Translated by elcreto

Table of Content

1. Why Do Game Projects Come to Polygon?

2. Casual Games Are Leading the Pack

3. Genres Are Increasingly Varied

4. Web2 Game Companies’ Participation May Spawn Growth

1. Why Do Game Projects Come to Polygon?

The current Web3 gaming market is split between Polygon and BNB Chain. In 2021, BNB Chain used to be the predominant leader in the gaming market. In 2022, however, as Polygon made a strong push into NFTs and gaming with the launch of Polygon Studio in 2021, the gap began to narrow. Metrics show that, while the number of game projects onboarded on Polygon is less than half the number on BNB Chain, its daily active users (DAUs) have grown to stand on par with BNB Chain’s in less than a year. This is indicative of the user base of the Polygon’s gaming ecosystem that has taken off to become comparable to that of Binance.

How has Polygon risen to one of the top two players in the Web3 gaming market in just over a year? To start with, its ability to enable both high security and high scalability sets it apart from other blockchains. The combination of Plasma + sidechains has allowed the network to secure scalability of layer 2 solution as well as inherit Ethereum’s security properties to enhance security.

Another key driver is Polygon's 2) business development (BD) prowess. Polygon's business acumen is a well-known fact in the blockchain industry. It has entered a series of partnerships with not only Web3 projects but traditional companies like Meta, Nike, and Starbucks. In September 2021, Polygon appointed Ryan Wyatt, former head of gaming at YouTube, as CEO and Michael Blank, former vice president at EA, as COO of Polygon Labs (formerly Polygon Studios). Polygon Labs has recently released a free Web3 games guide, Blueprint, as part of an effort to onboard developers. Polygon has most likely leveraged its battalion of business developers and know-how of traditional game companies to facilitate onboarding of a slew of game companies, including Neowiz.

One other exogenous facilitator of the growth of Polygon’s gaming ecosystem was 3) U.S. government clampdown on Binance. Since Binance Launchpad has won BNB a throng of games, the business has often been beleaguered by the regulatory scrutiny of its exchange operation in the U.S. As the pressure continues to grow, the company has now shifted their focus to the Southeast Asian market. Polygon, on the other hand, does not operate an exchange, sparing itself the type of scrutiny facing Binance. With the strongest competitor kept in check, Polygon appears to have been better positioned to attract game projects targeting the U.S. market.

These drivers led the network to take off to rank with the goliath in the Web3 games market. In this publication, we'll walk you through Polygon's gaming ecosystem and discuss its outlook.

2. Casual Games Are Leading the Pack

In terms of the number of users, casual games top the list of flagship games on the Polygon network. Requiring less specs and less time and money for development, casual gaming has widely been considered a befitting genre for the current blockchain infrastructure (See Xangle Research Asia Blockchain Gaming Deepdive). Benji Bananas, Arc8, and Sunflower Land are currently the most popular casual games on Polygon.

Benji Bananas

<Benji Bananas screenshot | Source: Google Play>

Released in 2013, Benji Bananas is a hyper-casual mobile game that has recently posted the highest 30-day user count. With cute monkey characters and simple controls, the hyper-casual genre had already crossed 50 million downloads since, even before the P2E mechanism was introduced to the game.

Benji Bananas started to morph into a blockchain game upon Animoca’s acquisition. Benji Bananas was acquired by Animoca Brands in 2018 and entered partnership with Yuga Labs' Apecoin DAO in 2022. Benji Bananas then launched its blockchain version in March 2022 and sold membership pass NFTs. Unlike its non-blockchain version, the P2E version of Benji Bananas allows users to earn $PRIMATE in proportion to the number of bananas acquired, which can be exchanged on centralized and decentralized exchanges.

