Product guy who does research from time to time

Translated by LC

Table of Contents

1. Ethereum Shanghai Update Brings LSD Back into the Spotlight

2. ETH Withdrawals: Enhancing the Protocol’s Financial Position

2-1. Minimal Risk of Revenue Loss

2-2. Improved Protocol Net Benefit Through Cost Reduction

3. The Upcoming Ethereum Staking Share Wars and Its Potential Impact on the DeFi Ecosystem

3-1. High Demand from LSD Competitors

3-2 Countermeasure of Lido, the No.1 Protocol

4. The Ethereum Liquidity Staking Set to Accelerate Amid Share Wars

1. Ethereum Shanghai Update Brings LSD Back into the Spotlight

What is LSD?

Liquid staking, also known as Liquid Staking Derivatives (LSD), is a service that enables users to stake their Proof-of-Stake (PoS) tokens while still being able to use them as collateral for other purposes. It accomplishes this by locking up the tokens and issuing derivative tokens that represent the staked tokens' value on PoS-based blockchain networks (for complementary reading, refer to Xangle’s Exploring Liquid Staking: A Comprehensive Guide to Understanding the Concept). Liquid staking gained attention prior to Ethereum's The Merge event but lost popularity after the FTX issue. However, there has been a renewed interest in liquid staking, primarily due to the Ethereum Shanghai update.

The scope of the Ethereum Shanghai update was determined during the Ethereum All Core Developers Execution call (ACDE) on Jan 3, 2023. Initially, two developments, namely EOF and the ability to withdraw staked Ethereum, were planned for the update. However, only the withdrawal of staked Ethereum on the Beacon chain was confirmed as a significant update following discussions among developers. The attention of the market is now on the LSD services impacted by the ETH withdrawal feature, given the subsequent release of the commissioned Zhejiang testnet and the scheduled release of the Shanghai update in April.

According to market analysts, the Shanghai update is expected to have a positive impact on the liquid staking protocol. Since the announcement, the average market capitalization of LSD, which includes Lido ($LDO) and Rocket Pool ($RPL), two prominent liquid staking platforms, has increased by more than 100% from its November lows. Furthermore, it is currently outperforming the DeFi sector's average performance (as measured by Jangle's DeFi Index XDEFI) by over 80%. Even after factoring in the recovery from the 2022 market crash, the market's anticipation for liquid staking protocols in this Shanghai update remains significant.

Nonetheless, it is my belief that we must closely examine the relationship between liquid staking protocols and the Shanghai update to determine whether there is a correlation between price hikes. Furthermore, I predict that the introduction of ETH withdrawals will serve as a catalyst in creating a more competitive environment for the Ethereum staking ecosystem, which has been relatively uneventful. In this article, I will discuss both topics in detail, analyzing the imminent "staking wars" and the potential growth of the staking liquidation sector after the update.

2. ETH Withdrawals: Enhancing the Protocol’s Financial Position

2-1. Minimal Risk of Revenue Loss

LSD Success Equation: Deposit Increase

In this section, we will explore how to gauge the performance of the Liquid Staking Protocol (LSD). LSD charges a fee on staked Ethereum as a means of generating revenue. Consequently, as the amount of deposited staked assets grows, the revenue increases, and as it decreases, the revenue decreases as well (Refer to Xangle’s Exploring Liquid Staking: A Comprehensive Guide to Understanding the Concept). As it is currently impossible to withdraw staked assets in Ethereum's case, the amount of Ethereum deposited in LSD has only risen.

However, what will happen after the Shanghai update? If users begin to withdraw their staked ETH, the amount of deposited ETH may decrease, resulting in a drop in revenue for liquid staking protocols. Nonetheless, I am of the opinion that the probability of a bank run after the Shanghai update is low, and I have three reasons to support my argument.

1) Staking Rewards Exceeding DeFi Returns

Ethereum staking rewards serve as the source of liquid staking rewards. Within the present liquidity constrained DeFi ecosystem, Ethereum staking provides the most dependable rate. Currently, staking rewards stand at approximately 4-5% (Lido Staking: 4.99%), which exceeds the liquidity pool deposit yield (DefiLlama APY Trend 6-month average: 2.7%) by over 2.2%, which is the standard yield in DeFi. When combined with MEV rewards (+0.4% on average) that are challenging for individual stakers to access, liquid staking becomes one of the most attractive investment opportunities in DeFi.

