Translated by elcreto

Table of Contents

1. Intro

2. State of Solana Infrastructure: FTX Fallout Has Fizzled Out and Network Is Getting Better Instead

2-1. Post-FTX Infrastructure Check: Low Impact on Consensus Layers

2-2. Network Stability and Performance on the Rise

2-3. The 2023 Lineup: Taking Its Infrastructure to the Next Level

3. State of Solana Ecosystem: New Content Expected to Drive Growth

3-1. Post-FTX Ecosystem Check: No Major Damage Found Except in DeFi

3-2. Steady Increases in Content

3-3. An Increase in Collaboration with Global Web2 Companies

3-4. Launch of Saga Signaling Potential Content Expansion

4. Final Thoughts

“Some smart people tell me there is an earnest smart developer community in Solana, and now that the awful opportunistic money people have been washed out, the chain has a bright future” - Vitalik Buterin

1. Intro

Two months on since the downfall of FTX, the price of $SOL plummeted to a third of its pre-FTX level, and some seem to reckon that Solana will never be the same again. I see it differently. Solana is one of the handful of layer-1 blockchains that carries the potential to bring about mass adoption. On top of that, our analysis of Solana’s infrastructure and ecosystem found that the damage the FTX meltdown has done to the network falls within a manageable range.

2. State of Solana Infrastructure: FTX Fallout Has Fizzled Out and Network Is Getting Better Instead

Rumors are spreading that validator nodes are leaving the chain en masse in the wake of the FTX collapse. Yet, the on-chain data says otherwise, and the market’s concern is deemed excessive. The number of validator nodes did retreat but hardly any data backed the claim of exodus. Rather, stability and throughput of the network are improving. Also of note are the various upgrades being made to Solana’s infrastructure, including new consensus client, MEV solution, and SVM-based L2 protocol. I will discuss this in more detail in the following section.

2-1. Post-FTX Infrastructure Check: Low Impact on Consensus Layers

Solana’s fundamentals remain strong. Although the $SOL staking rate and the number of validator nodes have edged downwards, the records are not as concerning as it sounds. As of Dec 30, 2022, the overall staking rate dipped from 73.9% in 3Q22 to 71.3%, and validators participating in the consensus process was down 2.5%. While the Nakamoto coefficient slid from 31 to 30 as a result, the figure is still higher than most other blockchains.

In addition, the high degree of decentralization is quite obvious from the distribution of data centers hosting Solana nodes. Solana validators are spread out across over 138 data centers in around 25 countries. Not a single data center hoards more than 30% of the nodes, which also remains true when it comes to the amount of $SOL staked in each data center. Even OVH SAS, which hosts the largest number of Solana nodes, represents only 27%. Quite likely, Hetzner Online GmbH’s Nov 2022 decision to block all Solana nodes has had an impact on such a high level of decentralization.

Again, this goes the same for the staking rate of each validator. Even Coinbase that has the highest staking rates dominates only 2.4% of the total SOL staked. The second and third largest stakers are Staking Facilities and Binance, making up 2.1% and 1.6%, respectively.

2-2. Network Stability and Performance on the Rise

Network outage has long been Solana’s biggest challenge. But the number of outage events was significantly down in 2022. This is thanks to Solana core team’s (Solana Labs) continued effort for enhanced stability as illustrated by constant upgrades to the protocol layer, including introduction of QUIC, stake-weighted QoS, and local fee market.

A. QUIC Transport Protocol (Released): Enhancing Stability

QUIC (Quick UDP Internet Connection) is a new UDP-based data transfer protocol developed by Google that has achieved higher speed and network stability and added more control units. QUIC’s simpler handshaking process makes the protocol more responsive than TCP and other connection protocols. It also has session management features that regulate client-server connections and flow control mechanisms that manage data flow, reduce congestion, and achieve a higher level of stability than UDP. Moreover, QUIC does not suffer from HOL blocking because it keeps transmitting streams except for streams that lost packets, for which it would wait for retransmission. Most validators and RPC nodes have already adopted QUIC, and the 1.13.4 validator client will employ it as its default data transfer protocol.