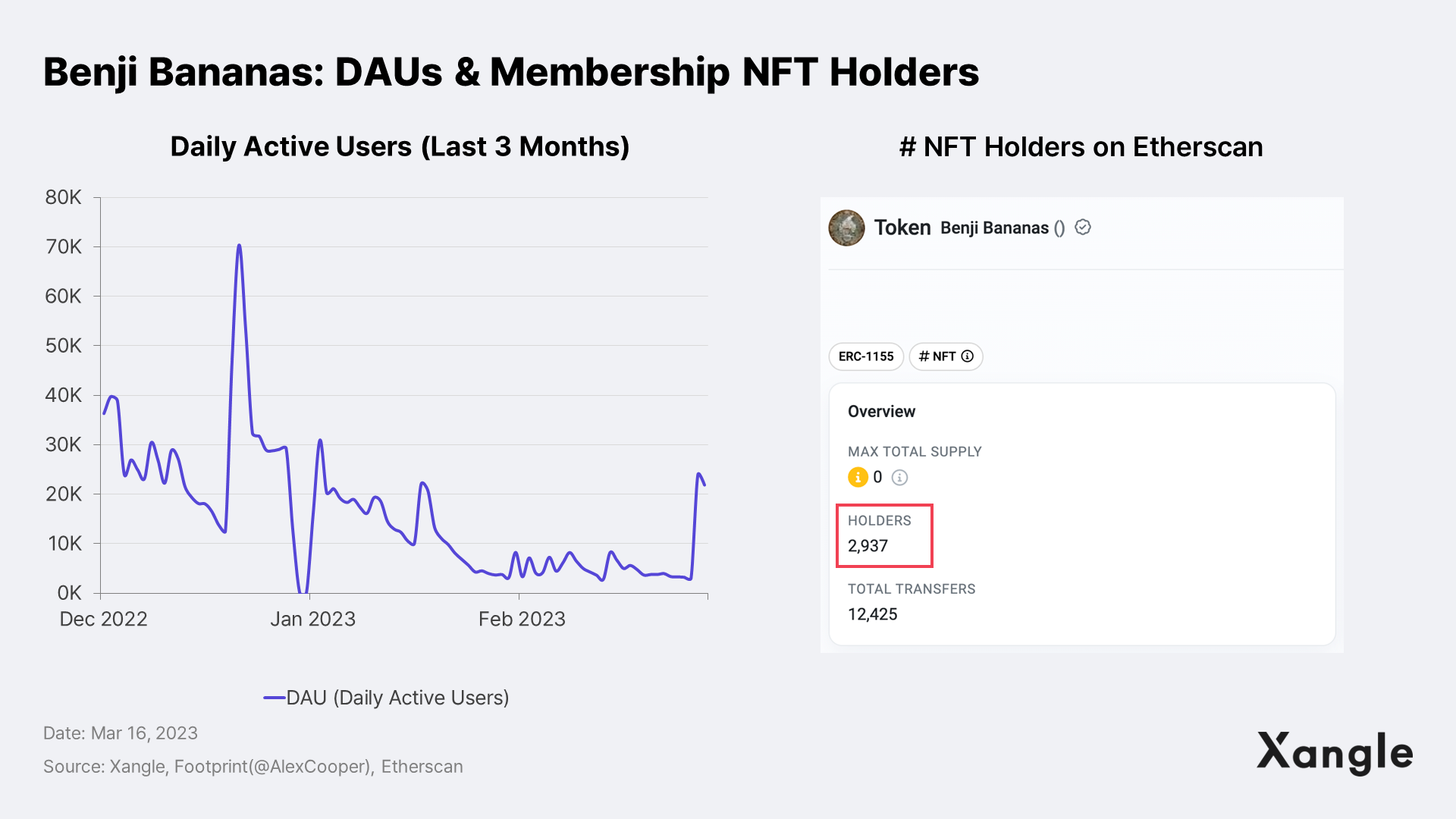

In the past three months, its daily active users (DAUs) have averaged around 15,000. Yet, not many seem to play the game to earn. Since membership passes are only available after completing KYC, there are around 2,900 membership pass holders. Hence, we estimate the percentage of players interacting with Web3 to be no more than around 19% over a period of last 90 days.

Arc8 by GAMEE

<Arc8 mini-games | Source: Games Docs>

Arc8, the fifth most popular game in the last 30 days, is a mobile game released in October 2021 by GAMEE, a subsidiary of Animoca Brands. Even before the acquisition, GAMEE already had more than 80 casual games and 13 million registered users. In this regard, Arc8 is a P2E game that builds upon GAMEE's proven success.

Arc8 is a gaming platform that offers 10+ mini games, where players get to compete in PvP against others. Arc8 can be played either in the standard or P2E version. While players can earn off-chain currencies called CREDIT, CREDITs cannot be cashed out. In the P2E version, players pay $GAMEE as an entry fee to compete, and winners get $GAMEE as a prize.

DAUs and transactions have steadily hovered around 10,000 and 30,000-50,000 except for mid-seasons. Yet, the number of $GAMEE holders disproportionately smaller than DAUs and transactions implies that there may be much fewer users who transfer $GAMEE earned to Web3 wallets.