2) Ethereum Dynamic Staking Reward Model

Furthermore, the Ethereum staking reward system employs a dynamic reward model* that discourages quick withdrawals. If withdrawals of staked ETH persist, the staking APR could reach up to 22%, depending on the magnitude of the withdrawals (refer to Xangle’s research article, Upcoming Ethereum Shanghai Upgrade and What to Note). Even in the event of a bank run after the update, the increased staking rewards will still boost the demand for staking ETH.

* In Ethereum's dynamic staking reward model, rewards increase inversely as the staking rate decreases

3) Expanding the Utility of LSD Tokens

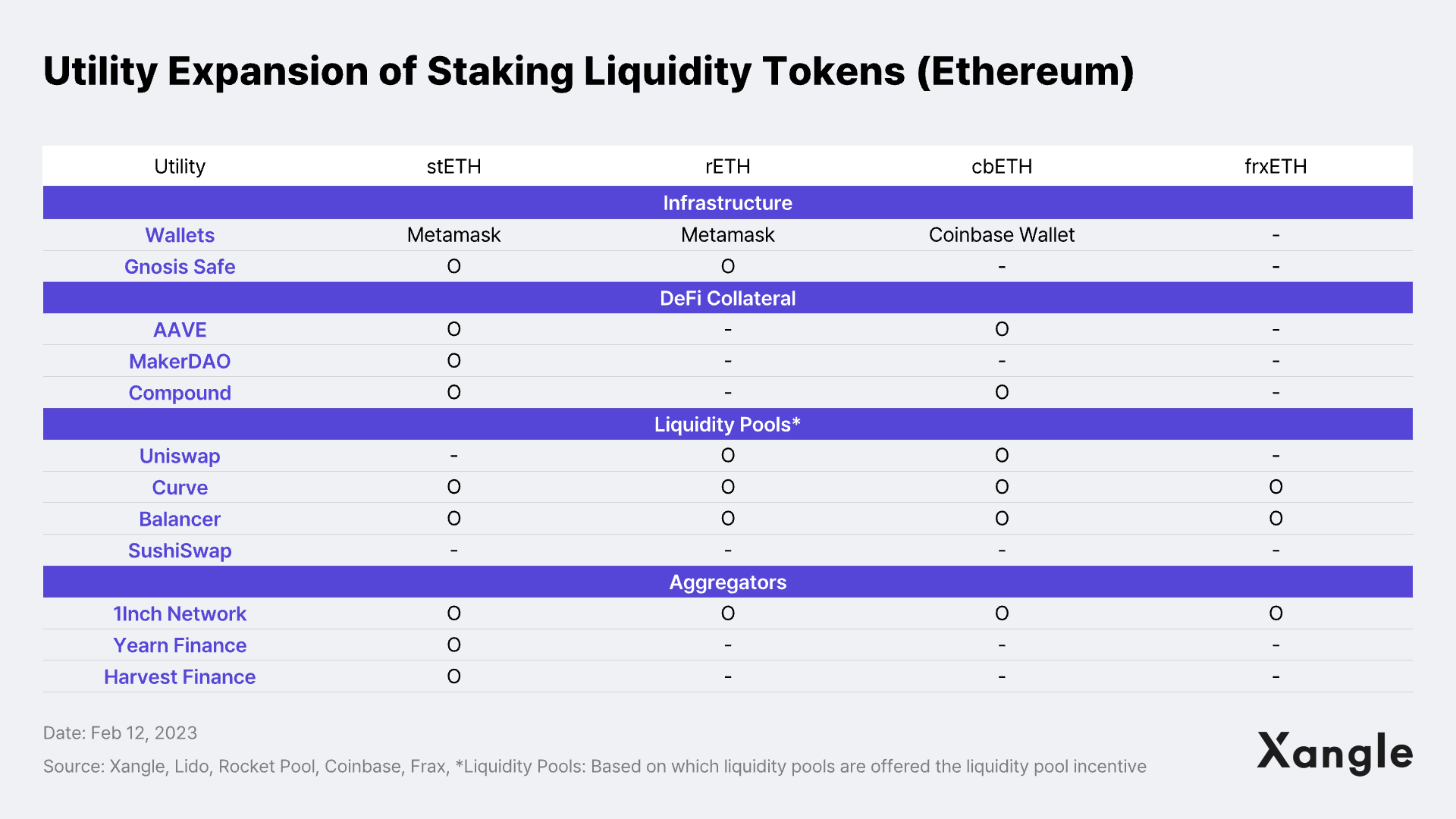

The extended utility of liquidity tokens of every liquid staking protocol (such as stETH, rETH, cbETH, frxETH, and others.) should be taken into consideration. These tokens serve as underlying assets or liquidity pool deposits for significant DeFi dApps such as Aave, MakerDAO, Curve, and others. Investors seek to generate additional value from liquidity tokens and staking rewards, rather than solely relying on staking rewards. This is why there is an increased demand for LSD protocols.

Based on the stability of Ethereum's staking rewards, the dynamic staking reward model, and the substantial utilization of its issued tokens, the probability of an Ethereum bank run on staking liquidity protocols, or a prolonged decline in deposits, is constrained, even with the withdrawal feature enabled.

2-2. Improved Protocol Net Benefit Through Cost Reduction

After examining the challenges associated with acquiring deposits, let us now shift our focus to the advantages that LSD will enjoy from the Shanghai update, specifically the Liquidity Pool Incentives (LP Incentives) which a liquid staking protocol must provide for the exchange of staked assets and tokens (ETH-xxETH).

Liquid staking protocols provide liquidity for staked assets

A liquid staking protocol is a type of protocol that commits to the liquidation of staked assets. This commitment creates a responsibility to offer adequate liquidity to the market for exchanging staked assets for staking rewards, as well as for certificates that are issued after staking. To fulfill this responsibility, many protocols facilitate the swapping of A tokens, the staking asset native to the platform, with A tokens that serve as evidence of custody and staking operations (e.g., Rocket Pool: rETH-ETH).

Liquidity Pool Incentives Account for a Significant Portion of Protocol Costs

At present, the dominant approach to providing liquidity for token swaps in DeFi is through Automated Market Makers (AMMs) and Liquidity Pools (LPs). To ensure that the depth of liquidity pools for DeFi swaps is maintained, the majority of protocols provide their own token incentives to those who deposit liquidity into the pools.