B. Stake-Weighted QoS (Released): Limiting Maximum Packet Size Transmitted by Each Validator

Solana processes and validates transactions on a first-come, first-served basis, regardless of transaction type or source—even if they are repetitive and meaningless bot transactions. The introduction of stake-weighted QoS has limited the size of packets validators nodes send to leader nodes and set the maximum packet size proportional to the amount of $SOL staked. For instance, if Validator A has staked 0.5%, the maximum packet size transmissible will be limited to 0.5%. A type of spamming where a validator could swamp the network by sending a massive amount of transactions to a leader node to take up 50% of the network capacity is no longer possible.

C. Local Fee Market (Partially Released; RPC nodes and wallets to be supported later on): Upping the Cost of Spamming

The introduction of local fee markets has limited fee competition to specific dApps, markets, auctions, or AMM pools. Unlike Ethereum, the foremost benefit of local fee markets is keeping the fees of the rest of the network unaffected by fee spikes from intense competition for block space for specific transactions. Put differently, hype for a specific NFT that renders the minting gas fee exorbitant will not have a significant impact on token swap fees on Raydium.

Introduction of fee markets not only helps prevent spamming but increase demand for $SOL as well as revenue for the supply-side (validators). What keeps the demand for $SOL low has been Solana’s gas fee per transaction, which is almost minimal at around 5,000 lamport (0.000005 $SOL). Users have been able to execute hundreds or thousands of transactions with less than 1 $SOL, but validator rewards for creating blocks have also been low. Once local fee markets are introduced, users will have to buy more $SOL, and validators will be rewarded more—which will further incentivize more validators to come on board. Fee bumping is steadily on the rise, representing 40% of all transactions as of December 28, 2022.

D. Compact Vote State (Testnet Released)

Vote transactions that arise from inter-node communication is a type of transaction that takes up the largest portion on the Solana network. How the process is designed directly impacts the network bandwidth and block size. At the same time, a reduction in the size of a vote transaction—even by a few bytes—will dramatically improve the quality of the network by decreasing the amount of data transferred between and stored in nodes.

E. Increased Transaction Size (Under Development)

Currently, the maximum size of a transaction on Solana is 1,232 bytes. The size limit has gotten in the way of interoperability and composability of dApps. Development to augment transaction size is underway since the introduction of QUIC has enabled an increase in the size of a transaction.

F. NFT Data Compression (Under Development)

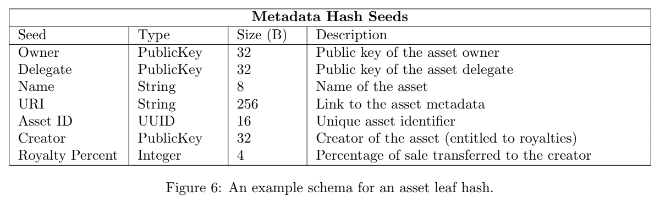

High storage cost has been a major drag for the mass adoption of NFTs. In an attempt to reduce storage costs, Solana Core is considering compressing data by having NFT metadata hash seeds (Owner, Delegate, Name, URI, Asset ID, Creator, Royalty %) hashed at once. Theoretically, leaving only the compressed minimum data that needs to be permanently recorded on the chain, while storing the original data in the existing database solution, can radially lower the storage cost from $1.14M to $248.

2-3. The 2023 Lineup: Taking Its Infrastructure to the Next Level

Now, the external improvements being introduced to Solana’s infrastructure, on the other hand, include: MEV solution (Jito), consensus client (Firedancer), and SVM-based layer 2 (Nitro, Eclipse).

A. Sealevel Virtual Machine (SVM) Based Layer 2 Protocols

While the reign of EVM is so dominant in the crypto space that L1 and L2 blockchains most often tout EVM compatibility as their competitive advantage, the first SVM-based layer 2 protocols, Nitro and Eclipse, have debuted. Nitro is a Sei-based, EVM-compatible optimistic rollup whereas Eclipse is a solution for building SVM-based rollups. Eclipse will use Celestia as its first DA (Data Availability) layer. Nitro and Eclipse cited speed and efficiency—or technical superiority, in other words—as reasons for choosing SVM over EVM. The team seems to have reckoned that the benefits SVM has to offer outweighed what tapping the Ethereum developer community could offer.

SVM's competitive advantage comes from parallel computation. While EVM and WASM-based runtime employs a single thread to process transactions or contracts linearly, SVMs are multi-threaded, allowing processing speeds to be determined by the number of cores a validator has.