Sunflower Land

<Farming simulation game | Source: Author's Sunflower Land>

Sunflower Land is a casual farming simulation game released in April 2022. Sunflower Land is a game where users expand their land and engage in activities like farming and gathering to grow their farms. To play the game, users have to first mint NFT character Bumskin and NFT farm Land. The price at this point is relatively low at 5 $MATIC. Users will then be able to harvest crops to cook and feed their characters to level up, or sell them to earn in-game currency, $SFL. Players can also collect items like wood and stones to enlarge the land of their farms.

Sunflower Land, which usually maintained 5,000 DAUs, saw a surge in the number in February. This is considered attributable to the launch of Treasure Island and acquisition of content derived from various events. It is important to note, however, that there are also ways game companies may arbitrarily increase the number of users by counting in all users who interact with the games’ logic contracts.

For more information on Sunflower Land, see Xangle Analytics: Sunflower Land.

3. Genres Are Increasingly Varied

Aside from casual games, Polygon is increasingly housing various genres, as illustrated by recent releases. Also, unlike casual games that can be played on the web without installation, most of the latest games require installation and high specs. In this section, we’ll introduce you to two of the most recently released games—Oath of Peak and Derby Stars.

Oath of Peak

<Oath of Peak screenshot | Source: Mike Fringe YouTube>

Oath of Peak is a mobile MMORPG released by ROC Games in January 2023. Set in a world of ancient myths and legends, users advance characters and take on quests and PvP battles in the game. Oath of Peak features Beast NFTs and on-chain token $PKTK. $PKTK can be exchanged for off-chain asset gPKTK to purchase in-game currency Shells, which can be used to level up Beast NFTs. The Shells earned can be used to earn gPKTK, which can then be exchanged again for $PKTK to cash it out. Being classified as P2E, Oath of Peak is currently unavailable in South Korea.

<Oath of Peak: Daily users and transactions | Source: Dappradar>

<Oath of Peak: Daily users and transactions | Source: Dappradar>

Oath of Peak gained 5,000-16,000 users in just two months of its launch, winning the 4th spot on Dappradar based on a 30-day user count. The majority of users are from the Philippines, Thailand, and Vietnam, according to Google Trends. Yet, the fact that large numbers of users in Southeast Asian countries play P2E games as part of their livelihoods can be a potential risk to the sustainability of the game as token inflation and subsequent drop in token price may result in user churn as has happened in the cases of Axie Infinity and MIR.

<Oath of Peak: Google Trends 3-month results by region | Source: Google Trends>

Derby Stars

<Early Access released by Derby Stars | Source: Derby Stars>

Derby Stars is a horse racing/training simulation sports game released by UNOPND, a subsidiary of Hashed in South Korea. It requires installation, and players get to buy, train, and race horses in the game. Derby Stars was originally developed on Terra, but moved to Polygon after the collapse of Luna. Derby Stars has recently released its Early Access version and racehorse NFTs, which are required to start playing the game. While the in-game currency, $CRT, allows users to nurture horses, $RUN earned from PvP will later be used to create items and breed horses.

<A plunge in the floor price of racehorse NFTs | Source: Derby Stars on OpenSea>

<A plunge in the floor price of racehorse NFTs | Source: Derby Stars on OpenSea>

The game is currently unavailable as Early Access ended on March 20. Although the alpha version will soon be released, the floor price of the racehorse NFTs has plummeted to 0.03 ETH since the end of Early Access, during which quests were underway for the $RUN airdrop.