Let us consider the case of Lido ($LDO), the current leading platform. To ensure a liquidity pool for ETH-stETH swaps on Curve and Balancer, Lido provides additional LDO tokens to liquidity pool depositors (LP Providers), on top of their usual LP rewards. As part of its operational expenses, Lido currently distributes approximately 4M LDO tokens per month on average, which represents over 70% of the liquidity pool incentive for all staking assets (stETH, stDOT, stATOM, stMATIC, etc.) pegged by Lido. This allocation of incentives to uphold liquidity pools is a recurring challenge for almost all liquid staking protocols that operate such pools for swaps.

Improved Balance Sheet Following the Shanghai Update

The Shanghai Update results in a reduction of the "Liquidity Pool Incentives" that were previously paid at a substantial cost to ensure sufficient liquidity for the withdrawal of Ethereum held on behalf of the protocol.

In the past, Liquidity Service Providers (LSDs) had to maintain deep pools to ensure liquidity for withdrawals that were not supported by the Ethereum network. However, with the recent introduction of protocol-level withdrawals, the responsibility of providing liquidity has reduced, enabling them to maintain shallower liquidity pools. Consequently, LP incentives paid to liquidity pool depositors have decreased, reducing the cost of LSD, and increasing the net revenue of the protocol.

Reduced Supply is an Added Benefit

In addition to the protocol's net profit, the token supply may also decrease as a result of reduced LP incentives. With fewer new tokens in circulation, protocols that have lower token inflation and greater incentive reduction may benefit from a supply perspective. In addition to the protocol's net profit, the token supply may also decrease as a result of reduced LP incentives. With fewer new tokens in circulation, protocols that have lower token inflation and greater incentive reduction may benefit from a supply perspective.

The Shanghai update is a significant development in the DeFi space that provides projects with an additional unstaking pathway, in addition to liquidity pools, that is directly supported by the protocol. As a result of this update, protocols can potentially use the cost savings to improve their financial health or expand their ecosystem by supporting other chains. Moreover, distributing fewer LP incentives could lead to a supply-side benefit of reducing the amount of new supply of each protocol token. Overall, the Shanghai update has generated a lot of interest in liquid staking projects, which leverage the benefits of staking and liquidity provision to enable users to participate in both activities simultaneously.