Then, what enables parallel computing in SVM? A Solana transaction has an instruction vector, where every instruction contains 1) program ID, 2) program instruction, and 3) a list of accounts to read or write data. This allows the SVM to pre-classify transactions according to instruction type, and orders independent transactions to be processed in parallel by different threads. This is why using SVM requires CPU/GPU that supports SIMD (Single Instruction, Multiple Data) and why it is necessary to have a multiprocessor with AVX (Advanced Vector Extension) to become a validator on the Solana network.

Maximized hardware utilization renders SVM more attractive than EVM and is the reason projects like Nitro and Eclipse have opted to be compatible with SVM instead of EVM. Of course, SVM’s high performance makes becoming a Solana validator expensive, but the cost of HW tends to go down over time. While it remains to be seen whether SVM emerges as a viable alternative to EVM, an increase in the number of projects choosing SVM over EVM does seem to bode well. I personally believe SVM has the potential to become the standard development environment for blockchain developers.

B. MEV Solution: Jito-Solana

Similar to Flashbots’ MEV-boost solution, Jito-Solana is a Solana validator client for MEV that activates MEV marketplaces. Yet, Jito-Solana works differently from MEV-boost as Solana does not have a mempool by design. Instead of mempool, Solana adopted Gulfstream, a technology where the order of leader nodes is pre-determined (pre-deterministic), and RPC/validator nodes send transactions to prospective leaders in advance*. Gulfstream enables validators to process transactions more efficiently, reduces memory overload, and allows them to switch leaders more swiftly. Moreover, Jito has introduced a liquid staking mechanism to its MEV solution (e.g., JitoSOL), giving $SOL holders tools to extract MEV and help expand the DeFi ecosystem.

*Block creation process: A user submits a transaction → A dApp sends the transaction to the RPC server via the sendTransacation HTTP API call → The RPC node verifies the transaction, converts it to a UDP packet, checks the leader's schedule, and sends the transaction to the next leader's TPU (Transaction Processing Unit) → The leader processes the transaction and sends the final state to the validators → The validators verify the final state and send the voting results to the leader.

The absence of a fee market in Solana has made the introduction of an MEV solution an urgent matter as triggering a bulk of MEV transactions has been the only way for an MEV searcher to increase the likelihood of MEV gains. Moreover, because transaction fees on Solana are almost minimal compared to Ethereum, submitting a large volume of transactions is not cost-prohibitive. MEV bots have taken advantage of these traits to spam the network. Solana's MEV failure rate, however, shows that such method of MEV extraction is terribly inefficient (since the probability of liquidation failure is close to 100%, while arbitrage failure is over 90%). Wider adoption of Jito-Solana by validators has the potential to reduce spam transactions and facilitate the formation of an efficient MEV market.

C. Solana's 2nd Consensus Client: Firedancer

Firedancer is Solana’s C++ consensus client developed by Jump Crypto (Jump Trading). Specializing in algorithmic and high frequency trading (HFT) strategies, speed and stability are the key focuses of its development of Firedancer. In a live demo during presentation at Breakpoint 2022, Kevin Bowers of Jump Trading showed Firedancer could process up to 1.2M TPS.

Once launched, Firedancer will make Solana the second blockchain to have more than one client (the first being Ethereum). Having multiple clients increases network stability as the same bugs are less likely to exist in two clients. This way, a problem in one client does not affect nodes using other clients. The launch of Firedancer is slated for late 2023 or 2024 at the earliest.

D. xNFT

xNFT stands for executable NFT. It literally means NFTs that contain executable codes and is a new Solana token standard being developed by Coral (Coral is the creator of the Anchor Program Registry, the most widely used developer toolkit on Solana). xNFT not only enables creation of tokenized Web3 applications with its plugin system but are also executable within wallets. Also under development is a wallet for xNFTs called Backpack. If Backpack is likened to Apple’s App Store, xNFTs are like apps in the App Store. Currently, private alpha testing of xNFT is underway.

Once released, Backpack and xNFTs are expected to bring improvements to existing Web3 wallets primarily in two different ways.

- UX: Backpack will significantly improve the UX by allowing users to access all of their xNFTs and use services within a single user interface, e.g., staking DeGods, viewing Aurory DNA, and buying and selling NFTs in Magic Eden. Once Backpack’s service is advanced enough, it may not be too far-fetched to expect a WeChat-like superapp from it. Currently, more than 40 dApps have released xNFT versions, including Solend, Audius, Aurory, and Mean Finance. Backpack OS would introduce development and wallet customization as well as support for multiple blockchains, Ethereum, Solana, and Polygon.