4. Web2 Game Companies’ Participation May Spawn Growth

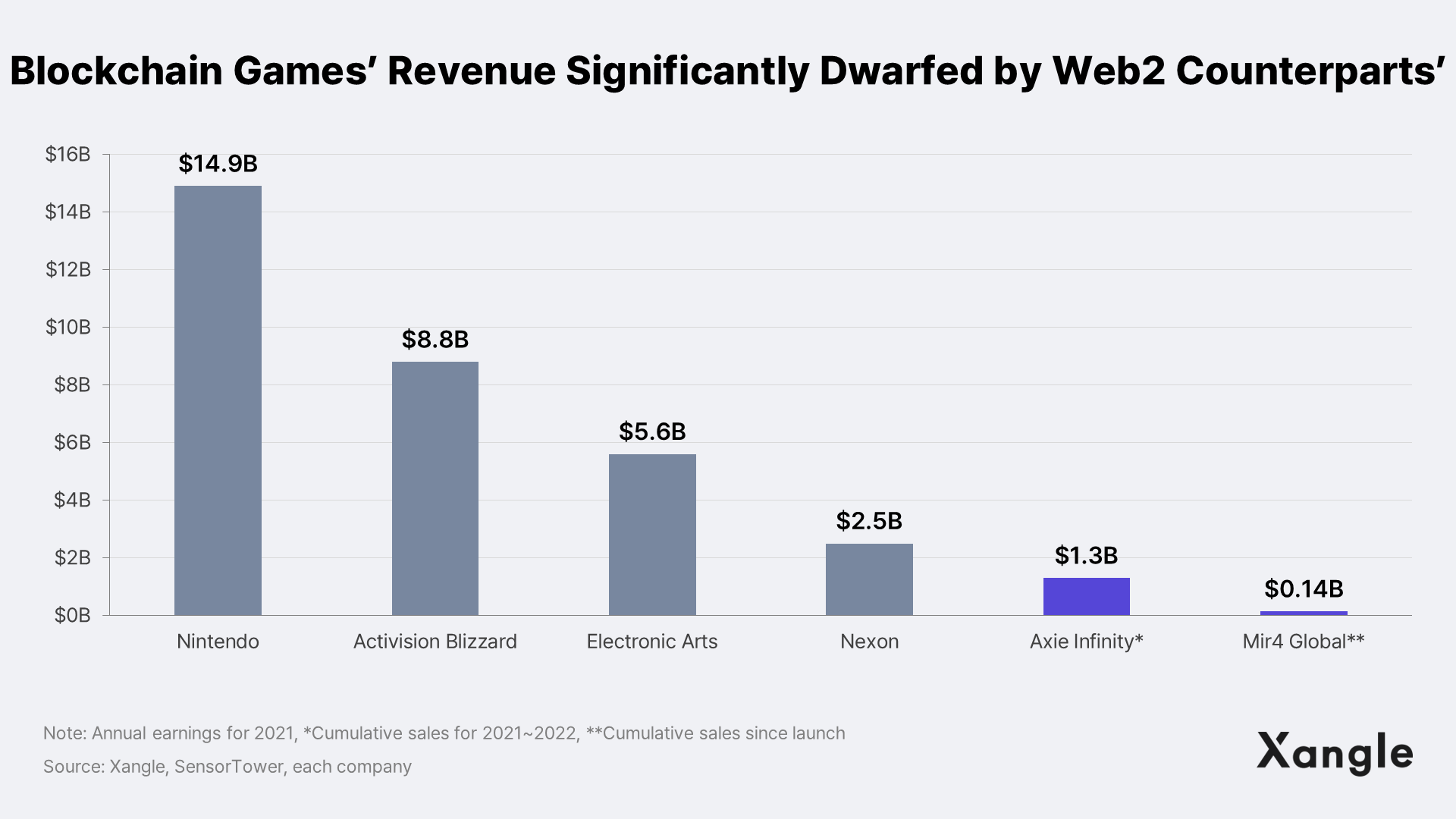

Despite numerous games available in the Web3 space, the size of the Web3 gaming market is significantly dwarfed by its Web2 counterpart. Participation of Web2 game companies, in this sense, is essential for the growth of the Web3 game market. On the positive side, game companies in Asia, such as Korea and Japan, have been keen on Web3 games. The most active players in South Korea, such as WeMade and Com2uS, rolled out their own mainnets, WeMix and XPLA, and are set to launch their own IPs soon. Japanese game companies are also looking to enter the blockchain gaming market, joining the network as validators on the Oasis mainnet.

Polygon is poised to traverse the bumpy terrain ahead, riding on its stellar partnerships with both Web3 and Web2 game companies, including Neowiz and Nexon. Neowiz, in particular, works most closely with Polygon and has already announced Intella X platform at Korea Blockchain Week in 2022. This year, blockchain spinoffs of its Web2 game IPs like AVA and BraveNine, will launch soon.

Nexon recently announced at 2023 Game Developers Conference (GDC) that it chose Polygon Supernets for its worldwide smash hit MapleStory. It says it will use Polygon Supernets to power blockchain gaming ecosystem MapleStory Universe and onboard games like MMORPG MapleStoryN. The fact that Nexon is leveraging its flagship IP, MapleStory, shows the magnitude of its commitment to Polygon and blockchain gaming.

Web2 game companies joining Polygon’s gaming ecosystem look set to augment the network’s games market. Plus, other mainnets perceived as competitors for now—namely WEMIX, XPLA, and OASIS—are expected to grow in tandem and work as a booster in the long run for the nascent blockchain gaming market, facilitating onboarding of users.

Other Related Research Reports