3. The Upcoming Ethereum Staking Share Wars and Its Potential Impact on the DeFi Ecosystem

While the recent performance of liquid staking protocols has been strong, the battle for Ethereum staking share after the Shanghai update will be critical in the medium to long term. This competition will involve newcomers vying to take away Lido's dominant market share ($LDO) and could result in a significant shift in the liquid staking and staking markets.

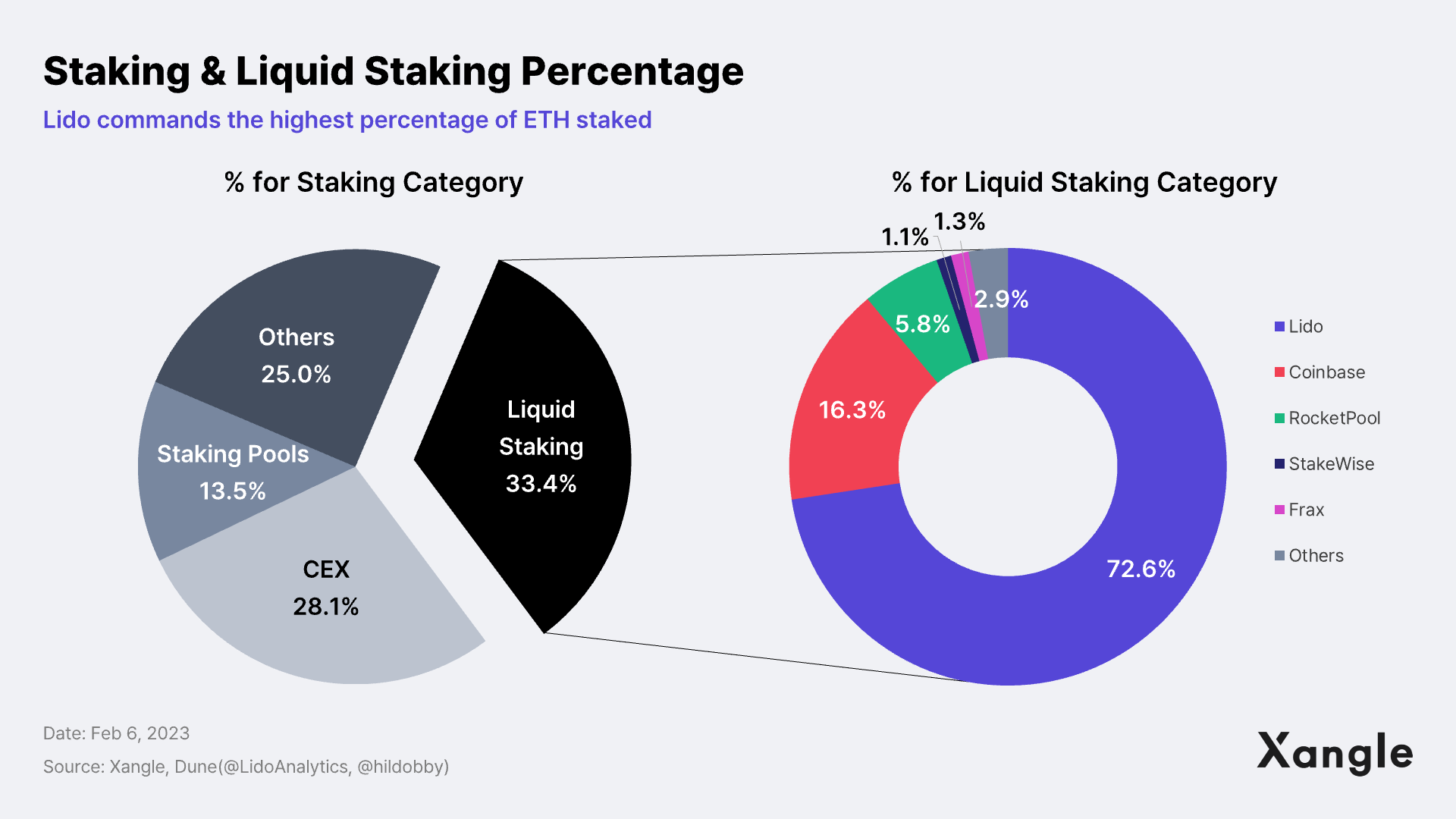

Significance of Lido's Market Position in Ethereum's Staking Economy

Lido's market position in the Ethereum staking economy is significant, with the protocol currently holding 29% of Ethereum staking. In the liquid staking protocol sector, Lido is even more dominant, commanding an impressive 72.6% market share, excluding centralized exchanges and staking pools. Liquid staking protocols are essentially smart contracts that enable users to participate in staking and liquidity provision activities simultaneously (for more information, see Liquid Staking on Xangle). Lido's dominant position in the Ethereum staking economy is significant and cannot be ignored.