- Security: Much like the current Web3 environment at play, the early-stage Internet was riddled with viruses. Then came the launch of app stores, which was a breakthrough. As they continue to filter out unsafe programs, virus infections have significantly dropped. Backpack is expected to play a similar role. An attack vector usually arises when DApps require users to link their wallets to access the services. Along with the multi-seed support, Backpack’s elimination of wallet linking process is signaling a more secure environment.

3. State of the Ecosystem: New Content Expected to Drive Growth

While it is true that the Solana ecosystem has lost one of its strongest allies, FTX, a recent report published by the Solana Foundation showed that the direct damage is limited, except for a few projects, such as Sollet and Star Atlas that have held treasury funds in FTX. Most concerning is the DeFi sector though, which saw its TVL plummet by a fifth as token prices dropped. Despite a slight decline though, the number of transactions, developers, and users on the Solana network are holding up strong.

3-1. Post-FTX Ecosystem Check: No Major Damage Found Except in DeFi

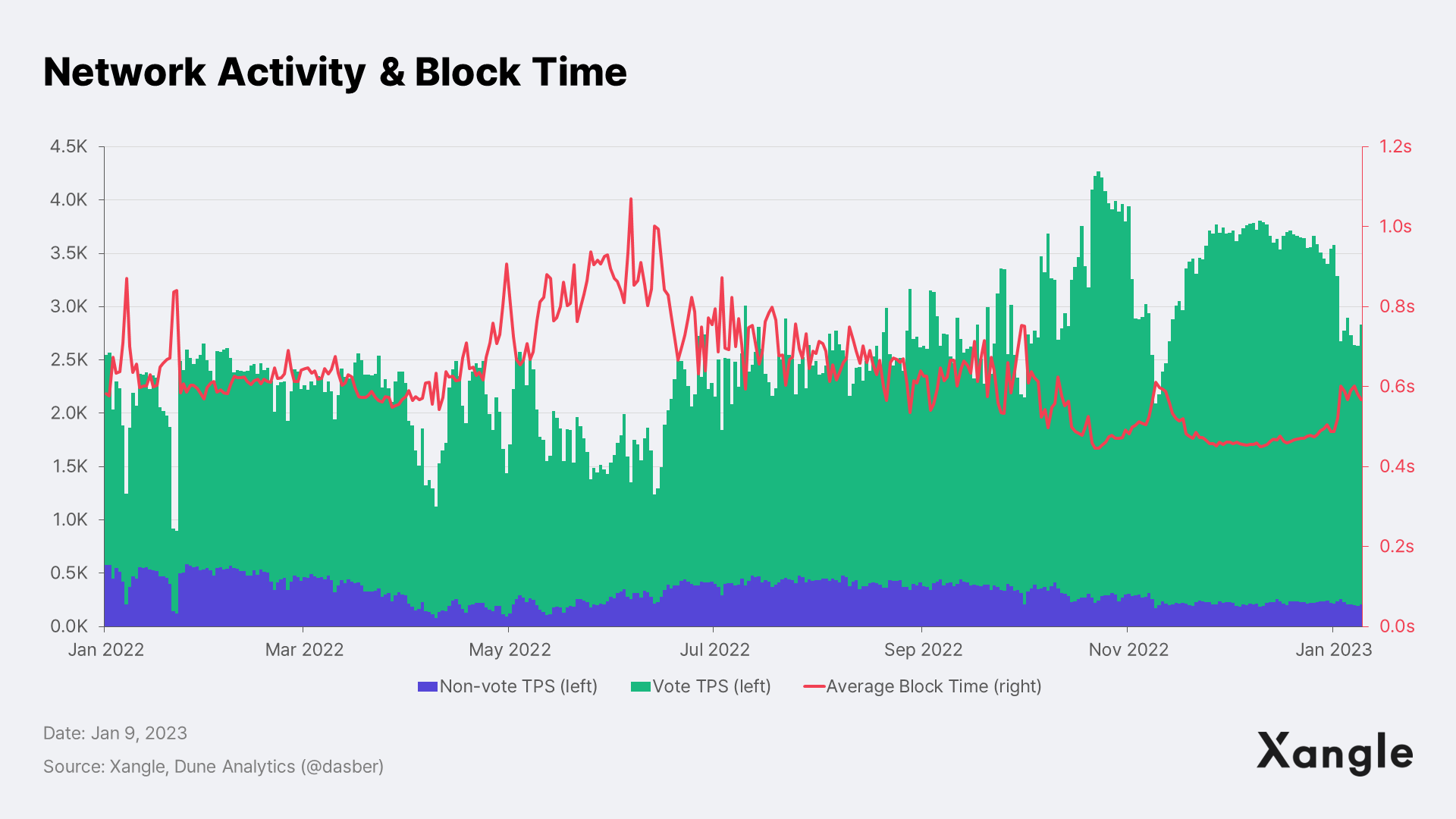

As Solana includes messages sent between nodes during block generation consensus process as vote transactions, the trend of non-vote transactions warrants attention to measure the actual vibrancy of the ecosystem. By this metric, Solana's total TPS is trending upwards (+71% YoY), while non-vote TPS is down 60% YoY, suggesting that the network activity is actually down from the beginning of the year. The gap between vote and non-vote transactions is likely due to a combination of a surge in vote transactions resulting from an increase in the number of validators and a decline in demand for blockspace.

Meanwhile, the impact of the FTX collapse on the demand for Solana’s blockspace was minimal. The numbers of non-vote transactions before and after the FTX disaster were not significantly different. Highest TPS tallied up by realtps.net came in in order of Solana (307), Polygon (36), BSC (29), Ethereum (12), and Avitrum (5). Also of note is Solana's average block time that has decreased from 1s to 0.5s since 2H22. This indicates enhanced finality, which attests to the effect of the protocol upgrades being introduced by Solana Labs.

Rumors of a mass exodus of developers from the Solana ecosystem following the FTX fiasco are also untrue. While some Solana employees, including former Solana marketing lead Austin Virts, left for Aptos, and DeLabs projects like DeGods and y00ts announced plans to move to the Ethereum ecosystem, the vast majority of projects have chosen to remain on Solana (See survey below). Moreover, GitHub data evidences that Solana still maintains the second largest number of developers of all networks.

