease Bitcoin’s security budget and further reinforce the need to develop a larger fee pool through a more productive Bitcoin ecosystem. This will solidify the importance of L2’s, like STX. Additionally, from a more technical perspective, the halving is going to be a massive narrative within the crypto community and many large investors will soon be searching for ways to position their investments to benefit from this event. BTC is the obvious candidate. However, as BTC is so large it has a lower beta compared to other smaller crypto assets. As a result, many investors will be searching for smaller investment ideas that also benefit from the halving. We did this very exercise over the last several months and all paths kept leading back to STX. There are not many tangential tokens in the Bitcoin ecosystem, and this will focus attention on the few that exist, and primarily STX. This is a very powerful dynamic as there will be a very large pool of money chasing a relatively small pool of assets. It has the potential to lead to outsized price movement in the smaller assets. This further supports the idea that STX can return multiples as an investment, which we have already justified through a more fundamental lens. In a base case, I believe STX can be to the Halving what LDO was to the Merge. LDO experienced a 600% gain in token price over 6 weeks during the July/August lead up to the Merge. In a bull case, if the Bitcoin ecosystem develops more meaningfully, I think buying STX now can be to the upcoming cycle what buying SOL at $1 was to the prior ’21 cycle. It is rare to find such a confluence of events as currently exists for STX. This is what gives rise to truly asymmetric investment bets. Over the next 12 months into the halving, I think STX has 10x upside potential and 50% downside potential. Of course, the result isn’t binary and there is a range of potential outcomes in between; at the moment the two extremes both seem equally likely.

Further notes:

- STX was distributed through the first-ever SEC qualified token offering in 2019 and has already decentralized, which adds some comfort in today’s hostile regulatory environment.

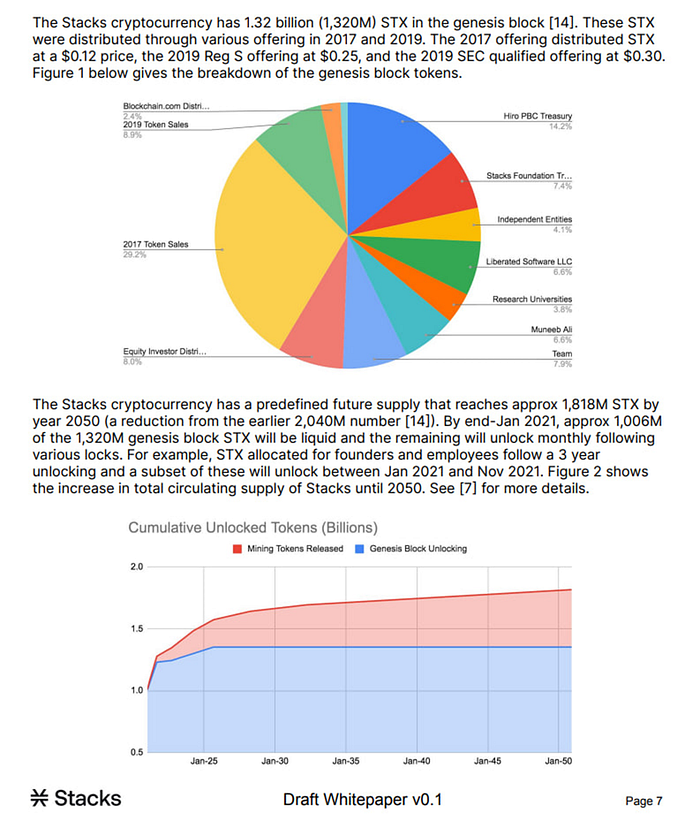

- STX tokenomics are quite favorable with a market cap to FDV ratio of 0.75 and most token unlocks already behind us.

→ Click here to read the full report.