The real battle for Ethereum staking share began post Merge. Prior to that, in 2021, only Lido's stETH was widely accepted across large-scale DeFi protocols such as Aave, Compound, and MakerDAO. However, staking users now have a plethora of options to choose from, including Coinbase's $cbETH and Rocket Pool's $rETH.

Lido has not been performing as well as its competitors, such as Rocket Pool ($RPL), Coinbase ($cbETH), and Frax Finance ($FXS) since the Merge update. As withdrawal capabilities have been added, other protocols are expected to make a major push to capture the $ETH that has been deposited on Lido since late 2020. Competing LSD protocols include Rocket Pool's $rETH, Coinbase's $cbETH, and Frax Finance's $frxETH. It will be interesting to observe how Lido's strategy compares to theirs and how their portion of Ethereum staking evolves.

3-1. High Demand from LSD Competitors

1) Rocket Pool - Advancing Decentralization in Blockchain Technology

Over the past few years, the cryptocurrency industry has grown more cautious about situations where a small group of operators holds significant power and the monitoring system lacks transparency, as exemplified by the UST de-pegging and FTX-Alameda controversies. Rocket Pool, on the other hand, is a liquid staking protocol that prioritizes the importance of decentralization to address this issue. It achieves a high level of decentralization by enabling anyone to partake in node operations through permissionless pools. This feature has made Rocket Pool increasingly popular, as it is highly resistant to censorship.

Recently, the SEC has imposed strict regulations on Kraken's staking services due to the company's unclear management of client assets in custody. However, Rocket Pool manages staked Ether through contracts with individual node operators and operates as a Decentralized Autonomous Organization (DAO), which significantly reduces the regulatory risk compared to Centralized Exchange (CEX) staking, where operations are often conducted in a black box, and Lido, which has a highly closed node operation.

With Rocket Pool’s Atlas upgrade, the amount of Ethereum necessary to operate an Ethereum validator node* will be reduced from 16ETH to 8 ETH. This change is expected to enhance the utilization of RPL tokens**, which are vital for node operations, and lead to an increase in the number of users participating in node operations. As a result, Rocket Pool is anticipated to become one of the most promising protocols for the future after the Shanghai update.

* To become a validator on Ethereum, users must stake 32 ETH

** RPL tokens are essential for node operations as a deposit and also enhance staking rewards.

A Tweet announcing that 8-ETH lower ETH bond minipools (LEB8s) will be added in the Atlas upgrade

2) Coinbase $cbETH - Bridging the Convenience of CEX with DeFi

Kraken and Binance, centralized exchange (CEX) based staking services, hold a significant advantage in capturing market share by leveraging the ease of use and web 2.0 convenience without differentiating between retail and institutional investors. Coinbase's Ethereum staking service is particularly noteworthy, as it stakes Ethereum and converts it into cbETH tokens, which are liquidity tokens. This enables users to conveniently use the Ethereum staking service within the exchange without undergoing the wallet-to-protocol connecting process in traditional DeFi and obtain a liquidity token as proof of their stake.

Kraken's recent $30 million settlement of the SEC's complaint on February 9th has increased the risk of exchange staking despite its conveniences. Nonetheless, I believe that Coinbase's staking service is less likely to be classified as a security because it differs from other CEX staking services by incorporating some of the non-custodial staking features through securitization*. This allows users to receive $cbETH issued through contracts, ensuring transparency of operations, and enabling them to establish various investment strategies such as position liquidation and lending, utilizing the DeFi ecosystem.