Recently, the number of users, too, has recovered to pre-FTX level. This may have been driven by the popularity of meme coin $BONK, and it remains to be seen if the user base remains sticky enough.

The FTX saga surely was crippling to the DeFi ecosystem. Solana has seen a 76.5% plunge in TVL from its pre-FTX level and is now sitting barely above $200M. By TVL, Solana's market share has fallen from 4% at the start of the year to around 0.5%. The crash of FTX-linked Serum token and de-pegging of Sollet wrapped assets may have accelerated liquidity outflows.

The NFT market, on the other hand, has been largely unaffected. NFT trading volumes and buyer numbers have not only remained stable but rather climbed since FTX’s downfall. Yet, there remains a possibility that the departure of DeGods and y00ts collections holding the first and second largest market shares in Solana’s NFT market for Ethereum may cause a blow to the activity.

3-2. Steady Increases in Content

A steady growth has been observed in the Solana ecosystem since its mainnet beta launch in March 2020. Solana hackathons kept seeing an increase in the number of participating projects, with over 750 projects participating in the Solana Summer Camp last August (STEPN was one of the winners of the IGNITION Hackathon). Solana is hosting its seventh hackathon in 1Q 2023, and the number of participants will be one of the focuses of many. Have a look at some of the exciting initiatives happening in the Solana ecosystem as well as its 2023 lineup:

- Aurory: A team-based combat strategy MMORPG created by a group of developers from global gaming heavyweights, such as Ubisoft, EA, and Atari. What sets it apart are the half Pokémon, half RoltoChess combat style and high level of sophistication. The game is now in open alpha and the full service will be available later this year.

- Star Atlas: A strategy MMO powered by Unreal Engine 5. A pre-alpha demo was launched on the Epic Games Store in September 2022. Once live, this highly anticipated triple-A game is expected to gain a large user base.

- BR1: A Solana-based P2E shooter that can be played in two different modes—Infinite Royale and free-for-all. In the Infinite Royale mode, players pay $1 to spawn a character and earn $SOL for killing enemies. Free-for-all is a game mode that anyone can play for free. BR1 has received investments from prominent players in the market, e.g., Krafton and Twitch co-founder Justin Kan.