*Kraken announced on February 9 that it would pay a $30 million fine and terminate its Ethereum staking services in the United States. This announcement has raised concerns about Coinbase's $cbETH staking service, we believe that there are evident contrasts between Kraken and Coinbase's operations that make it improbable for them to be classified as securities. Specifically, these differences arise from 1) operational transparency and 2) payout rights. While Kraken didn't provide any financial information on staking returns, Coinbase publishes comprehensive financial reports on its staking service quarterly. Furthermore, Coinbase's Chief Legal Officer confirmed on Twitter that Kraken had the discretion not to payout staking returns to customers, whereas Coinbase's customers have the right to the returns.

Recently, the utility of $cbETH has been enhanced by its addition as a collateralized asset on Aave ($AAVE). Provided that Coinbase's staking service adheres to regulatory standards, the $cbETH ecosystem is expected to grow due to the exchange's institutional friendliness and ease of use.

3) New Competitor on the Block: Frax's $frxETH

In October 2022, Frax Finance ($FRAX) launched $frxETH and $sfrxETH tokens for its Ethereum liquid staking service, as part of its decentralized stablecoin protocol. The $frxETH token differs from the existing liquid staking mechanism, which involves deposit and liquidation, by being split into three stages: deposit ($ETH), liquidation ($frxETH), and monetization ($sfrxETH). While this may not be immediately intuitive, the idea is to separate the tiers based on their respective purposes, namely receiving staking revenue or utilizing collateral assets in DeFi.

Frax issues $frxETH as wrapped tokens, which can be utilized by other financial institutions in their lending protocols as collateral to issue stablecoins or deposited into liquidity provider (LP) pools for additional rewards (yield). Alternatively, they can be converted into sfrxETH to receive staking rewards.

To earn staking revenue, users must deposit frxETH and convert it to sfrxETH on Frax.

The structure of frxETH-sfrxETH on Frax is similar to the issuance and distribution structure of land collateralized revenue bonds that are issued by real estate trusts, although the purposes are different. In this structure, a trust company (LSD, a liquid staking platform) issues revenue certificates ($frxETH) using land ($ETH) as collateral, and various financial institutions (such as CDPs, Aave, MakerDAO, etc.) use them as collateral for loans, which are issued in the form of stablecoins such as $DAI and $USDC.

Although the utility of frxETH-sfrxETH may still be somewhat limited, it is currently feasible to generate $FRAX stablecoins by using sfrxETH as collateral, and there is predicted to be a mutual benefit with FRAX's stablecoin ecosystem. Moreover, the ability for issuers to easily integrate liquid staking services into their existing DeFi infrastructure provides a significant advantage over other protocols.

One of the available infrastructures is Curve ($CRV) StableSwap. As the second-in-command to Convex Finance ($CVX), which currently manages the distribution of incentives on Curve, Frax can use its influence on Curve to provide more appealing incentives for liquidity pool participation. By offering incentives within Curve, the frxETH-ETH liquidity pool has the highest reward rate (6.62% as of February 21, 2023) compared to other Ethereum stablecoin pools (xxETH-ETH), making this an attractive liquid staking protocol to consider.

3-2. Countermeasure of Lido, the No.1 Protocol

Lido is continuously advancing. As a leading protocol, it's developing robust defense mechanisms to protect against aggressive attacks from rival protocols. The most notable among these efforts are Lido's 1) cross-chain and layer 2 scaling solutions, 2) significant decentralization initiatives, and 3) Lido V2.

1) Unlocking Business Growth: The Benefits of Diversifying with Multi-Chain and Layer 2 Scaling

At present, Lido's market capitalization to TVL (TVL/M. Cap) ratio surpasses that of any other liquid staking platform on Ethereum. Hence, instead of focusing solely on Ethereum, the company aims to diversify and expand its operations to other Proof-of-Stake based chains, including Layer 2 solutions.

As part of its expansion plans, Lido is gradually enhancing the utility of $stETH. It includes bridging $wstETH to Layer 2 on Optimistic rollups like Arbitrum/Optimism in the form of $wstETH. Lido also supports staking assets from other PoS chains, both Non-EVM and EVM-based, such as $MATIC, $DOT, $ATOM, and $SOL. Lido has already evolved into a cross-chain liquid staking protocol, extending beyond Ethereum. In terms of scalability, there are currently no comparable projects to Lido.

2) Intensifying Commitments to Enhance Transparency and Decentralization

Moreover, the recent high level of decentralization among Lido's internal validators, combined with the upcoming dual governance system, addresses concerns related to centralization and censorship. Lido's decentralization metrics, including the dispersion of consensus clients and the geographic distribution of validator nodes, continue to improve. The dual governance framework includes various compensatory and preventive measures to avoid excessive dominance of Lido, such as granting existing stETH holders the right to veto proposals related to Lido governance.

3) Lido V2 – Staking Router

Lido V2 and Staking Router

The announcement of Lido V2's Staking Router on February 7th aims to address the contentious centralization issue surrounding Lido's permission pool. The Staking Router, a controller contract currently in development, will make Lido's liquid staking infrastructure accessible not only to solo stakers but also to collectives such as DAOs and staking pools, ending the whitelist-based operation of Lido's permission pool.

Lido's Staking Router, which was announced in Lido V2, enables external groups such as staking pools and DAOs to operate nodes in a permissionless manner and utilize Lido's liquid staking infrastructure.

The Staking Router announced in Lido V2 is a significant step towards a permissionless liquid staking platform, addressing criticism around the protocol's centralization issues. With this development, Lido can now accommodate external groups such as other DAOs and staking pools to operate nodes in a permissionless manner, freeing it from its previous permissioned pool status. Additionally, the V2 announcement partially de-privatizes the infrastructure, potentially mitigating securities risks associated with staking services in light of the SEC's recent allegations against Kraken. Lido's efforts to address centralization and security concerns demonstrate its commitment to providing a reliable service. This will likely maintain Lido's edge over competing services like Rocket Pool and Coinbase Staking, which will have to work hard to attract users.

4. The Ethereum Liquidity Staking Set to Accelerate Amid Share Wars

The LSD Share War Commences

The Shanghai update can be compared to a scenario where a bank's savings product is transformed into a deposit and continues to provide attractive rates even after the conversion. With the implementation of the update, we anticipate that banks, specifically Liquidity Staking Providers (LSDs), will engage in more intense competition to acquire customer deposits in ETH, as their expenses are projected to decrease.

After the Shanghai update, it is expected that other Liquidity Staking Provider (LSD) services will launch an all-out effort to acquire the significant share of Ethereum staking currently held by Lido. Prominent players in the field, including Coinbase's $cbETH, Rocket Pool's $rETH, and Praxis' $frxETH-$sfrxETH, will be involved in this competition. Despite being the clear leader, Lido ($stETH) is well aware of this and has been proactively working on an expansion policy to prepare for the post-update battle. This includes decentralization and internal reorganization led by Lido V2. An arms race has already begun to prepare for the upcoming share war after the Shanghai update.

The Reason Why the Forthcoming Share War Crucial

Despite the aggressive tone, the upcoming share war is expected to have a positive impact on the structural stability of Ethereum's staking layer, which is anchored by the LSD. By decentralizing the staking ratio that has been heavily concentrated in existing lidos, this competition is likely to strengthen the overall system. Additionally, with recent developments in the Ethereum network giving more power to the validator layer, which includes the LSD, adequate decentralization of the staking layer has become increasingly crucial.

An example of this is EIP-4895 (Push-based Ethereum Withdrawals), which will be included in the Shanghai update. This proposal reinforces the power of validators and node operators (e.g., liquid staking protocols, staking pools) who directly engage with the consensus layer. This is due to the fact that the withdrawal authority is delegated to the validator's withdrawal key, and the node operator (validator) serves as a gateway that must be passed through during the withdrawal process. With this validator-dependent withdrawal feature, the decentralization of liquid staking, which holds a significant amount of ETH, is expected to be a crucial factor in the ecosystem's growth. As a result, we believe that further decentralizing the validator layer through the forthcoming share wars is crucial.

Share Wars: Boosting Liquid Staking as Crypto-Economic Infrastructure on EthereumShare Wars: Boosting Liquid Staking as Crypto-Economic Infrastructure on Ethereum

What comes after the share wars? As the adage goes, "the ground hardens after the rain," and I am confident that the share wars will enhance the decentralization of the validator layer, enabling liquid staking to thrive as a crypto-economic infrastructure on Ethereum. By enabling ETH withdrawals, Ethereum's staking system is near complete. As costs decrease, the sustainability of the liquid staking protocol will improve, and the structural concentration of staking shares in Lidos will diminish after the war. Therefore, the timing is perfect for liquid staking to flourish with the Shanghai update.