- EV.IO: A P2E FPS game on Solana that can be played directly from a web browser. Players earn in-game currency "e" by killing enemies, which can then be exchanged for $SOL, with the current exchange rate being $5 per 10,000 e. EV.IO released beta in January 2021 and has over 400,000 total subscribers. 2,403 characters and 1,463 weapons are turned into NFTs for sale.

- Phoenix: A CLOB (Central Limit Orderbook) DEX being developed by Ellipsis Labs. The full-service launch is expected to come in 1Q 2023.

- Drift Protocol V2: A cross-margin perpetual futures DEX that used to handle billions of dollars in trading before the Terra Luna crash. Drift Protocol V2 marked its resurgence with the launch on Solana on December 20, 2022.

- Zeta Markets: An under-collateralized derivatives platform that sells options and futures contracts.

- Openbook: A fork of Serum V3 formerly run by SBF.

- Friktion: A crypto portfolio management platform that builds portfolios based on users’ investment appetite. It topped $3B in total trading volume, $4M in TVL, and 17K users.

- Hivemapper: A drive-to-earn dApp that incentivizes users to provide street view data. Since its launch, it has acquired 80,000 kilometers of map data in over 498 cities and 4,100 users.

- GenesysGo: An RPC and on-chain storage service provider.

- Helius: An RPC node and API service provider that has successfully attracted over 1,200 users in just two months of its launch.

- Neon Labs: An EVM-compatible smart contract program set to launch in January 2023.

- Helium: A decentralized P2P 5G wireless network service that migrated to the Solana network in 4Q 2022 after the HIP-70 proposal passed a governance vote. As of January 5, 2023, it has successfully secured a total of 981,698 hotspot nodes.

3-3. An Increase in Collaboration with Global Web2 Companies

Solana’s collaboration with global Web2 companies is on the rise. Unlike Polygon, which primarily partners with mega brands like Starbucks, Nike, and Reddit, Solana continues to work with IT companies to beef up infrastructure and boost network activity.

- Stripe will support the fiat-to-crypto on-ramp payment service for 11 Solana-based projects, including Orca.

- Google joined the Solana network as a validator node in November 2022. Google has since announced that it would develop Blockchain Node Engine aimed at easier operation of Solana nodes using Google Cloud and index Solana data and add it to blockchain data indexing program BigQuery.

- Meta added support for Solana NFTs on Instagram and Facebook apps.

- Discord‘s Linked Roles began to feature Solana wallet integration.

- Asics rolled out two types of shoes in collaboration with Solana and STEPN. The shoes could only be purchased with USDC using Solana Pay.

- SM, a South Korean entertainment giant, announced in late 2021 that it would issue Solana-based NFTs. There are rumors, though, that SM may opt for another blockchain after the FTX collapse.

3-4. Launch of Saga Signaling Potential Content Expansion

The launch of Solana's Saga smartphone—its game-changing move to grow the mobile blockchain market—is imminent. Solana Labs began distributing Saga to developers on December 15, with the official release slated for the earlier half of this year. In addition, Solana Labs has accepted applications from Solana projects for dApp Store onboarding since January. Solana’s mobile business comprises SMS (Solana Mobile Stack), Saga (smartphone), and Solana DApp Store—with each expected to improve mobile app development and UX, increase mobile content, and boost mobile crypto payment.

Final Thoughts

The saying "It's always darkest before the dawn” is perhaps the best way to describe the tribulations facing Solana, whose name means "sunshine." Although the FTX crash has been detrimental to the narrative for Solana, SBF's relationship with Solana is not like CZ's relationship with Binance. Solana has a great leadership team, strong developer community, and self-sustaining ecosystem that can grow without FTX. Further, on-chain data continues to prove that Solana's fundamentals are holding up strong and that the network performance is improving fast. Also worth noting is the potential first mover advantage Solana’s Saga smartphone may bring to its mobile business.

First and foremost, Solana is an ultra-fast blockchain that keeps its monolithic design. Monolithic blockchains are characterized by higher composability, lower latency, and fewer attack vectors than modular blockchains. In this regard, I believe Solana has some architectural advantages over Ethereum, which is drifting towards a modular design. Another competitive edge of Solana lies in its design that leverages the computing power of hardware. This is why Solana continues to enter partnerships with Web2 giants like Google, Stripe, and Meta, and why high-profile VCs like Multicoin Capital, Jump Crypto, and Chris Burniske (R89) continue to have confidence in the network.